The American financial system for both businesses and individuals is built on the foundation of credit, which means it’s something that business owners can’t really avoid. It’s absolutely important to understand the different types of business credit available to your business clients and how their scores reflect their standing as a business.

This blog serves as a complete guide to understanding all there is to know about business credit, including what it is, how to improve it, and what you can do as a credit repair specialist to help your commercial clients:

Understanding the Basics: What is a business credit score?

A business credit score is essentially a reflection of a business’s creditworthiness. It provides an overview of a company’s credit history and utilization, offering insight into its performance, repayments, and other financial indicators that affect its professional relationship with your company. It’s something that all businesses have and should be improving because it plays a significant role in how relevant parties view a company.

A credit score for businesses helps lenders, clients, partners, and other parties see how likely you are to make timely payments, turnover, profits, and other valuable information for your collaborators and your internal processes alike. It essentially minimizes risk assessments for your business so that you’re able to secure better loans and deals, including mortgages, assets, and other transactions successfully.

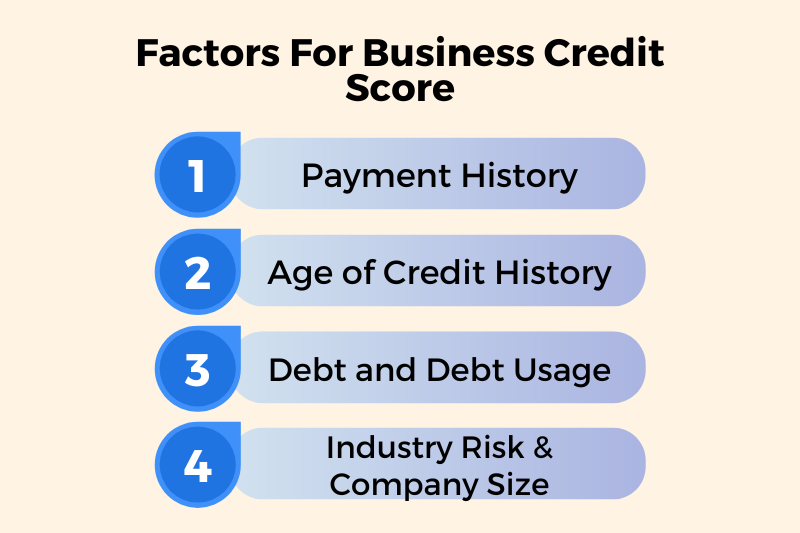

What gets factored into a business’s credit score?

Business credit scores are incredibly cohesive and reflect a wide range of factors, including the age of the business, bankruptcy claims, repayment efficiency, legal claims and filings, derogatory marks, and tax liens, among other things.

It’s a detailed document that provides you and your lenders with a clear overview of your company’s financial performance and credit history, with a rating and score that reflect your performance through it.

Additionally, the score also reflects and estimates your business assets’ collateral value, performance indicators, and even personal credit scores if the business is owner-run and operated. Depending on the bureau where the score is generated from, you’ll see a different set of factors that are accounted for in the process. Business credit scores are also generated by the Big 3, namely Experian, Equifax, and Dun & Bradstreet, which have separate systems for rating and calculation.

That’s also why you’re likely to see differences in the breakdown and scores generated from the process. A credit score for any business can look very different from one agency to the next, which is quite different from how personal scores work. So it may help to get reports from all three bureaus to get a more accurate assessment of where a business stands at present.

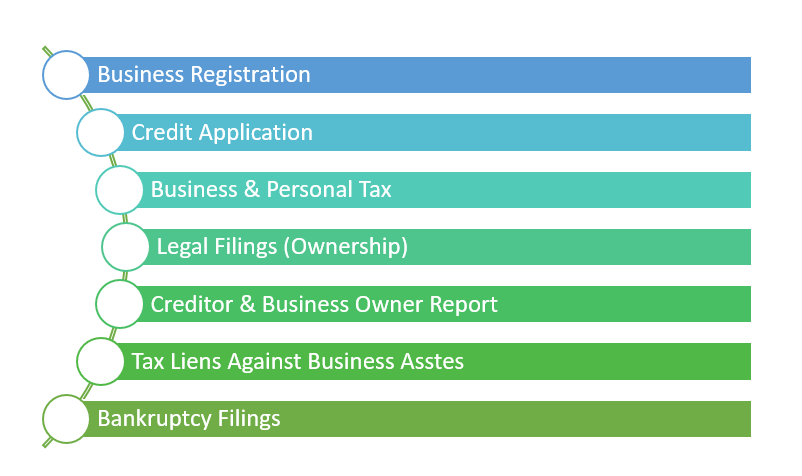

What gets listed on a business’s credit report?

As mentioned above, business credit reports factor in a wide range of variables to generate and provide the scores that they do. However, they also share an exhaustive breakdown of everything that goes inside them, listing multiple transactions and financial activities, including the following:

- Business registration proof that legitimizes ownership offer legal and valid operations and, of course, the length of operation and incorporation

- Credit applications that outline all major credit that you’ve applied for, have secured and are in the process of obtaining better insight into your borrowing history

- Business and personal tax filings, especially in the case of owner-controlled or small businesses, where taxation may overlap

- Legal filings that reflect any changes to ownership, operations, or other claims and contentions that have been filed in a court of law will also be listed on a score report

- Creditor and business owner reports which list the potential exchange of cash flow and payments between a business and its lenders, including outstanding dues and unpaid installments, defaulted payments, and possible refunds that are underway

- Tax liens are filed by the government against a business’s assets or property and are an essential marker of your client’s ability to pay on time, allowing lenders and creditors to examine the effects more closely

- Bankruptcy filings are another major listing on a business credit report because they affect the score quite significantly, indicating whether a business can be trusted with a new loan or not.

