Credit scores waver from time to time based on the payments, transactions, and overall usage habits. In most cases, the credit score is directly concerned with spending actions. And there can be errors on the credit report that you have no control over, like lines of credit and hard inquiries.

If it comes to your notice that the credit score has come down all of a sudden, even if it’s by a few points, then it may run the risk of an unwarranted credit inquiry. You should learn to get credit inquiry removal in 24 hours for people who await your assistance.

Table of Content:

What is a credit inquiry?

By definition, a credit inquiry refers to a request by an organization for arranging credit report information of an individual from a trusted credit reporting agency. Credit inquiries can come from a host of entities for several reasons, but they are generally probed by financial institutions and can be classed as a hard or soft inquiry.

Hard Inquiry:

As a borrower registers a new credit application, hard credit inquiries are set forth by a credit bureau. This information is procured using the Social Security number of the applicant and is needed for the credit underwriting procedure. With hard inquiries, a creditor can get the comprehensive credit report of the borrower. And this report includes the credit score and other important details of the borrower.

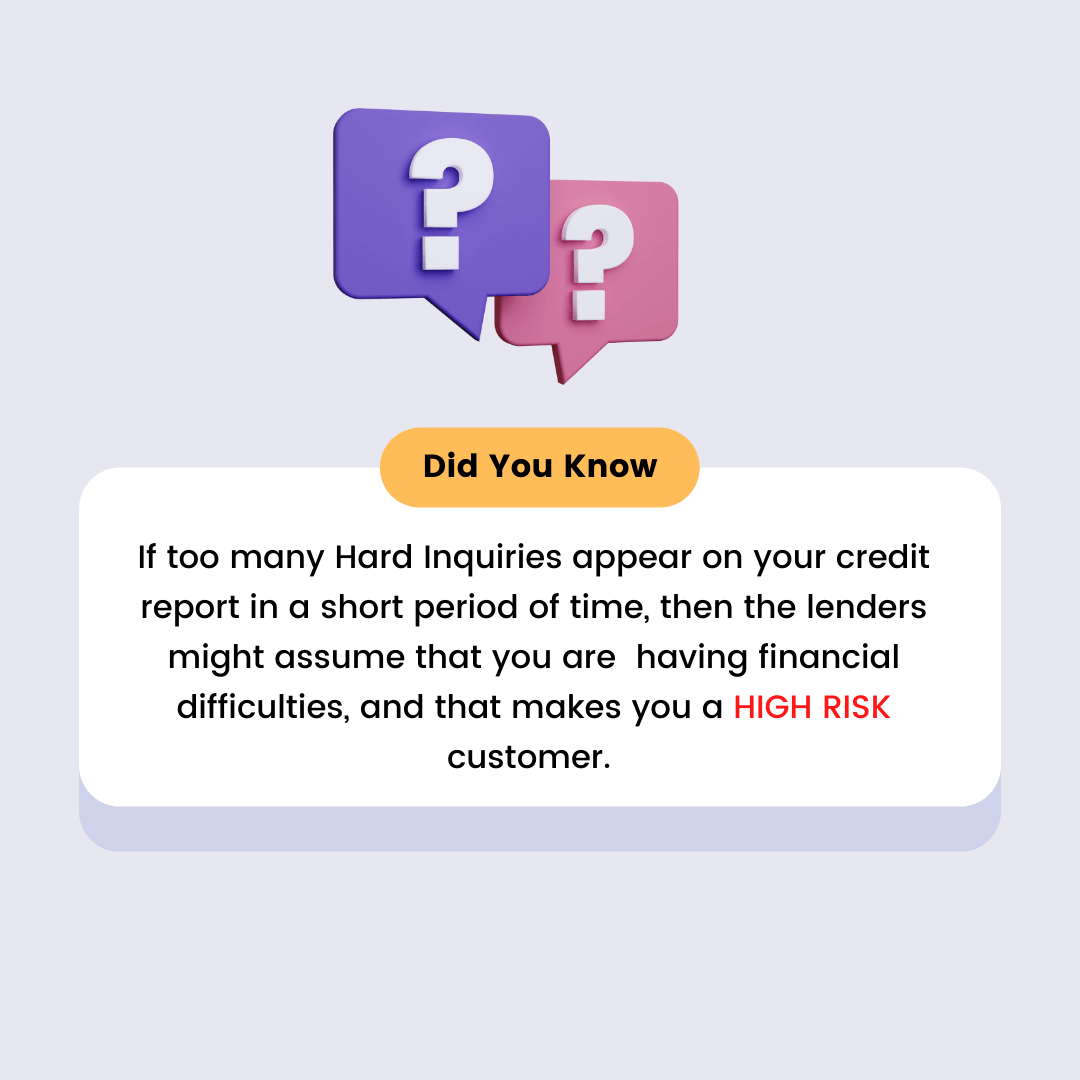

Hard inquiries may deem harmful to the credit score of the borrower. This is because every single credit inquiry brings down the credit score even more. It stays on the credit report for two years at a stretch.

In essence, when an applicant faces a higher number of hard inquiries in a short span, it is considered as a means of expanding the available credit. And this surges the risk for the lender. Unless someone is ready to wait for two years, then they can seek the assistance of reliable credit report companies to get credit inquiry removal in 24 hours.

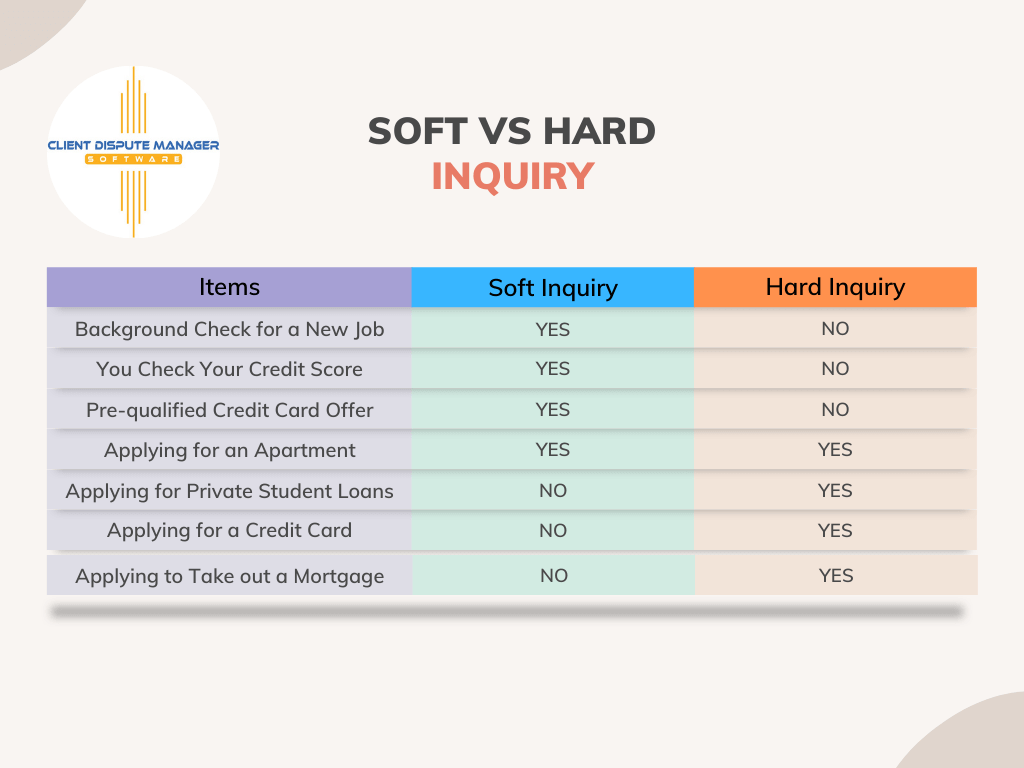

In some cases, hard inquiries can also be used in situations not related to credit application. The two most common reasons behind credit application are lease rental application and employment background check.

