The United States credit reporting system is far from flawless. On average, 34% of customers have one or more errors on their credit reports, resulting in incorrect credit ratings.

Borrowing becomes difficult or impossible when one’s credit rating is low since lenders demand higher interest rates or reject applications. Credit repair companies in Austin TX assist people in repairing their credit ratings or maintaining a decent credit score.

Table of Contents

Credit repair businesses may be operated from home or as a side hustle. Credit repair services involve a fairly wide range of activities; the actual procedure of credit restoration differs based on each client’s condition.

START A CREDIT REPAIR BUSINESS

Start-up Costs

The startup fees for credit repair Austin TX companies are quite low. You won’t need to rent office space since the bulk of work will be done online. Your home office should include a PC or MAC, a dedicated fax number and reliable internet access.

Every credit repair business in Texas is required to get a surety bond. The security bond protects customers against any damages under the bond’s limitations and ranges in price from $100 to $1000. A merchant account will be vital for credit repair companies in Austin Tx.

However, most banks are hesitant to take the risks involved with credit restoration services. This is why you need to make sure you do your research.

While not mandatory, credit repair Austin TX reviews suggest that investing in credit restoration software is a wise move. Because such software represents your largest everyday expense, many businesses try to avoid this cost.

This is a big mistake, and industry professionals warn against it, yet the company has reported a 400% growth in sales in around 12 months.

Credit Repair Business Ongoing Expenses

Your organization will have ongoing expenditures that are comparable to the initial launch expenses. Your budget ideally should also include expenses associated with credit repair automation software as well as insurance, a surety bond, payroll, and typical overhead expenditures.

The inclusion of continual education in the financial plans of business owners who have ambitions of sustained expansion and achievement for their credit repair companies in Austin TX should be strongly considered.

Who Is Your Target Market as a Credit Repair Austin TX Company?

It might seem as if the target market consists of everybody who has a poor credit history. But this isn’t the case. According to research, individuals under the age of 24 and 65 and over are more likely to either possess a good credit score and/or not be concerned with taking the required actions to fix their rating.

Marketing efforts need to be direct, and they should focus on clients who are over 25 or may have been denied a loan in the recent past.

START AN AUSTIN TX CREDIT REPAIR BUSINESS

When you have a fantastic plan to be one of the credit repair companies in Austin TX and the motivation to carry it out, the last thing you want to do is wait to get started on it. If you follow the processes that we’ve given here, you should be able to have your company up and operating in less than seven days.

LLCs (limited liability companies) might take longer under certain conditions. You should anticipate the approval of the formation to come within 22-25 business days if you submit the paperwork through fax or mail rather than paying an additional cost for expedited processing.

On the other hand, if you submit the paperwork for your LLC (Limited Liability Company) online, you may get approval in as little as four days. You will have some level of influence on the remaining steps in the process of establishing a firm.

You may complete a number of the processes in a matter of hours or days, and in order to make the most of your time, you can go through the majority of the steps simultaneously.

How to do it:

Step #1: Decide the Type of Your Austin TX Credit Repair Business

The primary advantages of forming a limited liability company are the ease with which it may be started up, protection from personal responsibility, credibility, and tax flexibility.

Ultimately, forming a limited liability corporation, also known as an LLC, will assist you in protecting your personal assets while also assisting you in expanding your business. LLCs are often sought after by owners of smaller businesses due to their low overhead costs and user-friendliness.

Even though you may launch a firm as a single proprietor in less than twenty-four hours, we do not advise doing so since it is not the most effective business model.

When you run a business as a sole proprietor, you expose yourself to the risk of being sued or subjected to other forms of legal action, which might put a strain on your personal resources.

Instead, filing for an LLC is the easiest method to incorporate a legal business organization in the state of Texas. A limited liability corporation may provide you with safeguards that operating as a sole proprietorship cannot, as well as erecting a wall of separation between your personal and professional assets.

In order to establish a limited liability company in the state of Texas, you will have to submit your Certificate of Formation to the Secretary of State of Texas. There are distinct applications to fill out for those living in Texas as opposed to those living in other states.

The state filing fee is required to be paid by owners of businesses located inside the state, while the amount for owners located outside of the state is $750.

Step #2: Your Austin TX Credit Repair Business Name

The paperwork and the costs may not be particularly exciting, but they are an essential part of making sure that your company is operating within the law and is protected.

However, after everything is over, you may go on to something a little bit more enjoyable, which is naming your company.

