How to Write a Dispute Letter for Better Results

In the video below, I’m going to show you various steps that you can take on how to write a successful dispute letter. These are steps that will get you results when you do it the right way.

One of the first things that you want to do when you are thinking about improving your own credit score or helping someone else improve their credit score is to get a credit monitoring report.

Let me show you the place that I go to. When I want my own credit monitoring report, I go to SmartCredit.

Here are the reasons why I go to SmartCredit:

- I like their layout. The report format is very easy for me to navigate the report.

- More tools. There are additional tools inside their platform that will help you dispute more effectively.

There’s a link right below you can click to get your own SmartCredit monitoring report. You can also become an affiliate and earn an extra stream of income if you decide to run and start your own credit improvement business.

Step #2: Pull Up the Credit Report and Analyze It

Step one is to get your credit monitoring report and once you get your credit monitoring report, you want to pull up the credit report section. What we’re going to do now is we’re going to pull up the credit report section and I’ve already prepared it for you right here.

Now, say for example, you got your SmartCredit report. Below are the things that you need to do once you have your report ready:

- Go through the credit report and you identify some of the information on the credit report that you feel that’s inaccurate. That is the first thing you want to do whenever you get your credit report,

- Next step is that you want to look at each account in the credit report. You want to go step by step. Check accounts individually like Chase, Wells Fargo, Bank of America… you want to look at each account

- You have to go looking for inconsistencies and inaccurate information

Let me show you what I’m talking about. All right, so let’s take it up.