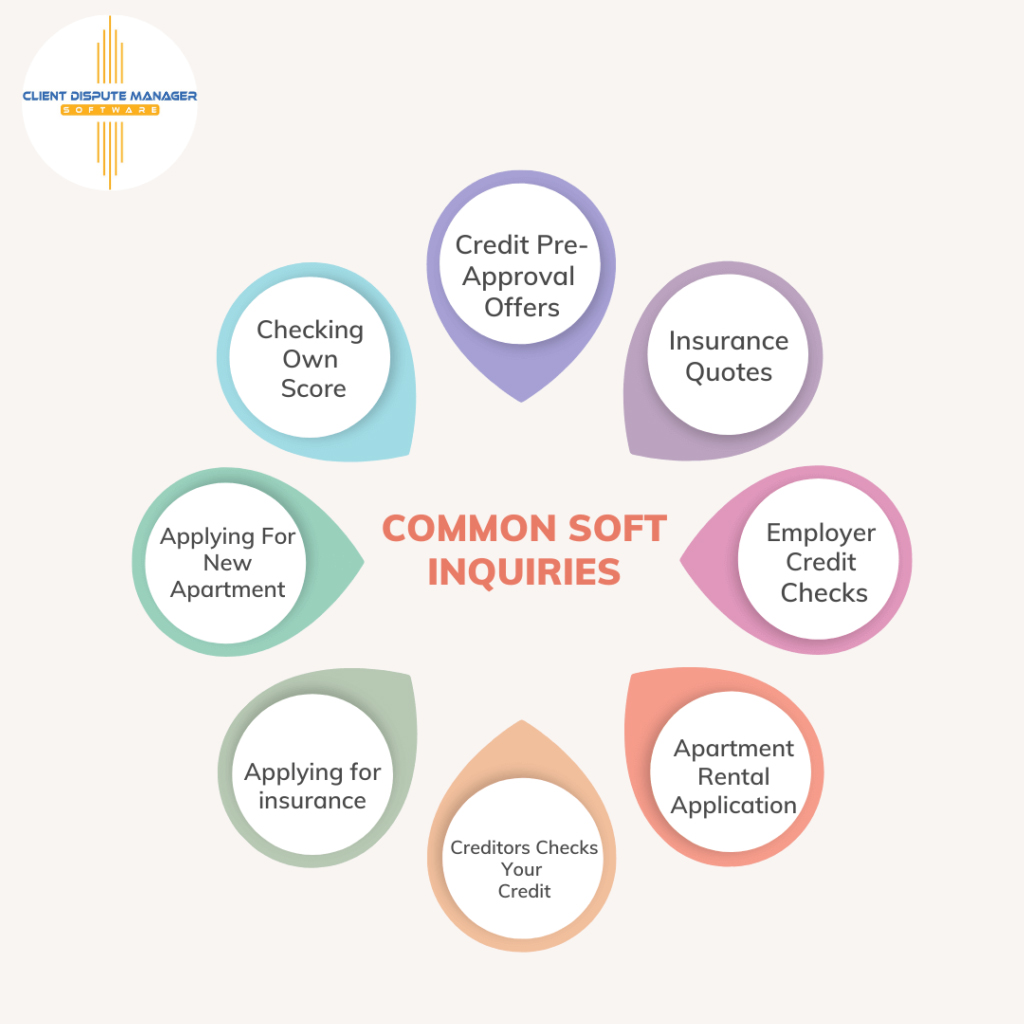

Soft Inquiry:

The first thing that deserves mentioning about soft inquiry is that it’s not mentioned on the applicant’s credit report. Such inquiries are requested for multitudes of reasons. Credit companies have a good link with the credit bureau to ask for soft inquiries resulting in a list for marketing for prospective clients. Soft inquiries are customized by credit companies for identifying borrowers meeting some underwriting traits for loans.

Services pertaining to credit aggregate also utilize soft inquiries for aiding the borrowers to procure loans. Such platforms call for information about the borrower, such as the Social Security number that allows for soft inquiries and offers of pre-qualification. Many lenders can also offer borrowers quotes through soft inquiry requests helping them comprehend prospective loan terms.

Personal credit reports are also procured through soft credit inquiries. It is the right of the individuals to get their annual credit reports from the reporting agencies that hold their credit information. You can also sign up in the credit card companies for a free credit score. The credit scores are also procured by the credit card companies through soft credit inquiry.

What are the differences between hard and soft credit inquiry?

While there is no distinction between the information provided in hard inquiry and soft inquiry, they don’t have the same effect on the credit score. Many people have a misconception that checking the credit history will negatively affect it. If you are checking your credit history, it is only a soft credit inquiry and is not prompted on the credit score.

