Are you tired of struggling with credit issues and feeling overwhelmed by the complex process of repairing your credit? Look no further!

Credit repair is crucial in improving your financial standing and opening doors to better opportunities. However, navigating through mountains of debt and managing multiple accounts can be daunting. That’s where software tools come into play.

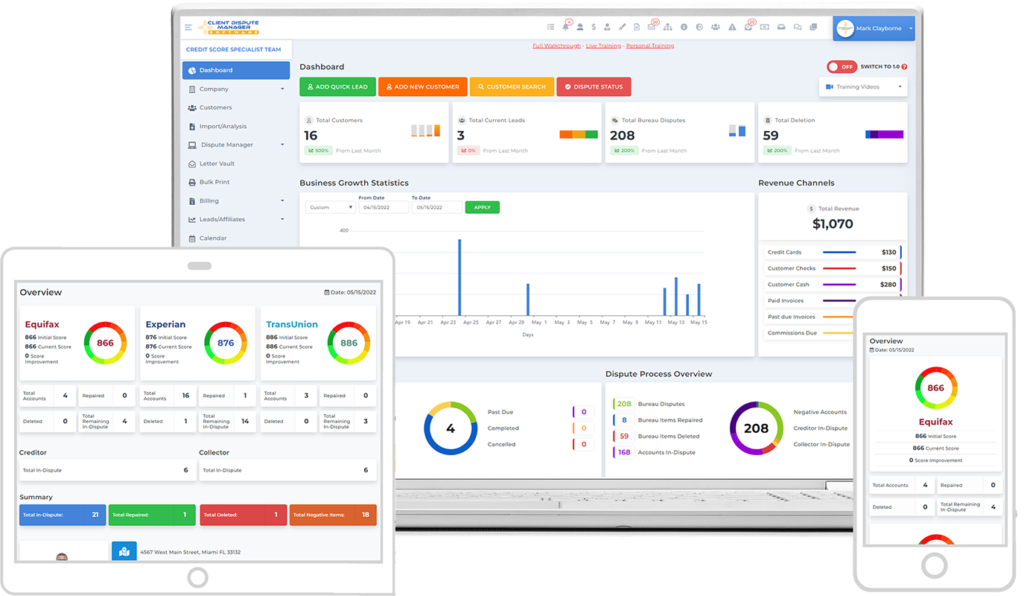

Utilizing cutting-edge software platforms can streamline the entire credit repair process, saving time and effort. Business credit repair software like Client Dispute Manager offers invaluable resources that integrate seamlessly with your existing systems, providing real-time reports on market performance and more.

Don’t let credit issues hold you back any longer. Let’s dive into how leveraging software tools can revolutionize your credit repair journey step by step. Get ready to take control of your financial future with ease and confidence!

Benefits of Using Credit Repair Software

Using credit repair software, such as Client Dispute Manager Software, offers several benefits that can significantly improve the effectiveness of your credit repair strategies. By leveraging these software tools, you can streamline and simplify the process, saving time and maximizing results.

- Increased Efficiency and Time Savings: With business credit repair software Client Dispute Manager, you can efficiently manage all your credit repair tasks in one place. This eliminates manual tracking and organization, allowing you to focus on more important aspects of improving your credit score.

- Access to Comprehensive Credit Reports and Monitoring Features: Our software provide access to detailed credit reports from major bureaus, giving you a comprehensive understanding of your current financial situation. They offer monitoring features that allow you to stay updated on any changes or updates to your credit profile.

- Automated Dispute Generation and Tracking: One of the key advantages of using credit repair software is the ability to automate dispute generation. These tools can generate customized dispute letters based on specific issues in your credit report. They also track the progress of each dispute, ensuring faster resolution and results.

- Enhanced Organization and Documentation Capabilities: Client Dispute Manager software provides robust organization and documentation features that help you keep track of all communication with creditors and bureaus. This ensures accuracy in case any disputes require further action or follow-up.

By utilizing these benefits offered by credit repair software like Client Dispute Manager Software, individuals can effectively navigate the complex process of repairing their credit scores while saving valuable time and effort.

Learn 10 Ways Credit Repair Software Elevates Your Business Growth

Optimizing Credit Repair Strategies with Software Tools

Leveraging software tools is crucial. These tools provide invaluable assistance in streamlining the repair process and maximizing results. Here are some key ways in which businesses can optimize their credit repair strategies using Client Dispute Manager Software:

Utilizing Data Analysis Features:

- Identify areas for improvement in credit scores through comprehensive data analysis.

- Pinpoint specific errors or factors affecting scores, allowing for targeted action.

Customizing Dispute Letters with Ease:

- Utilize software templates to create customized dispute letters based on individual circumstances.

- Tailor each letter to address specific issues identified during the analysis phase.

Tracking Progress and Monitoring Changes:

- Keep track of the entire credit repair journey by easily tracking progress and changes in credit reports over time.

- Monitor improvements and identify any new errors or negative factors that may arise.

Leveraging Automation For Timely Follow-ups:

- Automate follow-ups on disputes and negotiations to ensure timely resolution.

- Avoid missing deadlines or losing momentum during the credit repair process.

