Surety bonds are like insurances, though both differ in which party’s interests are protected (and in the number of parties involved). They serve to protect the interests of businesses, organizations, and professionals in a wide variety of financial arrangements such as contracts and consultancies.

They are relevant in many industries such as the travel industry, the health sector, and finance, such as a surety bond for credit repair business. If you intend to go into business, especially in the US, you will need to acquire a surety bond.

So, in this comprehensive guide, we will walk you through the important things you should know about surety bonds for the credit repair business and how to get one.

Let us start!

Table of Contents

What is a Credit Repair Business?

To understand what credit repair businesses or organizations are, we must first understand the concept of credit scores.

A credit score is your creditworthiness quantified. It is a numerical assessment of how much financial risk accrues from loaning you money and how likely you will repay a debt.

It is based on a credit report issued by a Credit Bureau, and it determines the willingness of banks and credit card companies to lend you money or issue you a credit card.

A bad credit score means less likelihood of getting loans, and any loans secured will be at higher interest rates. So, this is where credit repair businesses (or credit services) come in.

A credit repair organization is a financial organization that offers to “repair” one’s poor credit standing; this is done by corresponding with the credit bureaus or any financial institutions that supply relevant credit information to the bureaus.

They go through the financial reports and identify any inaccurate or disputable information damaging the client’s credit standing. Such information is then either modified or removed altogether.

Credit repair organizations also offer to counsel clients on how to improve their credit ratings going forward, and they also help clients get credit extensions.

Credit repair comes with risks both to the credit repair companies and their clients. These risks are mitigated through financial arrangements known as credit repair surety bonds.

What are Surety Bonds?

A surety bond is a contract or arrangement involving three parties:

- The Principal.

- The Obligee.

- The Surety.

The principal is you or your company, the party acquiring the bond.

The obligee (typically the State Government) is the regulatory party requiring the principal to acquire the bond. The surety is the company or agency that issues the bond.

In this arrangement, one party (the surety) pledges to answer for the default of another (the principal). It ensures that the principal operates according to state laws and regulations guiding the operation of his business.

It also assures customers of financial reparations in the event of any losses they may incur due to failure or misconduct on the part of the principal.

How Do Surety Bonds Works?

A surety bond for a credit repair business will typically last for one year, though some surety bonds may be valid for up to three years. Within the time duration of the bond’s validity, the credit repair operator may fail to keep to state regulations, or his actions may create losses for customers.

In such an event, the affected party may make a claim on the credit repair bond, and the surety company is liable to pay the stipulated bond amount to that party. The surety company may then go to the principal and demand reimbursement for the expense.

One major advantage of this bond system is that the principal does not have to worry about immediately paying damages. The surety company does the paying, while the principal may reimburse the company later, giving them (the principal) time to gather the necessary funds.

However, if no such mishap occurs within the bond term, and the principal fulfills all relevant obligations, no one makes a claim, and no damages are paid.

The business continues as usual. Of course, upon expiration of the bond term (duration), the principal must renew the bond to maintain their Credit Repair License.

10 Steps to Getting a Surety Bond for Credit Repair Business

The following are ten steps to getting a surety bond for a credit repair business.

Step 1: Understand why you need a Surety Bond

In the United States, and other parts of the world, surety bonds are a requirement for people or organizations doing business in various industries. These include (but are not limited to):

- Health Service.

- Transport Service.

- Construction.

- Auto Dealership.

- Finance.

This necessity is to ensure that operators in these sectors operate according to state regulation and to protect the public interest. Other businesses or enterprises for which surety bonds are not a requirement may also benefit from it.

But why do you need to get a surety bond?

Customer Confidence:

Being bonded (and appropriately licensed) gives customers confidence that their interests are protected in dealings with you.

Requirement for License:

Depending on the state, sector, and nature of business, a surety bond might be a requirement for getting licensed. For instance, a credit repair business operating in the United States must have a credit repair license.

And to acquire a credit repair license, a surety bond for a credit

repair business is a requirement. And a renewal of your credit repair bond, usually on an annual basis, is necessary to maintain the credit repair license.

Risk Management:

Getting a surety bond reduces the risk of bankruptcy due to liability lawsuits by transferring that risk to the

surety agency.

Regulation:

A surety bond may be required by state regulation for your organization to operate at all.

Step 2: Familiarize yourself with the State and Federal Laws

Prospective credit repair business operators need to be familiar with their nation’s laws concerning credit services. The two most important such laws in America are the Credit Repair Organization Act (CROA) of 1996 and The Fair Credit Reporting Act (FCRA) of 1970.

