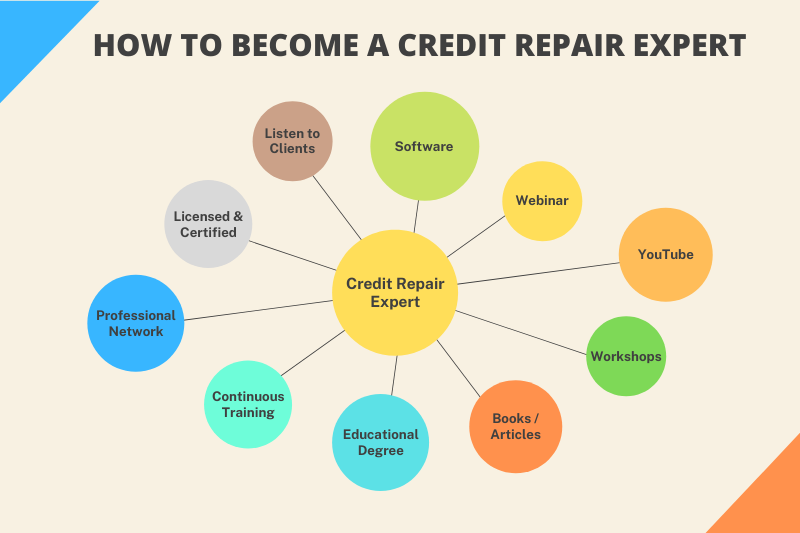

Have you ever considered becoming a credit repair expert? There is a huge market for credit repair specialists and people are desperate for help with repairing their credit. There are several different methods for learning credit repair. It is recommended that you choose a method that complements your learning style before becoming a certified credit repair consultant.

Table of Contents

Becoming a Credit Repair Expert Is Your Next Career

A good credit score is one of the most important financial tools an individual or business can possess. Having good credit opens many financial doors, such as being able to get good interest rates, secure loans, and make the major purchases you need in your life.

Indeed, an improved credit score can save you considerable amounts of money in interest over time and get you loans you otherwise wouldn’t qualify for.

This means there is a strong demand for credit repair services that can help people get their credit into better shape. It creates a good business opportunity for professionals who have the skill, drive, and knowledge to become credit repair specialists and successfully assist people in improving their scores.

Anyone who has a subpar credit rating should seriously consider working with a credit repair consultant to improve their score and maintain it in the years ahead. These services commonly work to identify incorrect items on your credit history and petition the major credit reporting agencies on your behalf to get them removed.

Bad credit repair companies give credit repair a bad name and incompetent credit repair companies that do not act with integrity when working with clients will be reprimanded. Ignorance of the law is not an excuse.

Be sure to follow state and federal laws and you should not have to worry about the Consumer Financial Protection Bureau penalizing or shutting down your company.

Read and understand the Credit Repair Organizations Act (CROA). This Act prohibits untrue or misleading representations and requires certain disclosures in the offering or sale of “credit repair” services.

For example, the Act bars companies that offer credit repair services from demanding advance payment, requires that credit repair contracts be in writing, and gives consumers certain contract cancellation rights.

Importance of Being a Credit Repair Agent

The top methods to learn credit repair will be covered in this article, but first, let’s discuss why it is important for you to learn this craft well prior to offering your expertise as a credit repair agent.

The Consumer Financial Protection Bureau (CFPB) is designed to protect consumers. The CFPB has sued several credit repair companies for multiple violations. These credit repair companies took advantage of credit repair clients and the CFPB acted swiftly to address complaints against credit repair services.

Visit https://www.ftc.gov/legal-library/browse/statutes/credit-repair-organizations-act to access and read the content of the Credit Repair Organizations Act (CROA) in its entirety.

Any credible training should cover the laws that govern restoration. You need to know what you can and cannot do to stay within the parameters of the law to protect yourself and your clients.

You can not afford to learn credit repair the wrong way. Therefore, it is extremely important to take the time to learn your craft in order to provide quality service and to protect your business and credibility.

How to Become a Credit Repair Expert

Learn the basics of credit repair before you take on your first client. Do the research! You cannot play around with other people’s credit report. This is not a hobby, this is a serious business.

Educate yourself. Budget for the costs that are needed to obtain the proper training. Explore paid as well as free credit repair training alternatives.

Software

The first method of learning credit repair is investing in credit repair software. The dispute process is the key to repairing a credit report, so you need to know how to do it effectively. Therefore, it is crucial to invest in a reliable Credit Repair Dispute Software that provides Credit Repair Specialists with the needed support.

The best credit repair software educates Credit Repair Specialists on the dispute process as well as how to utilize the software. While learning the software, you will gain valuable information and knowledge regarding the credit repair process.

There are several recommended credit repair software providers. One of the most popular is the Client Dispute Manager software. This software is highly recommended because credit repair training is offered within it.

Client Dispute Manager software includes very helpful information, and the in-software videos walk you through the credit repair process step by step. The software not only manages your customers, but it also offers training on how to dispute, what letters to send, and when to send them.

Interestingly, it assists with managing your business and has extensive training and a lead generation training option, which is crucial to growing your business.

Webinar

In addition to selecting the correct software, it is highly recommended that you ensure that additional training is available in a format that complements your learning style.

For example, if you are a visual learner, you may prefer to see the information and training material. Therefore, highly visual training, such as webinars, may be preferred.

YouTube

Another option for a visual learner is credit repair education via YouTube videos. There are informative YouTube videos created by credit repair experts. They provide valuable information on Vacuum Supply Store credit repair, the dispute process, how to get started, and how to grow your credit repair business.

YouTube videos are also a great option for auditory learners and are often free! Auditory learners prefer to hear information, so YouTube videos are a great option for auditory learners as well.

In addition, podcasts or audiobooks may be a great method to learn about credit repair methods and the industry for auditory learners.

Books/Articles/Blogs

Also, if you retain information through reading and/or writing, a credit repair course that will allow you to take notes during the class may be the preferred learning method. Reading articles, blogs, e-zine articles, and books is also suggested. There are highly informative books written by credit repair experts that would provide detailed training.

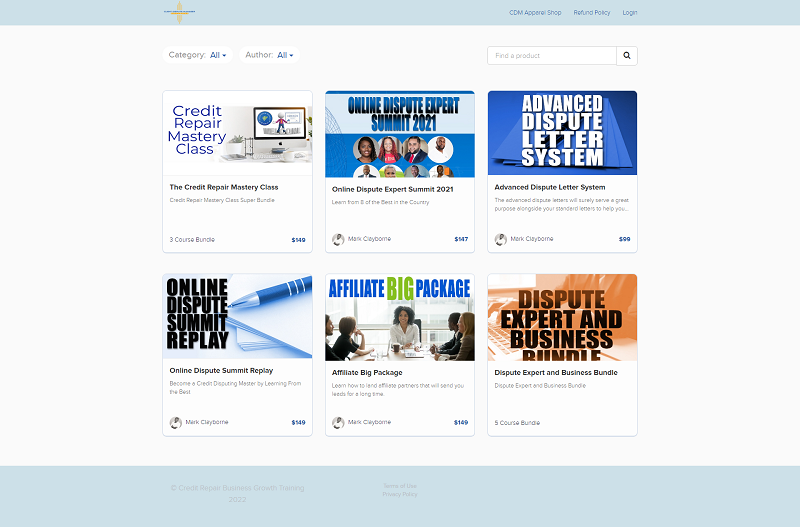

The number one credit repair book in the country is Hidden Credit Repair Secrets by Mark Clayborne. After suffering from a poor credit report for years, he studied the credit repair industry and was able to repair his credit using his newfound credit repair knowledge. He shares his knowledge of credit repair in his book, Hidden Credit Repair Secrets.

This book is highly recommended for individuals new to the credit repair industry and who want to learn about the credit repair process.

Workshops

If reading a book is simply not enough, you may be more of a Kinesthetic learner. As a kinesthetic learner, you will enjoy and retain information best through hands-on activities and experiences.

A face-to-face course or credit repair conference would benefit a kinesthetic learner; this would allow interaction through role-playing and hands-on exercises.

Educational Degree

There are no specific degree or education requirements to become a credit repair expert, but having a formal college degree can give you an edge in becoming a credit repair consultant.

This is especially useful if you are just starting your career and have the little practical experience to offer either employers or customers.

A degree in business or accounting is especially useful. With a master’s degree, more career opportunities will be open to you, and you can further specialize in a particular area to become a credit repair specialist.

A business or entrepreneurial degree gives you a solid foundation in business topics such as marketing, finance, management, and more, all of which help you start and run a business successfully.

An accounting degree teaches you about key financial topics and practices important for managing business and personal credit. You should also take any college courses offered to you that deal in credit or personal finance that are available to you.

Courses in law, finance, and marketing are also incredibly relevant to this profession.

Continuous Training

Continuous training is critically important to every profession, including the credit repair industry. Many aspects of the industry change frequently, especially in the area of technology.

