If you’ve ever missed a payment or made a late one, you know how fast it can hurt your credit score. Sometimes, it happens because of an honest mistake maybe you switched banks, lost track of due dates, or faced a sudden emergency. That’s when learning how to write a goodwill letter can make a real difference.

A goodwill letter is your chance to ask your creditor to remove a late payment from your credit report as a one-time favor. It’s not a dispute or a complaint. It’s a polite request that says, “I made a mistake, but I’ve learned from it, and I’m taking responsibility.”

In 2025, more lenders are open to reviewing goodwill requests, especially from people who show consistent on-time payments afterward. The key is knowing what to say, how to say it, and when to send it.

Key Takeaways:

- A goodwill letter is a polite request to a creditor asking for the removal of a one-time late payment from your credit report, not a dispute or guarantee.

- It works best when you’ve had an isolated mistake, maintained a strong payment history, and shown responsibility afterward.

- In 2025, creditors prefer digital submissions with verified proof, so keep your letter short, factual, and compliant with CROA and FCRA rules.

- Include clear details account info, dates, brief explanation, and supporting documents to increase your chance of approval.

- Most creditors reply within 30–45 days, and if approved, your updated credit report can show noticeable score improvement within one or two billing cycles.

Start Today and Explore the Features Firsthand!

What Is a Goodwill Letter and How It Helps Improve Your Credit?

A goodwill letter is a polite written request that asks a creditor to remove a late payment or other negative mark from your credit report. It’s based on goodwill, meaning you’re appealing to the creditor’s sense of understanding rather than challenging the accuracy of the information.

When you send a goodwill letter, you’re saying, “I made a mistake, but I’ve been responsible since then. Can you please update my account as a gesture of goodwill?” This approach works best when your payment history shows consistent improvement.

It’s important to understand what a goodwill letter isn’t:

- It’s not a dispute letter. You’re not claiming that the report is wrong.

- It’s not a demand for deletion. You’re requesting a courtesy adjustment.

- It’s not guaranteed to work, since creditors have no legal obligation to remove accurate information.

Still, many people and credit repair specialists use goodwill letters because some lenders are willing to make exceptions for long-term customers who show good faith and reliability.

Why Knowing How to Write a Goodwill Letter Still Matters in 2025?

Credit policies are stricter now, and most lenders rely on automated systems. That means every request must be clear, professional, and compliant. Knowing how to write a goodwill letter the right way can help you stand out and increase your chances of success.

Here’s why it still matters today:

- Credit scoring models still reward consistent behavior. Removing even one late payment can raise your score faster than you think.

- Lenders value relationships. Many companies use goodwill letters to keep loyal customers who made one-time mistakes.

- Digital communication options have expanded. You can now send goodwill letters through secure portals or email, not just by mail.

A well-written goodwill letter shows maturity and accountability qualities lenders respect when considering future credit approvals or loan terms.

Common Mistakes When Sending a Goodwill Letter to a Creditor

Even good intentions can fall flat if the message isn’t clear or respectful. Avoid these common errors when creating your goodwill letter:

- Using the Wrong Tone: Never sound demanding or entitled. Your goal is to request, not insist.

- Blaming Others: Take responsibility instead of pointing fingers at billing systems or banks.

- Skipping the Facts: Always include your account number, payment dates, and a short reason for the issue.

- Forgetting Compliance: If you help clients write goodwill letters, follow CROA and FCRA guidelines. Never promise guaranteed results.

- Sending Too Many Letters: Repeated requests can be flagged as spam or ignored. Wait at least 60–90 days before following up.

By writing respectfully and clearly, you’ll show creditors that you’re serious about maintaining a positive payment record — and that makes them far more likely to consider your request.

Start Today and Explore the Features Firsthand!

When to Send a Goodwill Letter for Late Payments?

Sending a goodwill letter at the right time can make all the difference. If you act too soon, lenders might view your request as premature; if you wait too long, they may have already reported the late payment permanently.

The best time to send a goodwill letter is after you’ve corrected the issue, made consistent on-time payments for a few months, and can show that the mistake was a one-time event.

Timing your request this way helps prove that you’re committed to maintaining good credit and gives your goodwill letter to the creditor a stronger chance of approval.

Ideal Situations for a Goodwill Letter to Remove Late Payments

A goodwill letter works best when your credit issue was a one-time mistake, not a pattern. Lenders are more open to helping when you’ve built a record of reliability. Here are situations where a goodwill letter can truly help remove late payments:

- You missed one payment by accident. Maybe you switched banks, forgot an autopay setup, or had a billing error.

- You had a temporary hardship. Job loss, medical issues, or family emergencies can justify a late payment if you’ve since recovered.

- You have a long history of on-time payments. Creditors tend to help customers with solid records who rarely miss payments.

- Your account is now current. If you’ve caught up and are maintaining good standing, it shows effort and responsibility.

- You’re applying for a major loan soon. Removing one negative mark before applying for a mortgage or car loan can make a difference.

These are all moments when a goodwill letter to a creditor is worth sending. It shows accountability and signals that you’re serious about keeping your credit in good shape.

When a Goodwill Letter May Not Work or Be Necessary?

There are cases where sending a goodwill letter won’t help, or may even be unnecessary. Knowing these boundaries saves you time and frustration:

- The account is in collections or charged off. Goodwill letters only apply to active or recently closed accounts. Collection agencies rarely adjust reports.

- You have several recent delinquencies. A goodwill deletion letter won’t fix repeated late payments in a short time span.

- You already disputed the same account. If you’ve filed a formal dispute, sending a goodwill letter could confuse or delay the process.

- The information is accurate and recent. Credit bureaus won’t remove legitimate late payments unless the creditor authorizes it.

- You’re already rebuilding credit. If your newer positive history outweighs one old late payment, it might be better to focus on current habits instead.

In short, a goodwill letter is most effective when it’s honest, specific, and tied to a single, explainable event not as a catch-all fix for multiple credit issues.

Start Today and Explore the Features Firsthand!

Credit and Legal Policies Affecting Goodwill Letters in 2025

In 2025, lenders and credit bureaus follow tighter compliance standards, making it more important than ever to write goodwill letters correctly. Credit repair professionals and consumers must now balance personal communication with legal responsibility.

Knowing how current policies work ensures your goodwill letter to creditors stays effective and compliant under the law.

How CROA and FCRA Impact Your Goodwill Letter to Creditors?

When writing or helping clients write goodwill letters, it’s critical to stay compliant with two major laws:

- Credit Repair Organizations Act (CROA): This law prohibits making false promises or guaranteeing credit score improvements. Always make it clear that a goodwill letter is a request, not a guaranteed result.

- Fair Credit Reporting Act (FCRA): This law ensures that all credit report information is accurate and fairly represented. A goodwill letter doesn’t dispute accuracy; it asks for leniency based on good behavior or unique circumstances.

To stay compliant in 2025:

- Use honest explanations and accurate details.

- Keep written records of all correspondence.

- Never charge or imply guaranteed deletion results.

Understanding how CROA and FCRA shape goodwill requests helps both individuals and credit repair professionals maintain credibility and trust while improving legitimate credit outcomes.

What to Include in a Goodwill Letter for Late Payments?

A goodwill letter for late payments should be short, respectful, and focused. You’re asking for a courtesy, so it’s best to be polite and professional without sounding demanding. Keep the tone cooperative.

Including the right details and using a clear format makes your goodwill letter to creditor easier to read and more likely to be taken seriously. Many people find success by adapting a goodwill letter template to reflect their specific situation and tone.

