Are you struggling to attract new clients and grow your credit repair business? Do you feel like you’ve exhausted all your marketing options without seeing the desired results? Fear not! In this article, we’ll dive deep into proven credit repair marketing strategies that can help you turbocharge your business growth and reach new heights of success.

Start Today and Explore the Features Firsthand!

Understanding the Importance of Effective Credit Repair Marketing

Before we delve into specific credit repair marketing ideas, let’s take a moment to understand why credit repair marketing is crucial for your business. In an increasingly competitive landscape, simply offering quality services isn’t enough to stand out and attract clients. Effective credit repair business marketing enables you to:

- Reach a wider audience of potential clients

- Build trust and credibility in your brand

- Differentiate yourself from competitors

- Educate people about the benefits of credit repair

- Generate a steady stream of leads and revenue

Investing time and resources into developing comprehensive credit repair marketing strategies lays the foundation for sustainable growth and long-term success.

Defining Your Target Audience For Credit Repair Marketing

One of the most critical aspects of any credit repair marketing strategy is understanding your target audience. Who are the people most likely to benefit from your credit repair services? Consider the following demographics:

- Individuals with poor credit scores due to past financial challenges

- Those who have recently gone through a divorce, job loss, or medical emergency

- Entrepreneurs and small business owners looking to secure financing

- Millennials and Gen Zers who may lack financial literacy skills

- People preparing for major life events, such as buying a home or getting married

By identifying your ideal client profile, you can tailor your credit repair marketing to their specific needs and preferences.

Building a Strong Online Presence

In today’s digital age, having a robust online presence is non-negotiable for credit repair businesses. Your potential clients are increasingly turning to the internet to research and compare service providers. To capture their attention and build trust, focus on the following credit repair marketing ideas:

Creating a Professional Website

Your website serves as the virtual storefront of your business. It should be professional, user-friendly, and informative. Key elements to include:

- Clear and compelling value proposition

- Detailed information about your services and process

- Client testimonials and success stories

- Educational resources, such as blog posts and guides

Invest in high-quality design and copywriting to create a website that reflects your brand’s expertise and trustworthiness. Ensure that your website is mobile-friendly and loads quickly, as these factors significantly impact user experience and search engine rankings. Regularly update your website with fresh content to keep visitors engaged and demonstrate your ongoing commitment to providing value.

Leveraging Social Media

Social media platforms offer unparalleled opportunities to connect with your target audience and build relationships. Consider the following credit repair business marketing ideas for social media:

- Share valuable content that educates and empowers your followers

- Engage in conversations and respond to comments and messages promptly

- Use paid advertising to target specific demographics and interests

- Collaborate with influencers and thought leaders in the financial space

- Showcase client success stories and testimonials

By consistently providing value and engaging with your audience, you can establish your brand as a go-to resource for credit repair information and services. Develop a content calendar to ensure a steady flow of relevant and timely posts across your social media channels. Monitor your social media metrics to understand which types of content resonate best with your audience and adjust your credit repair marketing strategies accordingly.

Start Today and Explore the Features Firsthand!

Implementing Search Engine Optimization (SEO)

To attract organic traffic and generate leads through search engines, it’s crucial to optimize your website and content for relevant keywords. Some SEO best practices include:

- Conducting thorough keyword research to identify high-value opportunities

- Optimizing your website’s structure, meta tags, and content for target keywords

- Building high-quality backlinks from reputable websites in your industry

- Creating informative and engaging content that addresses your audience’s needs

- Monitoring your search engine rankings and adjusting your credit repair marketing strategies as needed

By improving your search engine visibility, you can attract more qualified leads and establish your business as an authority in the credit repair industry. Stay up-to-date with the latest SEO trends and algorithm updates to ensure your credit repair marketing efforts remain effective. Consider partnering with an SEO professional or agency to help you navigate the complex world of search engine optimization and achieve optimal results.

Developing Compelling Credit Repair Marketing Material

To effectively communicate your value proposition and persuade potential clients to choose your services, you need compelling credit repair marketing material. Consider creating the following:

- Brochures and flyers that highlight your services and benefits

- Infographics that educate people about credit repair and its importance

- Videos that introduce your team and showcase your process

- Case studies that demonstrate your success in helping clients improve their credit

- Email newsletters that provide valuable tips and insights related to credit repair

Ensure that all your credit repair marketing material is professional, visually appealing, and aligned with your brand messaging. Use clear, concise language and focus on the benefits your services provide to clients. Incorporate persuasive calls-to-action to encourage readers to take the next step, whether it’s Sign Up form to signing up for your email list.

Building Strategic Partnerships

Collaborating with other businesses and professionals in complementary industries can be a powerful way to expand your reach and generate referrals. Consider partnering with:

- Mortgage brokers and real estate agents

- Financial advisors and coaches

- Bankruptcy attorneys and debt consolidation companies

- Auto dealerships and lenders

By establishing mutually beneficial relationships and cross-promoting each other’s services, you can tap into new networks of potential clients and grow your business exponentially. Attend industry events and join professional organizations to network with potential partners and build relationships.

Develop a referral program that incentivizes partners to send clients your way and reciprocate by referring your clients to their services when appropriate.

