Have you ever wondered why some credit repair businesses grow fast while others stay stuck managing a few clients? The difference often comes down to credit repair business automation.

When you start using an automated credit repair business system, you save time, handle more clients, and focus on results instead of repetitive work.

Many credit repair entrepreneurs begin as side hustlers, helping clients after their regular jobs. Turning that side hustle into a full-time business takes more than effort. It takes structure, consistency, and tools that work for you even when you are away from your desk. That is where automated credit repair software and AI credit repair software become essential.

Doing everything manually, from writing dispute letters to tracking updates, limits your growth. Automation software for credit repair removes that bottleneck. It helps you organize your work, serve more clients, and deliver faster results.

By the end, you will understand how credit repair automation services can help you grow faster, work smarter, and achieve steady progress in your business.

Key Takeaways:

- Credit repair automation reduces manual work by handling disputes, tracking deadlines, and managing client updates automatically. You spend less time on admin tasks and more time on results.

- Automated credit repair systems allow you to manage significantly more clients without adding staff. Many businesses increase capacity by three to five times using structured workflows.

- AI credit repair software improves accuracy by scanning reports, flagging errors, and applying consistent dispute rules across every client file.

- Automation strengthens compliance by logging actions, tracking timelines, and maintaining clear records required under CROA, FCRA, and FTC guidelines.

- Credit repair automation does not replace your expertise. It executes your processes at scale while you control strategy, review outcomes, and guide client decisions.

Start Today and Explore the Features Firsthand!

Streamline Credit Repair: Time-Saving Tips for Your Business

The key to success in the credit repair industry lies in efficiency. By streamlining credit repair processes, you can take on more clients and grow your business exponentially. Credit repair automation is the secret weapon that can help you achieve this goal.

Start by identifying the most repetitive and time-consuming tasks in your business. These might include:

- Collecting client information and documents

- Drafting dispute letters to credit bureaus and creditors

- Tracking client progress and sending updates

- Generating reports and invoices

Once you’ve identified these tasks, look for automation software for credit repair that can handle them for you. With the right tools in place, you can significantly reduce the time and effort required to manage each client’s case.

The Evolution of Automated Credit Repair Software

The credit repair industry has undergone a dramatic transformation with the advent of automated credit repair software. Modern technology solutions have revolutionized how professionals handle credit disputes and client management.

The integration of artificial intelligence with traditional credit repair processes has created unprecedented opportunities for business growth and efficiency improvement. These innovations continue to shape how credit repair agencies operate and serve their clients.

Understanding Modern Credit Repair Automation Systems

Modern credit repair automation systems combine software with AI-based analysis to handle disputes at scale. These platforms review credit reports, flag errors, and guide dispute actions with consistency.

You manage clients faster and with fewer manual steps. Credit repair CRM tools now centralize client data, dispute tracking, and document flow in one place.

These systems continue to improve as technology advances. You gain better control over workflows and clearer visibility into results. Integrated tools connect reporting, disputes, and client communication without extra steps. This structure supports steady growth and stronger service delivery.

Start Today and Explore the Features Firsthand!

Using AI-Based Credit Repair Solutions

AI-powered credit repair tools change how disputes move through the process. Algorithms scan reports, detect inaccuracies, and recommend dispute paths based on prior outcomes. You reduce guesswork and follow repeatable processes that scale. Automated systems apply the same rules to every case, which keeps results consistent.

Workflow tools reduce manual input and cut processing time. AI systems review past disputes to adjust future actions. You see trends in approvals, rejections, and bureau behavior. Built-in reporting shows which dispute types perform best. Over time, the system improves accuracy and predictability.

The Role of Machine Learning in Fixing Credit with AI

Machine learning enables AI-powered credit repair software to analyze your credit history, identify errors, and recommend personalized solutions.

These AI-driven systems scan credit reports in seconds, pinpointing inaccuracies that might take humans days or even weeks to detect.

By leveraging massive datasets and predictive analytics, AI can determine the most effective dispute strategies, ensuring faster resolutions with credit bureaus.

This eliminates human error and speeds up dispute resolutions, giving users a more efficient, automated, and precise approach to improving their credit scores.

Additionally, AI continuously learns from past credit trends, allowing it to offer customized financial advice and credit-building recommendations tailored to an individual’s unique financial situation.

Building an Automated Credit Repair Business

Establishing an automated credit repair business requires strategic planning and technology selection for optimal results. Modern credit repair CRM platforms form the foundation of efficient operations for sustainable growth. The right automated credit repair software enables scalable growth while maintaining service quality.

Integration of various technological components creates a comprehensive solution that positions businesses for success. The implementation of proper systems from the start prevents costly transitions later.

Start Today and Explore the Features Firsthand!

Implementing Credit Repair Automation Tools

Effective credit repair automation improves operational efficiency and accuracy in dispute processing. Best AI credit repair solutions reduce manual intervention requirements while maintaining quality standards. Integration with credit repair CRM systems ensures seamless workflows and data consistency.