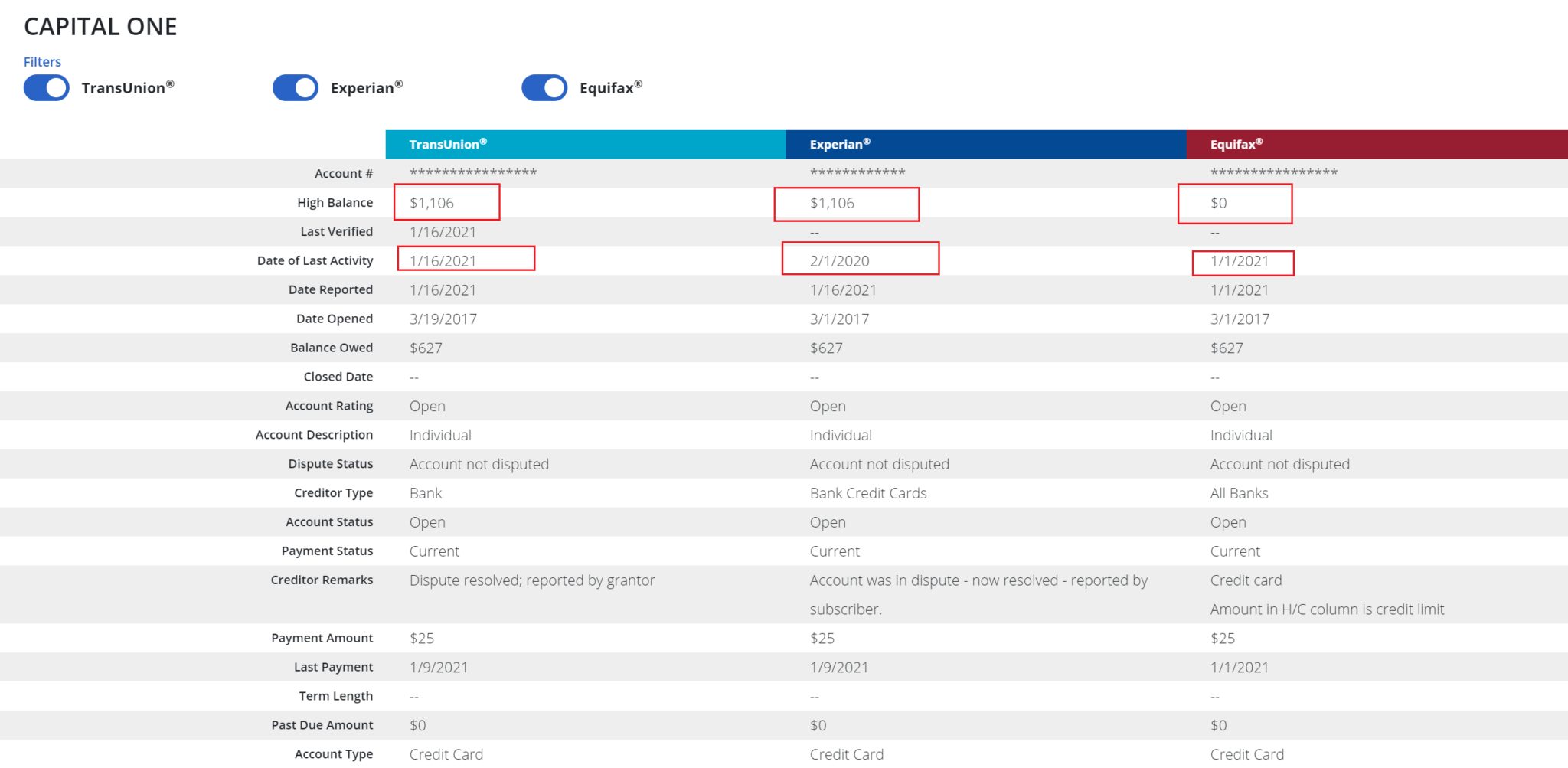

What we want to do, as we can see right below, we’re looking at one account.

It says high balance, 1,106, on both TransUnion and Experian, but it says zero in Equifax.

How is it possible these two, TransUnion and Experian, has one thing and Equifax has another?

That’s inaccurate reporting across the board. Then, you want to look at the data last activity. Look at this one, 1/16/2021, then Experian has it at 2/1/2020, and then 1/1/2021.

The Fair Credit Reporting Act states that all information must be reported 100% accurate across the board.

As you can see, that’s not being reported 100% accurate. That’s another problem with this particular account. Let’s keep going.

If we go down under late payment it says 1/9/2021, 1/9/2021, and then for Equifax it says 1/2/2021.

So, who’s right?

Why is it reporting one way on two credit bureaus and then the other way it’s not? That’s another problem that you can challenge.

Remember what the Fair Credit Reporting Act states, all information that’s reported on the consumer’s credit report must be 100% accurate. When you’re looking at your SmartCredit credit report, you want to look for the issues inside of the account. It’s called factual disputing, and anybody can do this.

When can you use Factual Disputing?

- You can do this for your own credit report

- You can do this if you’re helping someone else improve their credit.

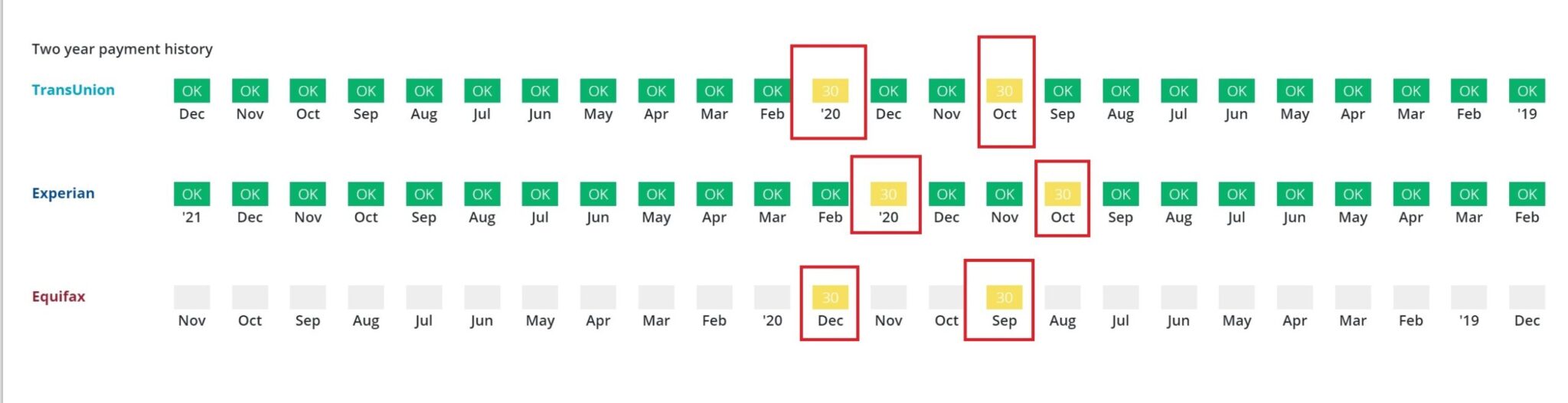

Next, let’s take a look at the payment history.

