Credit repair extends beyond mere numbers; it’s deeply rooted in the psychology behind credit repair success. This exploration delves into the mental frameworks and attitudes crucial for effectively managing and improving one’s credit.

Alongside these psychological insights, we’ll also discuss the role of innovative tools, such as Client Dispute Manager Software, in enhancing the credit repair process. The combination of a strategic mindset and advanced technology can be a powerful catalyst for achieving financial health.

Understanding Credit Repair: A Basic Overview

Credit repair is like fixing a broken tool, but in this case, it’s your credit score. Your credit score is a number that tells banks and lenders how good you are at paying back money. A high score means you’re great at it, and a low score, not so much.

When your score is low, credit repair is the process of finding mistakes or outdated info on your credit report and fixing them. This helps improve your score. It’s important because a good credit score can help you get loans, credit cards, and even a nice place to live more easily.

Common Challenges in Credit Repair

Repairing credit isn’t always easy. Sometimes, it’s hard to figure out what’s wrong with your credit report. You might see things you don’t understand or debts you don’t remember. Some people find it tough to talk to credit bureaus or don’t know how to prove that something on their report is a mistake.

This is where understanding the psychology behind credit repair success becomes vital. Knowing how to stay calm, focused, and organized can really help. Another big challenge is patience. Credit repair can take time, and it’s easy to get frustrated. But remember, it’s like planting a seed and waiting for it to grow. You need patience and the right mindset to see results.

In this journey of credit repair, knowing the basics and facing challenges with the right attitude can make a big difference. Stay informed, stay patient, and keep learning. Your credit score will thank you!

The Psychological Foundations of Credit Repair

The journey of credit repair is deeply rooted in psychology. Your mindset, discipline, and patience play pivotal roles in this process. Embracing a positive attitude and resilience can significantly influence your financial decisions and success in improving your credit. Understanding this psychological foundation is key to mastering the art of credit repair.

Mindset and Financial Decisions

The way we think about money plays a big role in how we handle it. If you think positively about fixing your credit, you’re already on the right path. It’s like being a coach of a team – you need to believe you can win.

When you have a good mindset, you make smarter choices about money. You’ll be more careful with spending and more committed to fixing your credit. This is all part of the psychology behind credit repair success.

Discipline and Patience: Key Players in Credit Repair

Repairing your credit is a bit like training for a race. You need discipline, just like a runner needs to train regularly. You have to keep checking your credit report, making payments on time, and staying away from new debts. And just like a runner needs to be patient to see their speed improve, you need patience to see your credit score go up. It doesn’t happen overnight, but if you stick to it, you’ll see changes.

Staying Positive and Resilient

Sometimes, credit repair can feel like a tough battle. There might be setbacks, like finding a big mistake on your report or dealing with a stubborn debt. That’s where a positive attitude helps. Think of it like a game where each challenge is a level to beat. Being resilient means you don’t give up, even when it gets tough. It’s about bouncing back and keeping your eye on the prize – a better credit score.

Understanding the psychology behind credit repair success means knowing how important your mindset, discipline, patience, and attitude are in this journey. Keep these things in mind, and you’ll be on your way to better credit.

The Psychology Behind Credit Repair Success

Understanding the psychology behind credit repair success is crucial in navigating the journey to financial health. Key traits like setting clear goals, believing in your ability, and persisting through challenges are essential. Recognizing and overcoming cognitive biases also plays a vital role in making sound financial decisions, ultimately leading to more effective credit management and repair.

Key Traits for Repairing Credit

Successful credit repair is all about having the right mindset. First, you need to set clear goals. Think of it like planning a road trip; you need to know where you’re going. Goals like improving your score by a certain number or clearing a specific debt are like your road map.

Next up is self-efficacy that’s just a fancy way of saying believing in yourself. If you believe you can fix your credit, you’re halfway there. Lastly, perseverance is crucial. This means not giving up, even if it takes a while to see changes in your credit score.

