Navigating the credit landscape requires more than just fiscal awareness; it demands a grasp of essential credit bureau communication tips. By mastering these strategies, you can deftly ensure your credit report accurately reflects your financial journey.

This guide is your toolkit for direct and effective interactions with credit bureaus, paving the way to a clear and controlled credit standing. Let’s set sail on the path to credit clarity.

Understanding Credit Bureau Dynamics

To get a grip on credit, you’ve got to understand the big players: the credit bureaus. Think of them like the headmasters of credit schools. They keep track of how well you handle your cash. Their word can make or break your chance to borrow money for important things, like a house or a car.

The Role of Credit Bureaus

Credit bureaus gather details on how you deal with money, like a detective collecting clues. They look at your loans, your credit cards, and your payment timeliness. This stuff gets into your credit report, and banks peek at this like a grade card to see if you’re good with money.

Why Your Words to Bureaus Matter

Chats with credit bureaus are a big deal. If your credit report has boo-boos or something fishy, you need to speak up. Use those credit bureau communication tips—it’s like telling the librarian they’ve got the wrong facts about what books you’ve taken out. Stick to the point, and you’ll get heard.

Keep Talking Simple

Your talks with bureaus should be easy to get. If you’re clear and straight to the point, they’ll fix your report faster. Double-check your info like you’re doing a school project. Simple, clear messages are the secret sauce to keeping your credit report tidy.

Grasping how to chat with credit bureaus gives you the power to shape your credit score. So, remember these credit bureau communication tips, and keep your financial report card looking sharp.

Preparing to Communicate with Credit Bureaus

Before you pick up the phone or send an email to a credit bureau, it’s like getting ready for a big game. You need the right gear and a good game plan. This means having all your facts straight and knowing exactly what you want to fix on your credit report.

Gather Your Credit Info

First up, get a copy of your credit report. It’s like your financial playbook. Look it over carefully. Make sure all the numbers and info are correct. If they’re not, circle them. These are the points you’ll talk to the credit bureaus about.

Know What to Say

When you’re ready to talk to the credit bureaus, be clear about what’s wrong. Use simple words. It’s not a time to tell your whole money story, just the bits that got mixed up. Think of it as if you’re pointing out where the referee made a mistake in a game.

Have Proof Ready

If you say something’s wrong, you need to show why, like having proof when you challenge a bad call in sports. Have documents ready to back up your claims. This could be bank statements or bills that show the real score.

Practice Makes Perfect

Before you actually talk to the credit bureau, practice what you’re going to say. Keep it short and on point. This helps you stay calm and collected, so when game time comes, you’re ready to win.

Remember, fixing your credit is a big deal, and how you talk to credit bureaus is part of that. Use these credit bureau communication tips to get ready, and you’ll have a better shot at getting your credit score in tip-top shape.

Crafting Your Message to Credit Bureaus

When you’re reaching out to a credit bureau, think of it as if you’re writing an important letter to a friend. You want them to understand what you’re saying, take it seriously, and write back. This isn’t just any old note, it’s one that can help fix your credit, which is like the grown-up version of your grade point average.

Start With the Clear Facts

Get your facts lined up like ducks in a row. Lead with your name and identification details spell it all out for them. Then, dive into the issue at hand. Describe what’s wrong in plain language, just like you would if you were explaining it to a buddy who doesn’t know a thing about credit. Keep it simple, and remember, this isn’t the time for long stories just the facts. And if you’re looking to beef up your communication even further, don’t forget to check out How to Market Your Credit Repair Services Effectively.

Use Evidence to Back Your Claim

Your claim needs muscle, just like when you have to show your math work in class. Include copies (never originals!) of documents that support your case. This could be bank statements, letters, or receipts. Let the credit bureau know you’ve got the goods to prove there’s a mistake. You’re not just making empty claims; you’ve got evidence.

Keep Cool and Be Polite

Nobody listens if you’re shouting or being mean, and that’s true for writing, too. Always keep your cool, even if you’re super annoyed. Start with a friendly “Hello” and end with a “Thank you for your help.” It’s about being polite, even if you feel like stomping your foot. Manners can make or break your game.