What you can see in the payment history:

- You’ve got TransUnion and Equifax, they both are reporting it

- You got TransUnion reporting in January.

- Equifax is reporting it in December.

- Experian is reporting here in January, and then over here in October

- TransUnion is reporting in October

- Equifax is reporting in September and then Experian again is reporting in October.

So again, based on the payment history, we have another problem there. These are the things that you want to dispute when you are challenging inaccurate information on your credit report, ladies and gentlemen.

It’s not that difficult.

I’m showing you how to do it right here in front of you. You get your credit report, you look at it, you look for inconsistencies. Now it is time for us to go ahead and create our first dispute letter with these issues.

I’m going to take you all the way from the beginning, all the way to the end. Hang in there because if you’re new, if you’re confused, you’re not sure of what to do, this video is going to do it for you.

Step #3: Create Your First Dispute Letter Based on Inaccurate Info

Next thing we’re going to do is now we’re going to create the dispute letter. I’m going to show you the things that you need inside of the dispute letter. That way the credit bureaus can do a proper investigation and your disputes can be pretty effective.

What we’re going to do is we are going to log into the Client Dispute Manager software. This software is a credit repair business software. It is basically for companies who want to help consumers improve their credit report. If you want to fix your own credit you can use the Client Dispute Manager to do that as well.

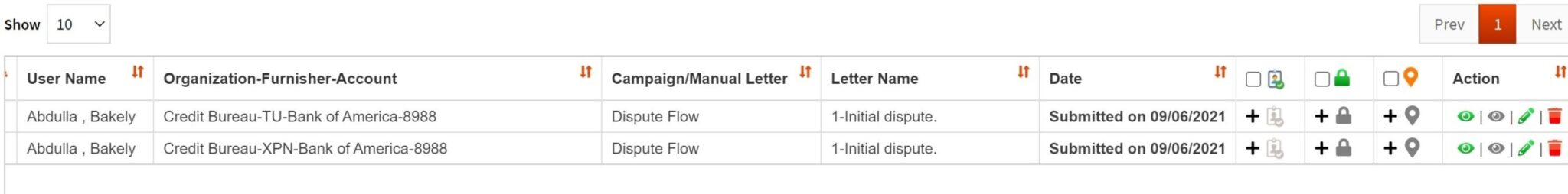

What are the steps you need to follow inside the Client Dispute Manager software?

- From within the software, we will go to Dispute Manager.

- We’re going to choose the customer.

- We’re going to go to credit bureau and I’ve already loaded some information inside of the software.

- So, we’ve got Bank of America, we’ve got Chase, Macy’s and Midland.

- I’m just going to do this for the simplicity of this particular video.

- go to dispute letter flow one

- we’re going to pick an initial dispute

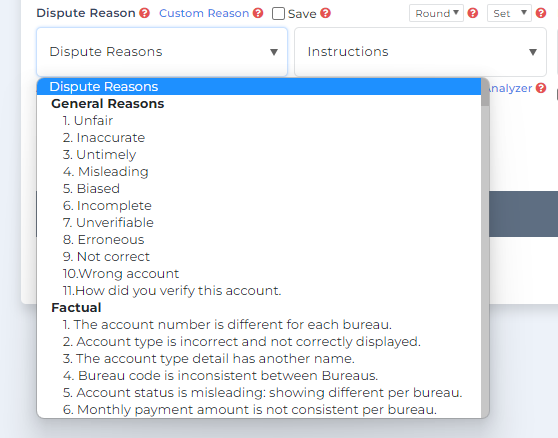

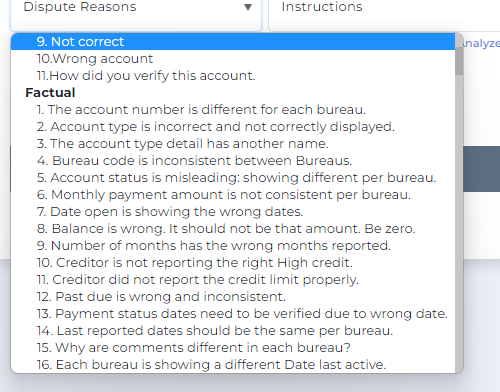

- we’re going to do a custom dispute reason. We want to tell the credit bureaus that we have all of these issues with these three accounts inside of this credit report. We’re looking at one account, but we got three issues inside of that one account. We got three issues that we saw.