On the flip side, hard inquiries take place when the lender takes out the credit report. A lender may procure it when they are simply going through the new loan application, a new credit card, or any other line of credit. Moreover, property managers and banks can also pull out the credit report while setting up the accounts or determine the loan approval for the apartment.

But it’s worth mentioning that a hard credit inquiry may be procured without the knowledge or approval of the applicant. Also, the Fair Credit Reporting Act allows the removal of the hard inquiry report that is pulled out without the applicant’s request.

How to Dispute Multiple Inquiries on Credit Reports?

Multiple hard inquiries can drastically impact your credit score. If unauthorized or erroneous inquiries appear on your report, disputing them is crucial. Follow these steps:

Access Your Credit Report: Obtain your three-bureau report from AnnualCreditReport.com. Review the “Inquiries” section for discrepancies.

Identify Unauthorized Inquiries: Cross-reference inquiries with your financial activities. Look for duplicates or errors.

Draft Dispute Letters: Write a clear and concise dispute letter to each credit bureau, detailing why specific inquiries are invalid and requesting their removal. Use templates if needed.

Submit Evidence: Include relevant documents, such as proof of unauthorized access or identity theft reports, to support your claim.

Follow Up: Regularly check the status of your dispute. Credit bureaus are legally obligated to respond within 30 days.

Taking these steps can help you effectively dispute multiple inquiries and safeguard your credit score. Disputing multiple inquiries on your credit report is an essential step to protect your financial health.

Add Your Heading Text Here

Hard inquiries can negatively affect credit scores, accounting for up to 10% of your overall rating. Removing them—especially unauthorized ones—is an effective strategy to boost your score. Here’s how:

Review Credit Reports: Obtain and analyze your credit report regularly to spot errors or unauthorized activity early.

Demand Proof of Authorization: Creditors are required to provide evidence that you approved the inquiry. If they can’t, the inquiry must be removed.

Leverage the Fair Credit Reporting Act (FCRA): The FCRA empowers you to dispute inaccurate or unauthorized hard inquiries. File disputes with all three credit bureaus to ensure the inquiry is removed across the board.

Monitor Results: Keep track of the inquiry status and verify its removal by obtaining an updated report.

Removing hard inquiries increase credit score by reducing negative items from your report. It’s an essential strategy for improving credit profiles.

How to Remove Hard Inquiries on Credit Even if Authorized

While removing authorized inquiries is challenging, there are ways to minimize their impact:

Negotiate with Creditors: Reach out to the lender to request a goodwill removal of the inquiry, particularly if you have a strong payment history.

Reduce Future Inquiries: Limit applications for credit cards, loans, or financing to prevent an accumulation of hard inquiries. Spacing out applications over time can lessen the score impact.

Add Consumer Statements: Attach a brief statement to your credit report explaining the circumstances of inquiries. While this doesn’t remove them, it can provide context to future lenders.

Focus on Overall Score Improvement: Offset the impact of inquiries by maintaining low credit utilization, paying bills on time, and keeping long-standing accounts open.

Understanding how to remove hard inquiries, even if authorized, helps individuals better manage their credit health and achieve financial goals.

How do credit inquiries influence the credit score?

Hard inquiries can be regarded as a minor negative entry and can be counted for up to 10 percent of the credit score. While the precise effect on the credit score can alter based on the applicant’s credit history as well as present position, you may expect a drop in your overall credit score ranging between one to five.

Even though the exact hit on the credit score may vary, consumers may see your credit score dropping as they get these inquiries. Also, lenders tend to pull out the credit score mistakenly or several times, which, in turn, may affect the credit score even more.

What did you need to know about credit inquiry removal?

When an individual applies for a loan or credit, the lending company will generally ask to check the credit report. With the applicant’s permission, lenders along with other creditors will make a hard inquiry for reviewing the details of a person’s financial life.

This helps them to consider whether they will approve the application process along with the terms of the application. As is already mentioned, hard credit inquiry may cause the credit score to go down. This is one of the major reasons why one should regularly monitor the credit score and the credit report.

