Understanding and managing one’s credit can be a daunting task for many. Errors in credit reports, mismanagement of finances, or past mistakes can lead to a lower credit score. This, in turn, can make it harder for individuals to get loans, secure housing, or even land certain jobs. Enter credit repair software, particularly the Client Dispute Manager Software, which is designed to streamline and simplify the process of repairing and improving credit scores. But who can truly benefit from this tool?

Let’s explore.

Benefits of Using Credit Repair Software

Using credit repair software can save time and effort compared to manual methods. With just a few clicks, you can streamline the process of improving your credit score without the hassle of paperwork or lengthy phone calls.

Credit repair software offers a convenient and user-friendly platform for monitoring progress. You can easily track changes in your credit report, receive real-time alerts about any updates or improvements, and view comprehensive reports summarizing your current standing. This allows you to stay on top of your credit repair journey effortlessly.

Individuals with Errors on Their Credit Reports

It’s a little-known fact, but errors on credit reports are more common than one might think. Whether due to clerical errors, mistaken identities, or outdated information, these inaccuracies can significantly affect a person’s creditworthiness. For those who recognize discrepancies on their reports, credit repair software can be a game-changer. The Client Dispute Manager Software helps users identify, challenge, and correct these errors in an organized and efficient manner. By guiding users through each step of the dispute process, the software ensures that no stone is left unturned.

Victims of Identity Theft

Identity theft is a growing concern globally. Victims often find themselves mired in debt and credit problems through no fault of their own. Unraveling the mess left behind by identity thieves can be a complex and time-consuming process. The Client Dispute Manager Software provides victims with the tools they need to dispute fraudulent accounts and transactions. The software also offers features that can help individuals monitor their credit and guard against future theft.

People Preparing for Significant Life Purchases

Whether it’s buying a home, getting a new car, or starting a business, significant life purchases often require a solid credit score. Those looking to make such big moves in the near future can use credit repair software to ensure their credit report reflects their true financial behavior. By proactively addressing any issues or discrepancies, individuals can put their best foot forward when it’s time to make that crucial purchase.

Individuals with Past Financial Mistakes

Everyone makes mistakes, and some of those can lead to credit blemishes. Late payments, defaulted loans, or even bankruptcies can leave lasting marks on one’s credit report. But past mistakes don’t have to define one’s financial future. The Client Dispute Manager Software can assist those looking to make amends for their past financial missteps. It offers guidance on how to approach creditors, negotiate settlements, or even work out payment plans. By following the right strategies, individuals can rebuild their credit and restore their reputation.

Financial Consultants and Advisors

It’s not just individuals who can benefit. Financial professionals, including consultants and advisors, can use the Client Dispute Manager Software to assist their clients. By incorporating the software into their service offerings, these professionals can provide more comprehensive advice and solutions. Whether it’s helping a client dispute a particular charge or offering insights into credit-building strategies, the software enhances the value these professionals bring to their clientele.

Renters Looking to Become Homeowners

The dream of homeownership is one that many renters share. However, a less-than-stellar credit report can be a barrier to realizing this dream. By using credit repair software, renters can work towards improving their credit profiles, putting them in a better position to secure mortgage approvals in the future.

Young Adults and Credit Newbies

Young adults or those new to the world of credit may find the landscape overwhelming. Missteps made in the early days can have lasting implications. The Client Dispute Manager Software can serve as an educational tool, guiding these credit novices in understanding the nuances of credit reports and scores, and assisting them in navigating potential issues.

Enhanced Accuracy and Organization

Credit repair software offers a useful tool for individuals, professionals, and businesses looking to improve their credit scores and reports. By leveraging the power of automation and digital solutions, this software streamlines the credit repair journey, providing enhanced accuracy and organization throughout the process.

One of the key benefits of using credit repair software is its ability to ensure accurate tracking of financial information. The software efficiently records all relevant data, including transactions, debts, and payments, minimizing errors that could negatively impact credit scores. With this digital solution in place, users can rest assured that their financial information is accurately documented.

In addition to accuracy, credit repair software excels in organizing documentation and correspondence related to the credit repair journey. It provides a centralized system where users can store all relevant paperwork, such as dispute letters or supporting documents. This organization not only saves time but also ensures that nothing gets lost or overlooked during the credit repair process.

Improved Credit Score Management

Credit repair software is a valuable tool for individuals looking to improve their credit scores. With this software, users can effectively track and manage their credit scores, gaining insights into the factors that affect their credit rating. By utilizing this software, users can make better-informed decisions regarding their credit.

Efficient Credit Score Tracking: The software enables users to easily monitor changes in their credit scores over time. It provides a centralized platform where users can access their credit reports and keep tabs on any modifications made by creditors or credit bureaus.

Insights into Credit Factors: Understanding the elements that influence one’s credit score is crucial for effective management. Credit repair software offers detailed analyses of common credit issues such as late payments, high credit utilization, or accounts in collections. This information empowers users to take necessary actions to rectify these issues and improve their overall credit health.

Real-Time Monitoring and Goal Setting: Users can set specific goals within the software and receive alerts when they reach milestones or encounter potential problems. This real-time monitoring allows individuals to stay on top of their progress towards improving their credit score.

Choosing the Best Credit Repair Software: Key Considerations

Selecting the right credit repair software can make a vast difference in the efficiency and effectiveness of managing credit repair processes. For those considering Client Dispute Manager Software, here are some key aspects to keep in mind:

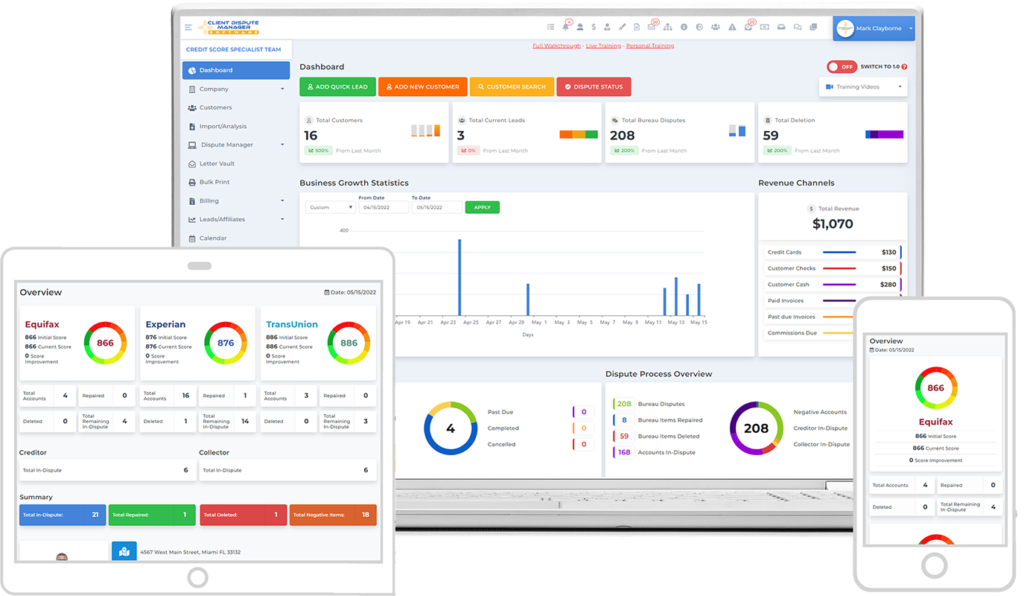

- User-Friendly Interface: One of the primary features of any software should be its ease of use. Client Dispute Manager Software boasts an intuitive dashboard, which means even those new to credit repair can navigate it easily. Always try a demo or trial before committing to ensure you are comfortable with the interface.

- Automation Capabilities: Automating certain tasks can save a considerable amount of time. Look for functionalities like auto-populating dispute letters, automating client follow-ups, and batch printing. Client Dispute Manager offers several automated features, streamlining the process for both professionals and novices.

- Customization: Every credit repair case can be unique. Hence, the ability to customize dispute letters, client agreements, and other elements can be crucial. Client Dispute Manager Software provides customization options that can be tailored to suit individual needs.

- Data Security: Given the sensitive nature of credit information, the software should prioritize data protection. Look for encryption standards, secure hosting options, and any additional safety features in place.

- Cost-Effectiveness: While it’s essential to have a software that’s feature-rich, it shouldn’t break the bank. Evaluate the pricing structure of Client Dispute Manager against the features offered and the support available to ensure you’re getting value for your investment.

- Training and Support: Especially for those new to credit repair, having access to training materials and customer support can be invaluable. Client Dispute Manager offers resources to help users understand the software and the credit repair process in general.

Conclusion

In a world where credit scores play a pivotal role in determining many life opportunities, having the right tools to manage and improve one’s credit profile is invaluable. The Client Dispute Manager Software, with its comprehensive features and user-friendly interface, is suitable for a wide range of people, from those with blemishes on their credit histories to professionals aiming to provide the best for their clients. If you find yourself or someone you know in any of the categories mentioned above, it might be time to consider harnessing the power of credit repair software.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.