Very straightforward guys, no tricks, no tricks of the game. Let’s just get straight to the point. It’s called factual disputing.

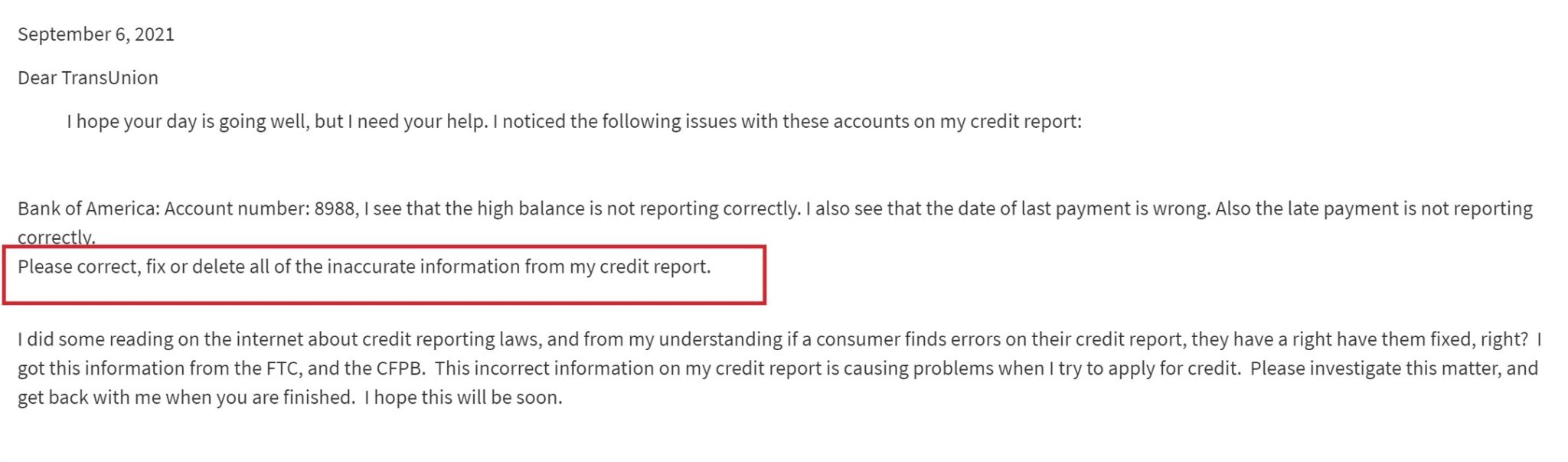

All right, so let’s take a look at that right now. So, we’re going to go here, so what I did was I picked the initial dispute letter. So, I’m going to click that and I’m going to preview this letter and we’re going to talk about the dispute letter. All right, so like I said before, there’s certain things you want in the dispute letter. If you leave out certain things in the dispute letter, you could have a problem with the credit bureau investigating your dispute and that’s a waste of time because it takes 30 days before the credit bureaus will respond back to you.

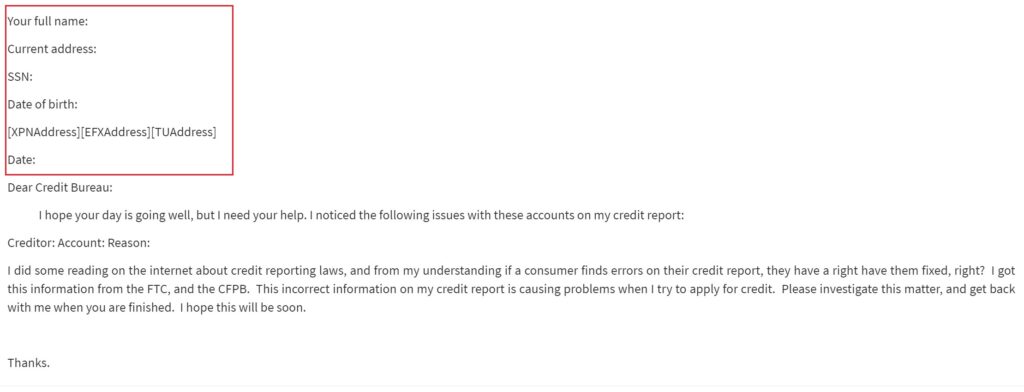

Here are the important things you need to have in your dispute letter:

- your full name

- your current address

- your social security numbers

- your date of birth

- the address of the credit bureau. That’s not mandatory, but it’s good to have

- the date that you’re actually sending this letter

- another thing that you need that we’re going to add the dispute reason. We’re going to put the dispute reason on why you are disputing this account.

It’s very important that you explain to the credit bureaus why you are disputing this account. You also want to tell them what you want them to do.

So, you’re saying I’m disputing this account, I want you to do this.

I want to show you how to do it, very easy to do inside of the Client Dispute Manager. All right, let me show you real quick. Now what we’re going to do is we’re going to do the first part is we’re going to do a custom reason and we’re going to tell them why we are disputing this account.

- The high balance is not reporting correctly across all three bureaus. This is your first dispute, this your first dispute reason. Remember there was three things we had. There was three things we had.

- The second one is the date of last activity is not correct because it’s not showing properly across all three bureaus

- The third one was the late payment. There is a problem with the late payment. I don’t believe it’s reporting correctly.

So, now we just told the credit bureau the problem, the dispute reason. So, now we want to tell them what we want them to do. All right, so now we want to tell them what we want them to do. The date of last activity…

So now, please correct, fix, or delete the inaccurate reporting ASAP. That’s it,

So then what we want to do from there is we want to click on add your dispute. That’s how quick it is. That’s how quick you can add a dispute, create dispute letters that fast inside of the Client Dispute Manager.

Send Your Letter to Bulk Print

Next step is we’ve created our disputes, we told the credit bureau exactly what we wanted, we told them what we want them to do, and now we’re going to send it to bulk print. We’re going to send it to bulk print, I’m going to show you how to do that. We’re going to go ahead and click on send to print, and now we’re going to go to bulk print screen right here, and this is where you have all of your letters. You got here going to TransUnion, we got one going to Experian, very easy, very straight to the point, and we got TransUnion again.

All right, and if you want to, you can preview your letters right here. You can also attach a copy of your ID, you can attach proof of address, you can also attach a copy of your social security card. We’re going to talk about that in a few minutes, and all you have to do is click one button and you can print out your information.

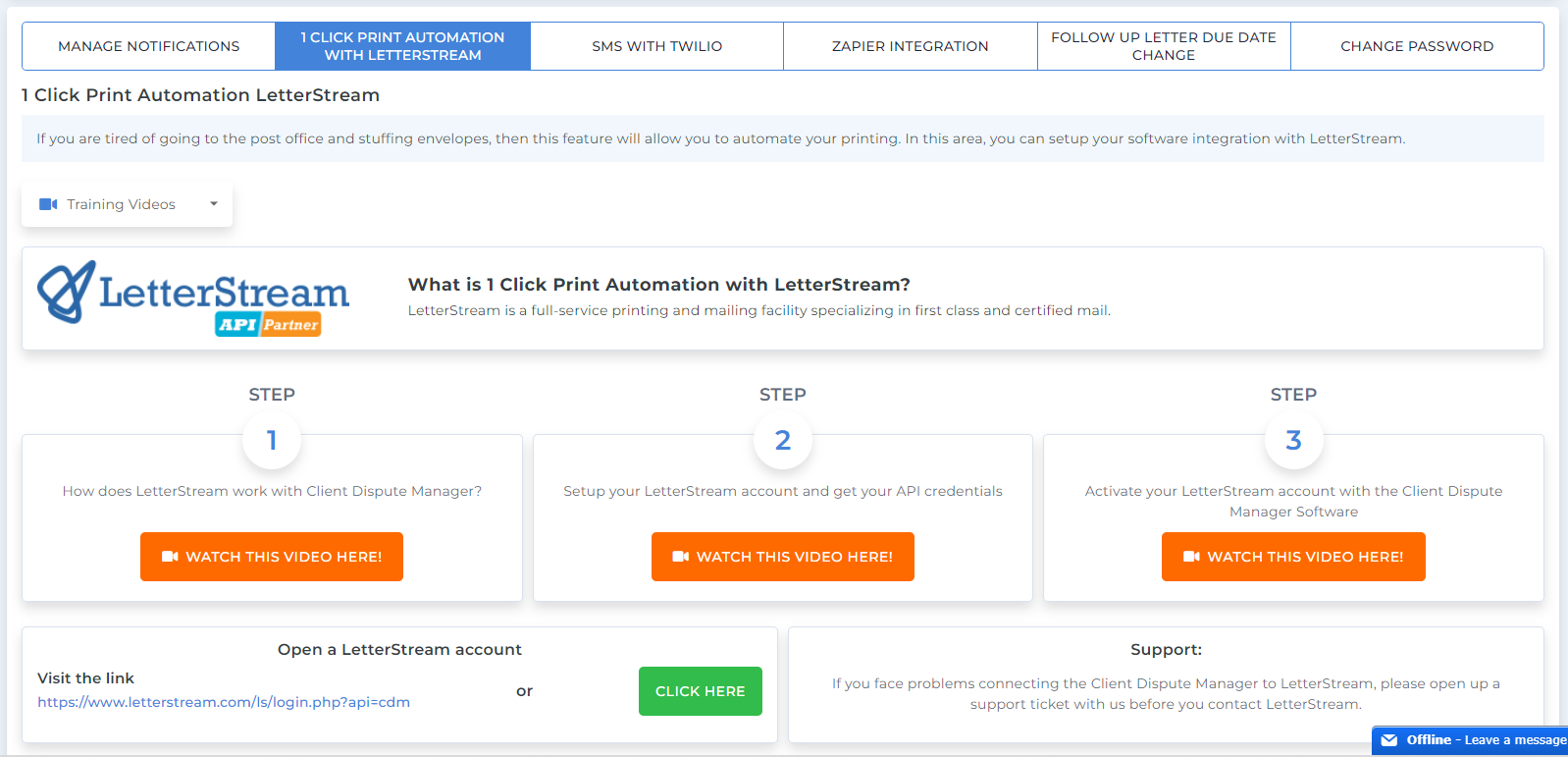

If you don’t want to go to the post office, the software will save you so much time by connecting to our one click print automation. Now, if you are helping someone else improve their credit, then this will definitely save you thousands of hours because basically you connect it to our third party, you click one button, and the letters will go over there, they’ll print them for you, it’s called one-click print automation.

Step #4: Printing Your Dispute Letter

We went over the letter part so now we have the printing part.

Let me show you how to print dispute letters using the Client Dispute Manager Software

This is the one click print automation right here. We want to simply print out our letters.

For example, we print out our letters and we’re not using one click automation, but we print out our letters and we say, Mark, I have some questions for you.

So, the number one question that a lot of people ask me is, do we place a signature on the letter?

I keep getting that all the time. Here’s my answer… it won’t hurt. If you’re fixing your own credit, it won’t hurt that you put your signature on your letter. However, it doesn’t make a difference to the credit bureau on if they’re going to investigate further, or they’re going to investigate faster

For example, the credit bureau failed to follow the law and you catch them in the violation and you signed your letter and then you go to an attorney and say, “Hey, the credit bureau violated my rights. Do we have a case?”

Now, the attorney may say, “Hey, we may have something because you actually signed the letter.”

What if you are helping someone else improve their credit score? Are you going to sign the letter for every single person? Does it really matter? The answer is absolutely not.

Now, if you have a power of attorney and you want to sign, that’s a different story.

Disclaimer: I’m not an attorney, so don’t take this as legal advice.

I’ve never signed any of my customers’ letters when I was doing credit restoration a long time ago. I’ve never signed them, and yet we still got great results by just simply doing exactly what I’m showing you on this video. So, I hope that helped.

Step #5: Know What You Need to Include in your Letters

All right, so the next thing we’ve printed the letter, we made a decision on whether we’re going to sign it or not.

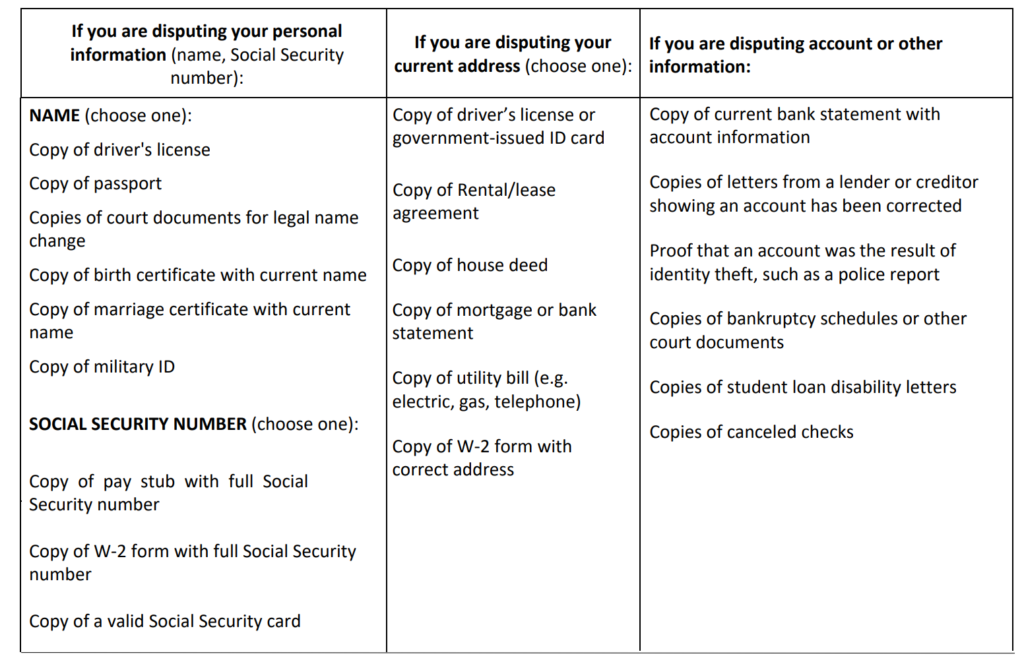

Now, what else goes with this letter to the credit bureau? What should you put in the envelope when you send this letter over to the credit bureau? Let’s take a look. Additional information, now check this out. It’s Equifax, so check this out.

- A copy of your driver’s license,

- a copy of a passport

- or copies of documents of your legal name.

So, basically what they’re saying here is that they kind of want proof of who you say you are. That’s what they’re saying there, and this is like a list of things you can use.

Here is a list of information you can provide base on what you are disputing:

If you’re disputing your personal information:

- name

- social security number

If you’re disputing your current address (choose one):

- a copy of your license

- a copy of your rental lease agreement

- a copy of your household deed

- a copy of your mortgage

If you’re disputing account or other information:

- a copy of your bank statement

So, what they’re saying is that you don’t have to send this every single time you send a letter, but the first letter that you send out. It is good to get in the habit to sending the following out with the first letter:

- a copy of your address or proof of address

- a copy of your license

- a copy of your social security card

So, what the credit bureau is trying to do, they want to make sure it’s you, you are the person that’s sending the letter. That’s what they’re doing.

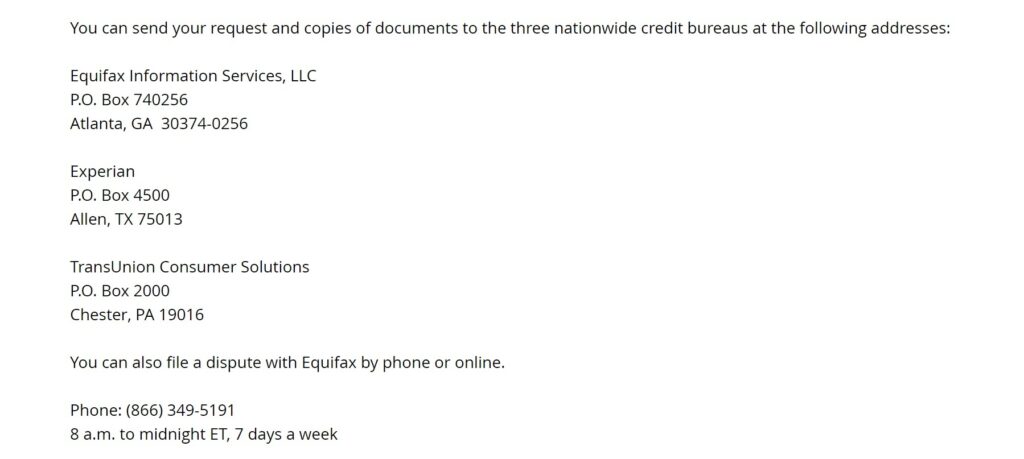

Step #6: Send Your Dispute Letter to the Correct Address

All right the next thing is, we want to make sure we’re sending it to the correct address. We want to make sure we’re sending it to the correct address.

I’m showing you the most updated credit bureau addresses right now.

You can see it right here on the screen. You want to make sure that you have the most updated addresses, so your letters do not get stalled, they do not get lost.

The Client Dispute Manager software has the most updated addresses inside the letter for you. If you are using the software, then you don’t have to worry about that part.

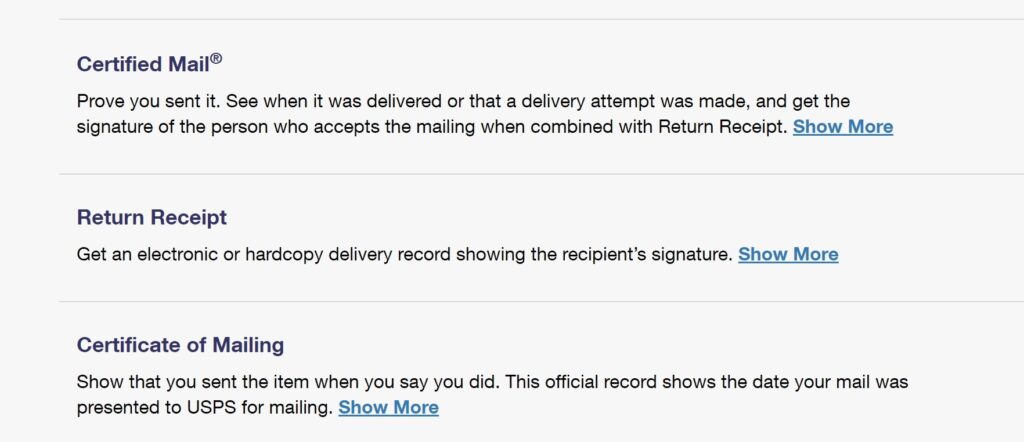

Certified or Non-Certified Mail

Now, another question that a lot of people ask me about is shipping.

Hey, Mark, should I send this by certified mail return receipt? Should I send it certified or non-certified?

So, here’s my thing on certified or no certified…

If you are repairing your own credit, if you’re working on your own credit report, you should always send it certified mail with return receipt. You have proof that the creditor or the collector or the credit bureau received your letter, and you’re only working on your own credit, so you have proof of that. You guys understand what I’m saying?

If you are helping someone else improve their credit, and you’re running a business, then you should absolutely not send it certified mail, unless you think that you have a case here, and you think that your customer has a lawsuit and you’re going to get an attorney involved. Then at that point, then yeah, you want to be sending it certified mail. You understand what I’m saying?

So, it’s very, very, very, very important that you understand that.

Are you looking earn an extra stream of income?

All right, so like I said before, I have a special gift for you guys. Everybody who stayed all the way to the end.

First of all, I have a question for you.

Would you like to earn an extra stream of income?

Would you like to earn this income just helping other people do what you do?

Now imagine, you go through all of this training, you read all these books, you watch all these YouTube videos, you learn all the skills to improve your own credit score, so why not earn an extra stream of income helping someone else improve their credit score, even while you’re working your nine to five job?

Now I can help you do that.

I have a free training, a 30-day video series teaching you step-by-step on how to start your own credit improvement business. And not only that, I’m going to give you a checklist, I’m going to guide you step-by-step video base, and I’m also going to show you how to get your first customer and it’s all absolutely free.

Let me show you what I’m talking about. All you have to do is click the link below.

When you click the link below, you’re going to be taken to this page right here.

It shows you exactly what I’m going to give you for absolutely free to get started, earn an extra stream of income, start living the life you really, really, really, really want to live.

I know I was completely tired of being broke, I was tired of working for the man, I was tired of people controlling my schedule. I can’t spend any time with my kids. I was tired not making any money, not being able to travel, but this is your time. You already know the skill. You already know, you did the studying, you’re helping improving your own. Why not help someone else?

This is the time, this is the opportunity, this is a year. Go ahead and click the link below. Once you click the link below you’ll be taken to the page where you can sign up for the free training, a step-by-step checklist and how to get your first customer guide.

GET YOUR FREE TRAINING HERE

This is Mark Clayborne, the founder of the Client Dispute Manager software. Don’t forget to subscribe. I want to see you on the other side.