In an era where financial health is pivotal, individuals everywhere are striving to bolster their credit scores. A less-than-stellar credit history can lead to daunting challenges, such as exorbitant interest rates or loan rejections. To counter this, the spotlight has recently been on credit repair software as a potential lifeline. But a pertinent question arises: how legal is it to deploy such software?

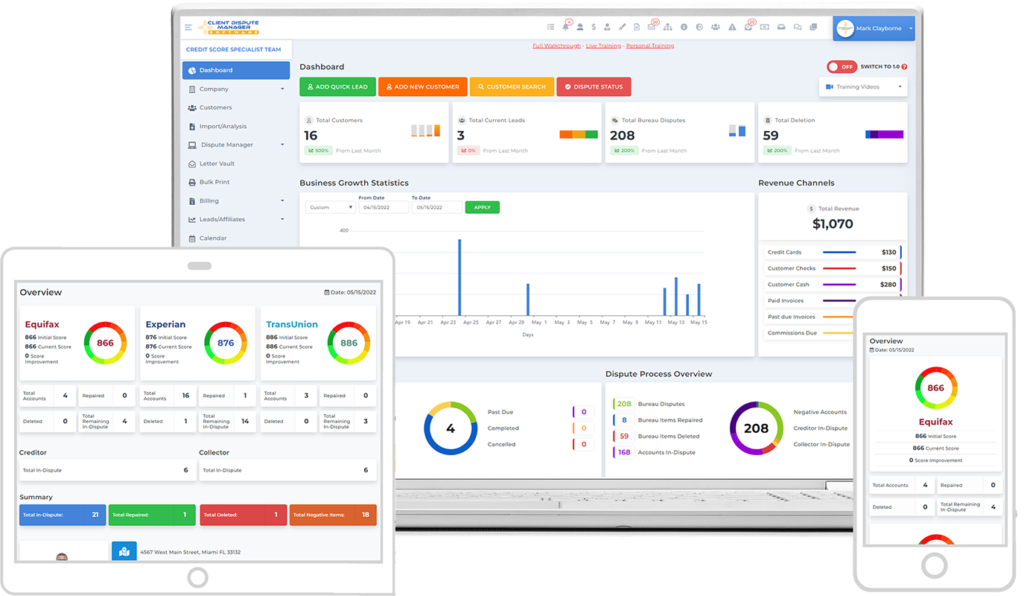

Taking a closer look at platforms like Client Dispute Manager Software, we will delve into the intricate balance between software-driven credit solutions and their legal standing. Whether you’re on the frontline of financial advisement, in the throes of credit hitches, or simply intrigued, this article promises to shed light on the nuances of credit repair software’s legitimacy.

What is Credit Repair Software?

Credit repair software is a tool designed to help individuals and professionals correct inaccuracies in credit reports and improve credit scores. It streamlines the process by organizing credit information, highlighting discrepancies, and even generating dispute letters to send to credit bureaus. While it simplifies the task of credit repair, understanding its legality and limitations is vital.

The software’s primary goal is to streamline the often intricate process of credit repair, making it more accessible and comprehensible for users. With features that simplify credit monitoring, report comparison, and communication with credit bureaus, these tools aim to expedite the path towards better financial health. As credit scores impact so many aspects of financial life, from loan approvals to interest rates, a reliable system to ensure their accuracy can be indispensable.

The Legality of Credit Repair

In the complex world of personal finance, credit repair has emerged as a topic of both interest and controversy. With the proliferation of credit repair software and services, individuals are often left wondering about the legality of these tools. Central to this discussion is the Credit Repair Organizations Act (CROA), a federal law designed to regulate the practices of credit repair companies and protect consumers from deceptive and unfair practices.

The Credit Repair Organizations Act (CROA)

The CROA sets forth specific guidelines and requirements for credit repair organizations, outlining permissible activities and curbing unethical practices. One of the key provisions of the act is the requirement for credit repair companies to provide consumers with a written contract that outlines the services to be rendered, the associated costs, and the consumer’s rights under the law.

Additionally, the act mandates that consumers have the right to cancel the contract within three days of signing without incurring any charges. Furthermore, the CROA prohibits credit repair companies from making false or misleading claims regarding their ability to improve a consumer’s credit history.

This includes refraining from misrepresenting their services, making promises of guaranteed results, or charging upfront fees before services are performed.

What Companies Are Not Allowed to Do Under This Act

Under the CROA, credit repair companies are explicitly prohibited from engaging in certain practices that could exploit consumers or mislead them. Some of the actions that credit repair companies are not allowed to do under this act include:

Charging Upfront Fees: Credit repair companies are prohibited from charging consumers upfront fees before any services are rendered. They can only charge fees for services after they have been completed.

Making False Claims: Credit repair organizations cannot make false promises about their ability to remove accurate negative information from a consumer’s credit report. Misleading claims about improving credit scores within a specific timeframe are also forbidden.

