Are you struggling with your credit score? Do you feel overwhelmed by the thought of tackling your credit report on your own? Fear not, because there’s a powerful tool that can help you take control of your credit: the 609 dispute letter. In this article, we’ll dive into the world of 609 dispute letters and show you how they can be your secret weapon in the battle for better credit.

Start Today and Explore the Features Firsthand!

What is a 609 Dispute Letter

A 609 dispute letter is a formal request sent to credit bureaus, challenging inaccurate or incomplete information on your credit report. The name “609” comes from Section 609 credit repair of the Fair Credit Reporting Act (FCRA), which gives consumers the right to dispute any information they believe is incorrect on their credit report.

By sending a well-crafted 609 dispute letter, you can ask the credit bureaus to remove negative items from your credit report, ultimately improving your credit score. This can open doors to better financial opportunities, such as lower interest rates on loans and credit cards.

Why Use a 609 Dispute Letter?

There are several reasons why you should consider using a 609 letter template to dispute inaccuracies on your credit report:

- Save Time and Effort: Writing a 609 letter dispute from scratch can be time-consuming and overwhelming. Using a 609 letter template streamlines the process and ensures you include all necessary information.

- Protect Your Legal Rights: The FCRA grants you the right to challenge incorrect information on your credit report. By using a 609 dispute letter, you’re exercising your legal rights and holding credit bureaus accountable.

- Improve Your Credit Score: Removing negative items from your credit report can significantly boost your credit score, making it easier to secure loans, mortgages, and other financial products.

How to Write a 609 Dispute Letter

Now that you understand the power of a 609 credit dispute letter, let’s walk through the steps to create one:

Review Your Credit Report

Request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) and carefully review it for errors or inaccuracies. You’re entitled to one free report from each bureau every 12 months, which you can obtain through Annual Credit Report

As you review your credit report, keep an eye out for the following types of inaccuracies:

- Accounts that don’t belong to you

- Incorrect account status (e.g., showing as delinquent when you’ve made all payments on time)

- Inaccurate personal information, such as a misspelled name or wrong address

- Duplicate entries for the same account

- Outdated information that should have been removed

Start Today and Explore the Features Firsthand!

Identify Disputed Items

Make a list of the items you believe are incorrect, such as late payments, collections, or bankruptcies that don’t belong to you. Be specific about each item, noting the account number, creditor name, and the reason you believe the information is inaccurate.

It’s essential to be thorough in your review and dispute any and all inaccuracies, as even seemingly minor errors can have a significant impact on your credit score.

Gather Supporting Documentation

Collect any evidence that supports your 609 letter dispute, such as receipts, bank statements, or correspondence with creditors. This documentation will help strengthen your case and provide proof to the credit bureaus that the information on your report is indeed inaccurate.

For example, if you’re disputing a late payment, you might include a copy of your bank statement showing that you made the payment on time. Or, if you’re challenging a collection account that doesn’t belong to you, you could provide a copy of your ID to prove that the account was opened by someone else using your name.

Use a 609 Dispute Letter Template

Find a reputable 609 letter template and customize it with your personal information and the specific items you’re disputing. A well-crafted 609 credit dispute letter template should include the following elements:

- Your full name, address, and contact information

- The name and address of the credit bureau you’re contacting

- A statement identifying the specific items you’re disputing

- An explanation of why you believe the information is inaccurate

- A request for the credit bureau to remove or correct the disputed items

- A reference to your rights under the FCRA

- A request for a copy of your updated credit report once the dispute is resolved

Be sure to keep your language professional and straightforward, avoiding emotional or confrontational statements. Stick to the facts and let your evidence speak for itself.

Send Your Letter via Certified Mail

Mail your 609 dispute letter to each credit bureau via certified mail with return receipt requested. This provides proof that your letter was sent and received, which can be valuable if you need to escalate your dispute or take legal action in the future.

Be sure to include copies of your supporting documentation with each 609 letter dispute, but keep the originals for your records. It’s also a good idea to send a copy of your 609 dispute letter and evidence to the creditor that provided the inaccurate information to the credit bureau.

Follow Up

The credit bureaus have 30 days to investigate your dispute and provide a response. If they fail to do so or if you disagree with their findings, you can escalate the dispute or seek legal assistance.

If the credit bureau removes the disputed items from your report, they must notify the other two bureaus so that the information is removed from all three reports. They must also send you a free copy of your updated credit report, which you should review carefully to ensure that all inaccurate information has been corrected.

If the credit bureau determines that the disputed information is accurate, they’ll notify you in writing and provide an explanation of their findings. At this point, you can either accept their decision or escalate your dispute by filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state attorney general’s office.

The Benefits of Professional Credit Repair Services

While it’s possible to write a section 609 credit repair letter on your own, many people find the process confusing and time-consuming. That’s where professional credit repair services come in. These companies specialize in identifying and disputing inaccurate information on your credit report, taking the burden off your shoulders.

By working with a reputable credit repair service, you can benefit from their expertise, resources, and proven strategies for improving your credit score. They can also help you develop a long-term plan for maintaining good credit and reaching your financial goals.

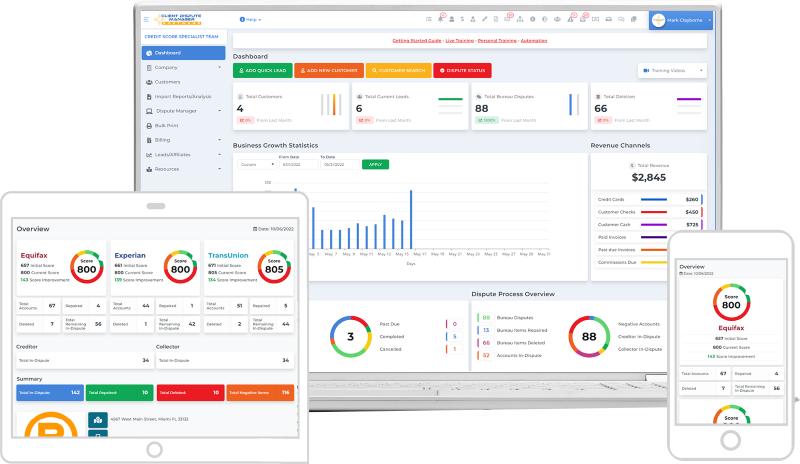

Streamlining the Dispute Process with Client Dispute Manager Software

As a credit repair professional, you know that managing client disputes can be a time-consuming and complex process. From tracking multiple disputes across different credit bureaus to ensuring timely follow-up and communication with clients, there’s a lot to keep track of. That’s where Client Dispute Manager Software comes in.

Client Dispute Manager Software is designed specifically for credit repair businesses, providing a centralized platform for managing and automating the dispute process. With this powerful tool, you can:

- Easily import client credit reports and identify negative items for 609 letter dispute

- Generate customized 609 credit dispute letters with just a few clicks

- Track the status of each 609 letter dispute and receive automated alerts for key milestones

- Communicate with clients through a secure portal, keeping them informed and engaged throughout the section 609 credit repair process

- Access detailed reporting and analytics to measure the success of your 609 letter dispute efforts and identify areas for improvement

By leveraging Client Dispute Manager Software, credit repair professionals can save time, reduce errors, and ultimately achieve better results for their clients. The automated workflows and centralized data management ensure that nothing falls through the cracks, while the customizable 609 letter templates and communication tools help maintain a professional and consistent brand experience.

Start Today and Explore the Features Firsthand!

The Importance of Financial Literacy

One of the most crucial aspects of credit repair is understanding the factors that influence your credit score and how to maintain good credit habits. This is where financial literacy comes into play. By educating yourself on topics such as budgeting, saving, and responsible credit use, you can make informed decisions that positively impact your financial well-being.

Financial literacy also helps you recognize and avoid common credit pitfalls, such as overspending, missing payments, or falling victim to predatory lending practices. By staying informed and proactive, you can prevent many credit issues from arising in the first place.

The Role of Credit in Entrepreneurship

For entrepreneurs, having a strong credit profile is essential for accessing the funding and resources needed to start and grow a business. Many lenders and investors rely on credit scores and reports to assess the creditworthiness and financial stability of potential borrowers.

By using 609 dispute letters and working with credit repair professionals, entrepreneurs can improve their credit standing and increase their chances of securing favorable loan terms, lines of credit, and investment opportunities. This, in turn, can help them achieve their business goals and create a more prosperous future.

Proven Ways to Improve Credit Score in 2024

Improving your credit score is a crucial step towards better financial health and opportunities. Whether you’re looking to qualify for a mortgage, secure a better interest rate on a loan, or simply strengthen your financial standing, a good credit score is essential. This guide outlines effective strategies to improve credit score quickly and sustainably.

We’ll explore both rapid techniques and long-term methods for improving credit scores, providing you with a comprehensive approach to credit management.

Rapid Techniques to Improve Credit Score

When you need to boost your credit score quickly, certain strategies can yield faster results than others. These methods focus on addressing the most immediate factors affecting your credit score.

While they may not solve all credit issues, they can provide a significant boost in a relatively short time frame. Let’s explore these rapid techniques for improving your credit score.

Slash Credit Card Balances: A Quick Way to Improve Credit Score

One of the fastest ways to improve credit score is by reducing your credit utilization ratio. This ratio, which compares your credit card balances to your credit limits, significantly impacts your score. Aim to keep your utilization below 30%, but for optimal results, target 10% or lower.

Prioritize paying down the cards with the highest utilization first. Consider making multiple payments throughout the month to keep balances low. Using windfalls like tax refunds or bonuses to make substantial payments can lead to a noticeable improvement in your credit score within a single billing cycle.

Rectify Credit Report Errors for Rapid Score Improvement

Improving credit scores often starts with fixing mistakes on your credit report. Errors can unfairly drag down your score, so addressing them is one of the most effective ways to improve credit score.

Request free credit reports from all three major bureaus: Equifax, Experian, and TransUnion. Carefully review each report for inaccuracies such as incorrect balances, unrecognized accounts, or misreported late payments.

File disputes for any errors you find, providing supporting documentation to strengthen your case.

Follow up on your disputes and check your credit report again after 30 days. Correcting significant errors can lead to a swift increase in your credit score.

Become an Authorized User: A Swift Strategy for Credit Score Boost

For those looking for ways to improve credit score quickly, especially with a limited credit history, becoming an authorized user on someone else’s credit card account can give your score a swift lift. Ask a family member or close friend with excellent credit to add you as an authorized user on their account. Ensure the account has a long history of on-time payments and low credit utilization.

The account’s positive payment history and utilization will be reported on your credit report, potentially boosting your score. You don’t need to use the card to benefit; just being associated with the account can help. However, be aware that if the primary account holder misses payments or maxes out the card, it could negatively impact your score.

Increase Credit Limits to Quickly Improve Credit Score

A fast way to improve credit score is by requesting higher credit limits on your existing accounts. This can instantly lower your credit utilization ratio without requiring you to pay off debt. Contact your credit card issuers and request a credit limit increase. Be prepared to provide updated income information, and if possible, avoid hard credit inquiries, which can temporarily lower your score.

Once approved, resist the temptation to spend more. The goal is to lower your utilization, not increase your debt. Consider timing your request after a salary increase or improved credit score for better chances of approval.

Eliminate Small Balances for Fast Credit Score Gains

Paying off minor debts across multiple cards is one of the fastest ways to improve credit score. Credit scoring models consider the number of accounts with balances, so eliminating small balances can reduce your number of accounts with balances, which can boost your score. Focus on paying off cards with balances under $100 first.

Once paid off, consider keeping these cards open but unused to maintain your available credit. This strategy can lead to a quick improvement in your score, often within a single billing cycle.

Negotiate Removal of Late Payments to Boost Your Score

For a significant boost in improving credit score, try negotiating with creditors to remove past late payments. This goodwill adjustment can have a powerful impact on your credit score. Identify which creditors have reported late payments on your credit report and prepare a goodwill letter explaining why the payment was late and requesting removal.

Highlight your otherwise good payment history and loyalty as a customer. If successful, ensure the creditor reports the removal to all three credit bureaus. Follow up and check your credit report to confirm the late payment has been removed.

How Fast Can You Improve Credit Score?

One of the most common questions about credit improvement is, “How long will it take?” The answer isn’t straightforward, as it depends on various factors including your current credit situation, the strategies you employ, and how consistently you apply them. However, understanding the general timeline for credit improvement can help you set realistic expectations and stay motivated throughout the process.

- Short-term (1-2 months): Correcting report errors and reducing balances are among the fastest ways to improve credit score. You might see a noticeable improvement within a single billing cycle if you significantly reduce your credit utilization. Removing inaccurate negative information from your credit report can also lead to a quick boost.

- Medium-term (3-6 months): Establishing a pattern of on-time payments can show noticeable improvements in credit scores. Becoming an authorized user on a well-managed account can start showing benefits in this timeframe. Consistently low credit utilization will begin to have a more substantial positive impact.

- Long-term (6+ months): Consistent positive habits lead to steady increases, solidifying your improved credit score. The full benefits of a diverse credit mix and lengthening credit history become apparent. Negative items like late payments have less impact as they age, gradually improving your score.

Remember, while there are fast ways to improve credit score, maintaining a high score requires ongoing financial responsibility. Combine quick-win strategies with long-term habits for the best results in improving credit scores.

By following these proven methods to improve credit score, you’ll be on your way to better financial health and increased creditworthiness. Stay consistent, patient, and proactive in your credit management, and you’ll see your efforts reflected in a steadily improving credit score.

Frequently Asked Questions

How Long Does The Credit Dispute Process Take?

The credit bureaus have 30 days to investigate and respond to your 609 letter dispute. However, the entire process may take several months, depending on the complexity of your case and the number of items you’re disputing.

Can I Dispute Accurate Negative Items On My Credit Report?

No, you can only dispute inaccurate or incomplete information. Accurate negative items, such as late payments or collections, will remain on your credit report for a set period (usually seven years).

How Often Can I Send A 609 Dispute Letter?

You can send a 609 dispute letter whenever you identify inaccurate information on your credit report. However, it’s best to wait for the credit bureaus to respond to your initial 609 letter dispute before sending another one.

Will Disputing Items On My Credit Report Hurt My Credit Score?

No, disputing inaccurate items on your credit report will not hurt your credit score. In fact, if the disputed items are removed, your score may improve.

Can I Use A 609 Dispute Letter For Identity Theft?

Yes, if you believe you’re a victim of identity theft and fraudulent accounts have been opened in your name, you can use a 609 dispute letter to dispute these items and request their removal from your credit report.

Take Control of Your Credit Today

Don’t let inaccurate information on your credit report hold you back from achieving your financial dreams. By using a 609 dispute letter and seeking the help of professional credit repair services, you can take control of your credit and pave the way for a brighter financial future.

Remember, knowledge is power when it comes to credit repair. By educating yourself on the process and your rights as a consumer, you can confidently navigate the world of credit and make informed decisions that benefit your financial well-being.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Prepare Your Dispute Letters for the Collectors in 15 Seconds

- Ready to Boost Your Credit Score? Learn How to Remove Inaccurate Negative Items Now