Are you an entrepreneur or individual struggling with credit issues, wondering why your pay per delete letters aren’t yielding the results you hoped for? As an expert credit repair pay for delete specialist, I’ve witnessed countless people face challenges when attempting to navigate the intricate world of credit repair.

In this comprehensive guide, we’ll dive deep into the common pay for delete mistakes people make when crafting pay for delete letters and arm you with effective pay for delete letter tips to maximize your success rate and avoid pay for delete errors.

Start Today and Explore the Features Firsthand!

Understanding the Basics of Pay for Delete

Before we explore the pitfalls to avoid, let’s ensure we’re on the same page regarding what a pay per delete letter entails. A pay for delete letter is a powerful negotiation tool designed to convince creditors or collection agencies to eliminate negative items from your credit report in exchange for payment.

By removing these derogatory marks through credit repair pay for delete strategies, you aim to boost your credit score and enhance your financial standing. However, many individuals find their efforts falling short due to common pay for delete mistakes, leaving them frustrated and discouraged. So, what could be going wrong?

Common Pay for Delete Mistakes to Avoid

When it comes to credit repair pay for delete, many individuals find themselves making common pay for delete mistakes that hinder their progress and prevent them from achieving the desired results. These mistakes can range from failing to conduct thorough research to relying too heavily on generic templates.

By understanding and avoiding these pitfalls, you’ll be better equipped to create effective letters that increase your chances of success and help you avoid pay for delete errors.

Failing to Conduct Thorough Research

One of the most prevalent common pay for delete mistakes people make is diving into the pay per delete letter process without conducting adequate research on the creditor or collection agency they’re dealing with.

It’s crucial to understand that each company has its unique policies and procedures when it comes to handling credit repair pay for delete requests. Some may be more receptive to negotiation, while others have a strict stance against it.

Before crafting your pay per delete letter, take the time to investigate the company’s position on pay for delete and tailor your approach accordingly to avoid pay for delete errors. This extra step can save you time and increase your chances of success.

Relying Too Heavily on Generic Templates

While pay for delete letter templates can serve as a helpful starting point, relying excessively on generic templates is one of the common pay for delete mistakes that can hinder your progress. Creditors and collection agencies are inundated with countless letters daily, and a cookie-cutter approach rarely captures their attention or persuades them to take action.

Instead of settling for a one-size-fits-all solution, personalize your pay per delete letter to address your unique circumstances and the specific relationship you have with the company. Demonstrate that you’ve put thought and effort into your credit repair pay for delete request, and you’re more likely to receive a favorable response.

Neglecting to Offer a Compelling Reason

Many individuals make one of the common pay for delete mistakes of simply asking for a pay for delete agreement without providing a persuasive reason for the creditor or collection agency to consider their request. Remember, these companies are not obligated to grant your wish, so it’s essential to present a compelling case in your pay per delete letter.

Take the time to explain your circumstances, such as financial hardship or recent efforts to improve your credit. Highlight the steps you’ve taken to rectify past mistakes and emphasize your genuine commitment to resolving the issue through credit repair pay for delete.

By painting a clear picture of your situation and demonstrating your sincerity, you increase the likelihood of the company empathizing with your position and agreeing to your proposal.

Underestimating the Power of Follow-Up

Sending a single pay per delete letter and hoping for the best is another one of the common pay for delete mistakes. Given the high volume of correspondence creditors and collection agencies receive, it’s easy for your letter to get overlooked or lost in the shuffle.

If you don’t receive a response within a reasonable time-frame, don’t hesitate to follow up with a polite reminder. Persistence can be the key to success in credit repair pay for delete. By demonstrating your commitment and determination, you show the company that you’re serious about resolving the issue and are willing to put in the necessary effort to avoid pay for delete errors.

Start Today and Explore the Features Firsthand!

Focusing Solely on Pay for Delete

While pay per delete letters can be a powerful tool in your credit repair arsenal, it’s one of the common pay for delete mistakes to rely on them as your sole strategy. To achieve optimal results and avoid pay for delete errors, it’s essential to adopt a comprehensive approach that incorporates various successful pay for delete strategies.

In addition to crafting compelling pay for delete letters, consider disputing inaccurate information on your credit report, negotiating with creditors for more favorable terms, and implementing positive credit habits moving forward. By attacking credit issues from multiple angles, you increase your chances of success and expedite your journey towards a healthier credit profile.

Crafting Effective Pay for Delete Letters: Tips for Success

Now that we’ve identified the common pay for delete mistakes to avoid, let’s shift our focus to the effective pay for delete letter tips that can help you create successful pay per delete letters:

- Be Concise and Professional: When drafting your pay per delete letter, aim for clarity and professionalism. Avoid excessive wordiness or emotional language, and instead, present your case in a succinct and well-organized manner. Use formal language and maintain a respectful tone throughout your correspondence.

- Clearly State Your Request: Be specific about the action you want the creditor or collection agency to take in your pay per delete letter. Identify the precise negative item you wish to have removed from your credit report and articulate your request in a direct and unambiguous manner. Leaving no room for misinterpretation increases the likelihood of a favorable response and helps you avoid pay for delete errors.

- Offer a Reasonable Settlement Amount: When proposing a payment in exchange for deletion in your pay per delete letter, ensure that the amount you offer is fair and reasonable. Consider the original debt amount, your current financial situation, and the potential impact on your credit score. Presenting a realistic settlement offer demonstrates your sincerity and willingness to resolve the issue through credit repair pay for delete.

