In today’s financial landscape, a strong credit score is crucial for accessing loans, mortgages, and other financial opportunities. However, the journey to repairing credit can be complex, often fraught with challenges like deciphering reports and disputing inaccuracies. Thankfully, technology in credit repair is revolutionizing this process, making credit repair more efficient and accessible.

At the heart of this transformation is Client Dispute Manager Software, a tool that streamlines the dispute process, enhances data security, and provides valuable insights. This technology simplifies credit repair tasks, making the process not only faster but also more accurate.

By embracing these technological advancements, both professionals and individuals can navigate the credit repair journey with greater ease and effectiveness, opening up new possibilities for financial health and opportunity.

Start Today and Explore the Features Firsthand!

The Evolution of Credit Repair

The journey of credit repair has dramatically transformed from its early days to the digital age. Let’s take a brief look at how things have changed.

Before Technology

Initially, credit repair was a manual and cumbersome process. Individuals had to navigate through piles of paperwork, understand complex credit reports, and send dispute letters by mail, often waiting weeks for a response. This era was characterized by inefficiency and a high barrier to entry for those looking to improve their credit scores.

The Dawn of Digital

With the advent of computers and the internet, the landscape began to shift. Access to credit reports became instant, disputes could be filed electronically, and the response times from credit bureaus improved significantly. Early financial software emerged, automating some of the most tedious tasks and providing the first tools to help individuals and professionals manage credit repair efforts more effectively.

This transition to digital solutions marked a pivotal moment in credit repair history. It not only made the process faster and more accurate but also more accessible to a wider audience. For the first time, technology began to empower individuals to take control of their financial health with greater ease and confidence.

The Digital Revolution in Credit Repair

The digital revolution has fundamentally reshaped the landscape of credit repair, introducing an array of technological tools and software that have made managing one’s credit history more accessible and effective than ever before. Let’s dive into this transformation and understand how it’s changing the game for everyone involved.

Current Technological Tools and Software

Today, a variety of innovative tools and software are at the forefront of credit repair, each designed to tackle different aspects of the credit improvement process.

From automated dispute letter generators that save time and reduce human error, to credit monitoring apps that alert users to changes in their credit report in real-time, technology has made it easier to stay on top of one’s credit health.

Furthermore, advanced analytics platforms help identify the most impactful strategies for credit improvement, allowing for a tailored approach to credit repair that was once only a dream.

Start Today and Explore the Features Firsthand!

Impact of Digitalization on Efficiency and Effectiveness

The impact of digitalization on the credit repair industry cannot be overstated. First and foremost, it has significantly increased the efficiency of credit repair strategies. What used to take weeks, or even months, can now be accomplished in a fraction of the time. Automated systems ensure that disputes are filed promptly and followed up on, cutting down the waiting period for corrections to appear on one’s credit report.

Moreover, the effectiveness of credit repair efforts has seen a substantial boost. With access to detailed credit reports and analytics, individuals and professionals can make more informed decisions about which items to dispute and which strategies to employ. This data-driven approach has increased the success rate of credit repair efforts, making it possible for more people to achieve their financial goals.