Multiple hard inquiries on similar lines are treated specially

Hard credit inquiry on the credit report, together with any new account that you have opened recently or the loans that you have received will be accountable for 10 percent of the FICO score. This credit score is used most commonly by creditors as well as lenders. While a hard inquiry will have a negative impact, it is just a negligible dip. According to FICO, a single hard inquiry can bring down the credit score for even less than five points.

The two most commonly used credit scoring models will not have any bad effect on the credit score for being a smart consumer who prefers to make an informed decision. For FICO, similar hard inquiries from varying lenders do not matter when they are made within a span of 30 days. This is particularly applicable when the individual is shopping for mortgages, car loans, and student loans as well. A new kind of FICO has also been available for lenders in which all similar checks made within a period of 45 days are taken into account.

It’s worthwhile to know that legitimate hard inquiries cannot be removed from the credit report by applying for the same. However, they will fade away after a span of 2 years. While it is visible on the credit report for 2 years, it can affect the credit score for the first year only.

Unauthorized hard inquiries can be a warning of ID theft

No matter if one prefers to have a DIY approach on the credit report monitoring or opt for a reliable credit monitoring service for reviewing the credit report, it is significant to watch out for any kind of unauthorized hard inquiries and take action against them without any delay. It can be a sign that the identity is robbed.

Identity thieves generally piece together all the private information adequately so that they can apply for a credit card or a loan while posing to be you. This will invariably trigger a hard inquiry on the credit report. If any of your clients has suffered from this, it’s important to contact the lending or the credit card issuing company and alert them of the fraud. You must then follow the directions to shut down the account immediately.

In many cases, the applicant may also choose to place a fraud alert on the credit report. This will make it difficult for identity thieves to open an account by posing to be you. Another way to apply protection is to freeze the credit report. With a credit freeze, a business is prevented from making any kind of inquiry. When your client will need to shop for a credit or a loan, you will have to unfreeze it to make way for the authorized hard inquiry.

How to remove credit inquiry from the credit report?

Hard inquiries may be removed from the credit history in case they have come without the applicant’s knowledge. If you do not know the hard inquiries pulled from the credit profile, then you can exercise your right to ask for credit inquiry removal in 24 hours.

For removal of the credit inquiry, the conditions are:

- When the inquiry has occurred without the applicant’s knowledge

- When the inquiry has occurred without the approval of the applicant

- When the number of credit inquiries has crossed what you expected

Hard credit removal in 24 hours is one of the fastest and most effective strategies for boosting the credit score. As a professional credit inquiry removal company, you can remove it within a span of a day. Every time you allow a business to run the credit for applying in some kind of financing in any way, an individual is likely to face credit inquiry.

Having a lot of hard credit inquiries will hurt the credit score a lot. They may even stay on the credit report for two years. So, if your users want the credit score to be in a top-notch position, you should attempt to get the credit inquiry removed at the earliest. Hard credit inquiries play a minor role if you take a look at the big picture. However, they can make a big difference based on the total number of hard inquiries one faces and their financial goals.

When you have an urgency to remove the credit inquiry, here is how you may get started:

Step #1: Getting access to 3 Bureau Credit Reports

You will find loads of credit monitoring sites on the internet that can offer you a three-bureau credit report. You must find the report that you are most at ease with and take your time in reviewing the report. You can easily access this under the section inquiries and there is nothing to worry about since you will not affect your credit score or get another hard credit inquiry for ordering 3 Bureau Credit reports.

one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com

Step #2: Getting the address for each hard credit inquiry

It’s worth noting that when you are looking for 24 hour credit inquiry removal, some websites may offer the address without paying any costs while others will not. But it’s very important to get the address in some way or the other. This step plays a critical role in starting the dispute process. If you face any difficulties in finding the address, you may try some other credit monitoring site. If all other efforts fail, you may even call the credit bureau on your own.

Step #3: Drafting a letter to all the creditors

You can also write a letter to all the creditors to remove the credit inquiries as to the soonest. According to the Fair Credit Reporting Act, only authorized inquiries to have the right to make a place in the credit report of an individual or entity. Thus, you can throw them in the face of a challenge and ask for necessary proof for permission granted for the credit inquiry. If there is no proof, then the law ensures credit inquiry removal in 24 hours.

The letter you have prepared for each of the creditors should not be very long but should contain all the necessary information. It must have a request pleading that you want all kinds of hard inquiries to be removed. Then you should mention the name of the credit bureau along with an itemized list of inquiries such as the creditor, account, and item number.