How Our Thinking Affects Money Choices

Sometimes, our brain can trick us into making not-so-great money choices. These are called cognitive biases. For example, we might think, “I’ve already ruined my credit, so this one extra purchase won’t matter.” But every decision counts in credit repair. Being aware of these biases helps you make better choices, keeping you on track towards your credit goals.

Understanding Finance Psychology for Better Credit Management

Knowing the psychology behind credit repair success isn’t just about fixing your credit score; it’s about understanding how you think about money. When you get why you spend or save the way you do, you can manage your money better. It’s like knowing the rules of a game – it makes you a better player. Learning about finance psychology helps you stay motivated and make smarter decisions, which leads to better credit management in the long run.

By focusing on goal-setting, self-belief, sticking to your plan, and understanding your own money habits, you can make big strides in repairing your credit. Keep these psychological tips in mind, and watch how they transform your approach to credit repair.

Strategies for Cultivating a Successful Credit Repair Mindset

To foster a successful credit repair mindset, focus on proactive steps and maintain a positive attitude. Educate yourself in financial literacy to understand and navigate the credit landscape better.

Tackling psychological barriers, like fear or overwhelm, with small, manageable actions can significantly enhance your credit management effectiveness. Embracing these strategies is key to mastering the psychology behind credit repair success.

Tips for a Proactive and Positive Approach

To make real progress in credit repair, it’s all about being proactive – that means taking action, not just thinking about it. Start by setting small, achievable goals for your credit, like paying off a small debt or checking your credit report regularly. Celebrate these small wins; they add up to big changes. Staying positive is key too.

Believe that you can improve your credit. This positive thinking will keep you motivated, even when the road gets a bit bumpy.

Financial Literacy: The Foundation of a Healthy Credit Mindset

Understanding money is like having a secret weapon in your credit repair journey. This is called financial literacy. Learn the basics of credit scores, how debts and payments affect them, and what your rights are. The more you know, the better you can manage your credit. There are lots of resources online, or even classes you can take.

It’s like learning the rules of a game – once you know them, you can play much better.

Overcoming Psychological Barriers in Credit Management

Sometimes, our own thoughts and fears can be barriers to fixing our credit. You might feel overwhelmed or scared to look at your credit report. The trick is to face these fears. Break down big tasks into smaller steps. If checking your entire credit report feels too much, start with just one section.

Remember, understanding the psychology behind credit repair success means recognizing these barriers and finding ways to overcome them. With each small step, you’ll build confidence and get closer to your credit goals.

Developing a proactive attitude, becoming financially literate, and tackling psychological barriers are all part of building a successful credit repair mindset. Keep these strategies in mind, and you’ll be on your way to not just repairing your credit, but also building a brighter financial future.

