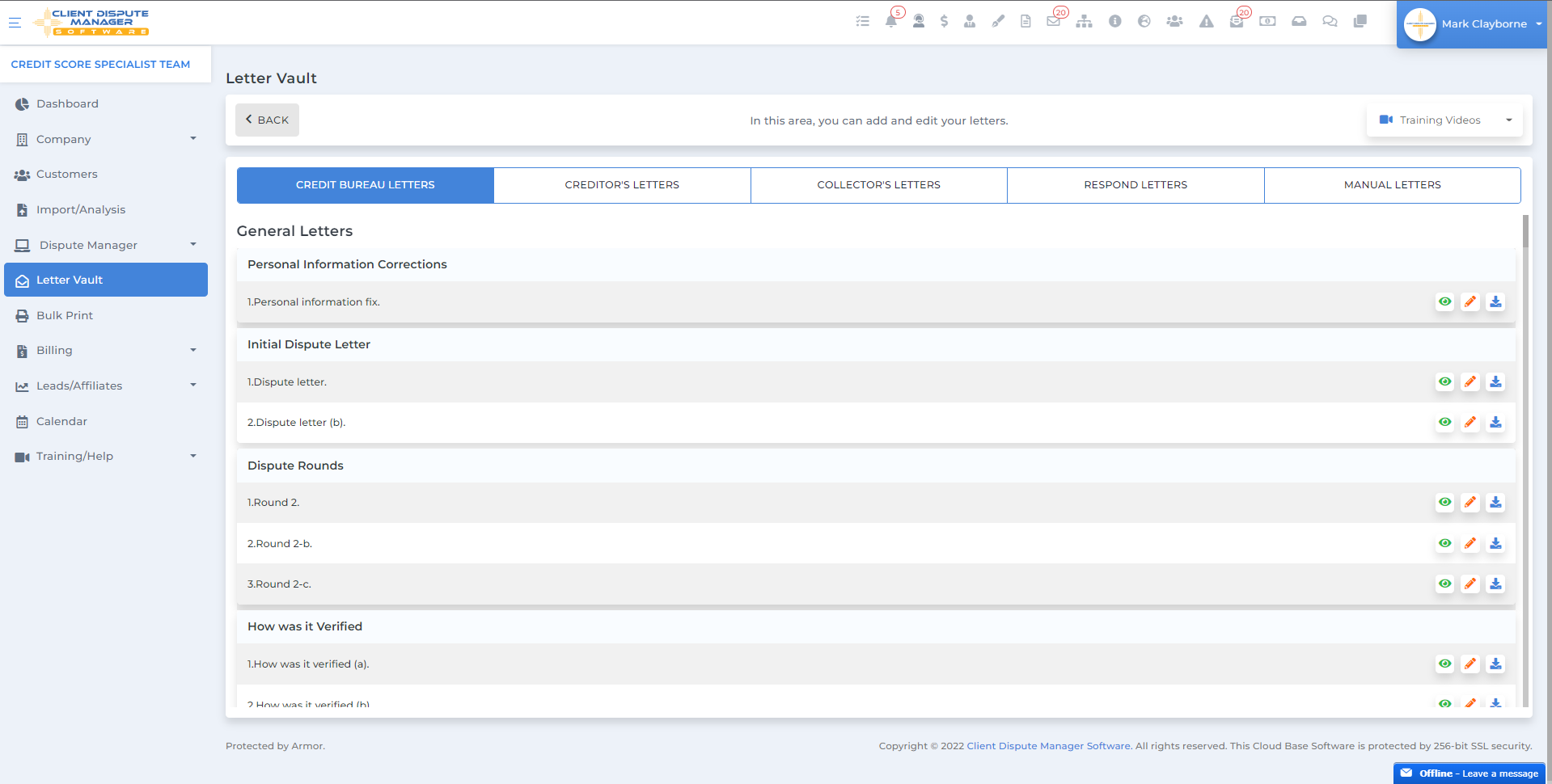

In this video, I’m going to show you how to use a debt validation letter and what is the purpose of a debt validation letter? But first I’m going to show you how to access a debt validation letter inside of the Client Dispute Manager software. What we’re going to do right here is going to go to Customers, and then what we’re going to do is we’re going to go ahead and click on Dispute.

From there we’re going to click on Collectors, and then we’re going to move right over to General Letters and we’re going to pick the debt validation account on the credit report, all right? Now, what we’re going to do is we’re going to talk about, and this is what we’re going to cover today in this video. What we’re going to do is we’re going to talk about when should you send out this debt validation letter and what is the purpose of sending this debt validation letter?

