Are you tired of being held back by a low credit score? Do you dream of accessing better loan terms, credit cards, and even housing opportunities? If you’ve been searching for a way to build your credit, you might have come across the concept loan to boost credit. But what exactly are they, and can they really help you boost your credit?

In this comprehensive guide, we’ll dive deep into the world of credit builder loans, explaining how they work, their benefits, and provide you with a detailed plan to make the most of this financial tool. Whether you’re an entrepreneur looking to start a credit repair business or an individual seeking to improve your personal credit, this article has something for you.

Start Today and Explore the Features Firsthand!

Understanding Credit Builder Loans

Before we explore how credit builder loans can help you boost your credit, let’s first understand what they are and how they differ from traditional loans.

What is a Credit Builder Loan?

A credit builder loan is a type of installment loan specifically designed to help individuals with little to no credit history or those looking to rebuild their credit. Unlike traditional loans, the money you borrow is held in a savings account or certificate of deposit (CD) while you make payments. Once you’ve paid off the loan, you receive the funds, making it a safe way to build credit without the risk of overspending. Credit builder loans are an excellent option for those seeking loans to build credit.

How Does a Credit Builder Loan Work?

When you take out a loan, the lender deposits the loan amount into a locked savings account or certificate of deposit. You then make monthly payments to the lender, which are reported to the credit bureaus. After you’ve completed all the payments, the funds in the account become available to you.

This process helps you establish a positive payment history, which is a crucial factor in determining your credit score. Credit builder loans are essentially installment loans to build credit, as they are repaid over a set period with fixed monthly payments.

The Benefits of Credit Builder Loans

Now that you understand the basics of credit builder loans, let’s explore the various ways they can help you improve your credit and financial standing.

Establish a Positive Payment History

Payment history is the most significant factor in calculating your credit score, accounting for approximately 35% of your FICO score. By taking out a loan and consistently making on-time payments, you can demonstrate to lenders that you are a responsible borrower, thus improving your credit score over time. Credit builder loans are among the best loans to help build credit due to their focus on establishing positive payment history.

Build Credit Without the Risk of Overspending

One of the most significant advantages of credit builder loans is that they allow you to build credit without the temptation to overspend. Since the funds are held in a locked account until you’ve paid off the loan, you won’t be able to access the money prematurely, preventing you from falling into debt. This feature makes credit builder loans an ideal choice for those seeking loans to build credit responsibly.

Start Today and Explore the Features Firsthand!

Develop Healthy Financial Habits

Taking out a builder loan to boost credit can help you develop healthy financial habits, such as budgeting, saving, and making timely payments. These skills will serve you well not only in managing your loan to build credit but also in your overall financial life. By opting for installment loans to build credit, like credit builder loans, you can cultivate these valuable habits.

Access Better Credit Opportunities in the Future

By successfully paying off a loan and improving your credit score, you can open the door to better credit opportunities in the future. This may include access to credit cards with more favorable terms, lower interest rates on personal loans, and even better chances of being approved for a mortgage or car loan. Credit builder loans are among the best loans to build credit for this reason.

Choosing the Best Credit Builder Loan for Your Needs

With numerous lenders offering credit builder loans, it’s essential to know what factors to consider when selecting the best credit builder loan for your unique situation.

Credit Builder Loan Amount

Credit builder loans typically range from $300 to $1,000, although some lenders may offer higher amounts. When choosing a loan, consider your budget and financial goals. Select a loan amount that you can comfortably afford to repay each month. The best credit builder loan will be one that fits your financial situation.

Interest Rates and Fees

Interest rates and fees for credit builder loans can vary significantly between lenders. Some lenders may offer competitive rates, while others might charge higher fees. Be sure to compare options from multiple lenders to find the most affordable loan that suits your needs. The best credit builder loan will have reasonable rates and fees.

Lender Reputation

When entrusting your financial information and goals to a lender, it’s crucial to choose a reputable institution. Research potential lenders, read customer reviews, and check their rating with the Better Business Bureau to ensure you’re working with a trustworthy company. The best credit builder loan will come from a reputable lender.