Check Your Work

Before you send off your letter, read it over—twice! Look for any spelling mistakes or places where you could be clearer. This is your chance to catch anything that could confuse the credit bureau. It’s like proofreading your homework before turning it in. You want a gold star, not a red mark.

The Waiting Game and Following Up

After you send your letter, give them some time to write back. It’s like waiting for your turn in dodgeball. If you don’t hear anything after a month or so, follow up with a phone call or another letter. It shows you’re serious about getting your credit report fixed up. Remember, a little patience can lead to big wins.

Keep these credit bureau communication tips in your pocket, and you’re all set to fix any hiccups on your credit report. Clear, polite, and straight to the point—that’s how you get things done with the credit bureaus.

Specific Credit Bureau Communication Tips

Make Every Word Count

When writing to the credit bureaus, think of your words as coins in a jar you only have so many to spend, so make each one count. Start your letter with the main point, like “I’m writing to dispute…” and then lay out your case. Keep your sentences tight and to the point. It’s like explaining a game strategy; you wouldn’t wander off talking about your lunch.

Keep the Tone Professional

Imagine you’re a detective laying out the evidence. You wouldn’t get emotional; you’d be all about the facts. Keep your writing calm and professional, even if you’re frustrated. It’s like when you’re asking for a redo on a test question you know you got right stay cool and collected.

The Magic of Bullet Points

Lists are your friend, especially bullet points. They break up big blocks of text and make it super easy for credit bureau folks to see what you’re talking about. List the mistakes, the facts, whatever you need—just like you’d list what you need for a school project.

Make It Easy to Reply

At the end of your letter, say exactly what you want them to do and how they can reach you. Give them a simple step, like “Please send me a confirmation that this has been fixed at this address.” It’s like leaving a clear, easy trail of breadcrumbs for them to follow back to you.

Proofreading Is Your Secret Weapon

Before you send that letter, check it again. Look for any slip-ups in spelling or grammar that might make it harder to take you seriously. It’s the same as checking your gear before a big game; you want everything to be just right.

Knowledge Is Power

Lastly, show them you know your rights. Phrases like “Under the Fair Credit Reporting Act…” signal that you’re not just guessing you’re in the know. It’s like having a guidebook for a new game. You’re playing to win, and that means knowing the rules inside out.

Using these tailored credit bureau communication tips, you’ll be set to convey your points effectively, ensuring that your credit narrative stays as accurate and spotless as your reputation. Keep your language simple, your details straight, and your mindset sharp, and you’ll be on your way to mastering the credit game.

Following Up After Initial Communication

Don't Let Silence Win

Just send off a letter or email to a credit bureau, and all you hear are crickets. That’s your cue to follow up. Picture it like sending out a scout in a strategy game; if they don’t report back, you send another.

It’s not nagging, and it’s making sure your voice is heard. Wait a couple of weeks about the time it takes for a good break from schoolwork, then reach out again. A simple call or letter asking for an update can do the trick.

Use the ‘Friendly Reminder’ Tactic

Think of your follow-up as a friendly reminder, not a demand. It’s like when you’re reminding your buddy they promised you a game trade. Be polite, add a touch of ‘just checking in’, and restate what you need from them. It’s a nudge, not a shove, to get things moving.

Keep the Paper Trail Going

Whenever you reach out, that’s another piece of your credit puzzle. Keep copies of what you send, and jot down notes when you talk to someone. It’s like saving your game progress.

You don’t want to lose any important steps you’ve taken. And always ask for a reference number or the name of the person you spoke to, it’s like tagging your game save with a memorable name.

Celebrate the Small Wins

If you get a response, any response, that’s progress. Sometimes credit bureaus move slow, like waiting for your turn in a board game. But even a small reply means you’re in the game and they’re paying attention. Give yourself a pat on the back, then prepare for your next move.

Stay Steady and Patient

Good things come to those who wait—like the best power-ups in a game. If the bureaus are taking a while to fix your credit report, don’t lose your cool. Keep things friendly, keep following up, and remember: patience is your superpower here. It’s all about that slow and steady race to the finish line.

Keep Your Goal in Sight

Never forget why you’re doing all this—to keep your credit report as spotless as your favorite white sneakers. Each follow-up is a step toward that goal, just like each level you beat gets you closer to the final boss. With these credit bureau communication tips, your endgame of a flawless credit report is well within reach.

