Do you have a knack for maintaining a good, if not overall an excellent credit score or at least have a keen interest in the business side of it? Well, you’ve come to the right place. This guide will give you the insights and actionable items to help you start and gain the necessary skills and confidence to become an efficient credit repair agent.

Table of Content:

However, just like any other worthwhile endeavor, you still need to work your way up to become competitive and profitable, especially in this corner of the financial market. This guide will also help you start your own business while simultaneously providing expert credit repair services that help people get back on their feet.

Let’s get to it!

Credit Rating and Credit Score

Before anything else, let us take a quick look at some important things you need to know to become a Credit Repair Agent.

Credit rating, by definition, is the process of determining the creditworthiness of a borrowing company or individual. Simply put, it attempts to measure the capacity of the borrower to pay back a loan at the agreed-upon time. This lender-borrower agreement is usually covered by a written document signed by both parties.

The higher the credit rating, the better chance the borrower pays back the loan.

How is Your Credit Score Calculated?

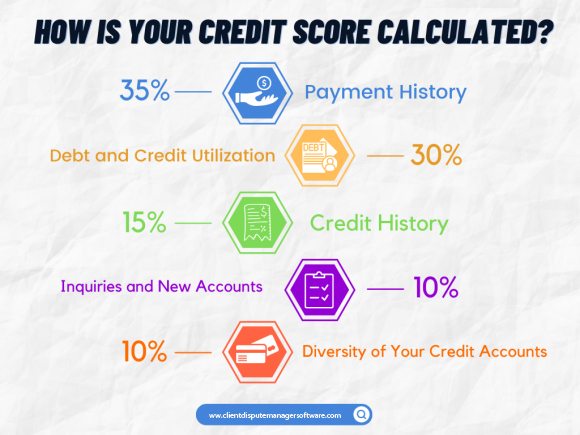

As a would-be credit repair specialist or a soon-to-be credit repair business owner, you need to understand at least the basics of how your score is calculated and the factors involved in the assessment. Listed below are the factors that directly affect your credit score:

1. Your Payment History (35%)

The most critical factor for determining your FICO score is your payment habits. It accounts for 35% of your total rating, of which your payment history is, to most lenders, a reliable gauge when it comes to credit risk. On-time payment is always the key to a better credit score, while a single delay can affect your score in more ways than you expect.

2. Debt and Credit Utilization (30%)

The rate for credit utilization is computed by how much you currently owe divided by your credit limit. Incidentally, credit utilization is 30% of your credit rating. And your score will go up or down, corresponding to the total borrowed amount against your total credit limit. To achieve a positive rating, your utilization must be no more than 25- 30% of your credit limit.

3. Inquiries and New Accounts (10%)

Inquires and new accounts are 10% of the credit score. They are generally categorized as “soft” and “hard” inquiries. Soft inquiries, also known as a soft credit check, are when you authorize someone or an employer to check your credit report. This type of inquiry doesn’t affect your credit rating since it is not attached to a specific loan application.

On the other hand, a hard inquiry happens when a lending company requests to check your credit report as part of an application for a loan that you submitted. A hard inquiry may negatively impact your credit score, and too much of it will also lower your rating.

4. Length of Credit History (15%)

The length or age of your credit history constitutes 15% percent of your total credit score. If most of your good accounts are older (dating many years back), they may boost your credit score. On the other hand, if your accounts are mostly new, it may negatively impact your score.

5. Diversity of Your Credit Accounts (10%)

The diversity factor of your portfolio makes up 10% of your credit score, meaning having different types of loans in good standing can potentially boost your score. For example, an installment debt such as a mortgage loan coexisting in your portfolio with revolving debt like a consumer credit card, all in good standing, demonstrates your capability to manage your finances well. Hence, a higher credit rating.

Initial Steps You Can Take to Repair Credit Score

First, you will want to make a full review of your client’s credit report from all three credit bureaus: Experian, TransUnion, and Equifax. They can request a full report of their FICO score, which is a measure that most top lenders generally use, as it may range between 300 to 850.

A FICO score of 720 to 850 is mainly rated excellent. After which is then followed by good, fair, and poor ratings. Anything below 620 is already considered bad credit.