Leveraging Technology in Credit Repair: Client Dispute Manager Software

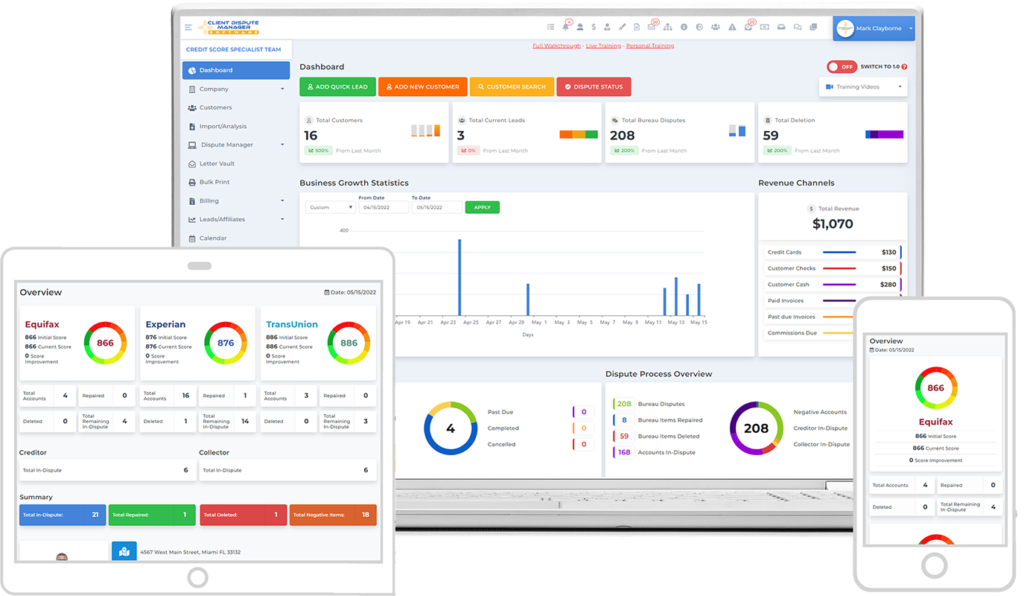

Client Dispute Manager Software is a game-changer in the world of credit repair, offering a streamlined, tech-savvy approach to managing credit disputes. It simplifies the process, allowing for efficient tracking and handling of credit repair tasks.

By leveraging this technology, individuals can keep a close eye on their progress, making the journey towards credit repair more organized and less stressful. Embracing such tools is a key aspect of the psychology behind credit repair success.

Introducing a Handy Tool for Credit Repair

When fixing your credit, using the right tools can make a big difference. One such tool is Client Dispute Manager Software. It’s designed for people who help others repair their credit. Think of it like a smart assistant that keeps all your credit repair tasks in order. It’s especially useful for keeping track of disputes and making sure nothing gets missed.

Streamlining Credit Repair with Technology

Client Dispute Manager Software helps streamline the whole credit repair process. It lets you easily send dispute letters, track responses from credit bureaus, and monitor your progress. This means less time spent on paperwork and more time working on improving your credit score. It’s like having a roadmap that guides you through the sometimes confusing journey of credit repair, helping you avoid any detours or roadblocks.

The Benefits of Tech in Tracking Credit Repair

Using technology like this software can really boost your credit repair efforts. It helps you stay organized and on top of things. You can see exactly where you are in the process, what’s been done, and what still needs attention. It’s like having a personal credit repair dashboard. Understanding the psychology behind credit repair success includes recognizing how such tools can reduce stress and make the whole process more manageable.

By integrating tools like Client Dispute Manager Software into your credit repair strategy, you simplify the process and empower yourself with better control and oversight of your credit repair journey.

Maintaining Credit Health Post-Repair

Maintaining good credit after a repair involves a blend of practical steps and the right mindset. It’s crucial to keep up with timely bill payments, manage debts wisely, and regularly check your credit report for accuracy. Embracing a long-term, disciplined approach to your finances, rooted in the psychology behind credit repair success, is key to sustaining your credit health over time.

Keeping Your Credit Score Healthy

After you’ve worked hard to repair your credit, it’s important to keep it in good shape. Think of your credit like a garden – it needs regular care to stay healthy. Some tips for keeping your credit score high include paying bills on time, keeping your debt low, and not applying for too many credit cards at once. Also, keep an eye on your credit report regularly to catch any mistakes early. These steps will help keep your credit score looking good.

The Mindset for Long-Term Credit Health

Keeping your credit healthy is not just about what you do, but also how you think. Having the right mindset is a big part of this. Stay positive and remember that you have the power to control your financial future.

Be mindful about your spending and borrowing habits. Always think about the long-term effects of your financial decisions. Understanding the psychology behind credit repair success means staying focused and disciplined even after your credit is repaired. This ongoing psychological approach will help you maintain good credit for years to come.

By following these practical tips and maintaining a healthy mindset, you can ensure that your credit stays strong long after the repair process. Remember, good credit is a continuous journey, not just a one-time fix.

Conclusion

In wrapping up, remember that the psychology behind credit repair success is all about having the right mindset, being disciplined, and staying patient. These key psychological aspects, along with practical tools like Client Dispute Manager Software, can make a huge difference in your credit repair journey.

Take these insights and apply them to your own situation. Stay positive and believe in your ability to improve your credit. It’s not just about fixing numbers; it’s about building a brighter financial future. So, keep your head up and stay focused – your credit health is worth it!