Are you struggling with inaccurate information on your credit report? Knowing how to write a dispute letter that gets results is crucial for improving your credit score. As an expert credit repair specialist, I’m going to share 10 insider secrets that credit bureaus don’t want you to know about crafting effective dispute letters.

Start Today and Explore the Features Firsthand!

The Essentials of How to Write a Credit Dispute Letter

Mastering the art of writing an effective credit dispute letter is crucial for anyone looking to improve their credit score. In this section, we’ll cover the fundamental aspects of crafting a compelling dispute letter that gets results.

From determining how many items to dispute to understanding the impact of recent negative items, these essentials will form the foundation of your credit repair strategy.

The Magic Number: How Many Items Should You Dispute?

When it comes to how to write a credit dispute letter, one of the most common questions is about the number of items to dispute. The truth is, there’s no one-size-fits-all answer. It depends entirely on your specific situation. Here’s the secret: Dispute every single inaccurate item on your report.

Don’t hold back thinking you should only dispute a few at a time. When learning how to write a dispute letter, remember that quantity doesn’t necessarily mean quality.

The Devil's in the Details: How Detailed Should Your Credit Dispute Letter Be?

When crafting a credit dispute letter, many people wonder about the level of detail they should include. The key is to provide enough information for the credit bureau to understand exactly what you’re disputing and why.

Include your full name and address, the item you’re disputing, why you believe it’s inaccurate, and any supporting evidence you have.

A well-crafted credit dispute letter template can help you structure your letter effectively.

The Priority Game: Which Items Should You Dispute First?

Not all negative items on your credit report are created equal. Some have a much bigger impact on your credit score than others. So, how do you write a dispute letter strategy that maximizes your efforts?

Focus on disputing items that have the most significant negative impact on your credit score first. These typically include bankruptcies, foreclosures, charge-offs, and collections. This strategy is crucial when figuring out how to dispute debt collection letter effectively.

The 24-Month Rule: A Little-Known FICO Secret

Here’s an insider tip that many people don’t know about: According to FICO, negative items on your credit report have the most impact within the first 24 months. This is crucial information when deciding how to write a debt collection dispute letter effectively.

Prioritize disputing negative items that have appeared on your credit report within the last two years. When you’re learning how to write a dispute letter, keeping this timeline in mind can help you focus your efforts where they’ll have the most impact.

The Statute of Limitations: A Double-Edged Sword in Debt Collection Disputes

Before you start firing off dispute letters, it’s crucial to understand the concept of the statute of limitations. This is the time period during which a creditor can sue you for a debt. Why does this matter when learning how to write a debt collection dispute letter?

Because disputing a debt that’s within the statute of limitations could potentially “awaken the giant” and prompt the creditor to take legal action. Be particularly cautious when disputing large debts that are still within the statute of limitations.

Start Today and Explore the Features Firsthand!

Advanced Techniques for Writing a Dispute Letter That Works

Now that we’ve covered the basics, it’s time to dive into more sophisticated strategies. These advanced techniques will help you navigate complex situations and overcome common obstacles in the dispute process. From handling verified accounts to dealing with credit bureau delay tactics, these insights will elevate your dispute letter writing skills to the next level.

The Verification Game: What to Do When Your Dispute Comes Back "Verified"

Don’t lose hope if your first dispute letter comes back with the dreaded “verified” response. This is where many people give up, but the pros know better. Here’s where knowing how to write a credit dispute letter that addresses verification becomes crucial.

Draft a new dispute letter focusing on a different aspect of the account that’s inaccurate. Provide any new evidence you might have. Remember, you’re not limited to just one dispute.

Stall Tactics: How to Handle Credit Bureau Delay Tactics

Credit bureaus are notorious for sending “stall letters” to delay investigations. These might claim your dispute is frivolous or that they need more information. Don’t let these tactics discourage you when figuring out how to write a credit dispute letter that overcomes these obstacles.

Send a new letter addressing their specific concerns and include additional proof of your identity and address. Firmly remind them of their legal obligation to investigate all disputes.

The Signature Dilemma: To Sign or Not to Sign Your Credit Dispute Letter?

There’s a lot of debate in the credit repair community about whether dispute letters need to be signed. Here’s the truth: it doesn’t really matter when it comes to how to write a credit dispute letter. Credit bureaus are required to investigate disputes whether they’re signed or not.

The only time a signature becomes crucial is if you’re planning to take legal action. This is an important consideration when creating your credit dispute letter template.

Notarization and Certified Mail: Necessary or Overkill for Your Dispute Letter?

You might have heard that you need to notarize your dispute letters or send them via certified mail. In most cases, this is unnecessary when learning how to write a dispute letter. Notarization doesn’t make your dispute any more valid in the eyes of the credit bureaus.

As for certified mail, it’s only really useful if you’re dealing with a particularly troublesome creditor and want proof that they received your communication. For routine disputes, regular mail works just fine.

Prevention is Better Than Cure: How to Dispute Debt Collection Letters Before They Hit

The best dispute letter is one you never have to write. If your client receives a collection notice, act fast to prevent it from appearing on their credit report. This proactive approach is a key part of knowing how to dispute debt collection letter effectively.

Have your client send you the collection notice immediately and draft a debt validation letter within 30 days of the notice date. Send it to the collection agency requesting proof of the debt.

Start Today and Explore the Features Firsthand!

Advanced Strategies for Writing Effective Dispute Letters

As you become more proficient in writing dispute letters, you’ll want to incorporate more sophisticated techniques into your approach. This section covers advanced strategies that can make your disputes even more effective.

These methods go beyond the basics and can be particularly useful when dealing with stubborn credit issues or complex reporting errors.

Use the "Method of Verification" Technique in Your Credit Dispute Letter

When you’re figuring out how to write a credit dispute letter, consider asking the credit bureau about their method of verification. This can be particularly effective when dealing with stubborn items that keep coming back as “verified.”

In your letter, request that the credit bureau provide you with the specific method they used to verify the disputed information. This puts pressure on them to conduct a more thorough investigation and can often lead to a resolution in your favor.

Leverage the "Burden of Proof" Principle When You Write a Dispute Letter

Remember, when it comes to how to write a dispute letter, the burden of proof is on the credit bureaus and creditors, not on you. They must be able to verify that the information is accurate and complete.

In your credit dispute letter, clearly state that if they cannot provide concrete evidence to support the disputed item, it must be removed from your credit report as per the Fair Credit Reporting Act (FCRA).

Use the "Obsolete Information" Argument in Your Credit Dispute Letter

When learning how to write a credit dispute letter, it’s important to know that certain negative information becomes obsolete after a certain period. For most negative items, this is seven years (10 years for bankruptcies).

If you notice any outdated information on your credit report, make sure to highlight this in your dispute letter. Knowing how to dispute debt collection letter effectively often involves identifying and calling out these obsolete items.

Employ the "Incomplete Information" Strategy When Writing a Dispute Letter

Credit reporting must be not only accurate but also complete. When crafting your credit dispute letter template, consider challenging items that may be technically accurate but incomplete.

For example, if a credit card account is reported as closed by the creditor, but it doesn’t specify that you, the consumer, initiated the closure, you can dispute this as incomplete information.

Utilize the "Inconsistency" Approach in Your Debt Collection Dispute Letter

When you’re learning how to write a dispute letter, pay close attention to any inconsistencies in how information is reported across the three major credit bureaus (Equifax, Experian, and TransUnion).

If an account is reported differently on different credit reports, you can use this inconsistency as grounds for dispute. This strategy can be particularly effective when figuring out how to write a debt collection dispute letter.

Perfecting Your Approach: Additional Tips for Dispute Letters

As you continue to refine your skills in writing effective dispute letters, it’s important to remember that practice makes perfect. The more you write, the better you’ll become at crafting persuasive arguments and presenting your case clearly. Here are some additional tips to help you master how to dispute debt collection letter and create an effective credit dispute letter template:

- Keep A Record Of All Correspondence: This includes copies of your dispute letters, responses from credit bureaus, and any supporting documentation. Having a well-organized file can be crucial if you need to escalate your dispute.

- Be Consistent in Your Approach: When learning how to dispute debt collection letter, develop a systematic method. This consistency can help you track your disputes more effectively and refine your strategy over time.

- Customize Your Credit Dispute Letter Template: While having a template is useful, make sure to tailor each letter to the specific circumstances of the dispute. A personalized approach can be more effective than a one-size-fits-all letter.

- Follow Up Regularly: Don’t assume that sending one letter is enough. If you don’t receive a response within the legally mandated timeframe, send a follow-up letter. Your credit dispute letter template should include a section for follow-up correspondence.

- Stay Informed About Your Rights: Laws and regulations regarding credit reporting and debt collection can change. Regularly update your knowledge to ensure your approach to how to dispute debt collection letter remains effective and compliant.

Remember, the key to success in credit dispute writing is persistence and attention to detail. By continually refining your credit dispute letter template and improving your understanding of how to dispute debt collection letter, you’ll be better equipped to handle even the most challenging credit issues.

Leveraging Technology in Your Dispute Process

In today’s digital age, there are numerous tools and software options available to help streamline your dispute process. These can be particularly helpful when managing multiple disputes or running a credit repair business.

Here are some ways technology can assist you:

- Credit Dispute Letter Template Libraries: Many software options offer extensive libraries of templates, making it easier to find the right starting point for your dispute letters.

- Automated Tracking: Keep track of when you sent each dispute letter, when responses are due, and when to follow up. This is especially useful when managing multiple disputes.

- Document Scanning and Storage: Easily scan and store supporting documents, making it simple to attach them to your dispute letters when needed.