What You Should Understand as a Credit Repair Specialist?

It may surprise some people that poor credit rating may actually cost them, even though it might also take years to correct. They need not worry, though. With your help as a credit repair specialist, they can begin to repair their credit as early as today.

Unfortunately, a poor credit rating may also affect their ability to rent an apartment or get hired for a job. You will have to be patient, too, since it may not be a quick fix. Make your potential client realize that starting the repair now is better than hiding their head in the sand and pretending that their financial problems don’t exist.

It is important to know that credit repair takes time and resources. Nevertheless, it does help you identify and remove any errors in the report for accuracy and fairness. And when enough time has passed, some items that have matured and need to be corrected or removed will be promptly taken off.

Who Are Your Potential Clients?

Let us take a look at individuals whom you can help:

- Borrowers who have been denied a loan or other debt products of similar nature. They have been denied mostly due to low credit scores.

- Individuals whose credit card providers increased their interest rates due to a sharp drop in their credit rating.

- Individuals who made some financial mistakes causing their credit rating to crash.

- Individuals who were not hired for a job due to credit score issues.

- And other individuals in related scenarios.

How to Become a Credit Repair Agent

Becoming a credit repair specialist will eventually open up opportunities to either join a company or set up your own business. So, if you think this is the career for you, go ahead and take steps to get yourself certified and be established as a professional. As of this time, there are no hard requirements to be recognized as a credit repair professional. Although, some certifications can be gainful in terms of your credibility in the market.

Step 1: Know Your Reasons for Choosing this Business

Knowing why you chose to become a credit repair agent can be a good motivating factor and inspiration for owners of this type of business.

Listed below are just a few reasons among many that you can come up with to motivate yourself:

- You can work this business from home.

- It gives you flexibility in terms of schedule

- It doesn’t require a large capital on startup.

- You can be your own boss regarding finances and your preferred work hours.

Step 2: Become an Expert Credit Repair Agent

As a specialist, it is only natural that you must be a good example of what you offer as a service. You will have to be an expert in this field to establish credibility. And one way of achieving this is to repair (when necessary) and maintain an excellent credit score whenever possible.

Below are the essential topics that you must master in the process of improving your and your client’s credit score:

You Must Know How to-

- Understand credit reports

- Legally dispute errors in reports and learn the strategies on how to do it.

- Handling the actual back and forth dispute process with credit bureaus, collectors, and creditors

- You must always practice the correct and ethical way to rebuild credit.

Step 3: Getting an Education

A College Degree

If you have the chance to get a college degree, go ahead and choose a course related to finance. A study in bankruptcy, taxes, and other related legal subjects will be very helpful when working with a client who might be facing these matters due to poor credit. You may also get a board certification as a CPA or Certified Public Accountant or maybe a law degree to further cement your credibility as a Credit Repair Specialist.

This will also allow you to offer your clients a wider range of services.

Part-time Courses

You may also want to stay updated as a credit repair specialist by taking refresher programs and learning new things in your field. This way, you can stay relevant and competitive.

Online Training Courses

There is a lot of free and paid credit repair training you can find online. You can also join groups on social media platforms, attend webinars and enroll in training and courses related to the industry you are in.

Step 4: Become Certified

This part of the process is by all means voluntary. But if you are looking to turn this business into a career, you might as well be equipped with the proper credentials to boost your skills and credibility as a specialist. You can look up reputable credit repair companies within your area, as well as online, which offer credit repair certifications and licensing programs.

The established and popular ones will likely land you more quality clients. Of course, there is a cost to getting these certificates. Aside from the time you will be investing by attending seminars and classes, be ready to shell out a few hundred dollars for the sessions.

Step 5: Know the Applicable Laws in the Industry

Credit repair is, for a good cause, a heavily-regulated financing industry. As a specialist, you will have to know and understand how laws apply to the business, regardless of whether it is yours or you work for an agency. Understand that federal and state laws govern the credit repair business.

Making sure that you are within the bounds will keep you out of legal trouble if some discrepancies arise from your dealings with clients and lenders. Moreover, if you are the owner and abide by the law, you can be assured of smooth operations with less worry about potential litigation.