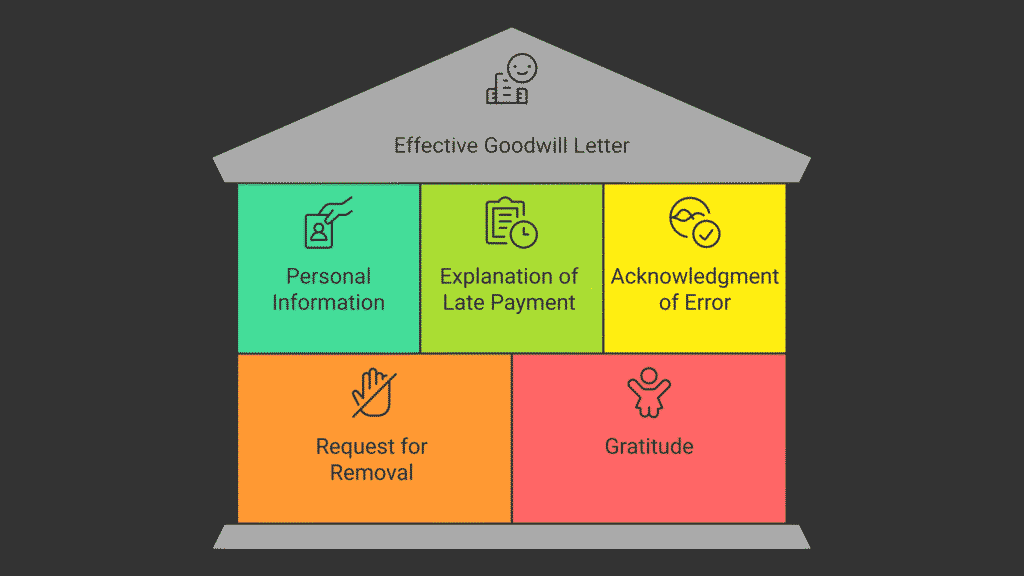

Key Elements of an Effective Goodwill Letter to Remove Late Payments

When writing your goodwill letter, include these elements:

- Your full name and account number

- A clear explanation of the late payment and what caused it

- A statement acknowledging the error without disputing it

- A brief request for the creditor to consider removing the late payment

- A thank-you for their time and consideration

Make sure to check spelling, grammar, and tone before sending it. A well-written letter can leave a better impression.

Structuring Your Goodwill Letter to Creditor Professionally

The letter doesn’t need to be long. Aim for 3 to 5 short paragraphs. Keep your explanation simple, your request clear, and your tone courteous.

You can write the letter by hand, type it and print, or send it electronically depending on what your creditor allows. If mailing, send a physical copy with your signature. Whether you’re sending a goodwill letter for late payments or a goodwill deletion letter, make sure it’s formatted neatly and addresses the creditor directly.

A well-prepared goodwill letter to creditor helps show that you’re taking responsibility and are serious about maintaining your credit.

Start Today and Explore the Features Firsthand!

Goodwill Letter Templates You Can Use

Templates can help you get started if you’re unsure how to write your letter. A goodwill letter template gives you a basic structure that you can customize with your own words and details. This can make the writing process faster and reduce the chance of forgetting something important.

Here’s a simple goodwill letter template you can use for a credit card account:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State, ZIP Code]

Subject: Request for Goodwill Adjustment on Late Payment

Dear [Creditor’s Name],

I am writing to respectfully request a goodwill adjustment to remove a late payment reported on my account [Account Number] in [Month, Year]. I take full responsibility for the missed payment, which occurred due to [brief explanation of situation].

Since then, I have kept the account current and have worked to maintain a strong payment history. I truly value our relationship and ask if you would consider removing the late mark as a one-time courtesy.

Thank you for your time and understanding.

Sincerely,

[Your Name]

This example can be edited to fit your tone, situation, and account type. Just remember to keep it honest, respectful, and clear.

Customizing a Goodwill Letter for Late Payments to Your Creditor

No two situations are exactly alike, and your goodwill letter to creditor should reflect your specific experience. While templates are helpful, taking the time to personalize your message makes a stronger impact.

A thoughtful and sincere goodwill letter for late payments can demonstrate accountability and a genuine desire to maintain a positive financial relationship.

Start by adjusting the language in the template to match your tone. Use your own words when describing what caused the late payment and explain what you’ve done to ensure it doesn’t happen again.

Avoid exaggerations or over-explaining. Creditors are more likely to respond favorably to a short, respectful note that sounds like it came from you, not a script.

Also, be sure to double-check that all details are accurate, including account numbers and dates. A small mistake can create confusion or slow down the review process. Clear communication and a respectful tone are just as important as the request itself.

Start Today and Explore the Features Firsthand!

What to Expect After Sending a Goodwill Letter?

Once your letter has been sent and received, what happens next can vary depending on the creditor. Some may review it quickly and respond within days. Others may take weeks or even longer, depending on their internal process and volume of requests.

Patience is key. While you wait, monitor your credit reports for updates and check your mail or email regularly in case the creditor reaches out with a decision.

How Long Does It Take for a Creditor to Respond to a Goodwill Letter?

On average, a response to a goodwill letter to creditor can take between two to four weeks. Some lenders may respond faster, while others might not reply at all.

If you mailed your goodwill letter for late payments, allow extra time for it to arrive and be processed. Electronic messages or online submissions might get quicker attention, but even then, there’s no standard time frame for a decision.

During this period, avoid sending multiple follow-ups too quickly. Give the process time and keep track of your communication.

Client Dispute Manager Software: Helping You Manage Goodwill Letter Requests with Ease

Client Dispute Manager Software is designed specifically for people working in the credit repair industry, whether for personal use or to serve clients. It offers a practical way to manage tasks like sending goodwill letters with less manual work and more consistency.

This software can be especially useful when you’re dealing with multiple accounts or a growing business.

Start Today and Explore the Features Firsthand!

Key Features That Help You Create, Track, and Send Goodwill Letters to Creditors

Client Dispute Manager Software provides tools that streamline every step of the goodwill letter process:

- Built-in Goodwill Letter Templates: Choose from a library of professional goodwill letter templates and personalize them for your needs.

- AI-assisted Customization: Quickly generate content by entering a few details and letting the software do the heavy lifting.

- Tracking Tools: Monitor the status of every goodwill letter to creditor and schedule reminders to follow up.

- Document Storage: Keep your letters and communication history organized in one secure place.

- Team Management: Assign letter tasks across users while keeping files structured and easy to access.

With these tools, Client Dispute Manager Software not only simplifies the process but also helps ensure no goodwill letter falls through the cracks. Whether you’re sending one letter or managing hundreds, the platform keeps your workflow consistent and efficient.

Frequently Asked Questions (FAQs)

Does a Goodwill Letter Work for Auto Loans and Credit Cards?

Yes, a goodwill letter can work for both auto loans and credit cards if the late payment was a one-time issue and the account is now current. Lenders often review the customer’s payment history and relationship length before making a decision.

Auto loan companies and credit card issuers are more likely to consider goodwill requests from long-term, responsible borrowers who clearly explain what happened and show steady on-time payments afterward.

Can a Goodwill Letter Improve Your Credit Score?

Sending a goodwill letter to remove late payments might have a positive impact on your credit score, depending on how the creditor responds and the overall state of your credit profile.

While it’s not a guaranteed fix, it’s a legitimate step people take to try and clean up past mistakes and move toward better credit health.

How Many Times Can I Send a Goodwill Letter to a Creditor?

There’s no official limit, but it’s best to wait at least 60 to 90 days between requests. Repeated letters too close together can appear insistent or automated. If your first goodwill letter is denied, spend a few months maintaining a perfect payment record before trying again.

Each time you reapply, update your explanation and include new proof of your good behavior.

Start Today and Explore the Features Firsthand!

Should I Email or Mail My Goodwill Letter?

Either option works, but digital submissions are faster. Many creditors now have secure online portals or customer service email addresses for credit-related requests.

Mailing a physical letter can add a personal touch, especially for smaller lenders or credit unions that review requests manually. Whichever method you choose, keep a copy for your records and confirm receipt through customer service if possible.

How Long Does It Take to See Results After Sending a Goodwill Letter?

Most lenders respond within 30 to 45 days, but it can take up to two billing cycles for updates to show on your credit report. Check all three major credit bureaus to confirm changes once your creditor agrees to the adjustment.

If no update appears after 60 days, contact the creditor for a written confirmation or request they resubmit the change. Patience is key — goodwill reviews often go through multiple departments before approval.

Conclusion

Writing a goodwill letter to creditor won’t always lead to a removed late payment, but it’s still worth trying. It gives you the chance to explain your situation directly, without disputing valid information or using aggressive tactics.

If you’ve kept your account in good standing and have a clear reason for the late payment, creditors may be willing to give you a break. Just remember to be polite, clear, and honest in your letter.

Whether you’re repairing your own credit or helping others through a credit repair business, knowing how and when to send a goodwill letter for late payments is a skill that can make a difference.

With the help of templates, automation tools, or software like Client Dispute Manager, the process becomes more manageable and efficient.

Take the step. Draft your letter, send it with confidence, and keep working toward your credit goals—one smart move at a time.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!