How are business credit scores used and applied?

Business credit scores are typically used when applying for loans, grants, assets or other types of exchanges. They play a major role in securing partnerships and investments for businesses too, and so as a credit repair expert, you need to help your clients improve their credit scores.

Some of the many ways that scores are used in business exchanges are quite interesting, given that other businesses and creditors will review a score or report before signing your client on as a client, investing in their business, or following through on any kind of partnership with them.

For instance, if your client requires new equipment or materials for their business, suppliers may be wary of giving them to them or charge higher markups and interest rates on their installment plans based on the score alone. Some may refuse service based on what the report and score indicate, i.e. late or missed payments, poor financial history, and various financial failures, making it all the more imperative to help your clients turn things around.

Simply put, a business credit score allows different businesses and lenders along the supply chain to perform a risk assessment and determine their terms of service.

Other situations where business credit becomes vital determinants include dealing with banks and private lenders, refinancing loans, securing properties where they’ll set up offices and other workplaces, and generally starting a line of credit. It can hurt a business quite a lot to have a poor credit score that drags down their ability to secure what’s necessary for their growth.

Why are business credit scores important and useful?

A good business credit score basically shows good financial health for a company, making it easier to secure different loans, insurance, grants, and deals. Lenders and partners alike are likely to trust a business with a better score because there isn’t always time, money, or trust to take that kind of risk.

This is especially true for small businesses trying to get more money in and build a stronger corporate presence, since many larger corporations, wholesalers, and suppliers, and governmental bodies will be able to get a better idea of your client’s ability to make payments, pay bills, and stick to schedules.

In fact, the stronger a business’s credit score, the more beneficial it is to their financial health in the future, too, given that they’ll enjoy lower insurance premiums, interest rates on loans and enjoy more flexible terms for repayment as well. For many small business owners, it also offers the unique stability to sign on to a loan or take on debt without jeopardizing personal assets such as homes, vehicles, and other forms of collateral.

It’s a pretty solid win-win situation for them and is definitely important to work on as a credit repair specialist.

Key differences between business and personal scores

There are some key differences between personal and business credit scores, which are important for business owners and credit repair experts to know.

Firstly, personal credit reports are quite easy to acquire and typically free, but business credit reports need to be paid for to be accessed. The former is also more private, while the latter is considered public information that is accessible to third parties such as investors. While personal credit scores tend to be quite uniform across all bureaus, business credit scores are not.

That’s why having a clear idea of a business’s financial health is about more than looking at one or two figures–it’s more comprehensive.

The importance of monitoring business credit scores

Knowing a credit score isn’t enough–it’s also necessary to monitor major changes and make financial decisions that reflect positively on them. For instance, as a credit repair consultant, you will be able to nudge your business clients in a more financially healthy direction, such as forming mutually beneficial partnerships, avoiding fraudulent situations, and rectifying incorrect negative items on their reports.

These are very valuable to the growth of any business, big or small, and you can steer your clients in the most financially responsible direction. Since a business credit report shares comprehensive details about major financial decisions and activities, it makes sense to strategize for the long run.

The better designed the strategy, the less risk there is of hurting the score overall. It’s preventative in its approach too.

Ways to improve your business’s credit score:

As for improving the score, there are certain proven strategies that businesses can use, and as a consultant or agent, you can choose which ones are most relevant to your client’s industry, requirements and issues. For instance, a client who has a history of non-payment will have different needs from a client dealing with inadequate funding, even though both factors affect the score in similar ways.

When trying to build a credit repair strategy for them, here are certain things that you should know and apply:

Check the accuracy of all listings

Any credit repair expert knows to prioritize this, and it holds true for business listings. You need to ensure that all charges and items on your clients’ credit reports are accurate, up-to-date, and not harming their scores.

Ensure that clients are making timely payments

However, you should also make sure that clients understand how crucial it is to make timely payments and strategize their financial obligations, so they’re streamlined more effectively. This is non-negotiable because there’s only so much you can do–poor financial habits will always drag their score back down.

Address legal claims and actions first

When correcting inaccurate or negative items on your clients’ reports, you should encourage them to address all legal claims and actions first and foremost. That means looking at possible tax liens, foreclosures, or other county or state-sanctioned issues before moving on to private lenders and accounts.

This also means filing their accounts on time before deadlines are up to ensure that there are no unnecessary delays or causes for concern, such as possible charges of tax evasion.

Recommend that they apply for less credit

Having a line of credit is very important for businesses but doing so unnecessarily hurts them more than anything. Ask your clients to apply for less credit and focus on managing the debt they already have in order to avoid missed payments and issues with their creditors. It’s not possible to run on debt and credit alone, especially in the long run, and so effective management is key.

As you begin working as a credit repair specialist or start your very own business, you must familiarize yourself with the variety of commercial financing options available for your clients. Helping other businesses improve their credit and financing is an important part of the job, and the more you educate yourself, the easier it gets to offer comprehensive services.

MC Credit Solutions LLC offers you the exciting opportunity to improve your business practices and upgrade your skills as a credit repair specialist or agency, with their extensive range of credit repair training modules and certifications.