By employing business credit repair software like Client Dispute Manager Software, companies gain access to efficient programs that simplify the entire credit repair journey. These solutions work seamlessly alongside businesses, offering a range of features that enhance productivity and effectiveness. With these tools, organizations can confidently navigate the complex world of credit repair while achieving optimal results.

Learn Credit Repair Software: The Future of Credit Restoration

Maximizing Results through Effective Credit Repair Strategies

Systematic Approach to Address Negative Items:

To achieve effective credit repair, it is crucial to adopt a systematic approach when addressing negative items on your credit reports. This involves carefully reviewing your credit history and identifying any discrepancies or inaccuracies impacting your credit score. Some key steps to consider include:

- Obtaining copies of your credit reports from all three major credit bureaus.

- Thoroughly examining each report for errors, such as incorrect personal information or accounts you don’t recognize.

- Disputing any inaccuracies with the respective credit bureau by providing supporting documentation.

- Following up with the bureau to ensure the errors are corrected promptly

Prioritizing High-impact Actions:

It’s important to prioritize actions that can significantly impact improving your credit score. This includes addressing delinquent accounts and negotiating settlements with creditors. Here are some steps you can take:

- Identifying Delinquent Accounts: Review your credit reports to identify any accounts that are past due or in collections.

- Communicating with Creditors: Reach out to these creditors and discuss potential options for resolving the delinquencies.

- Negotiating Settlements: If possible, negotiate a settlement agreement with the creditor, aiming for a reduced payment amount or favorable terms.

Establishing Positive Payment History:

Building good credit requires establishing a positive payment history. You can effectively repair your credit over time by strategically managing your debts. Consider the following techniques:

- Making timely payments: Ensure all bills and debts are paid on time each month.

- Paying more than the minimum amount due: Whenever possible, pay more than the minimum required payment to reduce outstanding balances faster.

- Keeping low credit utilization: Aim to keep your overall credit utilization ratio below 30% by responsibly managing your credit card balances.

Building Solid Financial Habits:

Effective credit repair is about fixing immediate issues and building strong financial habits for long-term credit health.

Consider the following practices:

- Budgeting and tracking expenses: Create a budget to manage your finances effectively and track your spending.

- Saving for emergencies: Build an emergency fund to cover unexpected expenses and prevent reliance on credit.

- Regularly monitoring your credit: Stay vigilant by checking your credit reports and monitoring any changes or potential issues.

By implementing these effective strategies for credit repair, and leveraging software tools, you can take control of your financial future and work towards improving your creditworthiness.

Empowering Your Credit Repair Journey Client Dispute Manager Software

Harnessing the power of technology is essential in taking control of your credit repair journey. By leveraging software tools, you can gain valuable insights into your financial situation through data-driven analysis. These tools provide a streamlined communication channel with creditors, bureaus, and other parties involved.

Understanding best practices in utilizing software tools is crucial for credit repair success. Here’s how these tools can empower you:

- Insights Into Your Financial Situation: Client Dispute Manager Software analyze your credit reports from various bureaus, providing a comprehensive overview of your credit health. They highlight areas that need improvement and identify potential errors or discrepancies.

- Streamlined Communication: Communicating with creditors, bureaus, and other entities involved in credit repair can be time-consuming and overwhelming. Software tools simplify this process by automating dispute letters, tracking progress, and organizing correspondence.

- Knowledge About Best Practices: Credit repair services often offer educational resources on using software tools effectively. By familiarizing yourself with these resources, you can maximize the benefits of the available features and navigate the complexities of credit repair more efficiently.

- Taking Control of Your Journey: With Client Dispute Manager Software, you become active in your credit repair journey rather than relying solely on credit repair businesses or professionals. You have real-time access to updates and progress reports, enabling you to make informed decisions regarding disputes and negotiations.

By embracing technology-driven solutions, individuals are becoming empowered credit repair experts. This tool equips users with the necessary knowledge to navigate their unique credit situations confidently.

Learn How Credit Repair Software Eliminates Errors & Disputes

Conclusion

In conclusion, leveraging software tools for credit repair can be a game-changer in your journey towards financial freedom. Utilizing these tools can streamline the process, optimize your strategies, and ultimately achieve better results.

One of the key benefits of using credit repair software for business is the time-saving aspect. With automated features and streamlined workflows, you can eliminate manual tasks and focus on what truly matters improving your credit score.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.

FAQs

How long does it typically take to see improvements in my credit score using Client Dispute Manager Software?

The timeline varies depending on individual circumstances; however, with effective credit repair strategies and consistent effort, you can start seeing positive changes in your credit score within a few months.

Will using Client Dispute Manager Software guarantee a perfect credit score?

While credit repair software can significantly assist you in the process, it cannot guarantee a perfect credit score. It is essential to address underlying issues and follow best practices to achieve the best possible outcome.

Can I access my credit report through Client Dispute Manager Software?

Yes, Client Dispute Manager Software allows you to access and monitor your credit report. This feature helps you stay updated on any changes or inaccuracies impacting your score.

How secure is my personal information when using Client Dispute Manager Software?

Client Dispute Manager Software prioritizes data security and employs industry-standard measures to protect your personal information.