The CROA lays down regulations for the operation of Credit Repair Businesses and specifies prohibited practices. It also stipulates consumer rights relative to dealings with Credit Repair Businesses.

- Limiting corporate access to their credit report.

- Limiting what information can be in their report.

- Guaranteeing right to accuracy.

The CROA and FCRA are both federal laws. The CROA is regulated by the Federal Trade Commission (the FTC, which also regulates the FCRA) and the Consumer Financial Protection Bureau (CFPB).

The different States in America may also have extra laws on Credit services.

Step 3: Get a Good Credit Score.

Interestingly, a good credit score is one of the requirements for getting a surety bond for a credit repair business. Typically, the process of applying for a surety bond comes with a credit check.

The surety company goes through your credit history to determine how likely they will be reimbursed on bond claim payments.

A high credit score inspires more confidence in the surety company, and you get to pay a smaller premium (1-3% of the bond amount for excellent scores).

A low or bad credit score inspires less confidence, and you also get to pay a higher premium (up to 15% of the bond amount with a poor score).

The surety company also checks for tax liens, foreclosures, bankruptcy filing, and other factors that may negatively reflect the credit.

Some surety providers will offer bonds to operators with bad credit but with some extra requirements, which may include:

- A personal promissory

- A Letter of Credit from a bank.

- Cash collateral as a gesture of good faith.

Step 4: Get A Personal Financial Statement (PFS) and Know the Financial Standing of any Partners or Co-owners.

A personal financial statement is a document outlining your general financial standing at a given time.

Underwriters tend to demand personal financial statements from applicants, depending on their discretion, as a requirement to approve a surety bond for a credit repair business.

Also, a credit repair business may be run by more than one individual listed as a partner/co-owner. The underwriting exercise that may be involved in the credit repair bond application process will also consider the financial standing and histories of such partners and/or co-owners.

Their negative credit score, financial histories, and other damaging elements in their financial record will negatively affect your bonding process.

Conversely, a good credit standing on the part of your partners/co-owners may be taken into account. It may increase your chances of acquiring the bond at an ideal rate. As such, it is important to partner with individuals who have good credit standing.

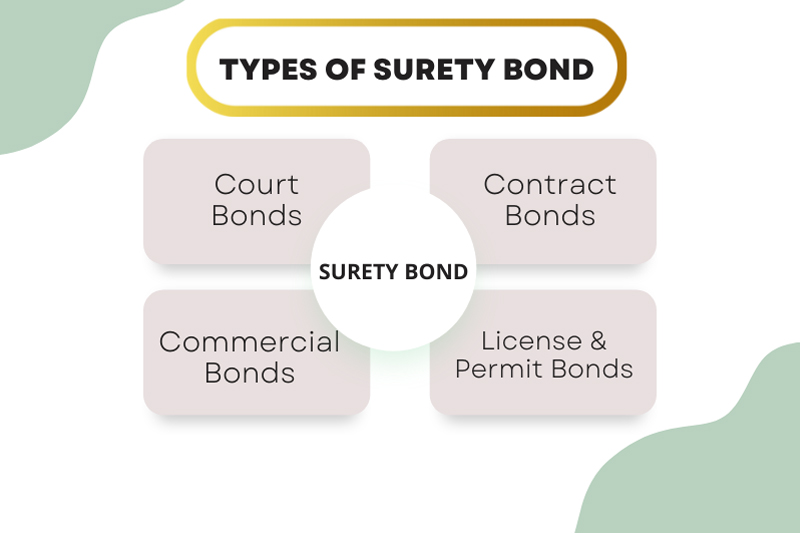

Step 5: Know the Surety Bond Type You Need

Prior knowledge of the type of surety bond you need helps the process of acquiring a bond go quicker and smoother. There are three main types of bonds you can obtain in the US. They are:

Court Bonds:

These are bonds of a judiciary nature filed to protect individuals or corporate entities from losses in legal proceedings.

They are usually plaintiff bonds. Plaintiff bonds are filed to protect a defendant from any damages that may accrue from the court ruling if the plaintiff loses.

Defendant bonds prevent a plaintiff from pursuing action on claims regarding rights to the defendant’s property.