Advanced platforms automate routine tasks and communications to improve productivity. Client satisfaction increases with faster dispute resolution and better outcomes. The automation of repetitive tasks allows staff to focus on strategic activities.

These systems provide comprehensive tracking and reporting capabilities for better management oversight.

Workflow Automation and Task Management

Modern automated credit repair software transforms daily operational workflows. Credit repair automation eliminates repetitive manual tasks while maintaining accuracy. Credit repair CRM integration ensures smooth task transitions between team members. The automation of routine processes allows staff to focus on strategic activities and complex cases.

Task Prioritization and Assignment

Leading best AI credit repair platforms include intelligent task management systems. Credit repair automation tools automatically prioritize disputes based on success probability.

Automated credit repair business operations benefit from smart workload distribution. The system assigns tasks based on staff expertise and availability.

Free AI credit repair trials demonstrate basic task management capabilities. Advanced analytics help optimize task allocation for maximum efficiency.

Deadline Tracking and Compliance

Advanced credit repair CRM systems maintain automated deadline tracking. Automated credit repair software ensures timely submission of disputes and responses. Best AI credit repair platforms include built-in compliance monitoring.

The system generates alerts for approaching deadlines automatically. Comprehensive tracking prevents missed deadlines and maintains compliance. Regular reports highlight workflow efficiency and potential bottlenecks.

Enhance Client Communication Through Credit Repair Automation

Effective client communication is crucial for success in the credit repair industry. Modern credit repair automation systems transform how businesses interact with clients, ensuring consistent, timely, and relevant communications.

The right automation tools can significantly improve client satisfaction and retention rates while reducing the workload on your team.

Automating Your Credit Repair Business Communications

Implementing automation in your client communication strategy revolutionizes how you stay connected with clients. The system automatically generates progress updates, milestone notifications, and important reminders based on client account activity. Smart scheduling features ensure communications are sent at optimal times for maximum engagement.

Regular automated check-ins help maintain client engagement throughout the repair process. These automated touches complement personal communications from your team, creating a comprehensive communication strategy.

Start Today and Explore the Features Firsthand!

Credit Repair Dispute Software with Automations

The latest credit repair dispute software with automations includes sophisticated client update features that keep customers informed and engaged. These systems can automatically generate and send detailed progress reports showing dispute statuses and credit score changes.

Automated alerts notify clients about important developments or required actions in real-time. The software can customize communication frequency and content based on client preferences and account status. These automated updates help maintain transparency and build trust with clients.

Client Dispute Manager in Credit Repair Dispute Software with Automation

Modern credit repair dispute software with automations includes sophisticated dispute management systems that streamline the entire dispute process from initiation to resolution. These advanced tools integrate seamlessly with the best automation tools for credit repair services to provide a comprehensive dispute tracking and management solution.

When you automate your credit repair business, the dispute manager becomes your central hub for monitoring and managing all client disputes across multiple credit bureaus. The system automatically tracks dispute statuses, deadlines, and bureau responses while maintaining detailed records of all communications.

Professional dispute management features help maintain organization and ensure no disputes fall through the cracks.

Key Features of Client Dispute Manager Software

- Dispute Automation: The software automatically generates dispute letters, allowing you to address multiple client issues quickly. This is essential for businesses handling large client volumes.

- Client Management: With built-in CRM features, Client Dispute Manager Software helps businesses keep track of client interactions, credit report changes, and dispute statuses. This makes managing multiple clients easier and more organized.

- Progress Tracking: The platform offers real-time tracking and reporting, so both you and your clients can monitor the progress of disputes as they move through the process. Clients can also receive updates on credit score changes.

- Customization and Scalability: Whether you’re a small business or looking to scale, Client Dispute Manager Software can grow with you. It offers customizable templates and tools that fit businesses of various sizes.

Start Today and Explore the Features Firsthand!

Ensure Compliance with Automated Systems

When you automate your credit repair business, compliance becomes more manageable and reliable. The system automatically tracks and enforces compliance requirements across all operations. Built-in checks ensure all communications and disputes follow regulatory guidelines.

Automated record-keeping maintains comprehensive audit trails for all activities. These features provide peace of mind while reducing the burden of compliance management.

Building Growth with Automated Systems

Implementing comprehensive automation creates a foundation for sustainable growth. The system streamlines operations allowing your team to handle larger client volumes efficiently.

Automated task distribution ensures balanced workloads as your team expands. Integration capabilities support adding new tools and services as needed. These features enable strategic growth while maintaining operational efficiency.

Remember that successful implementation of credit repair automation requires careful planning and ongoing optimization. Start with the features that will have the most immediate impact on your operations, then gradually expand your automation capabilities as your team becomes more comfortable with the technology.

Regular training and updates ensure you continue to maximize the benefits of your automation investment.

What Is Credit Repair Automation And How Does It Work?