Creating a New Credit Identity: Companies are not allowed to advise consumers to create a new credit identity, often referred to as “file segregation.” This practice involves obtaining a new Social Security number or an Employer Identification Number to create a fresh credit history, which is illegal.

Misrepresenting Services: Misrepresentation of services, misleading consumers about the scope and effectiveness of credit repair, and failing to disclose their cancellation policies are all violations of the CROA.

Legal vs. Illegal Practices in Credit Repair

Distinguishing between legal and illegal practices in the realm of credit repair is crucial for both consumers and credit repair companies alike.

Actions That Are Considered Legal

Disputing Inaccuracies: Credit repair organizations can legally help consumers dispute inaccurate or outdated information on their credit reports. This includes errors in personal information, account status, or payment history.

Educating Consumers: Providing consumers with accurate information about credit scores, credit reports, and responsible financial behavior’s is a legitimate aspect of credit repair.

Negotiating with Creditors: Credit repair organizations can engage with creditors on behalf of consumers to negotiate settlements, payment plans, or the removal of negative items.

Reviewing Credit Reports: Helping consumers review their credit reports, identify inaccuracies, and understand their credit profiles is a valid service offered by credit repair companies.

Actions That Are Considered Illegal

Creating a New Credit Identity: As mentioned earlier, advising consumers to create a new credit identity to evade their credit history is strictly illegal.

Misleading Claims: Making false claims about the effectiveness of credit repair services, promising guaranteed results, or misrepresenting the impact of their services on credit scores is illegal.

Charging Upfront Fees: Charging consumers before services are performed is in violation of the CROA’s regulations.

Falsifying Information: Submitting false information on credit disputes, such as claiming inaccuracies that do not exist, is considered illegal.

Precautions When Using Credit Repair Software

When discussing the legitimacy of using credit repair software, it’s essential to touch upon the precautions one must take when utilizing such tools. Specifically, if you’re considering Client Dispute Manager software, being aware of these concerns will safeguard you against potential pitfalls and help ensure your credit repair journey is successful and legal.

Understanding The Law: Firstly, while the software itself is legal, some practices in the credit repair world are not. Familiarize yourself with the Credit Repair Organizations Act (CROA) and the Fair Credit Reporting Act (FCRA). These laws set forth the rights of consumers and the responsibilities of credit repair organizations. Any software use should be in compliance with these guidelines.

Avoid Misrepresentation: Some software users might be tempted to input false or misleading information to alter their credit history. Never use software to provide incorrect details or create a “new” credit identity, as this is illegal and can lead to severe penalties.

Regular Updates: Like any software, credit repair tools need timely updates to stay current with the ever-changing credit industry rules, regulations, and technologies. Always ensure that your Client Dispute Manager software is updated to the latest version.

Data Security: Your credit information is highly sensitive. Before inputting any data, make sure the software provides top-tier encryption and security measures. Regularly back up your data, use strong and unique passwords, and protect your computer from malware and viruses.

Avoid Overreliance: While Client Dispute Manager software can be an excellent tool in helping you manage and repair your credit, it shouldn’t be the only method you rely on. Personal oversight and regular checks on your credit reports are essential. No software can replace human judgment and intuition entirely.

Transparent Practices: If you’re using the software as a credit repair business, always remain transparent with your clients. Make sure they understand the process, what the software does, and what they can expect in terms of results.

Realistic Expectations: No software can guarantee a specific outcome, such as a certain credit score boost. While Client Dispute Manager can help streamline and automate some tasks, results vary based on individual credit histories and situations. Always approach with a realistic mindset.

Backup Manual Processes: In case of software glitches or issues, it’s crucial to have a manual backup process. Keep copies of all disputes, resolutions, and related correspondence. This ensures that even if there’s a problem with the software, you have the necessary information at hand.

Educate Yourself Continuously: The credit industry is always evolving. Periodic training or courses will help you understand the software better and stay abreast of changes that might affect your credit repair processes.

Seek Expert Advice: If you’re ever in doubt about any procedures or the implications of using the software, consult with a credit expert or legal professional. This is particularly important if you run into complex credit issues that the software alone can’t address.

Conclusion

The journey through the realm of credit repair often presents a maze of complexities, leading many to seek tools that simplify and streamline the process. At the heart of this discussion is the use of credit repair software, particularly the renowned Client Dispute Manager software. So, to address the pressing query: “Is using credit repair software legal?” – The answer is a resounding yes. However, it’s not merely the legality of the software that matters, but how it’s used.

In the vast landscape of credit repair, let the software be your compass, guiding you toward informed decisions. But always ensure that your journey respects the laws of the land, maintains transparency, and upholds ethical standards. Only then can the synergy of technology and legality craft a promising pathway to improved credit health.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.