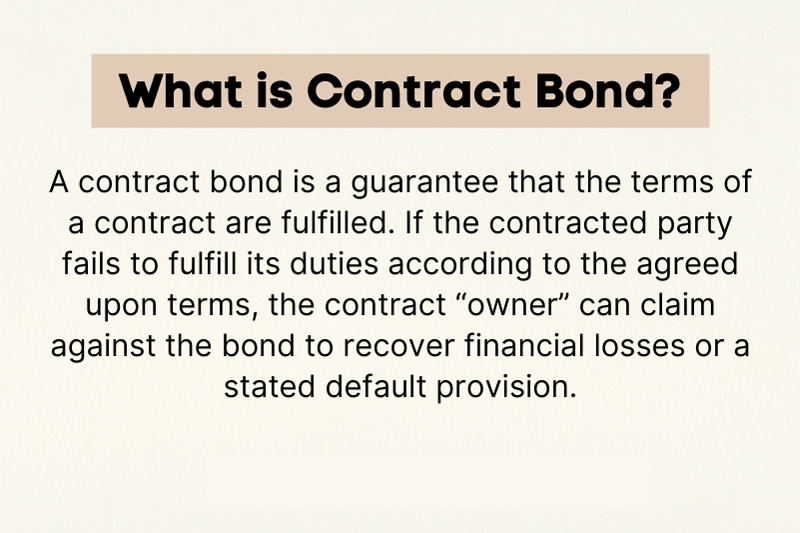

Contract Bonds:

These are performance bonds that ensure that a contractor fulfills their obligations to a given contract. Should the contractor fail to meet the performance specifications for the job, the contract owner may make a claim on the bond.

Upon validating such a claim, they may receive reparations for any damages sustained due to the contractor’s failure.

Contract bonds include bid bonds and payment bonds.

License and Permit Bonds:

These are the relevant bond type for Credit Service Organizations (specifically credit repair surety bonds) and are the most common bond type.

As the name implies, they are required by municipalities or governments as a condition for the award of a license to operate specific businesses or enterprises.

They ensure that these business operations proceed according to state regulations and protect customers’ financial interests.

License bonds are of several types, including insurance broker, auto dealership, and credit repair bonds.

Step 6: Determine the Relevant Bond Rates and Minimum Bond Amount Requirements for Your State

As previously stated, bond rates or premiums may vary depending on a number of factors such as:

- Bond Type.

- Your credit score and financial history.

- Bond amount.

- The risk associated with your specific business.

For instance, a $50,000 bond rate will vary from $500 to $7,500, depending on your credit health. Although, some bond policies have rates calculated independently of your credit rating.

Such bond policies offer a fixed rate without any credit assessments and are good for business operators with poor credit scores.

There may also be minimum bond amounts that vary significantly depending on which state you operate in.

For instance, the minimum amount for the State of California credit repair bond to acquire a credit repair license is $100,000. The requirement bond amount for a credit repair license in Florida is much smaller, at $10,000.

Before you set out to get a surety bond for a credit repair business, you should be familiar with the relevant bond rates and the minimum required amount in your state.

Step 7: Contact Your Surety Company and Apply for the Bond

It is important to acquire your credit repair surety bonds from a State registered and licensed surety bond agency to avoid scams.

It should go without saying that being bonded with an appropriately licensed agency does well for customer confidence. Once you have contacted the appropriately licensed agency, the application process begins.

The application process will involve supplying relevant information to your surety agency, such as:

- The name of your business.

- Prior professional work experience.

- The names of any partners or co-owners.

- Financial records.

Usually, a credit assessment process follows whereby the agency examines your credit history to determine your reliability.

Depending on the nature of your bond, the agency may also require your social security information; this is often true for credit repair surety bonds. And as previously stated, the financial histories of any partners or co-owners will also be assessed.

Step 8: Obtain Your Bond Quote and Pay Your Bond Premium

A bond quote is the last price at which a bond is sold. It is expressed as a percentage of the Nominal or Par Value (the face value of the bond, as stipulated in the corporate charter). The cost of a bond is determined by a calculation involving bond par value.

Bonds are typically quoted in 1/8 or 1/32 increments. The bond par value (typically set at 100) is converted to a percentage of par, then multiplied by 10, giving the cost of the bond (premium).

The nature of your application will determine the surety bond quote you get. And working with the right surety agencies, you can get better rates for quotes and your bonds in relatively little time. This may be within 24 hours of application in ideal situations, with riskier bonds typically taking longer.