Reporting to Credit Bureaus

To maximize the credit-building potential of your loan, choose a lender that reports your payments to all three major credit bureaus (Equifax, Experian, and TransUnion). This will ensure that your positive payment history is reflected on your credit reports, thus improving your credit score. The best credit builder loan will report to all three credit bureaus.

A Step-by-Step Plan to Boost Your Credit with a Credit Builder Loan

Now that you’re armed with knowledge about credit builder loans, let’s outline a detailed plan to help you successfully boost your credit using this financial tool.

Step #1: Assess Your Current Financial Situation

Before applying for a loan to build credit, take a close look at your current financial situation. Determine how much you can comfortably afford to borrow and repay each month. Consider your income, expenses, and any existing debt obligations.

Create a budget to ensure that you can easily incorporate your loan payments without straining your finances. This will help you choose a loan amount that fits your budget and avoid overextending yourself financially.

Start Today and Explore the Features Firsthand!

Step #2: Research and Compare Credit Builder Loan Options

Once you have a clear understanding of your financial situation, start exploring various lenders that offer credit builder loans. Compare loan amounts, interest rates, fees, and lender reputation. Pay attention to the loan terms, including the length of the loan and the payment frequency. Look for the best credit builder loan that suits your needs and financial goals. Don’t hesitate to reach out to lenders directly with any questions or concerns you may have.

Step #3: Gather Required Documents

Before applying for a loan to boost credit, gather all the necessary documents to streamline the application process. This may include proof of income, such as pay stubs or tax returns, bank statements, government-issued identification, and proof of residence. Some lenders may also require additional documentation, such as proof of employment or references.

Having these documents readily available will make the application process smoother and faster. Double-check that all your documents are up-to-date and accurate before submitting them to the lender.

Step #4: Apply for the Loan That Best Fits Your Needs and Budget

After identifying the most suitable builder loan to boost credit , submit your application. Be prepared to provide personal and financial information, such as your income, employment status, and bank account details. Take your time to fill out the application accurately and completely. Double-check your application for accuracy and completeness before submitting it to the lender.

If you have any questions during the application process, don’t hesitate to reach out to the lender for assistance. Once your application is submitted, wait for the lender’s response and be prepared to provide any additional information they may request.

Step #5: Set Up Automatic Payments

Once your loan is approved and funds are deposited into the locked savings account or certificate of deposit, set up automatic monthly payments. This will ensure you never miss a due date, which is crucial for building a positive payment history. Consistency is key when using installment loans to build credit. If automatic payments are not an option, create reminders or set alerts to ensure you make your payments on time each month.

Consider setting up your payments to coincide with your paydays to make budgeting easier. Double-check that your automatic payments are set up correctly and that you have sufficient funds in your account to cover each payment.

Step #6: Make Timely Monthly Payments

With your automatic payments set up, focus on making timely monthly payments throughout the loan term. Consistency is crucial when it comes to loan to boost credit, so make sure to prioritize your loan payments. If you face any financial difficulties that may impact your ability to make a payment, contact your lender immediately to discuss potential solutions, such as adjusting your payment due date or setting up a hardship plan.

Stay proactive and communicative with your lender to avoid missing payments and damaging your credit. Celebrate each successful payment as a step towards your goal of building better credit.

Step #7: Monitor Your Credit Score Regularly

As you make payments on your loan to boost credit, regularly monitor your credit score to track your progress. Many credit card companies and personal finance websites offer free credit score tracking services. Take advantage of these resources to stay informed about your credit standing.

Seeing your credit score improvement over time can be a great motivator to stay on track with your payments and continue building your credit. Make a habit of checking your credit score monthly and understanding the factors that influence it. If you notice any errors or discrepancies on your credit report, take steps to correct them promptly.

Credit Builder Loans and Client Dispute Manager Software

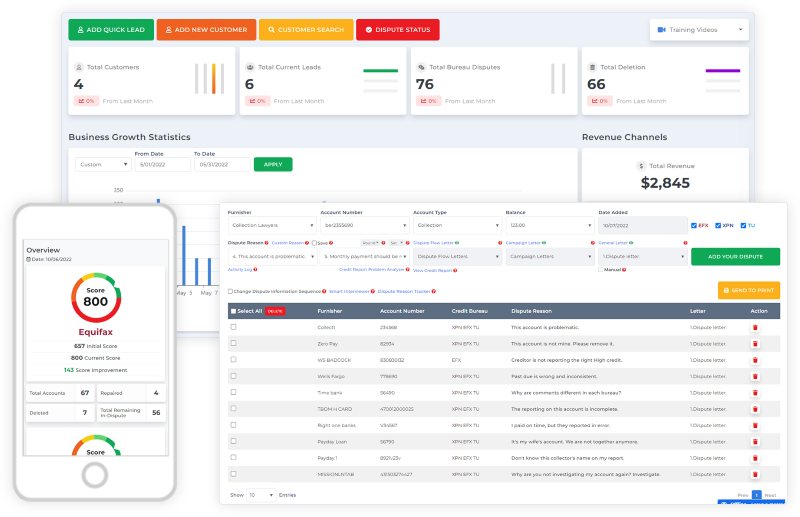

As an entrepreneur in the credit repair industry, not only is it essential to have a strong personal credit score, but it’s also crucial to effectively manage client disputes and streamline your business processes. This is where Client Dispute Manager Software comes into play.

Client Dispute Manager Software is a powerful tool designed to help credit repair businesses efficiently handle client disputes, communicate with credit bureaus and creditors, and track the progress of each case. By integrating this software into your business, you can save time, reduce errors, and ultimately provide better service to your clients.

Key features of Client Dispute Manager Software include:

- Automated dispute generation and tracking

- Seamless integration with credit bureau and creditor systems

- Real-time updates on dispute status and outcomes

- Customizable templates for letters and documents

- Comprehensive reporting and analytics

By leveraging Client Dispute Manager Software alongside your knowledge of credit builder loans and other credit-building strategies, you can create a comprehensive, end-to-end solution for your clients. This powerful combination can help you attract more clients, improve your success rates, and ultimately grow your credit repair business.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

How Long Does It Take For A Credit Builder Loan To Improve My Credit Score?

The timeline varies, but most people see an improvement in their credit score within 6-12 months of consistently making on-time payments on a credit builder loan. Credit builder loans are designed to be loans to help build credit over time.

Can I Get A Credit Builder Loan With Bad Credit?

Yes, credit builder loans are designed for individuals with bad credit or no credit history. However, some lenders may have minimum credit score requirements, so be sure to research and compare options. Credit builder loans are often the best loans to build credit for those with poor credit histories.

What Happens If I Miss A Payment On My Credit Builder Loan?

Missing a payment can negatively impact your credit score, as payment history is a significant factor in credit scoring models. If you’re struggling to make a payment, contact your lender immediately to discuss potential solutions, such as adjusting your payment due date or setting up a hardship plan. Consistency is crucial when using installment loans to build credit.

Are Credit Builder Loans Expensive?

The cost of credit builder loans varies by lender. Some lenders offer competitive interest rates and minimal fees, while others may charge higher costs. It’s essential to compare options and choose an affordable loan that aligns with your budget. The best credit builder loan will be one that is cost-effective for your financial situation.

Can A Credit Builder Loan Help Me Qualify For A Mortgage Or Car Loan?

While a credit builder loan alone may not guarantee approval for a mortgage or car loan, it can be an essential first step in establishing a positive credit history. Consistently making on-time payments on a credit builder loan can improve your credit score, increasing your chances of qualifying for other types of loans in the future. Credit builder loans are excellent loans to help build credit before applying for larger loans.

Conclusion

In conclusion, a credit builder loan can be a powerful tool for boosting your credit when used responsibly. By understanding how these loans work, their benefits, and how to choose the best credit builder loan for your needs, you can take control of your financial future and open the door to better credit opportunities.

For entrepreneurs in the credit repair industry, mastering credit builder loans can not only benefit your personal financial goals but also help you better serve your clients and grow your business. By sharing your knowledge and experience with loans to build credit, you can establish yourself as a trusted expert in the field and differentiate your services from competitors.

Remember, building credit is a journey, and a credit builder loan is just one step along the path. By staying committed to making timely payments, monitoring your progress, and exploring additional credit-building strategies, you can achieve your financial goals and create a brighter future for yourself and your business.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- How to Write a Goodwill Deletion Letter to Remove Inaccurate Late Payments

- Remove Late Payments from your Credit Report Successfully