Utilizing Technology for Efficient Communication

Embrace the Digital Wave

In today’s tech-driven world, staying in touch with credit bureaus is as easy as playing your favorite video game online. With a few clicks, you can send off emails or use online forms no more waiting for snail mail! Just like updating your favorite app, make sure your contact details are current. That way, you’ll be in the loop faster than you can say “high score.”

Tracking Your Progress

Ever tracked your steps or your pizza delivery on an app? That’s the kind of tracking you need for your credit report disputes. Use simple online tools to keep tabs on what you’ve sent and when. It’s a breeze to check on things when they’re all lined up in your inbox or in a dedicated folder.

The Power of Software

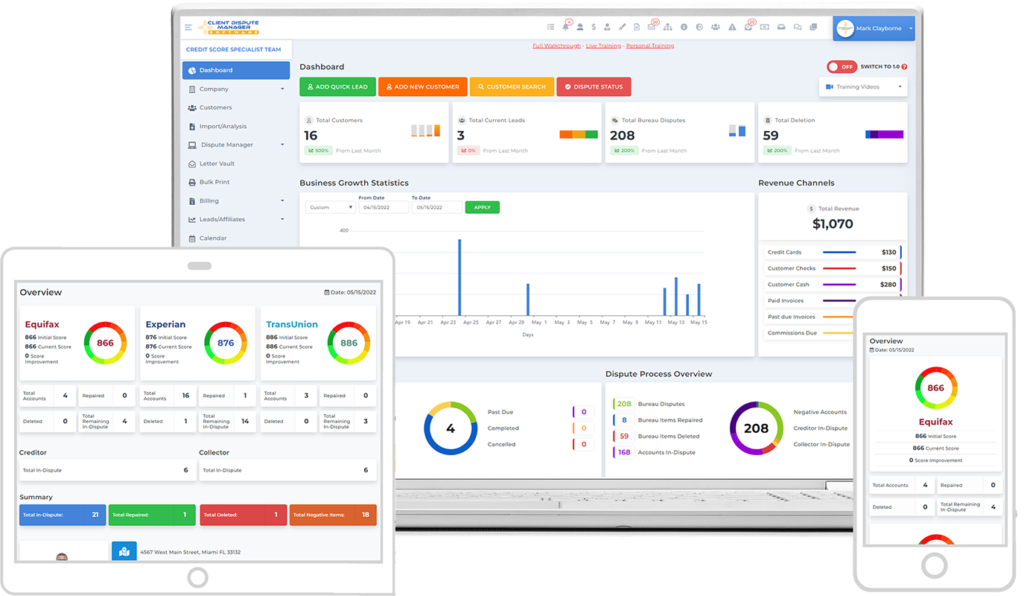

Let’s talk about a game-changer: Client Dispute Manager Software. This is like having a super-smart assistant who’s got your back. It can help you manage your disputes with credit bureaus without breaking a sweat. Think of it as your personal tool for making sure your credit game is strong.

Automated Alerts

With the right tech, like Client Dispute Manager Software, you won’t miss a beat. It’s like having notifications for your favorite online sale – it tells you when it’s time to take action or follow up. You’ll always be on top of your game, ready to hit ‘play’ on the next move in your credit repair journey.

Keeping It Secure

When you’re online, keeping things safe is as important as keeping your personal gaming account protected from hackers. With secure communication channels to credit bureaus, your info stays safe. Secure emails and encrypted messages are the way to go, like choosing the safest path in an adventure game.

By using these savvy credit bureau communication tips and integrating technology like Client Dispute Manager Software into your strategy, you’re setting yourself up for a win. You’re not just playing the game; you’re playing to win it, with every credit move streamlined and every communication on point.

Conclusion

In the quest for credit perfection, effective communication with credit bureaus is key. By harnessing these straightforward strategies and embracing the efficiency of technology like Client Dispute Manager Software, you’re well-equipped to navigate the credit landscape.

Remember, every step taken towards clear communication is a stride towards a stellar credit score. Stay persistent, stay patient, and let these tips guide you to success.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.