The following are some guidelines to help you choose a name for your Credit Repair Austin TX company:

- Check to confirm that it isn’t being used by any other companies in the state of Texas by visiting the following website to use the Texas Taxable Entity Search Tool: https://mycpa.cpa.state.tx.us/coa/Index.html

- Maintain a level of simplicity that is easy to remember and pronounce.

- Make sure that the name isn’t too similar to the names of other businesses that are in the same industry.

- It is best to refrain from employing made-up terms, elaborate acronyms, and meaningless jargon.

Step #3: You Need a Texas Street Address

This stage is not too difficult to do if you live in Texas and conduct business from your house. On the other hand, there are situations in which you may not be able to or might not want to provide your own address for your venture into credit repair Austin TX.

A virtual business street address might be the best option for you if any of the following apply to you: you live outside of the state; you don’t want your personal home address linked with your company; or you just don’t want to share your home address publicly.

With a virtual address, you may get a digital version of your mail at any time and read it from any location, ensuring that you never miss a minute of the action. One company that offers virtual street addresses in Austin Texas is IPostal1.

With them, your new virtual address is an actual mailing address that may accept mail and parcels sent by any carrier. These items will be safely kept at your new virtual address.

You may also use the virtual address to register a company, and if you want to construct a virtual office, you can even add a phone and fax to the service.

iPostal1 Digital Mailbox technology allows you to see your mail as soon as it is delivered to your mailbox. Make use of our mobile app or website to scan, discard, or forward pieces of mail as well as to schedule pick-up.

Step #4: You Need a Registered Agent for Your Credit Repair in Austin TX Business

A Registered Agent is the person who is entrusted with the responsibility of collecting all of the necessary legal documentation for your company. When you register your limited liability company, you will be required to designate a Registered Agent.

Although you have the ability to be the Registered Agent for your own company, doing so is not something that is often advised.

Because the Registered Agent has to be present in the state in which the business is operating at all times in order to accept documents, if you do not reside in the state in which the business is operating or if you frequently travel out of state, it is best to have someone else take on the role.

Step #5 :Employer Identification Number for Austin TX Credit Repair Company

In order to pay taxes, handle payroll, or arrange banking and financing for your company, it is absolutely necessary for you to obtain an Employer Identification Number, often known as an EIN, for your credit repair Austin TX business.

You may get your EIN from the Internal Revenue Service (IRS); you may also get an EIN number from the IRS Tax Number Website in as little as four hours or as much as four business days after selecting your organization and filling out the online application for a Tax ID, depending on the delivery method that you choose.

THE BENEFITS OF SELF-EMPLOYMENT AS A CREDIT REPAIR AUSTIN TX SPECIALIST

Here are the greatest joys of being self-employed:

- You can take back control of your life.

- You develop schedules that fit in with your life and family commitments.

- Instead of working for someone else making them wealthier, you have the satisfaction of knowing that as a self-employed person you are working as the Texas best credit repair Austin TX.

- You also benefit from the freedom to travel and make your own decisions in life.

These are the benefits I am sure you will never regret!

LAWS YOU NEED TO UNDERSTAND FOR YOUR CREDIT REPAIR AUSTIN TX BUSINESS

A person who specializes in credit repair in Austin TX should have a solid understanding of the regulations that govern credit and credit repair. These are the following:

The Credit Repair Organizations Act

The Credit Repair Organizations Act, sometimes known as CROA, is a piece of consumer protection law that controls the actions of businesses that provide services to repair consumers’ credit scores.

These businesses assess a cost to their clientele in order to assist them in raising their credit ratings. In most cases, this is accomplished by challenging any inaccurate or unfavorable material that is included in their report.

Although such services could be beneficial for customers, the CROA’s primary objective is to eliminate deceptive marketing practices. One example of this would be overstating the degree of improvement that is anticipated to be achieved.

The accuracy of the information included in someone’s credit reports is the single most important factor in determining an individual’s credit score. Credit repair services are required when a credit report does not provide an accurate or comprehensive picture of credit history.

An individual has the option of repairing their credit themselves, or they can engage credit repair companies in Austin TX to assist them. The Credit Repair Organizations Act is federal legislation that governs organizations and services that aim to enhance a person’s overall credit rating.

This law applies to any organization that offers credit repair services. Specialists for Credit repair Austin TX businesses sometimes make promises that they will get unfavorable information deleted from an individual’s credit report.

Under the Credit Repair Organizations Act, it is prohibited for any company to make misleading promises about its capacity to “repair” a person’s credit report or credit score.

