Navigating the complexities of credit reports is crucial, especially when it comes to dispute inaccurate items. These errors can significantly impact your financial health, from loan approvals to interest rates. As a Credit Repair specialist, I understand the importance of correcting these inaccuracies. This guide will provide you with the essential steps to effectively dispute inaccurate items on your credit report, ensuring your financial profile is as accurate and as strong as it deserves to be.

Understanding Your Credit Report

A credit report is like a detailed story of how you handle your money. It shows if you pay your bills on time, how much debt you have, and how you manage your credit accounts, like credit cards and loans. This report is super important because banks, landlords, and even some jobs look at it to decide if they can trust you with money or responsibilities.

Inside Your Credit Report

When you look at your credit report, you’ll see a few things:

- Personal Details: Your name, address, and other basic info.

- Credit History: This part lists your loans, credit cards, and how you’ve paid them.

- Debt Amounts: It shows how much you owe.

- New Credit: If you’ve recently applied for a loan or card, it’s here.

- Legal Stuff: Any legal actions related to your money, like bankruptcies.

Why Mistakes Happen on Credit Reports?

Sometimes, credit reports have mistakes. These can happen for simple reasons like typos or mix-ups with someone else’s info. Or, maybe a company made an error in reporting your payments. These mistakes can make your credit report look bad even if you’re good with money.

The Impact of Inaccuracies

If there are mistakes on your credit report, it can really mess things up for you. A bad credit report can make it hard to borrow money, get good rates on loans, or even affect getting a good place to live. That’s why it’s so important to check your report and dispute inaccurate items. Fixing these errors can help improve your credit score and make your financial life easier.

Identifying Inaccuracies on Your Credit Report

Identifying inaccuracies on your credit report is a crucial step in managing your financial health and is essential for the process to dispute inaccurate items. Begin by obtaining your free annual credit report from the three major credit bureaus. As you review each section, pay close attention to personal details, account listings, and payment histories.

Be on the lookout for errors such as incorrect personal information, unrecognized accounts, payments wrongly marked as late, and outdated debts that shouldn’t be reported. Spotting and addressing these inaccuracies not only helps in maintaining an accurate credit score but also forms the foundation for effectively disputing any erroneous items on your report.

Step-by-Step Guide to Review Your Credit Report

Checking your credit report for mistakes is like being a detective. You need to look closely and carefully. Here’s how to do it:

Get Your Credit Report

First, obtaining a copy of your credit report is the initial step. You have the right to access your credit report for free once a year from each of the three main credit bureaus Equifax, Experian, and TransUnion. These reports can be requested online, making it convenient to get a hold of them. It’s a good practice to check your report from each bureau, as they might have slightly different information.

This comprehensive review allows you to thoroughly inspect your financial history as recorded by different sources, ensuring you don’t miss any discrepancies that might be present on one report but not the others. Remember, staying informed about your credit history is the first line of defense in maintaining a healthy credit score.

Read it Carefully

Take your time going through the report, and don’t rush this important process. Carefully examine each section to ensure everything appears accurate and up-to-date. Start with your personal information, verifying details like your name, address, and Social Security number.

Then, move on to your credit accounts, scrutinizing the status of each account, the balance, and your payment history. Pay special attention to the inquiry section, where you’ll see if anyone has requested your credit information recently.

Lastly, review the public records and collections section for any legal issues or debt collections that may affect your credit score. By methodically going through each part of your report, you can be more confident that you’ve thoroughly checked for any inaccuracies or signs of potential identity theft.

Check Your Personal Info

Make sure your name, address, and other personal details on the credit report are correct and up-to-date. Double-check the spelling of your name and ensure that your current and previous addresses are listed accurately.

It’s also important to verify other personal information such as your Social Security number and employment history, if included. Any error in these details, even a small one like a misspelled street name or an old address, could potentially lead to your information being mixed up with someone else’s or indicate an issue with identity theft.

Ensuring that all this personal information is accurate is a crucial step in maintaining the integrity of your credit report.

Review Your Accounts

Go through each account listed on your credit report meticulously, ensuring that every account truly belongs to you. This includes checking credit cards, loans, mortgages, and any other lines of credit. For each account, verify that the details are accurate this means looking at the account numbers, the types of accounts, the credit limits, balances, and the payment history.

It’s essential to confirm that the opening dates and statuses of these accounts (whether they are open, closed, or in collections) are correctly reported. An unrecognized account could be a sign of identity theft, and inaccuracies in account details can unfairly affect your credit score. This thorough review helps ensure that your credit report provides a true and fair view of your financial history.