Software, for example, has become more necessary than ever, and it’s important to learn which programs are heavily used in the industry as well as how to use and implement them in your business.

Seminars, courses, and programs keep you updated on the kinds of services customers expect to receive from a credit repair consultant as well as changing industry standards.

Laws also change occasionally, and it is important to keep your knowledge on them up-to-date.

Cultivate A Professional Network

Networking is also important for maintaining and growing a career as a credit repair specialist. Networking with other professionals not only furthers your own professional education but puts you in touch with people who can connect you with new clients to grow your business.

You can also find quality employees through a professional network when your business has grown to the point of needing to find additional staff. Professional networks can also provide you with critical continuing education programs and other resources.

Find a mentor credit repair expert if you can – someone who has experience in the credit repair business and is willing to teach you about the industry. They can be an invaluable resource for helping you avoid mistakes and achieve success as a credit repair expert yourself.

Get Licensed and Certified

While there are usually no specific licenses or certifications required to work as a credit repair consultant in any state, having credentials can be beneficial to you. Clients are far more likely to use a credit repair specialist accredited by a trustworthy organization.

Non-profit industry organizations typically issue the most prestigious certifications. Also, the ones offered directly from software companies and other vendors can be useful.

If any local or state organizations offer certification or licensure, be sure to obtain those if you can because it will bring your business more prestige in your local community.

Don’t forget customer choice awards, too; these demonstrate to prospective customers that existing customers already highly regard your credit repair business.

Listen to Your Clients

An important but often overlooked way to become a credit repair expert is to listen to your clients and learn from the experiences you have with them. This is invaluable for understanding what you are doing right and the aspects of your business that could use work.

Other things you can do that could make your credit business likely to succeed:

- Constantly evaluating your credit repair consultant operations

- Being willing to make the needed changes

- Striving for improvement at every turn

- Putting your clients’ needs first

Word of mouth marketing is one of the most powerful tools to promote your business. And all it requires is giving customers a good experience and encouraging them to recommend you to others.

If you are not sure of your learning style, consider training that covers most of the styles of learning and will allow you to read, listen, watch, and participate. There is a lot of information to learn and seeing, hearing, reading, and participating will ensure that all learning styles are covered.

The Benefits of Being A Credit Repair Expert

1. The Ability to Help People

One of the greatest joys of working in the credit repair industry is being able to help people. Customers come to you hoping you can improve something as important to their quality of life as their credit health, and you are responsible for delivering on that.

This is an enormous responsibility that can feel overwhelming at times but can also be one of the most rewarding careers you can have. When you learn that your help allowed a family to buy a home or a student finally get out of debt, it creates a strong personal satisfaction that shouldn’t be underestimated.

2. The Flexibility to Work as An Employee or Independently

A career as a credit repair specialist is more flexible than other jobs because you can seek employment from a traditional employer, go into business for yourself, or even work as a freelance credit repair consultant. This allows for different approaches that fit your preferences, career goals, and schedule.

Many people prefer the stability of working for an employer. So some credit repair specialists will look to work for an established credit repair agency. Others are entrepreneurs at heart and want nothing more than to start their own business.

It is relatively easy to start up your own credit repair business and begin serving your own clients, but doing so is a major undertaking that should be taken seriously. For people who are more interested in freelance work or doing credit repair projects some of the time, you can also take on projects and clients when it suits you.

3. You Learn A Lot About Good Credit Management

In the course of your professional work, you will learn a lot about good credit management practices that not only help you educate your customers on the topic but will also help you in your personal finance.

In teaching your clients about the various factors that impact their credit scores and by how much, you can apply that knowledge to your credit report. You will also learn how important it is to monitor your credit reports for any false information or signs of identity theft.

4. You Are an Expert

Being an expert in your field is a prestigious position. As a credit repair expert, you will be looked to as an authoritative source on the many nuances of this topic. This is a major responsibility, but it can result in a lot of pride in your work as a credit repair consultant.

When you have successfully positioned yourself as an expert in your field, you become aware of the big picture and how your industry is interconnected with others. A credit repair specialist can specialize in a particular area of credit repair and occupy an in-demand niche.

5. You Can Use Your Knowledge

Perhaps you already have extensive knowledge about credit repair topics and would like to use that knowledge professionally. You might also already be familiar with business management or have always dreamed of starting your own business.

Being a credit repair consultant is an in-demand business opportunity where you can put these skills to work and build a flourishing career as a credit repair specialist out of them.

Roles and Responsibilities of a Credit Repair Expert

There are quite a few roles credit repair experts occupy as well as responsibilities you have to your customers.