Spotlight on Client Dispute Manager Software

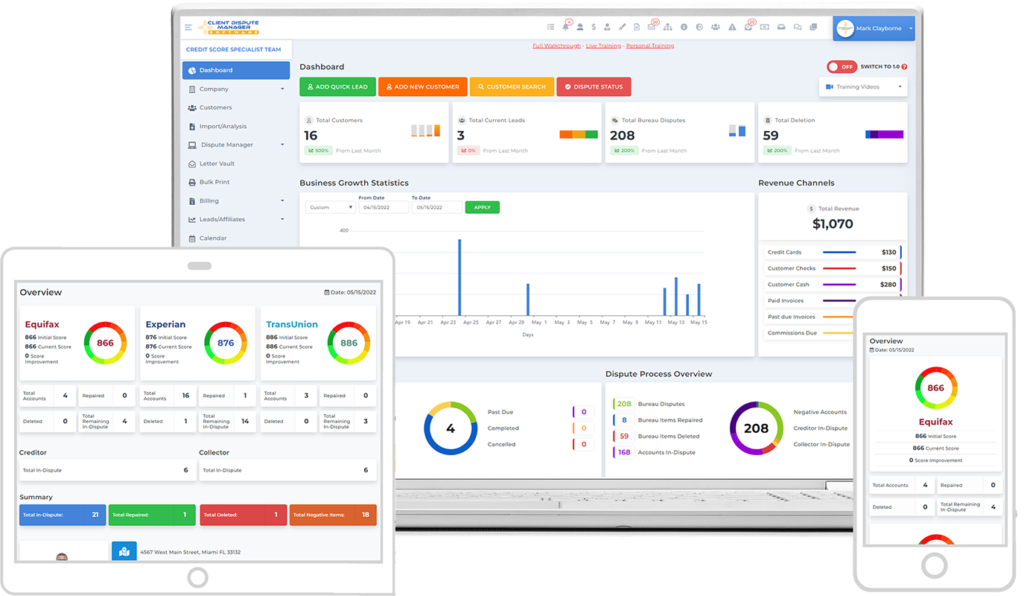

In the heart of the digital revolution transforming credit repair, Client Dispute Manager Software emerges as a standout tool, designed to streamline the dispute process and empower both professionals and individuals with its comprehensive features. Let’s delve into what makes this software a game-changer in the credit repair world.

What is Client Dispute Manager Software?

Client Dispute Manager Software is a specialized tool tailored for the credit repair industry, aiming to simplify the dispute process between consumers and credit bureaus. Its purpose goes beyond mere dispute management; it’s about providing a holistic solution that addresses the multifaceted needs of credit repair efforts, from case management to data analysis.

Key Features of Client Dispute Manager Software

- Automated Dispute Letter Generation: Say goodbye to the tedious task of manually writing dispute letters. This feature automates the creation of personalized dispute letters, saving time and reducing the potential for human error.

- Tracking Progress of Disputes: Keeping track of multiple disputes can be overwhelming. This software offers a streamlined way to monitor the status of each dispute, ensuring nothing falls through the cracks.

- Managing Client Information Securely: In the era of data breaches, the importance of secure data management cannot be overstated. This software provides robust security measures to protect sensitive client information.

- Analytics and Reporting Tools: Make informed decisions with advanced analytics and reporting tools. These features offer insights into credit repair strategies’ effectiveness, allowing for adjustments and optimization in real-time.

Start Today and Explore the Features Firsthand!

Benefits for Professionals and Individuals

For professionals in the credit repair industry, this software is a boon, enhancing efficiency and enabling them to serve more clients effectively. It automates mundane tasks, allowing professionals to focus on complex cases and strategy optimization.

Individuals using this software can take a more active role in their credit repair journey. The tools and insights provided empower them to understand their credit situation better and take informed steps towards improvement.

The Future of Technology in Credit Repair

As we stand on the brink of what feels like a new era in financial empowerment, it’s clear that the future of technology in credit repair holds promising advancements. These innovations are poised to make the journey to financial health not just easier, but more intuitive, personalized, and secure. Let’s cast our gaze forward and speculate on what the future might hold.

Predictions for Future Technological Advancements

- Integration of Augmented Reality (AR) and Virtual Reality (VR): Imagine donning a headset to navigate through your credit report in a virtual space, with each data point and statistic represented in three dimensions. This could make understanding credit reports more intuitive, especially for visual learners, and transform the daunting task of credit analysis into an engaging experience.

- Advanced AI for Deeper Personalization: As AI technology evolves, we can anticipate even more personalized credit repair advice. Future AI systems might be able to predict life changes (such as buying a house or car) and provide preemptive strategies for managing your credit in preparation for these milestones, making proactive credit management a reality.

- Decentralized Finance (DeFi) for Credit Repair: The DeFi movement could introduce new ways to manage and repair credit, bypassing traditional banking institutions. By leveraging blockchain technology, DeFi platforms could offer alternative credit scoring systems that consider a broader range of factors, providing a more holistic view of an individual’s financial health.

Conclusion

The journey through the technological evolution of credit repair highlights a transformative shift from manual processes to a digital era that champions efficiency, security, and personalization. From Client Dispute Manager Software to AI, blockchain, and mobile apps, technology has revolutionized credit repair, making it more accessible and effective for all.

Embracing these technological advancements is key to unlocking financial opportunities and achieving greater economic empowerment. The future of credit repair is bright, powered by technology that empowers individuals and professionals alike to navigate their financial journey with confidence. Together, we’re stepping into a new era of financial health, where managing and improving credit is simpler and more accessible for everyone.