Are you an entrepreneur or someone struggling with credit issues who wants to learn how to remove inaccurate negative items and improve your credit score? Negative items on your credit report can hold you back from achieving your financial goals, whether that’s starting a business, buying a home, or simply securing better loan terms.

But don’t despair there are proven strategies to delete negative credit items and get your credit back on track. In this comprehensive guide, we’ll cover everything you need to know about how to remove inaccurate negative items from your credit report.

Understanding Inaccurate Negative Items on Credit Report

First, let’s define what negative items are. Negative credit items include late payments, collections, charge-offs, repossessions, foreclosures, bankruptcies, and other derogatory marks. These items can significantly lower your credit score and make it difficult to get approved for loans, credit cards, and even rental housing or employment.

Most negative items stay on your credit report for seven years, while some bankruptcies remain for ten years. The good news is that the impact of negative items decreases over time, and there are steps you can take to potentially delete them from your report sooner.

The Impact of Inaccurate Negative Items on Your Credit Score

To understand why it’s so important to remove inaccurate negative items from your credit report, let’s take a closer look at how they affect your credit score. Your credit score is a three-digit number that represents your creditworthiness to lenders. The most common credit scoring model is the FICO score, which ranges from 300 to 850.

Payment history is the most significant factor in your FICO score, accounting for 35% of the total. A single late payment can drop your score by up to 100 points, and multiple negative items can have a compounding effect. This is why it’s crucial to address negative items as soon as possible, rather than hoping they’ll go away on their own.

Steps On How to Remove Inaccurate Negative Items from Credit Report

Now that you understand the impact of negative items, let’s dive into the specific steps you can take to remove them from your credit report.

#1: Check Your Credit Reports For Errors

About 20% of consumers have errors on their credit reports that could be hurting their scores. Common errors include accounts that don’t belong to you, incorrect payment statuses, and outdated information. You’re entitled to a free copy of your credit report from each of the three major credit bureaus (Experian, Equifax, TransUnion) every 12 months.

To get your free credit reports, visit Annual Credit Report, the only site authorized by federal law to provide them. Review your reports carefully and dispute any inaccurate negative items with the credit bureaus. They are required to investigate and remove any information that cannot be verified.

#2: Send Goodwill Letters For Late Payments

If you generally pay on time but had a few late payments due to extenuating circumstances like a job loss or medical emergency, try writing a goodwill letter to the creditor. Explain your situation politely and honestly, express regret for the late payment, and request that they remove it as a one-time courtesy.

There’s no guarantee this will work, but it’s worth a shot, especially if you have a long history with the creditor and have since caught up on payments. Include any documentation that supports your case, such as medical bills or unemployment benefits.

#3: Negotiate A "Pay For Delete" with Collections

If you have accounts in collections, you may be able to negotiate with the collection agency to remove the negative item in exchange for payment. This is known as a “pay for delete” arrangement. Essentially, you agree to pay off the debt (or sometimes a portion of it), and in return, the collection agency agrees to stop reporting the account to the credit bureaus.

Be sure to get the agreement in writing before making a payment, and keep proof of your payment in case the collection agency doesn’t follow through. Keep in mind that some newer credit scoring models like FICO 9 still consider paid collections, so this may not be a complete solution.

#4: Wait For Inaccurate Negative Items to Fall Off Naturally

Unfortunately, most legitimate negative items cannot be removed and will stay on your report for the full seven to ten year period. However, their impact on your credit score will lessen over time, especially if you’re taking steps to build positive credit in the meantime.

Focus on adding positive information to your credit report by making on-time payments, keeping credit card balances low, and only applying for new credit when absolutely necessary. As your negative items age and your positive credit grows, your score will gradually improve.

#5: Consider Working with A Reputable Credit Repair Company

If you’re feeling overwhelmed by the credit repair process or don’t have time to manage it yourself, you may want to consider working with a professional credit repair service. A legitimate credit repair company can review your credit reports, identify potential errors and negative items, and negotiate with creditors on your behalf.

However, it’s important to be cautious when choosing a credit repair company. Avoid any company that promises to remove accurate negative items, asks you to pay upfront before providing services, or tells you not to contact the credit bureaus directly. These are red flags for credit repair scams. Instead, look for a company with a proven track record, clear pricing, and personalized service.