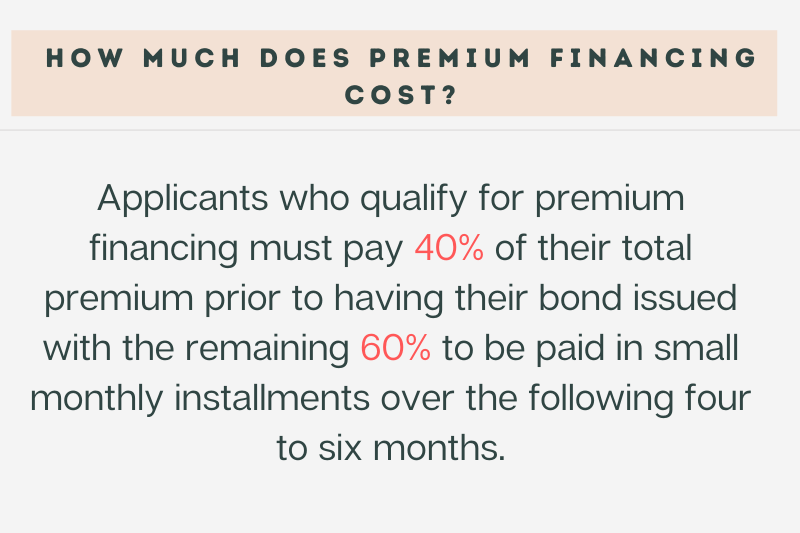

Usually, credit repair surety bond companies will require full payment of the surety premium upfront before the bond is issued. However, it is not always possible for operating or prospecting businesses to offer payment in one go due primarily to financial limitations. For such parties’ benefit, there is an arrangement called Premium Financing.

Premium financing is an arrangement that allows business operators to split a large premium fee into smaller chunks. They can then pay off the premium in installments over a given period (which may be half the bond term).

To protect the financial interests of the surety companies, premium financing is only available for bonds that can be canceled. This ensures that the surety company can cancel the arrangement and get its money back if you, the principal, fail to keep to the plan.

A surety bond for a credit repair business can also be acquired under premium financing. Most, if not all, credit repair bond providers will offer premium financing options.

However, where possible, it is advisable to make full payment of your premium upfront. Upon payment, the surety company prepares the bond and sends it to you (usually by mail).

Step 9: Check the Information on Your Credit Repair Bond for Accuracy

Unpleasant complications tend to arise when a bond contains inaccurate information concerning the relevant parties. If the information on your credit repair bond is incorrect, it may be rejected by the obligee with whom you are to file it. And this may delay your acquisition of a credit repair license.

False information on your credit repair bond may lead to lawsuits. Court cases between parties involved in the bonding process are not uncommon, and such cases may lead to unwelcome expenditure for the involved parties.

Of course, inaccurate information is not the only problem one might have. Important information that needs to be taken into account may also be omitted. And erroneous information or omission of relevant information (or both) can lead to criminal prosecution on fraud charges.

There may also be other expenses, not related to lawsuits that may accrue due to erroneous (or omitted) information. Such expenses include the cost of riders (extra documents attached to a bond policy as an amendment upon mistakes therein).

Riders are the most common way to correct errors in bond policies already in effect. In some cases, it is possible to have the surety company destroy the original bond document and make a fresh one.

These fixative measures are tedious and consume extra time and money. And this is why it is important that you thoroughly examine your credit repair surety bond policy once received.

You should ensure it contains all the relevant information (accurately represented) and signatures. Should you find any inaccuracies or omissions, contact your bond agency immediately.

Step 10: File Your Credit Repair Bond

Having received and verified your surety bond for a credit repair business, the next and final thing to do is file it with the obligee requiring it.

This last step is of great importance because filing your bond policy with the obligee proves that you have met the necessary bonding requirements. To be sure, not all bonds need to be filed (after all, not all businesses that can be bonded are required to be by the state). Instead, the customers may demand these bonds to protect their interests.

However, a surety bond for credit repair business is required by State legislation, especially as a prerequisite for a Credit Repair License. Thus, credit repair bonds need to be filed with the relevant government agencies.

Filing may be done electronically, by mail, or in person. Electronic filing is easier, cheaper, and less time-consuming since it eliminates the need for physical filing. It utilizes the internet or other means such as the Nationwide Multistate Licensing System (NMLS) to send your bond to the relevant agency.

However, most surety bonds require the principal to either mail the bond or file it in person instead of filing electronically. Some obligee agencies may require the bond to be signed by a notary (a publicly commissioned witness to a signing). In such situations, you should sign only when a notary is present.

Filing is usually done by the principal, though in the case of some surety bonds (such as freight broker bonds), the surety company may do the filing. Furthermore, the agency with which you must file your surety bond will depend on the nature of the bond.

For instance, court bonds must be filed with the court requiring them. Customs bonds are filed with the US Customs and Border Protection agency. Once you have filed your surety bond policy with the appropriate agencies, you have completed the bonding process.

Conclusion

Getting a surety bond is one of the confusing steps in starting a credit repair business. Hopefully, this comprehensive guide has demystified the concept of surety bonds, their requirements, and how to get a surety bond for a credit repair business. Follow these steps, and your credit repair license is in view.