- Set a Response Deadline: To create a sense of urgency and encourage prompt action, include a reasonable deadline for the creditor or collection agency to respond to your pay per delete letter. This timeline should allow sufficient time for processing while also conveying your eagerness to reach a resolution. Be sure to follow up if you don’t receive a response within the specified time-frame to avoid pay for delete errors.

- Document Everything: Throughout the credit repair pay for delete process, maintain meticulous records of all correspondence. Keep copies of the pay per delete letters you send, as well as any responses you receive. This documentation serves as evidence of your efforts and can be invaluable if any discrepancies or disputes arise in the future.

By implementing these effective pay for delete letter tips and avoiding the common pay for delete mistakes discussed earlier, you can significantly improve the effectiveness of your pay for delete letters and increase your chances of achieving the desired outcome.

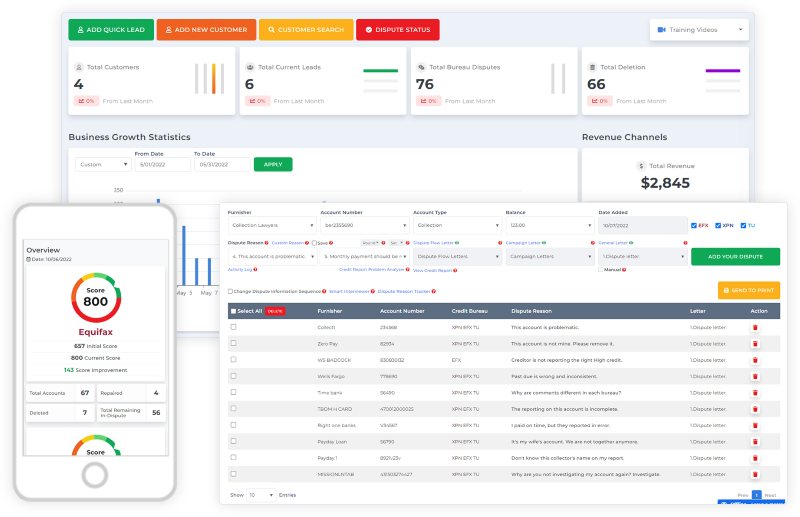

Client Dispute Manager Software: Streamlining Your Credit Repair Pay for Delete Process

As a credit repair professional, managing client disputes and crafting effective pay per delete letters can be time-consuming and challenging. This is where Client Dispute Manager Software comes in a powerful tool designed to streamline your credit repair pay for delete process and help you avoid common pay for delete mistakes.

Client Dispute Manager Software offers a range of features that simplify the creation and tracking of pay per delete letters. With customizable templates and intuitive workflows, you can quickly generate personalized letters that adhere to best practices and effective pay for delete letter tips. The software also provides a centralized dashboard to monitor the status of each dispute, ensuring that you stay on top of client communications and follow-up tasks.

Key features of Client Dispute Manager Software include:

- Customizable pay per delete letter templates

- Intuitive workflows for streamlined dispute management

- Centralized dashboard for tracking dispute status

- Automated tracking and reminder system to stay organized

- Built-in analytics and reporting for insights into success rates

- Integration with popular credit reporting agencies

By leveraging Client Dispute Manager Software, you can save valuable time and reduce the risk of errors in your pay per delete letter process. The software’s automated tracking and reminder system helps you stay organized and ensures that you never miss a critical deadline.

Additionally, the built-in analytics and reporting features provide valuable insights into your dispute resolution success rates, allowing you to continuously refine your strategies and avoid pay for delete errors.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

Are Pay For Delete Letters A Guaranteed Solution For Removing Negative Items?

While pay per delete letters can be a highly effective tool in credit repair pay for delete, it’s important to understand that there are no guarantees. The success of your efforts largely depends on the specific creditor or collection agency’s policies and willingness to negotiate.

However, by following best practices, crafting compelling pay per delete letters, and being persistent, you can greatly improve your chances of reaching a favorable agreement and avoid pay for delete errors.

How Long Does The Pay For Delete Process Typically Take?

The timeline for the credit repair pay for delete process can vary depending on several factors, including the responsiveness of the creditor or collection agency and the complexity of your specific case. In some instances, you may receive a response to your pay per delete letter within a few weeks, while other cases may require several rounds of correspondence over a few months.

It’s crucial to remain patient and persistent throughout the process, as credit repair is rarely an overnight solution. Utilizing effective pay for delete letter tips can help expedite the process and avoid pay for delete errors.

Can I Attempt Pay For Delete For All Types Of Negative Items On My Credit Report?

Pay per delete letters are most commonly used for collection accounts and charge-offs, as these types of negative items can have a significant impact on your credit score. However, you can certainly attempt to negotiate with creditors for other types of negative items as well, such as late payments or high credit utilization, as part of your credit repair pay for delete strategy.

Keep in mind that the success rate may vary depending on the type of item and the creditor’s specific policies regarding pay for delete agreements. By following successful pay for delete strategies, you can increase your chances of positive outcomes.

Conclusion

Navigating the world of credit repair and mastering the art of pay per delete letters can be a transformative experience for entrepreneurs and individuals alike. By understanding the common pay for delete mistakes to avoid and implementing effective pay for delete letter tips for success, you can take control of your credit narrative and pave the way for a brighter financial future.

Remember, pay per delete letters are just one piece of the puzzle a comprehensive approach that addresses various aspects of your credit profile is essential for long-term success and to avoid pay for delete errors.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Prepare Your Dispute Letters for the Collectors in 15 Seconds

- Ready to Boost Your Credit Score? Learn How to Remove Inaccurate Negative Items Now