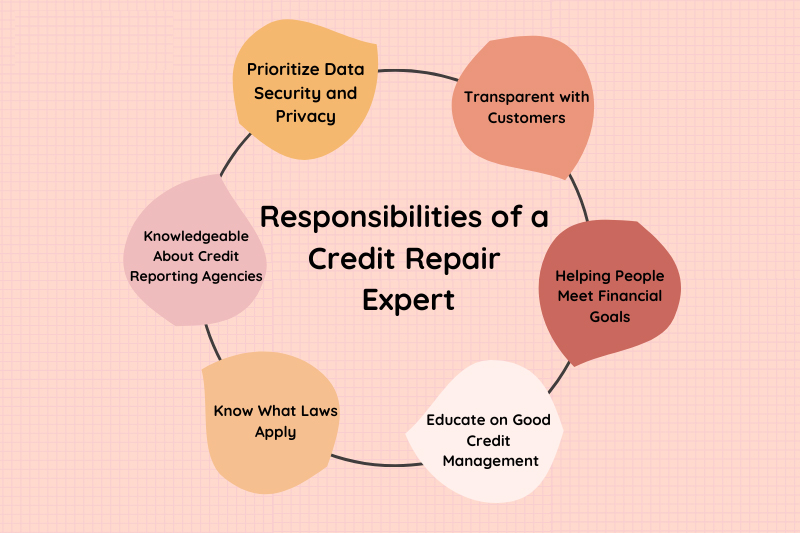

1. Being Transparent with Customers

Customers looking for credit repair services are seeking someone trustworthy who can help them achieve a better credit rating. For this reason, you must be transparent and honest in all of your dealings with customers.

Because credit repair professionals are not strongly regulated, many are subpar, and you will want to be especially careful to position your business as credible and effective.

Clients will appreciate transparency and honesty from their credit repair specialists and be more likely to think highly of you.

2. Helping People Meet Financial Goals

While credit repair companies cannot magically get consumers out of debt, they provide a number of services that equip clients with the right tools to make better financial decisions and maintain good credit going forward.

A qualified credit repair specialist will look over the negative items on a credit report and offer a variety of methods to handle each, including their pros and cons.

This helps customers address these negative items in the most effective way possible and ultimately meet their long-term financial goals.

3. Educate Customers on Good Credit Management

One of the most important responsibilities you will have in this profession is to educate customers on good credit management practices to maintain healthy credit going forward.

A credit repair consultant is responsible for educating customers on the options they have to improve their credit to decide for themselves the best way to move forward.

Each client’s financial information and background will be different, and people learn in different ways too. You will learn to tailor your approach to each client so that they will get the most out of your services.

4. Be Knowledgeable About the Major Credit Reporting Agencies

Credit repair customers need to work closely with not only their credit repair specialist but also with the major credit reporting agencies that oversee consumer credit history. Because of this, you need to have a strong understanding of how each of these companies works to manage your business most effectively.

The top three credit bureaus are TransUnion, Equifax and Experian. They are are similar, but they also have some notable differences, such as the fact that a person’s credit score can vary between the three agencies.

It is critically important for a credit repair consultant to understand all current laws and regulations that govern consumer credit. Doing so not only helps you provide better service to your clients but also prevents your business from having legal trouble.

For example, anyone providing credit repair services is required by law to present customers with a written contract outlining what they will do before services are rendered.

A credit repair specialist needs to understand federal and state regulations on credit repair practices. If you are ever in need of legal advice or have a legal question, be sure to contact an attorney qualified to help credit repair consultants.

5. Know What Laws Apply to The Profession

Federal agencies involved in consumer credit rights include the Federal Trade Commission and the Consumer Financial Protection Bureau. Key federal laws include the Fair Credit Reporting Act, the Credit Repair Organizations Act, the Fair and Accurate Credit Transactions Act, and the Fair Debt Collection Practices Act.

6. Prioritize Data Security and Privacy

When you work as a credit repair consultant, you run a business that closely handles your customers’ sensitive financial information. Hence, it is imperative that you prioritize the security of that data.

Undoubtedly, data breaches of sensitive financial information can be devastating for your business because you will lose customers’ trust. So invest in software and cybersecurity tools upfront to protect the information you work with.

You can certainly showcase the data security measures you take when trying to draw in new customers or affiliates to your business.

Conclusion

No matter the method you choose, the credit repair training that you receive should be easily accessible and detailed. As a Credit Repair Specialist, you will have to opportunity to assist thousands of people with your knowledge. Invest in your training and you will be well on your way to becoming a Credit Repair Expert.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.