Now, in this video, I’m going to break down all eight steps right here of the debt validation letter to give you a great, deep, understanding on the purpose of a debt validation letter, and how powerful it can be and some of the things that you may think the collectors have to do and really they don’t have to do, all right?

We’re going to break this down step-by-step, line by line, so don’t go anywhere, grab your coffee. As you can see, I got mine and we’re going to go through this debt validation letter step by step. Make sure you get your pen, and this is very powerful because no one’s really, really broken down a debt validation letter like I’m going to do right now on this video.

All right, are you ready? Let’s get right into it. All right, so we’re going to look at the debt validation letter from the perspective of an actual letter, a letter that I’ve created and I’m going to send to the debt collection agency.

When Do You Send a Debt Validation Letter?

Well, you send this letter whenever you see a negative collection account on your credit report. Now, it could be on your credit report or it can be on one of your customer’s credit report if you are a credit score improvement specialist.

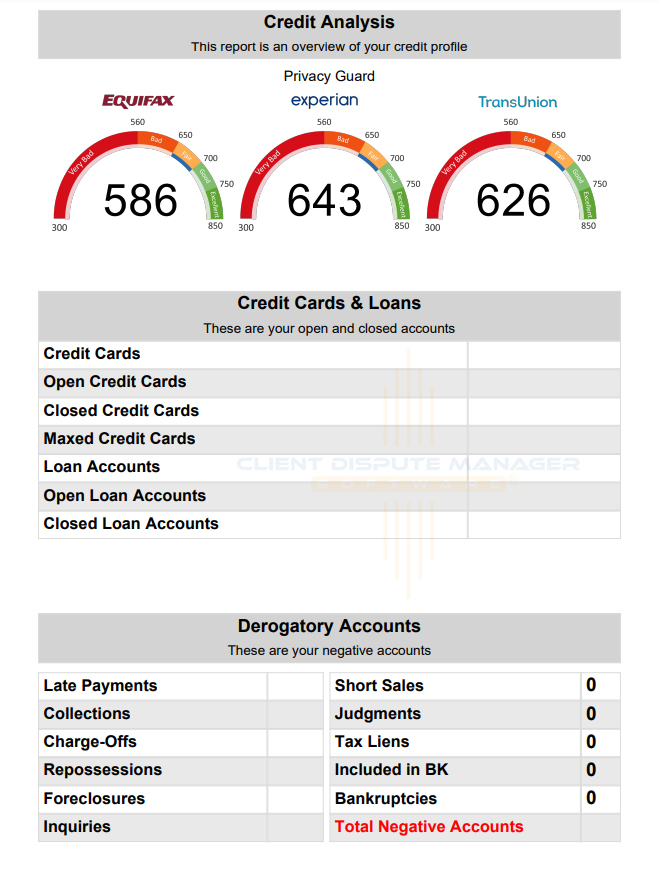

As soon as you see the collection, Because you know what, there’s been times when, a long time ago where a collection account just hit my credit report and I knew I didn’t have any debts out there. I was just like, where did this collection come from, because they dropped my credit score like almost 20 to 30 points.

The average consumer out there when a collection hits their credit report and it dropped their credit score, like 20 to 30 points, they don’t know what to do. They pretty much freak out, they don’t know what to do. They don’t know how to respond to the debt collectors, they just don’t know what to do. But now, with this video, I’m going to show you, based on my experience exactly what I did.

I sent this same debt collection letter right here that I’m showing you here in this video to the collection agency, and they dropped, they removed that collection account from my credit report right away, because let me tell you something, if you don’t know how to respond to these collection agencies, you’re going to be dead in the water because you don’t know what to do. Especially if you don’t know credit repair, you don’t know how to do credit restoration.

This video is going to be very important to you if you don’t know what to do or even as a refresher if you do know what to do. Look at me break this down. One of the first things you want to do is, as you can see right here, I have your full name, your current address, your social, your date of birth, and the date. Now, I pulled this letter right from my software, the Client Dispute Manager.

From the software. I want to give back and this is my way of giving back to the world and to our industry. Hey, they hit my credit report, they hurt me, they hurt my credit score, and I sent the same exact debt validation letter to the collection agency, and they removed that collection account from my credit report immediately, because I knew what to do. Now, I’m giving you the ammunition and the power so you can do the same thing.

All right, so here we go. Here’s this information right here. Here’s the thing, you don’t necessarily have to give the collection agency your social security number.

Account Number:

If you have an account number, if you have an account number, that’s good enough, all right? If you have an account number that is absolutely good enough. You don’t really need to include the social security number here, but you do need to include your full name, your current address, date of birth.

Date Of Birth:

Date of birth, you probably don’t need to include either. You can leave that out, because if the collection agency includes account number on the credit report, you can just put that account number, and that way they can pull it up from the account number or your full name.

All right, here we go. You want to include the date. Now, why do you want to include the date? Is because you want to keep track of this, and anytime you send it to a collection agency.

Send Letter Via Certified Mail:

Let me just back up. Anytime you send it to a collection agency, you always want to send in certified mail, with return receipt. Never ever send a letter to the collection agency through regular mail. You want to be able to track what you do with them because they’re not going to behave. I’m telling you right up, they’re not going to cooperate with you.

They’re not going to behave. Some of these agencies, collection agencies are worse than others. You always want to track your letter sending in case you have to sue them in court, or in case you have to take this case over to a lawyer. You always want to send it certified mail with return receipt.

Online return receipt signature is fine, all right? Now, if you’re a credit restoration company and you’re watching this video, the only time you should send this certified mail is if you think that the debt collection agency is going to be sued, because you can’t send it certified mail with every single one of your customers.

All right, you make sure you want to have a date, so here we go. Hello collector, I see that you have reported inaccurate information on my credit report, and that you keep verifying this account when it is clearly inaccurate. Right now I’m demanding validation of this account.

Now, you want to send this letter after you have sent a general debt validation letter. Now, what is a general debt audition letter? A general letter is kind of like just asking them for all the information pertaining to this particular account that they placed on your credit report. I call it the basic letter. It’s like a basic letter. You’re just requesting for information.

Also, you can send this letter after you have disputed with the Credit Bureau. Say you’ve disputed with the Credit Bureau first, and the collection agency verified it with the Credit Bureau and then the Credit Bureau updated your account. They updated your credit report and they said it was valid, you got it? Then you get your response back and the credit Bureau said it was valid, so then you can hit the collection agency with this letter.

It’s under two or two cases you can send the letter. You can send it on the first case after you sent the basic debt validation letter where you’re just asking them for general information. You’re not asking them to validate anything. You’re just saying, “Send me the information that you have on this account.”

That’s the first… You would send this second letter, the second debt validation letter after the first one, or when you send out a dispute letter to the credit bureaus and the credit bureaus verified it and they report it back to you that the debt collector verified it.

All right, creditor’s name, you also want to put the creditor’s name and the account number that you’re disputing because the collector bought the debt from the creditor and now they trying to collect it from you or the debt was assigned to the collection agency and now they’re trying to collect it from you. You want to make sure you give the debt collector the information that they need, that they can find this particular debt in our database.

All right, please provide me with the following information. Let’s scroll up some. Now, let me just let you know this right up front, the debt collector is not obligated, from my understanding, based on my experience, they’re not obligated to provide you with all of this information that I’m listing right here. They’re not obligated.

Now, the Fair Debt Collection Practices Act pretty much states what the debt collector is obligated to provide unless that law has been updated or unless there’s been case law that said that the debt collector must provide this or must provide that. You would have to find the case law that says that they have to provide certain things.

I just want you to be aware of that or you can talk with a lawyer that specialize in suing debt collectors to see if there’s any new case laws that mandates the debt collector to provide all of the information that you see right here, this list.

What To Ask?

The first thing we want to ask the debt collector is we want a full accounting of this account. When I say a four accounting, I want to know all of the financial things that are tied to this account. Everything, all interest, all penalties, all debt collection fees that are associated with this.

I want to know a full accounting, give me a full breakdown of everything, every piece of the dollar, every piece of change that you’re saying that I owe. I want to see the list.

Ask For A Copy Of The Proof Of Purchase

You can ask the collection agency, “Hey you’re trying to collect this debt from me, but I didn’t sign an agreement with you. Did you purchase this from a creditor, and if you did, show me proof.

Show me proof that you purchased this from a creditor because I didn’t sign anything with you. So, why are you trying to collect from me directly if I have this debt with Chase Bank? I don’t have this with you, you collector. So, show me proof.”

Ask For the Breakdown of the Charge

It’s like the accounting right here. Sometimes the debt collector, just place it on your credit report, and then if you ask for information pertaining to the debt, they’ll just give you a one-sheet thing.

I don’t want to see that, you’re trying to collect $5,000 from me, break it down, give me every single charge, everything. I want to see everything. Everything involved, provide me with the proof that justifies you placing this on my credit report. That’s exactly what you want to see.

Calculation of What You Owe

How you calculate what you claim I owe. See, the collectors will come out of nowhere and say, “Well you owe this. You owe me this money.” “Oh really? How do I owe you this? How did you come up with this?” What were your calculations? What did you base your calculations on this $5,000 amount?”

Before you go on paying, you never ever, just because a collection account appears on your credit report, you have to validate it first to make sure that the amount that they’re claiming that you owe is actually the amount that you owe, because they’re tacking on all of these additional fees.

Don’t just go run an out there paying a collection account, you have to make sure that, number one, they have a right to collect it. Number two, they have a legal right to collect it. Number three, that you truly owe the amount that they’re saying that you owe because they’re tacking on all of these other additional charges and fees.

Fields versus Wilber Law Firm and Arrow Financial Services

This is a very popular case right here. When the debt collector placed a collection account on my credit report, and they dropped my score almost 30 points, I was just so mad, I didn’t know what to do.

I researched this case right here and this deals directly with debt collectors and the type of information that they must provide to you or to a consumer when a consumer requests information.

You remember when I was talking to you about case studies and case law on how case law can force the collectors to do things if you find this case and you remind the collector of their responsibilities based on this case.

Now, I’m not a lawyer at all, so don’t take this as legal advice, please do not. This is not legal advice. I’m just telling you about a case that I researched and I found out about and I printed out the case and I attached it with my debt validation letter that I sent over to the collection agency, all right? We got a siren in the back. So, let’s just let that siren go by.

I’m doing a lot of talking, ladies and gentlemen. I’m doing a lot of talking because I’m going step by step in the back and we got the siren going off in the back. Can’t control environment as you can see. All right. Number six, let’s talk about the full chain of assignment from charge off to presence, from charge off to present.

Basically this could be a charge off, right? This can be a charge off that I’m talking about. We want… In the debt collection world, they call us a full chain of assignments. From where it started to now that the debt collection agency has the debt. You want to go from where it started to the collection agency has a debt.

You’re asking for this chain of all of the events that happened, right? Give me copies of all of this, give me copies of all of this. I’m going to tell you a secret. I’m going to tell you a secret on why we’re asking for this at the end of this video. I’m going to tell you a secret, so don’t go anywhere because if you go somewhere, you’re going to miss the secret of this whole video. So, hang tight, okay?

Proof that you own the debt with full clear title. Debt collector, you are trying to collect $5,000 from me, and yet you haven’t showed me any proof that you actually own this debt. Before you say, give me money, show me proof, because I’m going to fight you until you can provide me with all of the necessary information that I am the one that truly own this debt, okay?

You have to show me that you owe this debt… You own this debt, I’m sorry. You got to show me that you own this debt. You’re trying to get money from me, prove it to me. Prove to me that you own the debt and the title of this debt, all right? All right.

Proof That You Have The Original Contract

Basically, you want to reach out to the collector and say, “Okay, look, you put this on my credit report and now you’re asking me for $5,000, so show me the original contract that I owed the money to you.

Show me. Show me the original…. Somebody better show me, somebody better show me the original contract that I owe this money to you, all right? Show me the original contract.

Most debt collectors, they don’t have that. They don’t have the original contract, because why? Because they buy the debt in bulk. They buy the debt in bulk, okay? This is why you have to be educated on how to respond and protect your rights and protect your credit report, because guess what, the debt collector doesn’t care about you.

They don’t care about you, they don’t know you, you’re just a number. All they’re trying to do is collect money from you. So, you have to be educated, you have to be on top of the game so you can respond to these debt collectors the correct way, so you can stop them in their tracks, okay? All right.

This is another case right here that you could look into. This is another case that you can look into, another case law that pretty much spells out the duties and the responsibilities of the debt collector. All right, so let’s go to the last one here. Let’s move this up here. If you can’t provide me with sufficient proof as listed above, then you must delete the above account from all three credit reports, ASAP.

Let me remind you of the law. According to the Fair Debt Collection Practices Act 809(b) furnishing, verify and updating is considered collection activity. If you verify this inaccuracy from the credit bureaus without providing me with all of the items listed, you will be in violation of the law, which carries a fine of $1,000 per violation.

Now, let me stop right here, let me stop right here. Now, I wouldn’t say so much of you that you would be in violation of the law, which carries a fine, because remember like I said before, all of the debt collectors are not obligated to provide everything now.

If there’s a few things on here that the Fair Debt Collection Practices Act states that they must provide and they don’t provide, then this statement will apply. You guys understand what I mean? You have to adjust this. That’s why you got to understand the Fair Debt Collection Practices Act because if they are in violation, what I do recommend you to do is get a lawyer involved and let the lawyer file the case for you, okay?

My attorney who specializes in suing debt collectors will be on standby waiting for my instructions. Now, here’s the thing, what I recommend you to do, if you find that the debt collector is violating your rights, contact an attorney, go over this with an attorney and then you can possibly use this language because at that point it is very true, because you have retained an attorney, you have consulted with an attorney, and if the attorney says, “Look, send this letter out. If the debt collector don’t respond, then contact me.”

Then this could be true. The attorney who specializes in suing debt collectors is on standby waiting for your instructions, which is correct.

Now, I told you that I will give you a secret. I told you there was a secret. Here’s the thing, one of the reasons why you want to send out these debt validation letters is because you want to see what kind of information that the debt collector sends back. Now, most of the debt collectors are not going to send you half of the stuff that’s on the list. They’ll probably sending you a computerized printout that they print it right from their screen because they feel that you’re an uneducated consumer.

Now, when they send that print out, this is where you go through it and find all of the problems with that printout and you can counter them based on what they sent you. You can also send a rebuttal dispute letter to the credit bureaus based on what the collector sent you because they’re not providing you with the correct information.

Now, here’s my thing, if you got value from this video, if you got value, I’m giving you permission right now, I’m giving you permission to use this letter. It’s fine. This is the letter that I use. Modify it to fit your old situation, modify it to fit your own situation. I use this when a debt collector put it on my credit report. The collection account came off my credit report.

You can use it at your own discretion. You understand what I mean? I’m just telling you that it worked for me, I don’t know if it’s going to work for you. It may work for you, but again, you have to protect your own rights, because no one cares about who you are because you’re just a phone number and a social security number to the debt collection agency.

Listen, if you got value from this video, I got one more thing I want to share with you before we go, one more thing. If you got value from the video, go ahead and hit the subscribe button for me. Hit the subscribe button. Turn on the notification link, so every time I produce a new video, which I’m going to be doing two a week and we’re going to be focused on the dispute letter series, we’re going to talk about all different types of letters; creditor letters, debt collection letters, every type of letter, bankruptcy letters.

Turn on the notification so every single time I go upload a new video, you get notified, okay? Make sure you subscribe as well. Now, I want to tell you something, I want to let you in on a little secret here. Have you ever thought about earning an extra stream of income while working your 9:00 to 5:00 job?

Let’s think about it, because in order to become financial wealthy in life, we need to start adding extra streams of income because working the 9:00 to 5:00 is not going to do it. We’ll be broke for the rest of our lives, by letting someone else control what we do. You agree?

Especially, we won’t have the money that we need to get things, to do things, to travel. To travel the world, to enjoy vacations with our family. Now, the reason why I’m saying this is because I believe that if you did a lot of research on repairing your credit, dealing with debt collection agencies, fighting debt collectors, I believe that you have acquired what I call a skillset.

Now, a skill set that can help others improve their credit score, that can help others deal with debt collection agencies. So, why not earn an extra stream of income on the side while you’re working your 9:00 to 5:00 job doing what you already know? Because if you’re still watching this video, then that means you’re interested in what I have to say.

I’ve created a free video course on how to become a credit score improvement specialist and earn while you’re working your 9:00 to 5:00. Now, some of you who are watching this, you probably already a credit score improvement specialist, and that’s good, I’m so glad, but for the ones that’s not and that’s thinking about it and didn’t even know that they can become a credit score improvement specialist, I created a special free video for you, all right?

Now, all you have to do… The video is going to pop up very soon. Just click on that video and it’s going to give you… It’s not going to give you… The video’s about 10 minutes long. I want you to watch that video and it walks you step by step through how to become a credit score improvement specialist, and then I would love you to take the knowledge and the training that you know and earn an extra stream of income.

We cannot be broke forever, we have to put more streams of incomes in our life in order to do better in our life. If not, we will always struggle. Again, this is Mark Clayborne, the founder of the Client Dispute Manager software and I’m also a motivational marketing expert as well.

I am a credit score improvement specialist and I’m a motivational marketing expert and the founder of the Client Dispute Manager. I hope you enjoyed this video. Again, hit the subscribe button and make sure you turn on the notification feature. Take care.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.