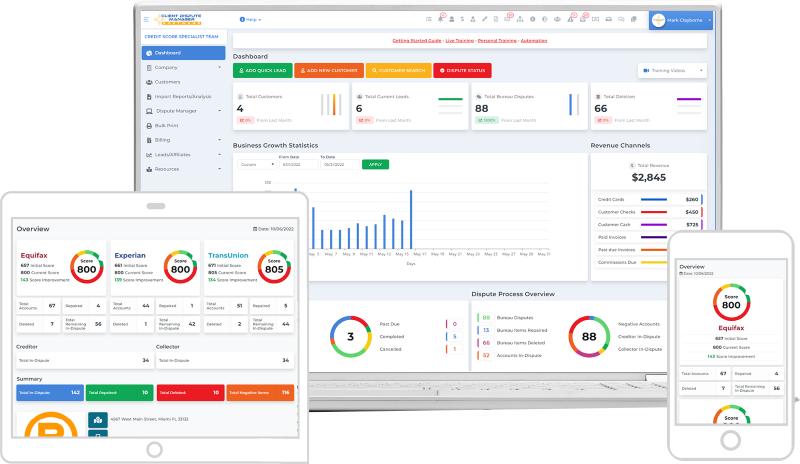

Client Dispute Manager Software to Streamline Credit Repair

If you’re running a credit repair business or handling a high volume of personal credit disputes, using specialized software can make the process much more efficient. Client Dispute Manager Software is designed specifically for credit repair professionals to track, manage, and automate the dispute process.

With client dispute manager software, you can:

- Securely import and store client credit reports

- Automatically identify negative items and generate dispute letters

- Track the status of each dispute and follow up as needed

- Communicate with clients and share updates on their cases

- Generate invoices and accept payments

- Access credit repair education and resources

Using software to manage credit disputes can save countless hours compared to manual methods, while also ensuring accuracy and compliance.

Other Tips for Improving Your Credit Score

While removing negative items from your credit report is an important part of credit repair, it’s not the only factor that affects your credit score. Here are a few additional tips to help you improve your credit:

- Pay All Bills On Time: Late payments can quickly drag down your credit score, so make it a priority to pay all of your bills on time each month. Set up automatic payments or reminders to ensure you don’t miss a due date.

- Keep Credit Utilization Low: Credit utilization, or the percentage of available credit you’re using, is the second biggest factor in your credit score. Try to keep your balances below 30% of your credit limits, and pay off balances in full each month if possible.

- Don’t Close Old Accounts: The length of your credit history also affects your score, so avoid closing old credit card accounts even if you don’t use them often. Keeping them open with a zero balance can actually help your score.

- Limit New Credit Applications: Each time you apply for credit, the lender will do a hard pull on your credit report, which can ding your score by a few points. Only apply for new credit when absolutely necessary, and space out applications by at least six months.

Frequently Asked Questions (FAQs)

Can Collection Agencies Remove Inaccurate Negative Items?

Yes, collection agencies can and do sometimes delete negative items in exchange for payment. This is known as a “pay for delete” arrangement. However, they are not legally obligated to do so, and may require that you pay the debt in full.

Why Would Inaccurate Negative Items be Deleted From My Credit?

There are a few reasons why negative items may be deleted from your credit report:

- They are inaccurate or unverifiable and have been successfully disputed

- The creditor agrees to remove them as a goodwill gesture

- You negotiate a pay for delete arrangement with a collection agency

- The negative items have reached the end of their statutory period (typically seven years) and have fallen off your report naturally

Most accurate negative items, however, will remain on your report for the designated period.

How Long Does It Take to Remove Inaccurate Negative Credit Items?

The time it takes to remove a negative item depends on the specific method used. Disputing an error can take 30-45 days for the bureaus to investigate. Goodwill removals and pay for delete negotiations may happen more quickly if successful.

If you’re simply waiting for a negative item to age off your report, it will take seven to ten years from the date of the original delinquency.

Is It Really Possible to Remove Inaccurate Negative Items From Your Credit Report?

Yes, it is sometimes possible to remove inaccurate negative items from your credit report before the end of their statutory period. The most reliable methods are to dispute any inaccurate information, negotiate with creditors for goodwill removals or pay for delete arrangements, and ensure that any outdated items are promptly deleted.

However, most accurate negative items will remain for the full seven to ten years.

Conclusion

Learning how to remove inaccurate negative items from your credit report is a key step in repairing bad credit and raising your credit score. By regularly checking your credit, disputing any errors, communicating with creditors, and building positive credit, you can minimize the impact of negative items and get closer to achieving your financial goals.

Repairing your credit takes time and effort, but the results are well worth it. If you’re an entrepreneur looking to start a business or an individual recovering from credit challenges, removing negative items can open up new opportunities like better loan terms, lower insurance rates, and even higher-paying jobs.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review: