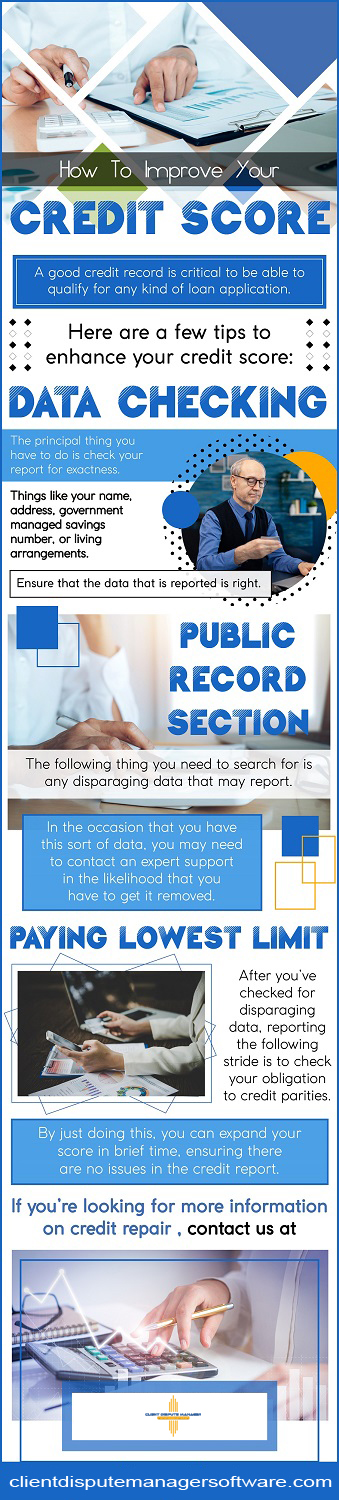

Here’s what you need to know on how to improve your credit score. Check out the tips we shared in this infographic:

To improve your credit score, it is important to understand where you stand and the best ways to improve your financial situation. Credit repair can be a long journey, but it is one worth taking to have greater financial purchasing power. The following are all reliable ways for anyone to improve their credit score.

Check the Information on Your Credit Report

The first step on a credit repair journey should always be requesting a copy of your credit report and checking it for errors. Sometimes incorrect information gets attributed to you, negatively impacting your credit score. So if you find something wrong, you should report it. This can be anything from simple details like your name and address to more specific information such as payments incorrectly reported as late or lines of credit you did not open.

You should also ensure your managed savings number and living arrangement information are correct. Again, you might need the assistance of professionals to ensure incorrect information is removed from your credit report for good.

Clarify Your Obligations to Creditors

The first step on a credit repair journey should always be requesting a copy of your credit report and checking it for errors. Sometimes incorrect information gets attributed to you, negatively impacting your credit score. So if you find something wrong, you should report it. This can be anything from simple details like your name and address to more specific information such as payments incorrectly reported as late or lines of credit you did not open.

You should also ensure your managed savings number and living arrangement information are correct. Again, you might need the assistance of professionals to ensure incorrect information is removed from your credit report for good.

Pay Down Debt

Aside from payment history, the amount of debt you carry is the next most influential factor in your credit score. This is why you will want to get serious about paying down the debt you owe if you want to enjoy a better credit score.

It is important to remember that carrying a healthy level of debt is good for your credit, as it demonstrates to lenders that you can reliably pay back loans. This makes it easier to be approved for new lines of credit or loans and at lower interest rates. You may only be able to make minimum payments, which is fine, so long as you refrain from taking on additional debt. Also, consider your debt-to-income ratio, which has a major impact on your credit score.

There are a number of effective ways you can employ to improve your credit score. Some can improve your score relatively quickly, while others might take longer. But all are good financial habits to exhibit to maintain a good credit score going forward. Once you have a strong understanding of credit scores and the best ways to improve them, you are in a better position to make solid financial decisions.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.