Tips for Spotting Errors

Now, let’s talk about finding those tricky mistakes:

Wrong Personal Info

Sometimes, your credit report might inadvertently contain someone else’s information, a situation more common than many realize. This mix-up can occur especially if you have a common name, where there’s a higher chance of your details overlapping with another individual with a similar or identical name.

Accounts You Don't Recognize

If you encounter an account on your credit report that you don’t recognize, it could be a red flag for identity theft, or it might simply be a clerical error. Identity theft occurs when someone uses your personal information to open accounts and incur debts in your name, potentially wreaking havoc on your financial standing. On the other hand, a simple error could be due to a mix-up at the credit bureau or a reporting mistake by a lender.

Payment Mistakes

Ensure that all your payments are correctly listed on your credit report. Sometimes, a payment made on time might be mistakenly marked as late due to reporting errors or processing delays. Such inaccuracies can negatively impact your credit score, so it’s important to promptly dispute inaccurate items and provide proof of on-time payments to maintain an accurate credit history.

Old Debts

Old debts should typically disappear from your credit report after seven years. However, sometimes these debts might mistakenly remain listed, affecting your credit score. It’s important to check your report regularly and ensure old debts are removed on time, as their continued presence can unfairly impact your financial profile.

The Importance of Disputing Inaccurate Items

Disputing inaccurate items on your credit report is essential. These errors can unfairly lower your credit score, impacting your ability to get loans and favorable interest rates. Correcting them helps ensure your financial profile is accurately represented, safeguarding your financial opportunities.

How Inaccurate Items Affect Your Financial Opportunities?

When your credit report has mistakes, it’s like having a bad grade on your financial report card. Inaccurate items on your report can make it harder for you to get loans or credit cards. Even if you do get them, you might have to pay more in interest.

This means everything from buying a car to getting a mortgage for a house can become more expensive and difficult. That’s why it’s super important to dispute inaccurate items on your credit report. Doing this can help you get better deals and save money in the long run.

Your Rights Under the Fair Credit Reporting Act (FCRA)

Thanks to the Fair Credit Reporting Act (FCRA), you have the right to a fair and accurate credit report. This law says that the information on your credit report must be correct, complete, and up to date. If you find mistakes, the FCRA gives you the power to dispute inaccurate items with the credit bureaus. They have to investigate your dispute and fix any errors they find. This law is there to protect you and make sure your credit report is a true picture of your financial history.

How to Dispute Inaccurate Items on Your Credit Report

To dispute inaccurate items on your credit report, write a clear letter to the credit bureau outlining each error, and attach any supporting evidence. Include your contact details and specific account information. Send the letter with tracking and keep a copy for your records, ensuring your credit report accurately represents your financial history.

Step-by-Step Process for Disputing Errors

If you find a mistake on your credit report, don’t worry. You can dispute these inaccurate items to get them fixed. Here’s how to do it:

Write to the Credit Bureau

Begin the process of dispute inaccurate items on your credit report by writing a letter to the specific credit bureau that shows the error. You can easily find the postal address for each of the three main credit bureaus Equifax, Experian, and TransUnion on their official websites. It’s important to directly address the bureau that has the incorrect information since each bureau operates independently.

Make sure your letter is clear and concise, focusing specifically on the inaccuracies you’ve identified. Sending your dispute directly to the responsible bureau helps ensure a timely and accurate response to your concerns.

Explain the Mistake

When dispute inaccurate items on your credit report, it’s crucial to clearly explain the specific issue. For instance, you might say, “My report incorrectly shows a late payment for June 2021. However, I have bank statements that confirm the payment was made on time.” Be as detailed as possible in your explanation, specifying dates, amounts, and any relevant account information.

This clarity helps the credit bureau understand exactly what needs to be investigated and corrected. Providing concrete examples, like the discrepancy in payment dates, along with solid evidence, such as bank statements, strengthens your case and increases the likelihood of a favorable outcome in the dispute process.

Send Your Letter

When mailing your dispute letter to the credit bureau, use a service that provides a tracking number. This way, you can track the letter and confirm when the bureau receives it, ensuring your dispute doesn’t get lost in transit. It’s also wise to keep a copy of the letter for your own records.

This copy should include any attachments you sent, like evidence of payment or account statements. Having a copy is important in case there are questions or follow-ups needed later. It also serves as proof of your proactive steps to correct the inaccuracies, providing you with a clear record of your actions to safeguard your credit health.

Crafting an Effective Dispute Letter

Writing a good dispute letter is important. Here’s what to include:

- Your Info: Start with your name, address, and contact details.

- Specifics of the Error: Clearly describe each error you’re disputing. Use simple words and be direct.

- Attach Proof: If you have any proof, like a bank statement or receipt, attach copies to your letter.

What to Include in Your Dispute

When you dispute inaccurate items, being detailed helps a lot:

- Account Details: Mention the account number and name for any error you’re disputing.

- Evidence: Include any evidence you have that shows the error. For example, a payment confirmation for a debt that’s listed as unpaid.

- Ask for Corrections: Be clear about asking the credit bureau to fix the errors.

Dispute inaccurate items on your credit report might seem a bit tricky, but it’s a powerful way to ensure your credit score reflects your true financial history. By taking these steps to dispute errors, you help protect your credit score and open up better financial opportunities for yourself.

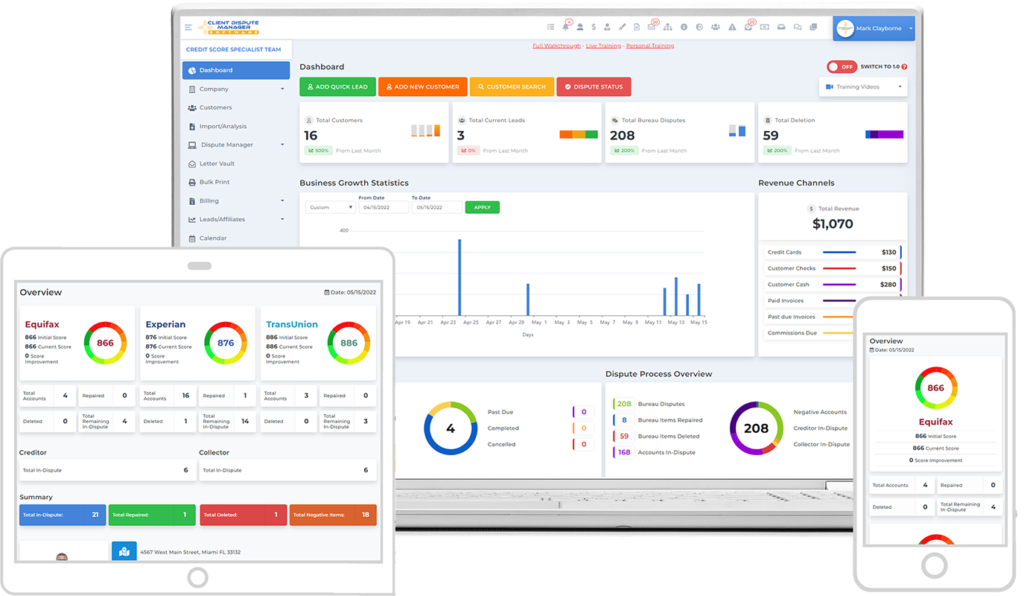

Using Client Dispute Manager Software

Client Dispute Manager Software streamlines the process of disputing inaccurate items on your credit report. It helps you create, send, and track your dispute letters, organizing all your information in one convenient place. This tool saves time and ensures you efficiently manage and follow up on your disputes, making credit repair simpler and more effective.

What is Client Dispute Manager Software?

When you’re looking to dispute inaccurate items on your credit report, using Client Dispute Manager Software can be a big help. Think of it like having a personal assistant for your credit repair journey. This software is designed to make the whole dispute process easier and more organized. It’s a tool that helps you keep track of all your disputes with credit bureaus, all in one place.

Streamlining the Dispute Process

Client Dispute Manager Software really shines by making the credit dispute process smoother. With this software, you can easily create and send dispute letters, and it helps you organize all your information. This means no more getting lost in piles of paperwork.

The software guides you on what to write and where to send it, taking a lot of the guesswork out of the process. Plus, you can keep track of when you sent each dispute and see updates all in one spot.

The Benefits of Technology in Managing Disputes

Using technology like this software has lots of benefits. First, it saves you a bunch of time. You don’t have to write every letter by hand or keep track of everything in a notebook. The software does a lot of the work for you.

Also, it helps you stay on top of your disputes by sending you reminders and updates. This means you’re less likely to miss important deadlines or forget to follow up on a dispute. It’s a smart way to make sure you’re doing everything you can to keep your credit report accurate and up-to-date.

Conclusion

In conclusion, understanding and managing your credit report is crucial, especially when it comes to disputing inaccurate items. By following the outlined steps to identify errors, effectively drafting dispute letters, and utilizing tools like Client Dispute Manager Software, you can ensure your credit report accurately reflects your financial history. Remember, a well-maintained credit report opens doors to better financial opportunities, and taking charge of your credit health is a key step towards achieving your financial goals.