Knowing how to start a credit repair business is beneficial as it is a rewarding venture that will not only help you do something for your community but also become your path to a better life. Most people are constantly looking out for ways to improve their credit score, as it affects their important financial decisions.

From accessing loans, insurance premiums to finding a good job, credit reports play a key role. Therefore, if you can help people fix their credit issues, they will also help you grow your business as well. It’s a win-win situation.

Do you want to dive into this venture? Look no further. In this guide, we take you through a comprehensive guide on how to start a credit repair business and be successful at it.

Let’s get started!

Table of Content:

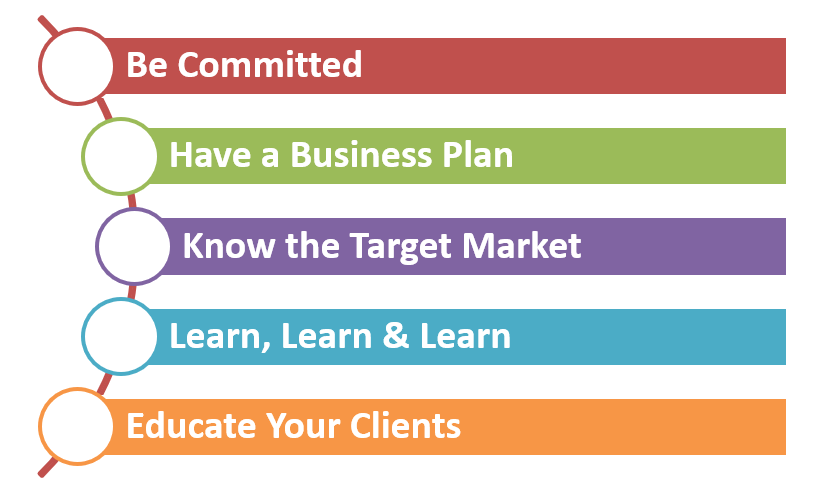

Step #1: Adjust to the 5 Habits of a Successful Credit Repair Business Owner

If you want to succeed in any business, it’s advisable to have a mentor or two. This might not be the people or businesses you know at an individual level, but they are industry leaders who came before you and can help you grow wings.

The credit repair business is mainly focused on helping people attain their financial goals. Therefore, relevant companies have mastered the art of holding each other’s hand to reach as many people as possible.

As such, it wasn’t difficult for us to gather some of the most useful habits veterans in this credit industry to have helped them get where they’re. We share them with you below:

Habit 1: Show commitment to your credit repair business

If you want to start and run a serious credit repair business that is successful, you must start by running it with the dedication it deserves.

Most startups want to run their business on the side, while at the top of their full-time jobs, which is absolutely okay. But you can also run it full-time. Either way, the secret is knowing how to balance everything.

Remember, people are getting to know you, and they will only take you as seriously as you take them. Therefore, if a credit repair business is something you’re serious about and see yourself running in the future, and even passing it down to your generation, consider putting more work into it.

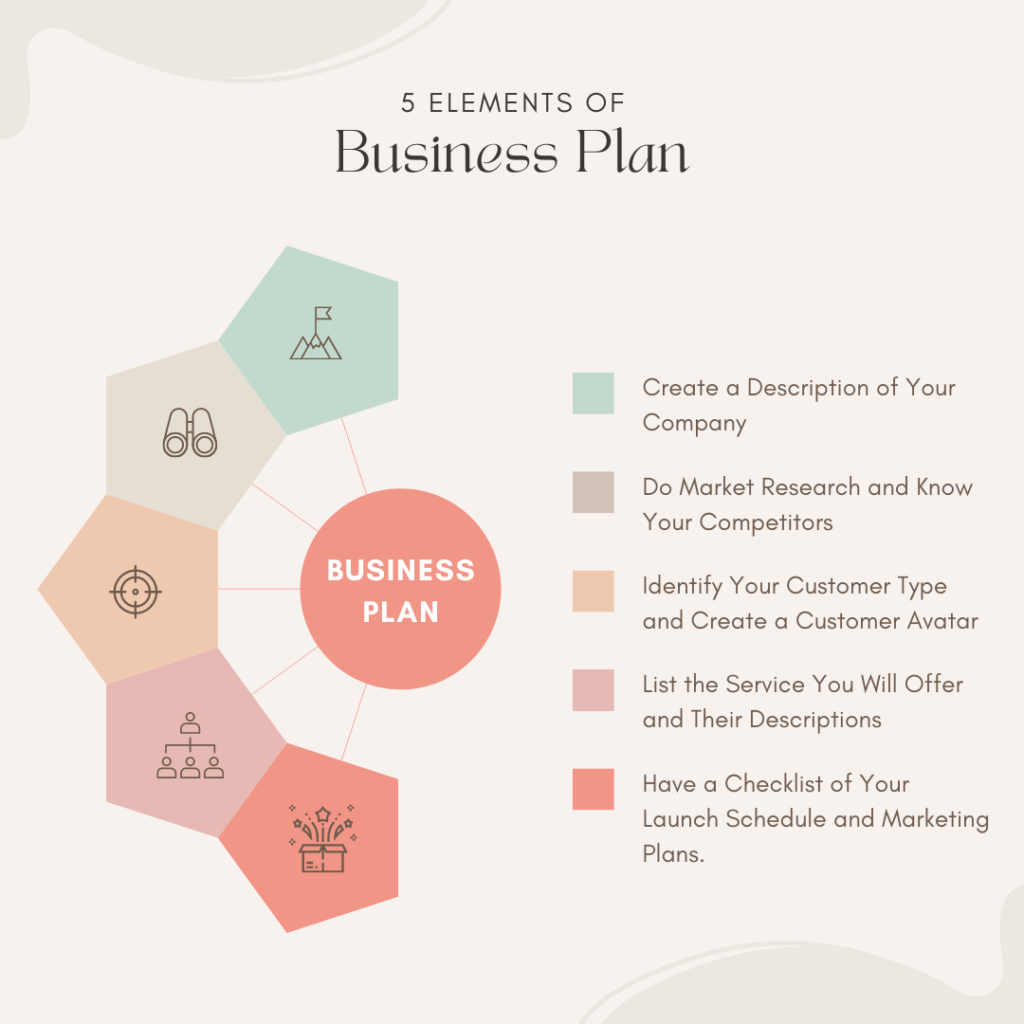

Habit 2: Have a Business Plan

A business plan is simply a map of what you want to achieve in your business within a specific time (could be weeks, months, and even years). It includes measurable impactful goals in your credit business’ operations, sales and marketing strategies, and financial goals. The goal is to help you measure growth.

The last thing you want is to dive straight into business with the “I will figure it out later” attitude. Well, not unless you want to hit your head hard on the wall and learn the hard way. A business plan should be your number one priority as it carries your vision and will guide your steps. So, ensure you have one before you even try reaching out to any prospect.

If you don’t know how to come up with one, reach out to a few already established business owners for some tips. It will also help you build the much-needed professional relationship to help you in your new journey. With the right people in your circle, you might not even have to pay for marketing.

Habit 3: Know the Target Market

Don’t just jump into business and say you will serve whoever comes in your way. Yes, people will come in search of your services later on, but as a new entry into the industry, you have to figure things out. Who are your potential clients? Which marketing and operational strategies will get them onboard? You need to ask yourself all these questions to fully understand how to start your own credit repair business.

For instance, you might consider targeting people in need of mortgages but can’t seem to access one due to their low credit score. Have a target credit score such as between 520 and 620 as those within this range can easily be helped.

Habit 4: Learn and Learn Some More

There is no end to learning. Each day, as you figure out your clients’ situations, you also get to learn new credit industry skills.

Therefore, ensure you’re always looking out for opportunities to learn. Register for credit repair business training (physical/online), attend nearby events and cultivate meaningful relationships with those who have gone ahead of you (we can’t stress this enough).

Most renowned credit repair professionals are always willing to help newcomers. Of course so long as you exhibit a teachable attitude.

Continuously working on yourself will give you the confidence you need to handle various client issues. And if your clients can see you as an expert in credit repair, they will bring you more business through word of mouth.

Habit 5: Educate your Clients

The best part of your credit repair business should be to see your clients making better financial decisions. When they can comfortably hold more financial power due to their improved credit score, that’s when you’ll truly know that you’ve made an impact.

Remember, you are the expert, and clients expect more from you. Feed them with useful information such as the credit functionality, various ways of speeding the credit repair process with their help, and much more.

You can check out the Credit Repair Mastery Super Bundle below so you can learn how you can educate your clients more when it comes to improving their credit and maintaining it later on.

Step #2: Set Up a Sustainable Business Process

Truth be told, nothing is underwhelming about starting a new business. Get ready to put in more effort in your credit repair business, because you have to spend time learning about the credit industry, and how it functions to offer perfect solutions to your clients.

Although you don’t have to handle everything at once, here are the essential things you need to do if you want to launch your business in less than 30 days, be it full-time or part-time:

Select Your Business Name

Make it simple, professional, and memorable. It should reflect your personality and the services you offer.

Name Selection Tips:

- Cannot be similar to other (already existed on the register of company name)

- Cannot imply a product or service that is not being offered

- Cannot be vulgar, offensive, or contrary to public policy

- Cannot have the name of a person who is not connected to the company except for historical persons

- Must have a corporate indicator

Have Your Own Website

Ensure the website is well set, with necessary portals and procedures. It’s advisable to use your business name as your domain. Therefore, ensure you search both the business name and domain online before settling for one.

Here are the reasons why you need to get your website up:

- Higher visibility where people can find you easier and become familiar with your services.

- Higher chances of acquiring clients as most people’s purchase decisions start online.

- It shows your professionalism and credibility.

- Your website has a lasting value as it will continue to work for you as long as you have it up.

Setting up a website may take a lot of work and some basic technical skills. If you want to save time, you can choose a pre-made site with a custom layout for the credit repair business industry.

For more information please visit: https://clientdisputemanagersoftware.com/credit-repair-websites/

Know the Legal & Tax Structure

Come up with a clear business legal and tax structure. The last thing you want is to be on the wrong side of the law.

Get a Credit Repair Software

Running a credit repair business without the client dispute manager software can be overwhelming. You need a space where everything is well arranged, making it easy to manage.

Why you need a Credit Repair Software:

- Saves you time with the different features and automation available.

- You can work anywhere as most credit repair software is cloud-based.

- You can easily manage and nurture your clients within the credit repair software.

- It will help you become more efficient and will even allow you to provide your services without actually being there.

- Some of the credit repair software includes training that will help you grow your business.

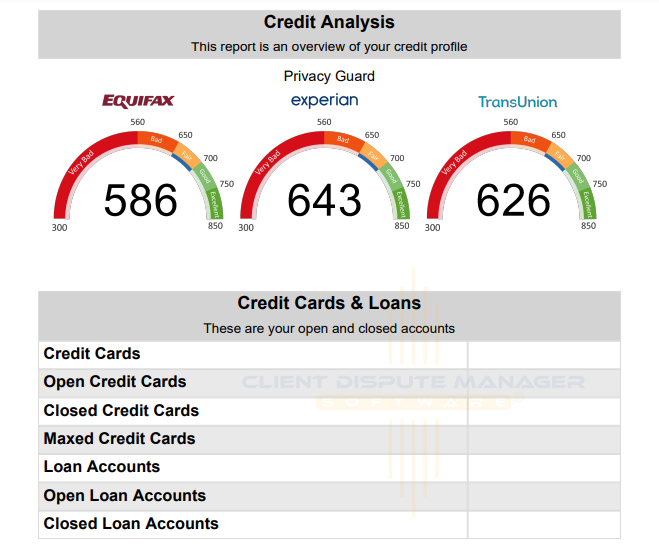

The client dispute manager software also makes it easy and faster for you to analyze your clients’ data, share information with clients, and your business affiliates (if any). It’s also the most reliable way to assess the growth of your business and the monthly changes in your clients’ credit reports.

Besides, you can access it from anywhere, anytime, meaning you really never stop managing everything, unless you want to take a break.

Create a Service Structure

The best service structure for your credit repair business is the one that strictly adheres to state laws, Federal laws -Credit Repair Organization ACT, and the Telemarketing Sales Rule. Ensure you check them out before deciding anything.

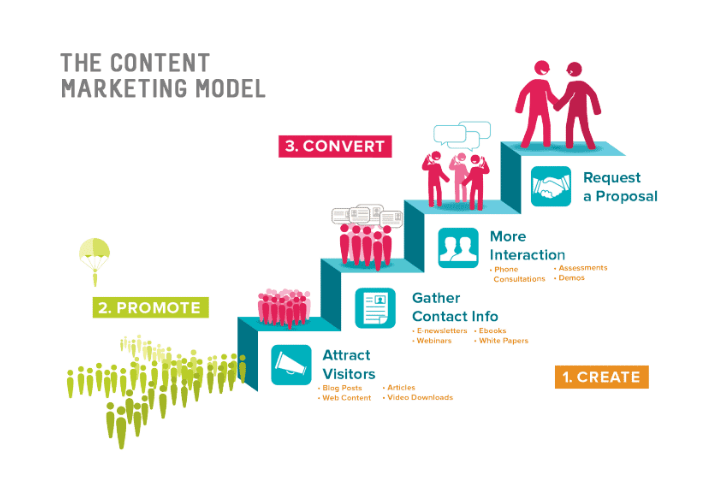

Step #3: Turning Leads Into Clients

The process of converting leads into clients isn’t as simple as ABC. You will need a sales to funnel to help you visualize the entire conversion process, which is a vital part of your credit repair business.

Sign-ups, especially for a new business, don’t just occur. You have to master the number game revolving around getting as many leads as possible and then working on getting the strongest of them all to sign up finally.

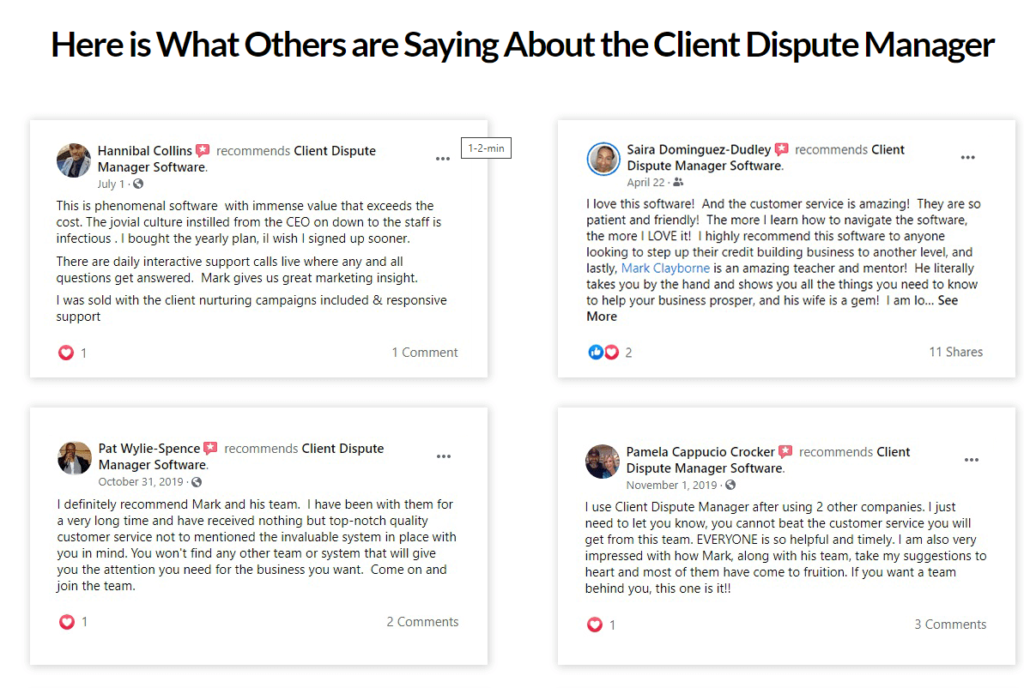

However, the process improves with time as you master your leads’ habits and know which methods work best for them. The follow-up automation, emails, and chats are the seeds you must plant to continue generating more results even in the future. It might seem like a lot of work, but your work will be more accessible with the Client Dispute Manager. It provides automation to make starting the business more accessible.

Always remember to add a lead form to your website. Also, collaborate with other industry stakeholders such as loan officers, mortgage brokers, etc., to recommend clients to you at a commission.

Step #4: Build Client Trust

This is one of the credit repair business strategies you can use to continuously build your brand. Remember, your clients are your number one testimonials.

Therefore, you need to serve them well to build positive reviews. To achieve this:

Identify The Problem

Yes, the reason why people need the services of a credit repair expert is because of their poor credit scores. However, you shouldn’t generalize client needs. Ensure you sit down with your client to clearly understand their problem.

Offer useful advice, educate them on issues they need to deal with in their financial journey, and provide all the necessary resources they need to get credit in places where they wouldn’t have accessed before.

Ask Relevant Questions

Don’t go forcefully digging into your clients’ personal lives. Instead, focus on getting as much useful information as possible concerning their financial decisions and their current credit score.

It’s important to make your clients feel that you genuinely care about their current credit score predicament, and want to help them solve the matter so that they can stretch their financial options. People can easily tell when you’re quickly rushing them into trusting you.

Building a close business relationship with your clients makes them comfortable around you, making it easy for you both to help each other solve the problem at hand.

Some of the questions you should never miss asking include: What happened, how it happened and how long it has been going on. This will give you the proper foundation you need to understand the problem and come up with the best solution.

Come up with a Marketing Strategy

If you master the art of asking the right questions, you will get relevant information from various clients to help you create a befitting marketing strategy for your credit repair business. Keep the strategy simple and targeted for best results.

Remember, when people share with you their problems, they expect you to offer a perfect solution. Therefore, ensure you are always expanding your knowledge on the various issues as they come.

You’re the expert. Behave like one at all times by focusing on your true purpose and passion. Target clients whose problem you know you can solve. It will be easy to attract, engage, nurture, offer service and deliver what you genuinely believe in.

You also don’t have to stick to the standard sales funnel, be flexible to use what works for your target clients, and your ideology.

Ensure you create impressive marketing materials such as flyers, brochures, and business cards. With the availability of various online shops, this shouldn’t be difficult. Some places to check out include moo.com and vistaprint.com. You can also promote local design businesses.

Also, use the client dispute manager software for easy engagement with your clients. It provides automation making it easy to manage your business. Plus, it helps your clients learn more about you, and the services you can offer. This could be through your landing page, a welcome note, or an introductory email, whichever they prefer.

Note: Avoid using promotional language in the introductory email as this can be a total turn-off. Instead, be more informative.

Follow-Up

Sometimes, you may not need to follow up to close a deal. But most of the time, you will have to follow up several times before anything tangible such as a free scheduled meeting happens. Don’t lose hope. Keep at it, and eventually, you will see fruits.

Also, it’s important to know when to give up on a lead. But if they still open your emails, it means the message is still interesting to them, even if they might not need your services at that particular time. In this case, continue with occasional follow-up to keep the client reminded of your credit repair business in case their friend or family member needs such services.

Transparency is Key

For your business to be successful, you must uphold transparency. Remember, you’re dealing with people, and your credibility mainly depends on their opinion of you.

You are the expert they need to solve their problem, not to add to it. Let them be involved in every single step you take. And then use your expertise to do what they can’t do with efficiency. Add integrity to it and ensure everything you do is lawful.

One advantage of using the client dispute manager software is that it helps you send current updates to your client. So you can always be on the same page. If they don’t like something, they can let you know on time so that you work out the best solution.

Working together as a team is the best way to build, and maintain trust.

Step #5: Have that Client Signup

A successful credit repair business marketing campaign should give you a prospect that you can easily turn into a client. If you find yourself struggling with zero lead conversion rates, it’s time you figure out what you’ve been doing wrong.Below is a checklist of what you ought to do every time you’re sourcing out for new clients:

Measure Prospect's Interest and Expectations

Equip your prospective client with all the important details they need to know about your services. Afterward, take time to listen to their story, and gather all the necessary details you need to solve their problem.

With the information on the prospect’s goal, you can now decide whether you can successfully handle their case or not.

Get a Copy and Check Their Credit Report

If you decide to go forward with the client, the next move is to get their credit report. Ask the client to send you their credit report login credentials, to help you access the credit report, and then send them the results.

Give them a Free Credit Consultation

Now that you have already examined the credit report, you will know which potential client is a good match for your services and which one is not.

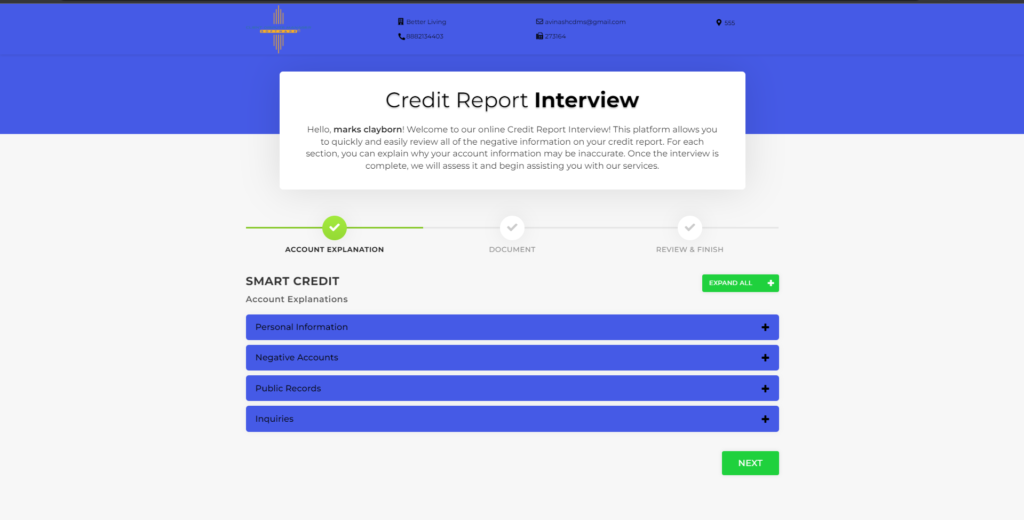

The best way to find a perfect match is ticking through a checklist to see if a client meets the requirements. For this, request the client to go through a smart interviewer where they can do an automated online interview without talking to you. Then use the information they provide to go through your checklist.

For instance, ensure you understand the hard facts such as the number of small irrelevant accounts, possible incorrect personal details on the credit report, etc. You will use this piece to educate the client.

It’s also important to note the client’s goals and timeframe in case you missed it earlier. If they want quick results, like in a week or two, it’s better to let the client go, because you will end up doing things quickly, and the results will not be pleasant. The result?

A dissatisfied client, who might influence the decisions of other potential clients. It’s always advisable to have a standard procedural time frame in place and stick to it.

Determine their Eligibility

After going through all the above conversations, examining the credit report, and even having the first meeting, you now have sufficient information to determine whether the client fits your services or not.

Yes, you might have been optimistic from the beginning, and even betting on the positive outcome of the first free consultation, but it’s better to let go if things aren’t looking up.

The best indicator of a failed case is unrealistic expectations and timeframe. But, whichever the outcome, always ensure to inform the client of the reasons behind your decision. It will help come up with your credit repair business client selection criteria. Also, you won’t have problems in case of a government audit.

If you can comfortably handle the credit problem, let the client know as soon as possible, and then request all-important personal details. They will come in handy when creating their portal in the client dispute manager software.

Perform Audit

This comes after you decide to work with the client. Schedule a virtual or physical meeting and go through all the fine details in the credit report. With the client dispute manager software, this should be easy and fast, as the system helps you conduct an automated audit.

So, all you have to do is take the client through all the audit details and ask for their opinion. You should both work together to come up with a list of what you will dispute and in which order.

This will build trust and curb expectations. Once the client signs the contract you can schedule a meeting to discuss what will be disputed.

Have an Action Plan

Now that you’re on the same page with the client concerning their credit problem, it’s time to prepare an action plan. Take some time to research and find out what other credit repair experts did when faced with similar scenarios.

Your action plan should indicate what you plan to do and the possible outcome. If you can describe the process, the better. Suggest relevant supplementary services you offer to help your client get the best out of their financial issue.

Share the action plan with the client on time, to help them prepare.

In Conclusion

Setting up your own credit repair business isn’t as hard as many people think. Like any other business, you need to decide that this is what you want to do, then take all the necessary steps as suggested in this guide on your way to success.

First, take time to learn some useful tips from the veterans in the industry, then come up with a sustainable business process., before going after your prospective clients. We hope you finally get the courage to step out of your comfort zone in 2022 and make your dream of running a credit repair business come true.

All the best!