This content is a transcript of the video above.

In this video, I’m going to show you how to write the perfect dispute letter when you are trying to dispute inaccurate information for your credit report to the credit bureaus. Now, I want you to watch this video all the way through, because I have a special gift for you at the end of this video.

So make sure you watch the whole thing all the way through, because I have a special gift for you at the end of the video.

Now, what is the perfect dispute letter? And when you ask yourself that what is the perfect dispute letter, the perfect dispute letter is exactly what it says. Everything you need inside of a letter that it’s going to work for the credit bureaus, every little element you need inside of a letter that the credit bureaus need to properly investigate your dispute when you send it out to the credit bureaus.

All right. So let’s go ahead and look at the perfect dispute letter step-by-step.

All right, so one of the first things we want to do is we want to take a look at this screen right here. These are the key points of a perfect dispute letter. And I’m going to go over this with you.

You want to have your full name. You want to have your full address. You want to have your date of birth, your social security number, the date that you’re sending this letter, the creditor’s name, the account number you’re disputing.

Your dispute, what is it that you’re disputing, the purpose of your disputes, the reason why you’re disputing, what you want the credit bureau to do. And you also want to sign the dispute if you are disputing on your behalf.

Now, this is very important. If you are sending this dispute out for your credit report, you want to sign it. Okay? If you’re sending the dispute out on behalf of your customer, then you don’t need to sign it. Okay?

We’re talking about you. This video is for you in particular. So let’s go and get into some of the nitty-gritty when it comes to a dispute letter.

All right, so the first thing we want to talk about is your full name. So make sure you have your full name in the letter. Okay? Your full name and your middle name. You have your first name, your middle name and your last name.

The next thing is you want to make sure you have your full address because you don’t want to give the credit bureaus any reason why they should deny your dispute. So you don’t want to give them any reason on why they should stall your dispute, on why they should deny your dispute.

So make sure you have your full name and make sure you have your full up-to-date address in the letter itself. Okay?

Dispute Letter on Credit Report

So the next thing you want is the date of birth. So you want to make sure you have your date of birth in the letter. You also want to make sure you have your full social security number. All right, remember the credit bureaus have to verify that it is you that’s sending this letter.

So you want to make sure you give the credit bureau what they need in order to investigate, because if you don’t give them what they need, I mean, they’re going to delay your letter pretty much. Okay?

So this is why I call it the perfect dispute letter. So you need to give the credit bureau, all the elements that they need to investigate your credit report.

So guys, listen to what I’m trying to say. The credit bureaus are a big machine and you are just one social security number to them. So if you give them everything that they need, they’re going to investigate your dispute.

But if you leave out some of these critical things I’m talking about here in the perfect dispute letter, the credit bureau dispute letter, then you are going to face issues with the credit bureau. All right?

Okay. So let’s take a look at some of the other stuff here. Next, the date. Well, why do we need the date? Why is that so important? So you need the date on every single letter that you send out to the credit bureau so you can track the date that you’re sending the letter.

Remember, the credit bureaus have 30 days to investigate the letter, but you have to allow five days for the mail. So five days for the mail to go out and five days for the mail to come back to you.

So even though the credit bureau has 30 days to investigate your dispute, that starts from the day that they receive it. Not from the day that you mail it. It’s from the day that they receive it. So you got to allow some time for the mail to get there, and you got to allow some time for the mail to come back. All right? So that’s why we say, make sure you put the date on your letter.

Next, the creditor’s name. Don’t forget the creditor’s name. Some people leave out the creditor’s name. What is the purpose of that? When you look at the credit report, make sure you grab the name of the creditor so the credit bureau knows who you are disputing. You also want the account number. You also want to put the account number inside of the letter as well.

So you want the creditor’s name and you want to make sure you have the account number also, inside of the letter. This stuff is critical because if you missed a creditor’s name and you missed the account number, the credit bureaus are not going to investigate.

They’re going to send you a letter back and state that they’re missing information and that’s going to cause a longer delay. So you want to make sure you have the creditor’s name and you also want to make sure you have the account number inside of the letter as well. Okay?

The next thing you want to have in your letter is your dispute. Okay? So what is your dispute? What are you disputing? The main thing is what are you disputing? Okay? So you have to tell the credit bureau what you are disputing.

Be straightforward on what you are disputing. Tell them exactly what you are disputing. And not only do you want to tell them what you are disputing, you also want to give a reason why you are disputing this. You can’t just say, “I’m disputing this.” You have to give them a reason for the dispute.

You guys understand? Here is the reason why I am disputing this. Not just, “It’s not mine.” Okay? But more of like, “It’s not mine because I’ve never had this account before. I’ve never seen this account before.”

So you have to give a reason why you’re disputing it. And it has to be factual. It can’t be something that’s made up. Okay? We’re talking about your own credit report now. All right?

So it can’t be made up. It has to be a factual dispute, meaning it’s something really, really wrong with your credit report. And you are trying to get this inaccurate item off of your credit report. So you have to give the credit bureaus a reason why you feel this account is inaccurate and why they should investigate it. All right?

All right. So let’s keep going. All right. So you also want to tell the credit bureau what to do. So what is it that you want the credit bureau to do? So you gave them the dispute reason, you gave them the dispute itself. Now, what do you want the credit bureau to do? Do you want them to investigate it? Do you want them to correct this matter? Do you want them to remove it off of your credit report?

So you have to tell them exactly what you want them to do. “Hey, credit bureau. I just want you to investigate this. Hey, credit bureau. I want you to correct this matter. The balance is wrong. It should be zero. This account is inaccurate. The open data is wrong. I didn’t open this account at this time. I opened it at that time.” That’s what we call correction. Right?

But if it’s truly not yours and you know it’s not yours, then you want to tell the credit bureau that, and then you probably want to think about identity theft if it’s truly identity theft. All right? It’s very, very powerful.

Next, signing the document. A lot of people ask, “Should I sign the letter?” Yes. It’s you. You are the one that’s disputing it, right? So you’re sending this to the credit bureaus yourself. Is it mandatory that you sign the document?

No, it’s not mandatory that you sign the document, but a lot of lawyers that I’ve talked to, they said, it’s a good idea that you do sign the document, that you do sign this letter. Okay? All right?

From a legal perspective, a lot of lawyers that I’ve talked to, they said that by signing the letter, if it’s you, then it gives the letter a little bit more weight with the credit bureaus, that the credit bureaus feel that this letter is coming from you.

But is it required that you sign the letter? No. It’s not required that you sign the letter. I mean, when I was working on my own credit report, I’d never signed the letter. Right? And the credit bureaus still investigating my dispute.

So it’s not mandatory that you sign the letter. But like I said, some of my lawyer friends said that if you can sign the letter and you’re working on your own credit report, you should sign the letter to give it some authenticity to the credit bureau, especially if you have to sue them one day. All right?

So like I said before, let’s go and recap really quick. What is the perfect dispute letter? Let’s go ahead and recap that right now. This is what it looks like. Some of the key points of the perfect dispute letter: your full name, your full address, your date of birth, your social security number, the date that you send the letter out, the creditor’s name, the account number, your dispute and your dispute reason for your dispute, what you want the credit bureau to do, and also signing the letter.

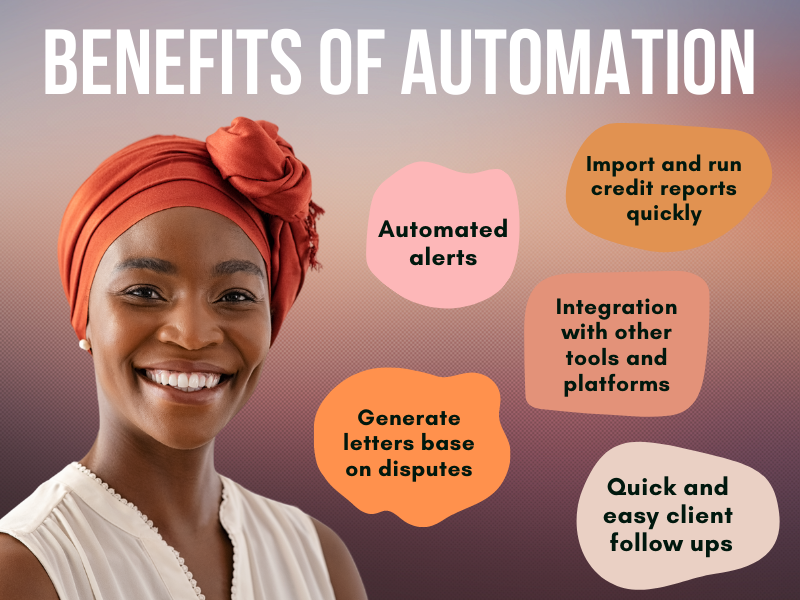

And like I said before, just for watching this entire video all the way through, I have some special gifts for you right now. Let me show you what I’m going to give you just for watching the video all the way through. All right, so the first thing I’m going to give you is a dispute letter checklist. All right?

So if you ever want a checklist on what to check for when you’re sending out your first dispute round, I’m going to give you for free a dispute letter checklists. Right, that’s correct. Absolutely free, a dispute letter checklist. And lastly, I’m going to give you three powerful, free dispute letters, Get The Job Done. All right?

So I’m going to give free 3 powerful dispute letters to get the job done so you can go out there and work on your credit report to help you improve your credit report, to help you remove inaccurate information on your credit report.

So all you have to do right now, anywhere in this post, just click the link anywhere you see a link to get your free gifts. Again, I want to give you a checklist on, when you’re sending your first dispute letter out, what to check for when you’re trying to build this perfect dispute letter.

I want to give you this checklist. I also want to give you three powerful dispute letters that you can use to get the job done, and also help you remove inaccurate information off of your credit report.

All you have to do is click the link anywhere inside of this post that says free gifts. Go and get your free gifts. All right, until next time don’t forget to subscribe, share, and like this video. Take care.