Are you tired of the constant harassment and abuse from debt collectors? You’re not alone. Many people face these challenges, often feeling powerless and unsure of their rights. But the truth is, you have the power to fight back and sue a debt collector who violates your consumer rights. In this comprehensive guide, we’ll walk you through the process of filing a lawsuit against a debt collector, step by step.

By the end, you’ll be equipped with the knowledge and tools to stand up for your rights and protect yourself from unfair debt collection practices, debt collector harassment, and debt collector legal defense tactics.

Start Today and Explore the Features Firsthand!

Understanding Your Rights: The Foundation of Your Case

Before we dive into the specifics of how to sue a debt collector, it’s essential to understand the rights afforded to you under the Fair Debt Collection Practices Act (FDCPA). This federal law protects consumers from abusive, deceptive, and unfair debt collection practices. Some common violations that can give you grounds for a lawsuit against a debt collector include:

- Calling at unreasonable hours, such as before 8 a.m. or after 9 p.m.

- Using threatening, profane, or abusive language, constituting debt collector harassment

- Contacting you after you’ve requested them to stop, violating your consumer rights against debt collectors

- Discussing your debt with third parties, such as family members or employers, which is a form of debt collection abuse

- Misrepresenting the amount you owe or their legal authority to collect the debt, providing grounds for a debt collector lawsuit.

If you’ve experienced any of these violations, you may have a strong case for a lawsuit against a debt collector. But what exactly constitutes a violation, and how can you prove it? Let’s take a closer look at each step in the process of suing a debt collector and overcoming their debt collector legal defense.

Step #1: Document the Harassment

To build a strong lawsuit against a debt collector and counter their debt collector legal defense, you need evidence. This is where documentation comes in. Start by keeping a detailed record of all interactions with the debt collector, including:

- Phone calls (date, time, and content of the conversation)

- Letters and emails

- Voicemails

- Text messages

Consider creating a log or spreadsheet to organize this information. The more detailed and accurate your records, the better your chances of success in your debt collector lawsuit and in challenging their debt collector legal defense.

Be sure to note any instances of debt collector harassment or abusive behavior, as well as any attempts to contact you at inappropriate times or after you’ve requested them to stop.

Step #2: Send a Cease and Desist Letter

If you want the debt collector to stop contacting you, you have the right to send a written cease and desist letter. This letter should explicitly state that you want the debt collector to stop all communication with you, asserting your consumer rights against debt collectors. Be sure to send the letter via certified mail with a return receipt to prove the debt collector received it.

It’s important to note that sending a cease and desist letter does not erase your debt or prevent the debt collector from taking other actions, such as filing a lawsuit against a debt collector. However, it can stop the debt collector harassment and give you some peace of mind while you work on resolving the debt.

Start Today and Explore the Features Firsthand!

Step #3: Verify the Debt

Under the FDCPA, you have the right to request debt validation within 30 days of the debt collector’s initial contact. This means you can send a written request asking the debt collector to provide proof that you owe the debt and that they have the legal right to collect it. If they fail to provide this information, they cannot legally continue to collect the debt, and you may have grounds for a debt collector lawsuit.

Debt verification is a crucial step in the process, as it ensures that you’re not being harassed over a debt you don’t actually owe. It also puts the burden of proof on the debt collector, forcing them to substantiate their claims before proceeding with collection efforts and weakening their debt collector legal defense.

Step #4: Consult with an Attorney to Sue A Debt Collector

While it’s possible to file a lawsuit against a debt collector on your own, it’s highly recommended to consult with an experienced consumer rights attorney who specializes in debt collector harassment and debt collection abuse cases. They can help you navigate the complex legal process, gather evidence, and represent you in your debt collector lawsuit. Many attorneys offer free initial consultations and work on a contingency basis, meaning they only get paid if you win your case.

When choosing an attorney for your lawsuit against a debt collector, look for someone with experience in FDCPA cases and a track record of success in defending consumer rights against debt collectors. Don’t be afraid to ask questions about their qualifications and approach to your case. A good attorney will be transparent, communicative, and dedicated to fighting for your rights in your debt collector lawsuit.

Step #5: File a Complaint

Before filing a lawsuit against a debt collector, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) and your state’s Attorney General’s office. These agencies can investigate the debt collector and take action on your behalf to address debt collector harassment and protect your consumer rights against debt collectors. While this step isn’t mandatory, it can add weight to your case and potentially lead to a faster resolution.

Filing a complaint is relatively simple and can be done online or by mail. Be sure to include as much detail as possible, including copies of any supporting documentation that demonstrates the debt collection abuse. The CFPB and Attorney General’s office will review your complaint and determine whether to take action against the debt collector.

Step #6: File Your Lawsuit

If you decide to proceed with a lawsuit against a debt collector, you’ll need to file a complaint in federal or state court. Your complaint should outline the specific FDCPA violations, the damages you’ve suffered (such as emotional distress or lost wages), and the relief you’re seeking (such as monetary compensation or an injunction to stop the debt collector harassment).

You’ll also need to serve the debt collector with a copy of the complaint and a summons to appear in court. Filing a lawsuit can be a complex process, so it’s important to work closely with your attorney to ensure that all necessary steps are taken.

They can help you draft a compelling complaint, navigate the court system, and build a strong case on your behalf to defend your consumer rights against debt collectors and put an end to the debt collection abuse.

Step #7: Prepare for Trial

If your debt collector lawsuit goes to trial, your attorney will help you prepare your evidence and arguments. This may involve gathering witness testimony, expert opinions, and additional documentation to support your claim of debt collector harassment and violations of your consumer rights against debt collectors. Remember, the burden of proof is on you to show that the debt collector violated the FDCPA and engaged in debt collection abuse.