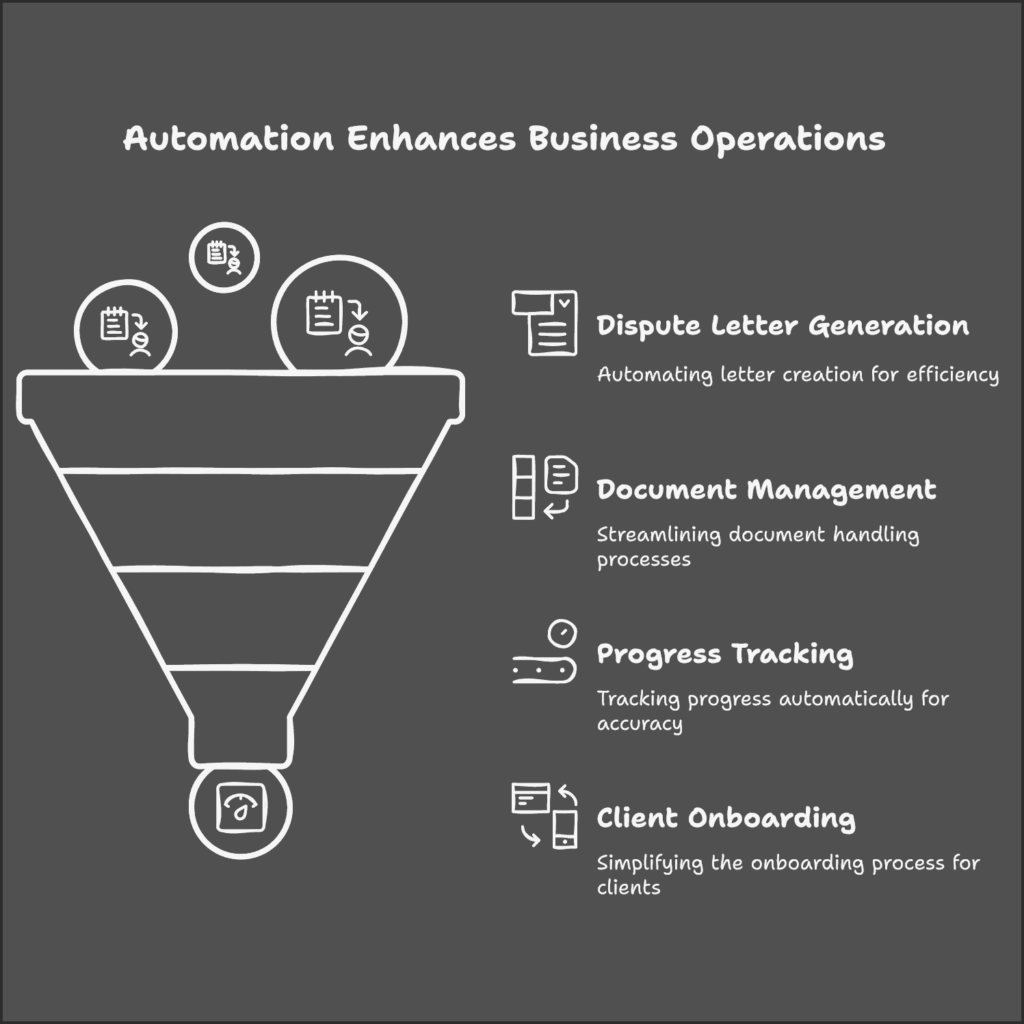

Credit repair automation uses structured software systems to manage repeatable credit repair tasks. These systems collect client data, organize credit reports, generate dispute letters, track deadlines, and log bureau responses.

Advanced platforms use rule-based logic and AI-assisted analysis to flag potential inaccuracies. You still control strategy and review actions, but the system executes tasks consistently and at scale.

Can Credit Repair Automation Help You Handle More Clients Without Hiring Staff?

Yes. Automation reduces the time spent per client by standardizing workflows. Businesses often move from managing 20 to 30 clients manually to managing 100 or more with automation in place.

Intake, disputes, tracking, and reporting run in parallel instead of one at a time. This allows you to increase capacity without adding staff or extending work hours.

Start Today and Explore the Features Firsthand!

Is AI Credit Repair Software Allowed Under Credit Repair Laws?

AI credit repair software is allowed when used within CROA, FCRA, and FTC guidelines. The software must not promise results, misrepresent outcomes, or collect payment before services are performed.

Compliance depends on proper setup, disclosures, and usage. Automation supports lawful processes, but responsibility for compliance always remains with the business owner.

Which Tasks Should You Automate First In A Credit Repair Business?

You should automate tasks that occur daily and follow a repeat pattern. Client onboarding forms, credit report imports, dispute letter creation, deadline tracking, and progress notifications deliver the highest return.

Automating these steps typically reduces administrative workload by 40 to 60 percent within the first few weeks.

Conclusion

The implementation of credit repair automation has become more than just a competitive advantage it’s now a necessity for sustainable business growth in the credit repair industry.

As we’ve explored throughout this guide, the best automation tools for credit repair services can transform every aspect of your operations, from client onboarding to dispute management and compliance.

When you decide to automate your credit repair business, you’re investing in your company’s future. The right automation tools not only streamline current operations but also create a foundation for scalable growth.

The best automation tools for credit repair businesses provide the infrastructure needed to handle increasing client volumes while maintaining service quality and compliance standards.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: