A good credit score opens doors, while a poor one can limit opportunities. If your score isn’t shining as bright as you’d like, it’s time to dive into advanced credit repair strategies. Beyond basic fixes, these strategies offer deeper solutions.

And in our digital age, credit repair software has become a game-changer, simplifying, and enhancing the repair journey. In this article, we’ll guide you through effective strategies and introduce top software tools to rebuild your credit score.

Understanding the Basics

Before diving into the advanced techniques of credit repair, it’s vital to grasp the foundational elements that underpin your credit score. A solid understanding of these basics ensures that any advanced strategies are built on a strong, informed foundation.

Credit Reports

Credit reports are detailed records of your financial history, including loans, credit card balances, and payment history. You can access one free report annually from each of the three main credit bureaus: Experian, TransUnion, and Equifax.

Monitoring these reports helps ensure accuracy, spot errors, and manage your financial health, which is crucial for obtaining loans, renting, and job opportunities.

Credit Scores

Crafted from your credit reports, credit scores span the spectrum from 300 to 850, acting as a numerical manifestation of your financial trustworthiness. A loftier score doesn’t just mirror your astute financial decisions but also acts as a key to unlock superior financial opportunities.

When your credit score stands strong, you’ll discover a smoother journey in securing loans and credit cards, often accompanied by more alluring terms such as reduced interest rates. This equates to substantial long-term savings.

Key Factors that Influence Your Credit Score

Payment History: Timely payments boost your score, while late payments can harm it.

Credit Utilization: This is the ratio of your current debt to your available credit. A lower percentage (using less of your available credit) is preferred.

Length of Credit History: A longer history, if managed well, can benefit your score.

Types of Credit: A mix of credit types, like cards and loans, can show lenders you’re versatile in managing debts.

New Credit: Regularly applying for new credit can temporarily dip your score, so it’s essential to be judicious.

Disputing Errors

Errors on your credit report can hurt your credit score. It’s important to regularly check for mistakes. These errors can include things like getting your personal information wrong or reporting your financial activities incorrectly.

When you notice these mistakes, it’s crucial to take action. You should officially tell the credit bureaus about the errors. By doing this, you make sure that your credit history truly reflects your financial actions.

This helps you keep your access to better financial opportunities and makes sure that others see you as a responsible borrower, without needing to use complex words or jargon.

Strategies for Credit Improvement at an Advanced Level

While foundational knowledge is essential, diving deeper into advanced credit repair strategies can provide the extra edge needed to elevate your credit score.

These techniques, though more nuanced, can significantly enhance your financial profile when applied correctly:

Tackle High-Interest Debts First

Prioritizing high-interest debts is a savvy financial strategy that can significantly impact your financial well-being. These debts have a knack for growing rapidly, thanks to the compounding interest that piles up. But when you take action to address them as a top priority, you’re essentially putting a leash on their growth. This approach has several positive effects on your financial journey.

Firstly, it curbs the relentless accumulation of interest, which means you’ll pay less overall. This, in turn, frees up more of your hard-earned money for other important financial goals and expenses.

Secondly, by tackling high-interest debts early on, you expedite your path to becoming debt-free. This not only reduces the emotional burden of debt but also sets the stage for a healthier and more optimistic financial outlook.

By strategically focusing on those high-interest debts, you’re taking control of your financial destiny, ensuring that your money works for you rather than against you. It’s a prudent step towards securing your financial future and achieving greater financial freedom.

Leverage Credit Builder Loans

Credit Builder Loans, offered by specific banks and credit unions, are a valuable resource for individuals looking to improve or reestablish their credit. When you obtain a Credit Builder Loan, you borrow a small sum of money, which is then placed in a secure account for the duration of the loan term.

This unique setup encourages responsible financial behavior, as you must make regular, on-time payments.Moreover, your positive payment history is reported to the credit bureaus, gradually enhancing your credit profile.

Upon successful completion of the loan term, the held funds are released to you. This not only gives you access to the borrowed amount but also marks a significant improvement in your credit score. By strategically using Credit Builder Loans, you can pave the way for better financial opportunities and a more secure financial future.

Become an Authorized User

One savvy strategy for improving your credit score involves enlisting the help of a responsible family member or close friend. If they have a lengthy track record of managing credit cards responsibly, consider asking them to add you as an authorized user on their account.

This arrangement can work wonders for your credit score since their positive payment history can be factored into your credit profile by the credit bureaus, even if you never actually use the card yourself. This is especially useful if you’re in the early stages of building or repairing your credit, providing a solid foundation for your financial journey.

Becoming an authorized user is a mutually beneficial arrangement, as it not only assists you in boosting your credit score but also reinforces the responsible credit management practices of the primary cardholder. It’s a smart strategy that can open doors to better financial opportunities while strengthening your creditworthiness.

Negotiate with Creditors

When you find yourself falling behind on payments, taking proactive steps like reaching out to your creditors can make a significant difference in your financial situation. Engaging in an open and honest discussion about your financial hardships can be remarkably beneficial. It often opens the door to various potential solutions, such as renegotiating payment plans or reaching settlements.

Creditors, in most cases, prefer to see some form of repayment rather than none at all. By initiating a conversation about your financial challenges, you’re demonstrating your commitment to meeting your obligations, even in difficult times. This can foster goodwill and understanding, potentially leading to more favorable terms that can help alleviate financial strains.

Leveraging Credit Repair Software

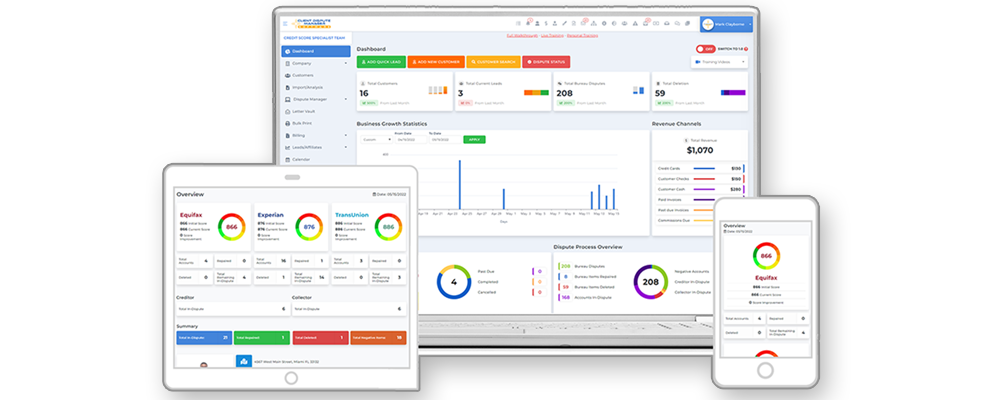

Credit repair software simplifies the process of managing and improving your credit. These platforms provide user-friendly central hubs where you can efficiently handle tasks such as generating dispute letters and conducting comprehensive credit analyses, all in one place.

By incorporating such tools, you not only enhance convenience but also significantly boost the precision and efficiency of your credit repair efforts, making it easier to work towards a healthier credit score. While traditional credit repair methods remain valid, integrating credit repair software can elevate your credit repair endeavors to new levels of efficiency and effectiveness.

These digital tools empower you to optimize your credit repair strategy, helping you achieve better results in your pursuit of improved financial well-being.

The Role of Client Dispute Manager Software in Advanced Credit Repair

Client Dispute Manager Software is your trusted ally in advanced credit repair, offering an array of strategic advantages that can significantly boost your credit score rebuilding efforts.

Streamlined Credit Report Analysis

The software simplifies the often complex task of reviewing your credit reports. Its user-friendly interface and customizable dashboards provide a clear, organized view of your credit information. By streamlining this process, it not only saves you time but also enhances your ability to identify errors and discrepancies swiftly.

Automated Error Identification and Dispute Management

Client Dispute Manager excels at spotting inaccuracies and errors on your credit reports. It streamlines the dispute process with automated letter generation, making it easier than ever to address and rectify issues. This strategy ensures that you can tackle inaccuracies effectively, a crucial step in advanced credit repair.

Personalized High-Interest Debt Management

To accelerate your credit repair journey, the software assists in managing high-interest debts. Its tools enable you to prioritize these debts and create personalized repayment strategies. This proactive approach ensures that you address the most critical financial aspects, ultimately leading to a healthier credit score.

Real-Time Progress Tracking and Analysis

Tracking your credit repair progress is pivotal, and Client Dispute Manager excels in this aspect. It offers real-time monitoring and a transparent overview of your efforts and results. This not only keeps you informed but also motivates you to stay on track and make necessary adjustments along the way.

Proactive Communication with Creditors

Effective communication with creditors is a key component of advanced credit repair. Client Dispute Manager Software can assist you in initiating conversations, negotiating terms, and maintaining a record of interactions. This ensures that you are proactive in addressing outstanding issues with your creditors.

Conclusion

By implementing the proven strategies discussed in this article, you now have a powerful toolkit at your disposal. From reviewing your credit reports diligently to utilizing credit repair software like Client Dispute Manager, these strategies simplify the process and enhance your ability to rectify errors, prioritize high-interest debts, and maintain effective communication with creditors.

Embark on this journey with confidence, equipped with the knowledge and tools to rebuild your credit score and secure a brighter financial future.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.