Here are the 10 steps to follow in Improving your Credit Score:

1. Check for errors and inaccurate information in your credit report

2. Make on-time automatic bill payments to meet deadlines

Any late payment to your mortgage, credit card accounts, utility bills, or car loans can damage your FICO credit score. Your payment history accounts for 35% of the total score, which means that late payments should be discouraged. One of the best ways of improving your credit score is by automating your bill payments.

3. Consider paying debt and lower your credit utilization ratio

The creditors and lenders consider the utilization ratio when lending. Those with higher utilization ratio are considered less likely to pay back. In this regard, you need to consider paying your debts to improve your credit score.

4. Missed Payments? Act now.

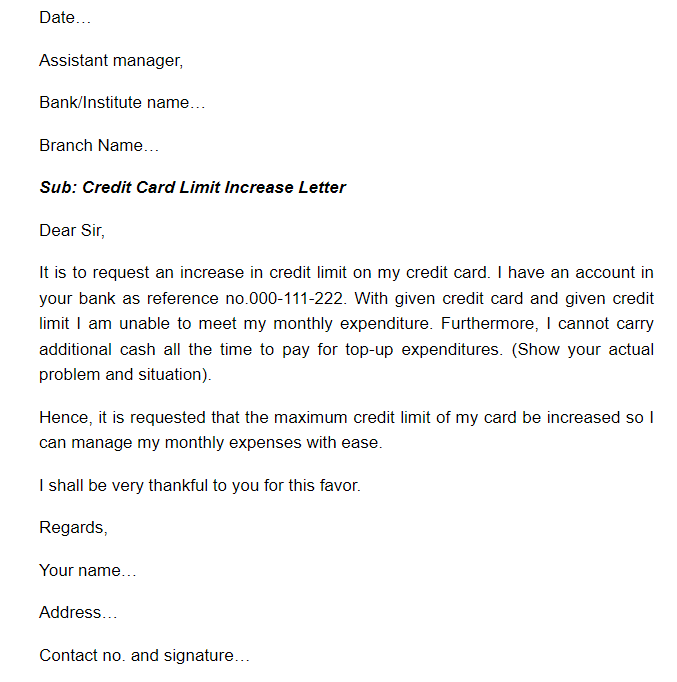

5. Request an increase to your credit limit and keep your debt well below it

To achieve a credit limit increase, you can do this periodically. Credit card companies have different limits and different processes to do this. Do it gradually. Small credit limit increases are appropriate as your credit card companies will not make a hard inquiry on your credit reports. Such an inquiry would be detrimental to your credit standing.

6. Do not close old accounts

Another secret with the old accounts is to use old credit cards. Since the credit industry closes old or inactive accounts since the credit crunch, do everything to avoid this. Put a charge on old credit cards at least once a month; this keeps these accounts active and ultimately enhances your credit score improvement.

7. Demonstrate responsibility in borrowing and repayments

Your ability to handle credit responsibly is a good step to improving your score. In this regard, you should not borrow too much. Also, ensure that you make timely repayments. It is detrimental for one to open many accounts to increase available credit. This may work negatively for people who are new and are establishing a credit history.

8. Be added as an authorized user of credit cards

9. Use of a secured credit card

10. Contact your creditors