- Integration with Credit Monitoring Services: Some tools can automatically alert you to changes in your credit report, allowing you to quickly respond with a dispute letter if necessary.

- Analytics and Reporting: Track your success rate and identify patterns in your disputes, helping you refine your approach to how to dispute debt collection letter over time.

By combining these technological tools with your knowledge of how to dispute debt collection letter and a well-crafted credit dispute letter template, you can significantly enhance your efficiency and effectiveness in the credit dispute process.

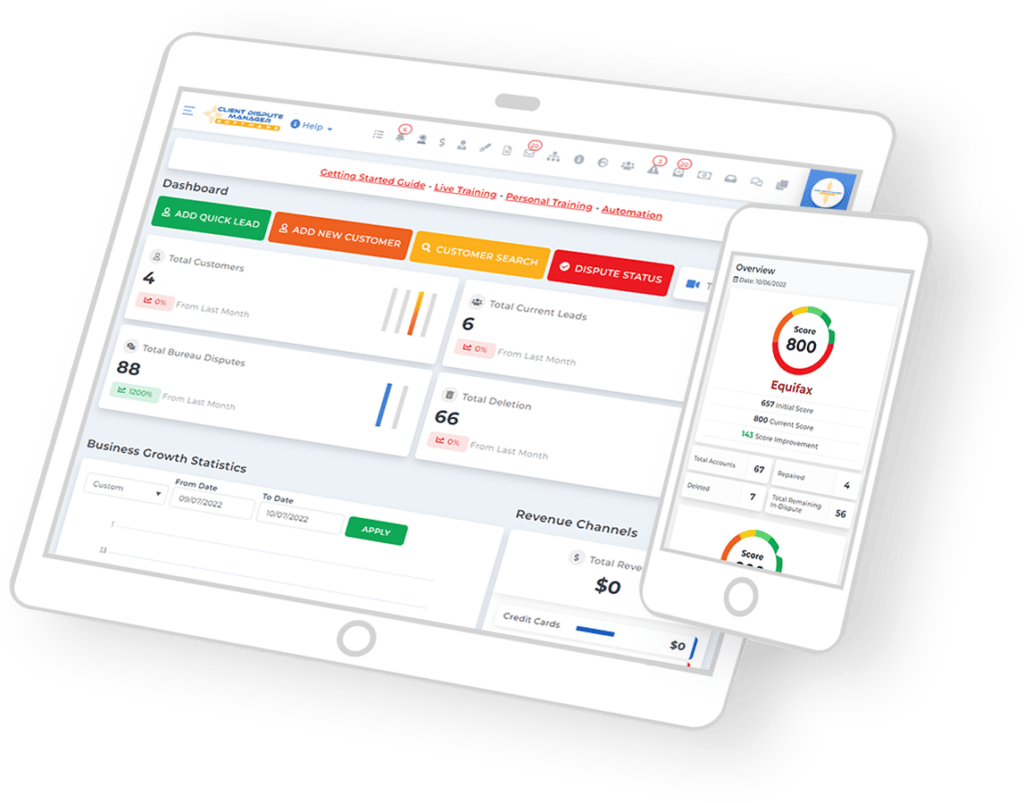

Streamlining Your Dispute Process with Client Dispute Manager Software

As you become more proficient in how to write a dispute letter, you may find yourself managing multiple disputes for various clients. This is where Client Dispute Manager Software can be a game-changer for your credit repair business or personal credit improvement journey.

Client Dispute Manager Software is a specialized tool designed to streamline the process of creating, sending, and tracking credit dispute letters. It’s an essential resource for anyone serious about mastering how to write a credit dispute letter efficiently and effectively.

Key Features and Benefits

- Customizable Templates: The software often includes a variety of credit dispute letter templates that you can customize to fit specific situations. This ensures consistency and saves time when crafting dispute letters.

- Automated Follow-ups: Learn how to write a debt collection dispute letter once, and let the software handle timely follow-ups automatically.

- Progress Tracking: Easily monitor the status of multiple disputes across different clients or accounts.

- Document Management: Store and organize supporting documents, making it easier to include relevant evidence with your dispute letters.

- Client Portal: Some software includes a client portal, allowing your customers to track their own progress and upload necessary documents.

Start Today and Explore the Features Firsthand!

Conclusion

Learning how to write dispute letters that get results is a powerful skill in the world of credit repair. By following the insider secrets and advanced strategies outlined in this guide, you’ll be well-equipped to challenge inaccurate information on your credit report and potentially improve your credit score.

Remember, persistence and attention to detail are key when crafting effective dispute letters.

Whether you’re working on your own credit or helping others as part of a credit repair business, these techniques can make a significant difference in achieving positive outcomes. Keep refining your approach to how to write a credit dispute letter, and you’ll likely see improvement over time.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Give Me 10 Minutes, I’ll Give You The Truth About Collector Letters

- Advanced Credit Repair: Proven Strategies to Rebuild Your Score