On the flip side, however, if you work for a credit repair agency known for cutting corners and skirting these laws, it would create a lasting negative impact on your reputation as an agent. A good credit specialist will look for an agency that has better reviews regarding the legitimacy of its transactions. You may also want to do a background check by asking former employees and reading up on client feedback.

What are its clients saying? Have there been any complaints? Too many complaints and unhappy clients indicate that you will need to keep looking until you find one that will eventually satisfy your reasonable standards.

Click to learn more about credit repair laws.

How to Start Your Own Credit Repair Business?

What Is a Credit Repair Company?

A credit repair business is defined as a service that helps consumers qualify for a loan or do the necessary steps to ethically increase their credit score. As a business, you will accept clients who need to improve their scores.

Your Role as Credit Repair Specialist

As the credit repair agent, you will assist in managing errors and disputes on your client’s credit report. The process entails representing, speaking for, filing disputes, and doing follow-ups with credit bureaus, lenders, and collection agencies for your client.

Step 1: Learn the Ropes and Invest in Yourself

Starting a business with zero experience can be tricky. Being a credit repair specialist is different from running your own business or company that provides the same service. Use your expertise in credit repair and allow experienced business owners to mentor you. Seek out successful individuals who have already been in the trenches when managing their own company.

Some mentors offer paid classes, while others accept apprentices by way of receiving free services from their students as a means of compensation. Choose a credit repair mentor with a proven track record of success in the industry.

Step 2: Come Up with a Qualified Business Plan

Suppose you are now confident enough that you have already acquired the necessary skills and experience as a credit repair specialist. It is now time to begin crafting your business plan as an owner.

A well-designed plan will keep you and your business organized and consistent. Should challenges arise, a good plan will help you bounce back quickly and maybe even facilitate scaling up your business when the right time comes.

Elements of a Good Business Plan

- Create a clear description of your company by issuing a mission and vision statement

- Conduct comprehensive market research

- Make a listing of the services you offer and how they will address the needs of your client

- Create a customer avatar that will describe your ideal customer.

- Other matters on marketing and the launch date of your business.

Step 3: Be Knowledgeable About All Applicable Laws in Your Business

Try to avoid falling into the trap of unknowingly violating any law that could potentially impact your business only because you haven’t adjusted yet to the owner mindset. Protect yourself and your business, and learn about applicable laws as much as possible. State laws will guide your business regarding what to put in your contracts. These include requirements needed to set up and run your business, as well as complying with the rules on how to advertise it.

Federal laws, on the other hand, such as the 1996 CROA or Credit Repair Organizations Act, is the most important law regarding running a credit repair enterprise. It will guide you on what to do and what not to do when representing and advising your clients. Any violation of the CROA will result in your business being penalized, fined, or possibly being shut down altogether, depending on the severity.

Among many other scenarios, this law states that:

- You are not to mislead your clients by misinterpreting the services you provide.

- The owner must have a contract up front before doing business.

- As the owner, you are not allowed to charge your client in advance as you are required to provide consultation and a credit report analysis before charging your client a getting-started fee.

It is necessary for you to learn more about credit repair business laws

Step 4: Make an Estimate of Your Costs

Like most businesses, credit repair also has its own set of fees and startup costs that need to be taken care of. You may want to prepare $500 as a fair amount for the startup.

Note the following list of fees and other essential expenses:

- Licensing Fee– the amount for licensing for credit restoration services differs from state to state. The cost can be anything from $20 to $100.

- Surety Bond– a surety bond is a hedge or security bond for the consumer or borrower to ensure that the credit repair company will abide by the rules regarding its offered service. The amount can either be 1% or 2% of whatever the state requires you to cover for the bond. Visit your state’s website to get more information about surety bonds.

- Website Hosting and Other Online Expenses-you may purchase a domain for your website and establish an online presence for your brand. Nowadays, the first thing people do when checking on services and products is to log on to see if they can find you on the internet. A well-constructed website with a clearly delivered message can land you many clients.

- Equipment and Other Tools-you will need a computer with sufficient storage capacity and specs to process information without worrying about your systems breaking down. Don’t forget to get a business a printer that could be brand new or not. What is important is that it will serve its purpose for a few years before it expires.