Lastly, you should request a follow-up together with a new copy of the credit report on the credit inquiry removal. If you are not sure, it is always suggested to speak to a financial professional for drafting the letter.

Step #4: Read the information thoroughly

There can be some creditors showing you that you have permitted them for the credit inquiry. But you should read it very closely and observe the documents very carefully. This is because, many a time, you can find some wrong and irrelevant information furnished by the company.

If you see that this is the case with your client, you should be firm and fight for what you know the truth is. You should try to establish your point and even if they are not ready to give in, then you can let them know that you will connect with the State Banking Commission for help. Make sure that you are sending the email via certified mail ID so that you will come to know as they receive it.

They tend to ignore the emails they receive, and when they do this, you will have better chances of getting your inquiry removed at the earliest. Also, our software is equipped with letters that comes in handy when disputing for your clients.

Note that removal of credit inquiry stemming from an application that one has genuinely made will not be possible in any way. Credit bureaus do have the right for reporting accurate information within the established credit reporting tenure limit. It is not feasible to remove credit inquiry just because your client has thought to opt-out of a new line of credit or they prefer not to face an inquiry in that respect.

But thankfully, hard inquiries are not something that you need to worry a lot about. They may affect the credit score but that’s not the only deciding factor. And if you can manage to restrict the number of hard inquiries on the report by reducing the number of credit card applications in a one-year time frame.

Also, you should consider sending the credit inquiry removal letter online. This method is way faster than sending through registered posts and also lets you track the dispute proceedings in real-time. You can expect to hear from them and get the unauthorized inquiry removed within a day.

Why does hard inquiry matter for the lender?

Inquiries serve to be a doorway to reveal important information about the borrower, such as whether they have been looking for credit recently. Thus, prospective creditors may attempt to predict if the borrower has taken on other debt that may make it even more difficult to pay the credit that you are going to apply for.

As per the reports of FICO, applicants having more than 5 inquiries on the credit report have eight times higher chances of declaring bankruptcy compared to those without any inquiry. This is the reason why most companies regard hard inquiries posed in the last one year while calculating the credit score. And also why lending institutions take them into account while making decisions in credit extension. Thus, you should not take chances and opt for 24 hour credit inquiry removal.

A credit repair company can effortlessly remove the hard credit inquiry from the credit history of an applicant, but it can only be removed when it results from fraud. Filing a dispute shouldn’t have any negative impact on the credit report in an ideal condition. The effect of challenging an inquiry may lead to a number of results, such as deletion of inquiry, upholding it, or even pushing it towards a fraud alert on the account.

When the challenge is denied, the hard credit pull will continue to loom large on the credit history. However, it will not bring any further damage to the existing credit account beyond what you have gone through as it first appeared. But if you have denied many disputed pulls on one account, the credit bureau may decide to remove the account from the list. And this can have a negative impact on the credit score:

- When an account is removed from the list, it won’t be able to support the credit score in any way. This could be a bad thing if that account is running for a long time. In such a scenario, the mean age of all the accounts will automatically come down. The duration of the credit history makes up 15 percent of the credit score. Thus, delisting the account is likely to have quite an impact on the applicant’s credit score.

- Many hard credit pull disputes could be indicative of identity theft. The credit bureau may issue a fraud alert on the credit history but it is likely that you are going to request for one. This would instigate third parties to take additional measures for verification of identity before granting a new credit or loan. You are liable to keep this alert posed for up to 7 years.

The Bottom Line for credit inquiry removal in 24 hour

When looking to improve the credit score or remove credit inquiry, the process can be just very time-invasive. As a business trying to help the consumers, you cannot afford to take any shortcuts and take the right course of action for credit inquiry removal in 24 hours.

Following the mentioned tips will not remove the credit inquiry right away or boost the credit score anyway. But over time, the overall finance will improve and you can better guide your consumers in managing their credit score and credit inquiry removal.

Several financial institutions, real estate agencies and also, prospective employers use credit scores for making a final decision. Thus, you should be ever ready to help your clients come out of this terrible situation. Our professionals will work with you while our software will offer ample support for you to assist your consumers and build a strong reputation in the market.