At trial, your attorney will present your case to the judge or jury, cross-examine witnesses, and make arguments on your behalf. The debt collector will have the opportunity to present their own case and defend against your allegations. Ultimately, the judge or jury will decide whether the debt collector violated the FDCPA and what damages, if any, should be awarded in your lawsuit against the debt collector.

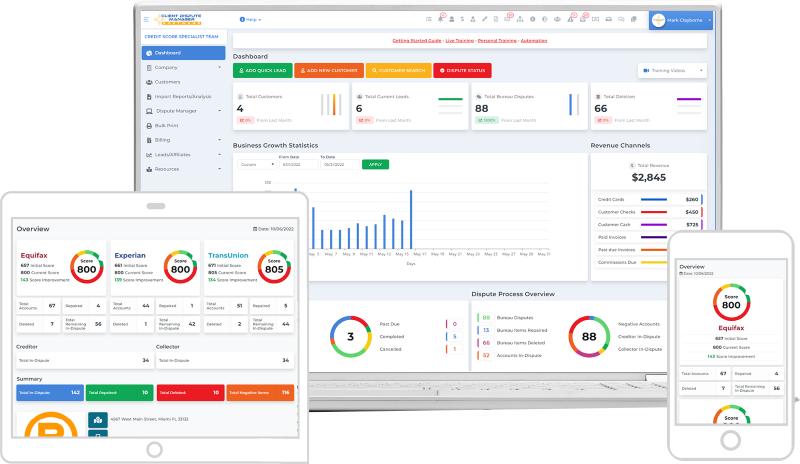

Client Dispute Manager Software: Streamline Your Debt Collection Lawsuit Process

When suing a debt collector, staying organized and efficiently managing your case is crucial. That’s where Client Dispute Manager Software comes in. This powerful tool is designed to streamline the process of filing a lawsuit against a debt collector, making it easier for you and your attorney to build a strong case and protect your consumer rights against debt collectors.

Key features of Client Dispute Manager Software include:

- Documentation Management: Easily store and organize all evidence of debt collector harassment and debt collection abuse, including call logs, emails, letters, and voicemails. The software ensures that all relevant information is readily accessible when needed.

- Timeline and Deadline Tracking: Keep track of important dates and deadlines related to your debt collector lawsuit, such as the statute of limitations, court filing dates, and discovery deadlines. The software sends reminders to ensure you never miss a crucial milestone.

- Communication Tools: Securely communicate with your attorney, share documents, and receive updates on your case progress through the software’s built-in communication features. This streamlines collaboration and keeps you informed throughout the legal process.

- Legal Document Templates: Access a library of customizable legal document templates specific to debt collector lawsuits, saving time and effort in drafting complaints, motions, and other necessary paperwork.

- Billing and Expense Tracking: Keep track of all expenses related to your lawsuit against a debt collector, including attorney fees, court costs, and other legal expenses. The software generates detailed reports and invoices, making it easy to manage the financial aspects of your case.

By leveraging Client Dispute Manager Software, you and your attorney can efficiently navigate the process of suing a debt collector, ensuring that your consumer rights against debt collectors are protected every step of the way. The software empowers you to build a compelling case, stay organized, and ultimately achieve a successful outcome in your fight against debt collector harassment and debt collection abuse.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

How Much Can I Sue A Debt Collector For?

Under the FDCPA, you can sue a debt collector for actual damages, statutory damages up to $1,000, and attorney’s fees. Actual damages include any financial losses or emotional distress caused by the debt collector harassment or debt collection abuse.

How Long Do I Have To Sue A Debt Collector?

You must file your lawsuit against a debt collector within one year of the FDCPA violation. This is known as the statute of limitations. It’s important to act quickly to protect your consumer rights against debt collectors and preserve your ability to seek justice.

Can I Sue A Debt Collector For Harassing Me Even If I Owe The Debt?

Yes, even if you owe the debt, debt collectors must follow the rules set forth in the FDCPA. If they engage in debt collector harassment, abusive, or deceptive behavior, you have the right to sue a debt collector regardless of the debt’s validity.

What If I Can't Afford An Attorney For My Lawsuit Against A Debt Collector?

Many consumer rights attorneys work on a contingency basis, meaning they only get paid if you win your debt collector lawsuit. Some may also offer pro bono services for low-income clients. Don’t let the cost of an attorney deter you from seeking the justice you deserve and protecting your rights against debt collector harassment.

Will Suing A Debt Collector Hurt My Credit?

Suing a debt collector should not directly impact your credit score. However, if the debt in question is still unpaid, it may continue to negatively affect your credit until it’s resolved. It’s important to address the underlying debt as well as the debt collector harassment when seeking a comprehensive solution.

Conclusion

In conclusion, suing a debt collector is a powerful way to protect your rights, hold abusive collectors accountable, and overcome their debt collector legal defense. By understanding your consumer rights against debt collectors, documenting debt collector harassment and debt collection abuse, and following the steps in this guide, you can successfully file a lawsuit against a debt collector.

Don’t let fear or a seemingly strong debt collector legal defense prevent you from standing up for yourself. Seek the guidance of a consumer rights attorney to navigate the legal process and fight for the compensation you deserve.

Take action today and send a clear message that debt collector harassment will not be tolerated, regardless of their debt collector legal defense. Remember, the law is on your side, and you have the strength to pursue justice.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- How to Write a Dispute Letter for Better Results

- Guide To Understanding The Fair Credit Reporting Act