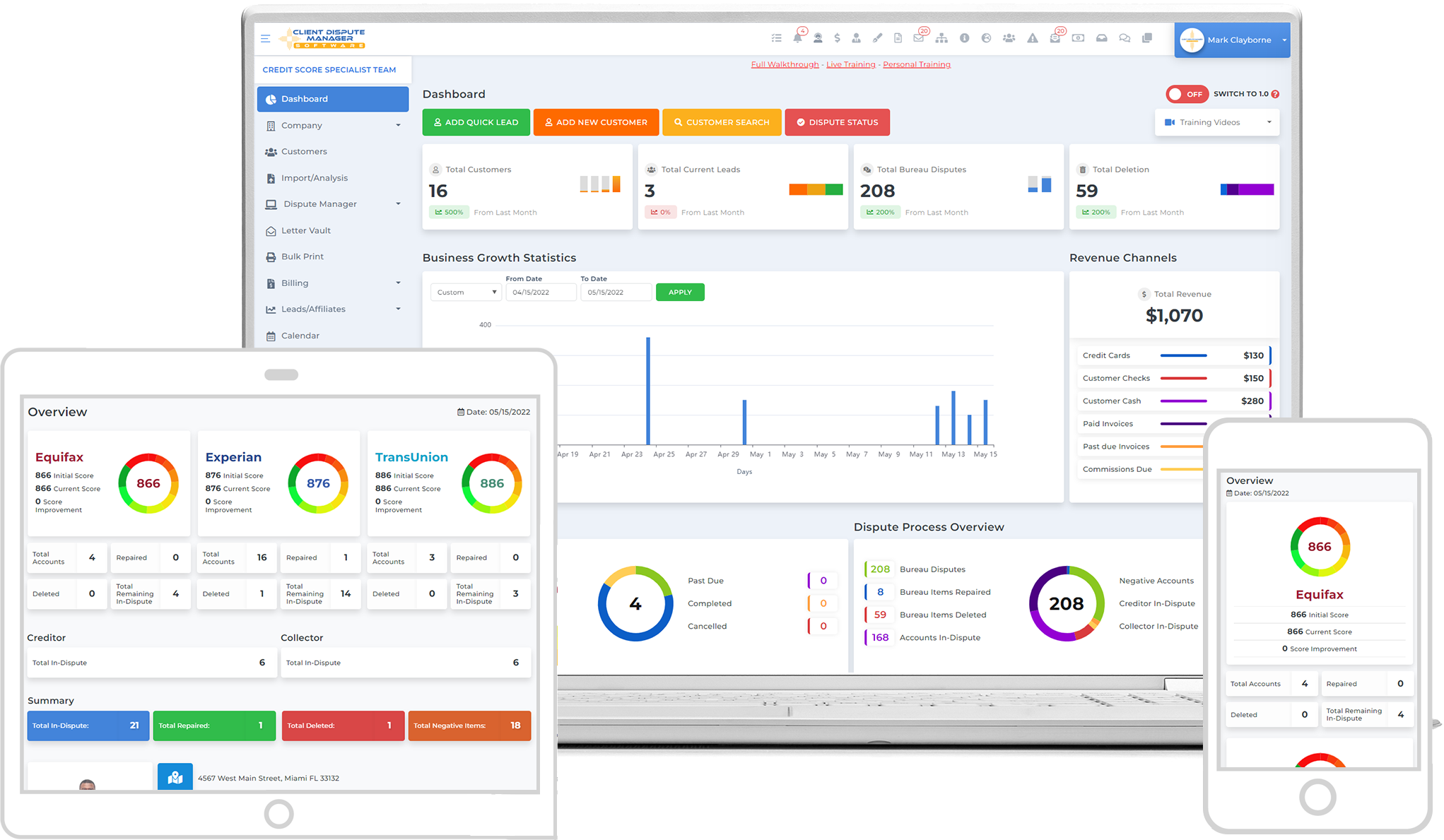

Step 5: Invest in a Credit Repair Software such as the Client Dispute Manager

The Client Dispute Manager Software will keep your business organized and efficient. Your business would do well to be ready to scale up when it is streamlined and already automated.

Here are a few of the benefits of using software to run your important tasks:

- Savings in time and resources through automation.