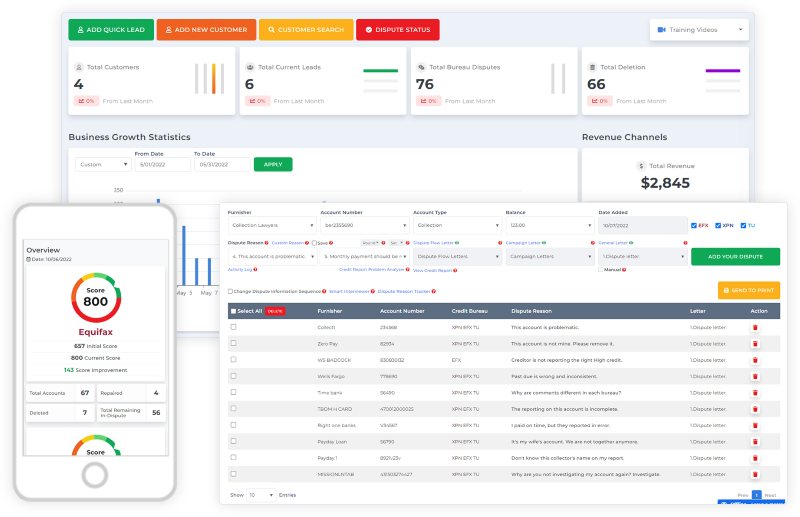

Streamlining Your Operations with Client Dispute Manager Software

As your credit repair business grows, managing client disputes and documentation can become increasingly complex and time-consuming. To streamline your operations and provide a seamless client experience, consider implementing Client Dispute Manager Software. This specialized software offers several benefits:

- Centralized database to store and organize client information and dispute details

- Automated workflows to ensure consistent and efficient dispute processing

- Real-time status updates and communication with clients

- Integration with credit reporting agencies to streamline dispute submission and tracking

- Customizable templates and letters to save time and maintain professional standards

- Reporting and analytics features to monitor performance and identify areas for improvement

By leveraging Client Dispute Manager Software, you can reduce manual workload, minimize errors, and focus on delivering exceptional service to your clients. This, in turn, can lead to increased client satisfaction, positive reviews, and referrals that fuel your credit repair marketing ideas.

When selecting Client Dispute Manager Software, consider factors such as ease of use, scalability, security, and customer support. Look for a provider that offers a comprehensive solution tailored to the unique needs of credit repair businesses. Schedule demos with multiple providers to compare features and pricing, and read reviews from other credit repair professionals to inform your decision.

Start Today and Explore the Features Firsthand!

Measuring and Optimizing Your Credit Repair Marketing Efforts

To ensure that your credit repair marketing strategies are delivering the desired results, it’s essential to track and measure your performance regularly. Use tools like Google Analytics, social media insights, and customer relationship management (CRM) software to monitor key metrics such as:

- Website traffic and engagement

- Lead generation and conversion rates

- Social media followers and interactions

- Customer acquisition costs and lifetime value

By analyzing this data, you can identify areas of strength and weakness in your credit repair marketing approach and make data-driven decisions to optimize your efforts over time. Set clear, measurable goals for each credit repair marketing strategy and campaign, and regularly review your progress to ensure you’re on track.

Don’t be afraid to experiment with new credit repair marketing ideas, but always base your decisions on data and insights rather than assumptions.

Frequently Asked Questions (FAQs)

What Is The Best Way To Market A Credit Repair Business?

The best way to market a credit repair business is through a multi-channel approach that combines online and offline credit repair marketing strategies. This may include building a professional website, leveraging social media, implementing SEO, developing compelling credit repair marketing material, and building strategic partnerships.

How Much Should I Budget For Credit Repair Marketing?

Your credit repair marketing budget will depend on factors such as your business size, target audience, and competition. As a general rule, consider allocating 7-10% of your revenue towards credit repair marketing strategies. However, be prepared to adjust your budget based on the performance of your campaigns and the growth of your business.

How Long Does It Take To See Results From Credit Repair Marketing?

The timeline for seeing results from your credit repair marketing strategies can vary depending on the tactics you implement and the competitiveness of your market. However, with consistent and well-executed credit repair marketing ideas, you should start to see an increase in leads and clients within 3-6 months.

Can I Handle Credit Repair Marketing On My Own, Or Should I Hire Professionals?

While it’s possible to handle some aspects of credit repair marketing on your own, working with experienced professionals can help you achieve better results faster. Consider hiring a credit repair marketing agency or consultant who specializes in credit repair marketing strategies to guide your strategy and execution.

How Can Client Dispute Manager Software Help My Credit Repair Business?

Client Dispute Manager Software can help streamline your operations, reduce manual workload, and provide a seamless client experience. By centralizing client information, automating workflows, and integrating with credit reporting agencies, this software allows you to focus on delivering exceptional service and growing your business through effective credit repair marketing strategies.

Conclusion

By implementing these comprehensive credit repair marketing strategies and leveraging tools like Client Dispute Manager Software, you can turbocharge your business growth, attract more clients, and establish your brand as a leader in the industry. Remember to stay focused on your target audience, continuously educate and provide value, and adapt your approach based on data-driven insights.

With dedication, persistence, and smart credit repair business marketing techniques, your credit repair business can thrive and make a meaningful impact in people’s lives.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- 10 Credit Repair Marketing Strategies

- Online Marketing Strategies for Credit Repair: A Comprehensive Guide