This applies to both individuals and businesses. Under the Credit Repair Organizations Act, credit repair companies are prohibited from engaging in the following activities:

- Providing present or potential creditors false information about their client’s credit history counselling the client to do so

- Attempting to change their identification by, for example, obtaining a new EIN (Employer Identification Number) or a new identity if the client wants to start over with a fresh credit history

- Lying to clients about the services they are providing

- Putting the client in the position of having to pay for services before they have been rendered.

The law mandates that the credit repair company give the client a disclosure that is titled “Consumer Credit File Rights Under State and Federal Law“. This disclosure will let the client know that they have the legal right to obtain a copy of their credit report as well as the legal right to contest any inaccurate information that may be included in it.

In addition to this, they have the legal authority to file a lawsuit against an organization that is in violation of the CROA.

What Is the Consumer Credit Protection Act of 1968?

The Consumer Credit Protection Act of 1968 (also known as the CCPA) is a piece of federal law that came into effect in 1968 and established consumer safeguards against financial institutions such as banks, credit card companies, and other lenders.

Since its introduction in 1968, the legislation has undergone a substantial amount of expansion, and it now specifies disclosure standards that must be followed by consumer lenders as well as auto-leasing companies.

The CCPA prohibits misleading advertising and discrimination by creditors, and it also controls the fair reporting of a customer’s financial information. Because the CCPA mandates financial institutions to explain financial terminology in ways that are simpler to grasp for customers, it also makes the conditions of loans more visible to borrowers who may not be well-versed in finance or banking.

The Credit Card Accountability and Disclosure Act served as the foundation for a number of other consumer protection legislation that addresses lending, the disclosure of terms and conditions as well as the collecting and sharing of a customer’s credit and borrowing history.

The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a piece of legislation that governs how information on a consumer’s credit and finances may be shared, stored, and collected.

It was enacted in 1970 in order to protect individuals’ right to privacy and maintains the veracity of the personal information that is kept in the files of credit reporting companies who are responsible for storing the credit histories of all customers.

It is the responsibility of the Consumer Financial Protection Bureau (CFPB) as well as the Federal Trade Commission (FTC) to keep the act current and to ensure that it is followed.

The credit report of a consumer contains information on their credit history, which may include loan and payment information as well as credit card numbers. Creditors will then consult this report in order to evaluate a consumer’s past financial activities and assess whether or not the person is credit-worthy.

A credit score is a numeric number that is used to evaluate an individual’s credit-worthiness. This value is derived from the information that is collected. The Fair Credit Reporting Act gives customers the right to request a free copy of their credit report once per year.

This is done to guarantee that their financial history has been accurately disclosed by financial institutions. Consumers have the ability to challenge any information that they believe to be erroneous. Under some conditions, consumer credit reporting organizations are permitted to share the customer’s financial information with other parties.

The Fair Credit Reporting Act places restrictions on who may see the information included in a consumer’s credit report. When a customer applies to a mortgage firm for a loan to purchase a house, for instance, the financial institution may access the client’s credit record.

However, an employer who is interested in seeing a person’s credit record cannot do so without first receiving the individual’s consent in writing.

The Equal Credit Opportunity Act (ECOA)

When considering a person’s request for a loan, creditors and lenders are prohibited from engaging in discriminatory practices under the Equal Credit Opportunity Act (ECOA), which was passed into law in 1974.

When determining a person’s credit-worthiness, the legislation prohibits utilizing gender, race, color, religion, and any other factor that is not directly related to credit-worthiness.

For instance, lenders are not permitted to reject loan applications on the basis of the applicant’s age or the fact that the individual is receiving government support.

Fair Debt Collection Practices Act (FDCPA)

When trying to collect an outstanding debt from a consumer or entity, third-party debt collectors are restricted in the actions that they are allowed to take by the Fair Debt Collection Practices Act (FDCPA), which is a federal law.

Credit card companies, for example, may outsource the collection of outstanding debts to a third-party debt collector.

The Fair Debt Collection Practices Act (FDCPA) places restrictions on the range of activities that may be carried out by debt collectors as well as limitations on the number of times a borrower can be contacted and the hours of the day during which calls can be sent to debtors.

The Fair and Accurate Credit Transactions Act

The primary motivation for the addition of the Fair and Accurate Credit Transactions Act as an amendment to the Fair Credit Reporting Act was to provide more consumer protection against identity theft.

The Act sets rules for the privacy of information, the accuracy of the information, and the disposal of information, and it restricts the manner in which consumer information may be disseminated.