- Better management of company-client relationships

- Safe, anywhere, anytime accessibility of your client’s data and other pertinent information

Step 6: Create a Contract

A smart and comprehensive contract must be included with offering your services. A good agreement builds trust and confidence with your client while mapping out detailed parameters and other specifics of your business. It is essentially a written document, and you should let your client know what’s in it before doing any business. You may consult your lawyer for the necessary items that should be included in the contract.

Step 7: Market Your Business and Build an Online Presence as a Credit Repair Specialist

Build your brand by taking advantage of the many available platforms on the internet. Social media sites like YouTube, Facebook, Twitter, LinkedIn, and Instagram are some of today’s most popular platforms to boost your brand.

Step 8: Grow Your Business by Using Proven Online Strategies

Having a website is one of the primary ways of establishing your brand’s online presence. It then doubles in potential when you combine it with the power of social media.

You can now proactively promote and gain credibility on and offline by using the following marketing strategies:

Become an Authority

By being an expert in your industry and teaching others how to improve their credit scores, you will gain a following that you can nurture and grow. You can now increase your business through trust and sharing of knowledge.

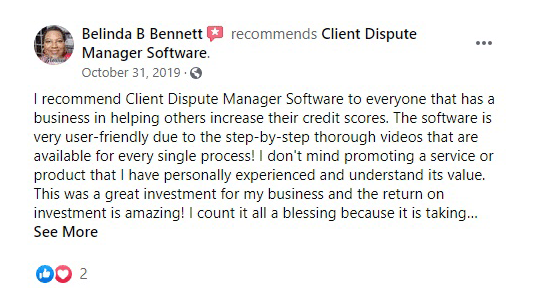

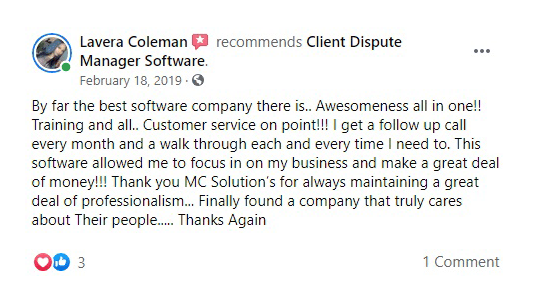

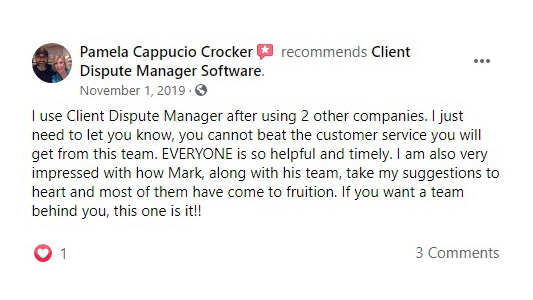

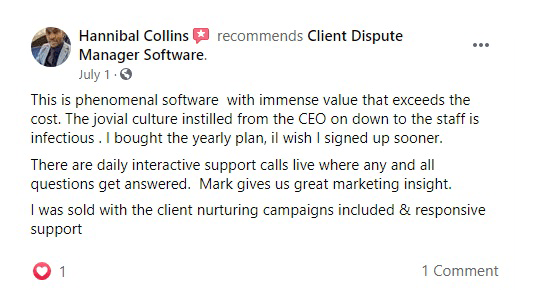

Gather Testimonials in Exchange for Your Credit Repair Services

Testimonials can be a powerful avenue to create personal/emotional appeal to your prospective clients. It also serves as evidence of your expertise while creating advocacy through your clients. Positive testimonials carry more weight than one could expect.

Here is What Others are Saying About the Client Dispute Manager

Create an Affiliate Program

Network affiliates is a sidewinder marketing strategy that uses content as an indirect approach to advertising your brand. Advertising through content is subtle, powerful, and creates loyalty that could last forever. Find ways to nurture your partner affiliates and touch base with them from time to time.

Always keep your affiliate partners in the loop for any updates about your brand. This is so that they continue sharing it and bring in more conversions and, ultimately, added revenue for your business.