There Is a Great Deal More to Understand Besides the Law

Although it is certainly beneficial, knowing and understanding the rules that pertain to credit is not the only need for becoming a Credit Repair Specialist; in fact, there are several more requirements.

If you go to the website Client Dispute Manager Free Training, you will be able to register for a FREE course that lasts for six weeks and teaches you all you need to know.

You will have a better understanding of the sector as well as the priorities that need to be prioritized when launching a credit repair company in Austin TX and ensuring its success, thanks to the course.

The following are some of the topics covered in the course:

- An introduction to the credit repair industry

- A review of what training you will require

- How to form your business professionally

- How to establish your own brand

- Signing clients up

- Preparing the files

- Sending your first dispute

- How to print your letters

- How to nurture your client

- Portal access for the client

- Carrying out competitor research

- Working with affiliates

- Using virtual assistance

- Running your adverts

- Ongoing professional training

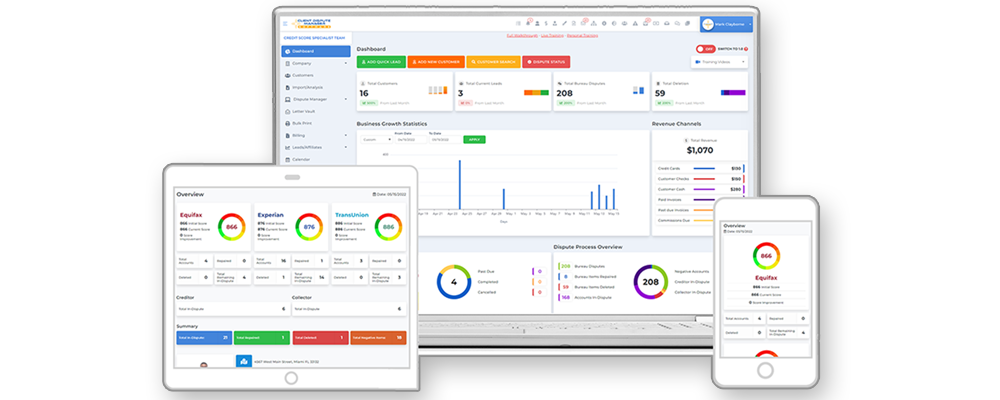

THE BENEFITS OF SOFTWARE FOR YOUR CREDIT REPAIR AUSTIN TX BUSINESS

Earlier in the section labeled “What are the Ongoing Expenses for a Credit Repair Agency?” I mentioned credit repair software and explained how those in the know recommend this software.

I want to expand on this as we near the end of this article. Client Dispute Manager Software makes it simple for you to launch your own credit repair company from the ground up. Client administration, credit reporting tools, the ability to automate credit restoration, and much more are included in this solution.

Client Dispute Manager (CDM) is an all-in-one solution for repairing credit that comes in a box. Using this customer relationship management system, you will be able to handle client data as well as credit repair documents, including letters, disputes, notes, and so on.

It is essentially a comprehensive software solution that can be used by any individual or organization interested in launching a credit repair Austin TX services.

Here are just two of the main benefits of owning this software:

Client Management for Your Austin Tx Credit Repair Business

By using CDM, you will have the ability to effortlessly follow up with customers and sign them up for their client management systems. They have a credit monitoring import function that enables you to check the credit reports and scores of your customers on a daily, weekly, or monthly basis, depending on which option you choose in your credit repair Austin Tx business.

CDM also provides you with tools that are built in so that you can follow up with all of your leads and customers without having to leave the page that you are on.

Automated Systems for Credit Repair Companies in Austin Tx

As a credit repair organization (CRO), having access to CDM will help you to save time by automating a significant portion of the credit repair process.

These features include the creation of a credit audit in less than thirty seconds, the onboarding of new clients, the monitoring of existing clients’ credit, and the generation of automated dispute letters.

You can also combine Zapier (automation platform) to work with all of your other marketing tools like Google Docs or email marketing. This can be done by following the instructions on the Zapier website.

I could go on and on describing exactly what this software can do for your new credit repair business, but perhaps the best way of seeing for yourself is to check out the FREE TRIAL and DEMONSTRATION VIDEO so you can appreciate the benefits yourself.

Final Thoughts

I hope this guide to credit repair Austin TX, has provided you with food for thought and explained how you could start your own credit repair business. Take this decision and you will never regret it as your life is transformed and freedom becomes the basis of your lifestyle.

Our Client Dispute Manager Specialist can answer any of your questions, so please do not hesitate to get in touch.