Understanding Credit Repair Laws

Credit repair laws form the cornerstone of ethical practices in the industry, protecting consumers and ensuring fair operations. These laws for credit repair are crucial for maintaining the integrity of credit reporting systems and preventing fraudulent activities. Understanding and following these regulations is essential for both consumers seeking to improve their credit and businesses operating in the credit repair industry.

Historical Context of Credit Repair Laws and Compliance

Before the implementation of current credit repair laws, the industry lacked oversight, leading to widespread consumer exploitation. The introduction of key legislation, such as the Fair Credit Reporting Act (FCRA) in 1970 and the Credit Repair Organizations Act (CROA) in 1996, marked significant milestones in consumer protection. These laws established clear guidelines for credit reporting agencies and credit repair organizations, bringing much-needed regulation to the industry.

The Fair Credit Reporting Act (FCRA): Foundation of Credit Repair Laws

The Fair Credit Reporting Act is a cornerstone of credit repair laws. Enacted in 1970 and subsequently amended, the FCRA regulates how credit reporting agencies handle consumer information. FCRA compliance is essential for both consumers and credit repair companies.

Key provisions of the Fair Credit Reporting Act include:

- The right to request free annual credit reports

- The ability to dispute inaccuracies on credit reports

- Time limits on negative information retention

- Requirements for employer consent before accessing credit reports

For credit repair companies, FCRA compliance involves obtaining written permission before accessing client credit reports and educating clients on their rights under the Fair Credit Reporting Act. Credit reporting agencies must follow reasonable procedures to ensure the accuracy and fairness of the information in credit reports, which is crucial for maintaining the integrity of the credit reporting system.

The Credit Repair Organizations Act (CROA): Safeguarding Consumer Interests

The Credit Repair Organizations Act, enacted in 1996, is another pivotal piece of credit repair legislation. CROA sets standards for credit repair businesses and ensures fair treatment of consumers seeking credit repair services. Understanding and adhering to CROA is crucial for credit repair compliance.

Key CROA requirements include:

- Providing clients with written contracts outlining services and fees

- Prohibiting companies from charging fees before performing services

- Giving clients a three-day cancellation period after signing a contract

- Prohibiting false or misleading advertising claims

CROA compliance involves more than just following rules; it’s about building a reputation as a trustworthy organization. Credit repair businesses can differentiate themselves by developing clear, transparent contracts, implementing systems for tracking service completion before charging fees, and training staff on proper communication with clients.

Credit Repair Compliance: Balancing Regulations and Effective Service

To provide effective credit repair services while maintaining compliance with credit repair laws, businesses should focus on education and empowerment. Developing educational materials that explain laws for credit repair in simple terms and offering workshops on topics like understanding credit reports can position a company as both an educator and service provider.

Emphasizing accuracy in credit reporting is at the heart of FCRA compliance and ethical credit repair. When assisting clients with disputes, ensure that all information provided is accurate and verifiable. Maintain open communication with clients throughout the process, explaining each step and potential outcomes.

Thorough documentation is essential for demonstrating compliance with all credit repair laws. Implement a robust system for tracking client interactions, disputes filed, and services performed. This not only helps in case of any legal scrutiny but also allows you to track your progress and improve your services over time.

Staying Updated on Credit Repair Laws and Regulations

The landscape of credit repair laws is continually evolving. To ensure ongoing credit repair compliance, businesses must stay informed about changes in legislation and industry best practices. Regularly review and update your policies to align with the latest interpretations of the Fair Credit Reporting Act, Credit Repair Organizations Act, and other relevant laws for credit repair.

By adhering to these principles and maintaining a strong focus on credit repair compliance, businesses can build trust, provide valuable services, and contribute to a more ethical industry landscape.

Understanding and implementing the requirements of the Fair Credit Reporting Act, Credit Repair Organizations Act, and other credit repair laws is not just a legal necessity—it’s a cornerstone of building a reputable and successful credit repair business.

Conclusion

The role of a credit repair agent is highly rewarding as well as a reasonably challenging career. However, you can be sure that it’s always never a one-off thing, as you will find yourself establishing short and long-term business relationships with most of your valued clients. So, if you are a people person who loves to help other people rebuild their economic lives, by all means, serve them well and don’t forget to have a blast.