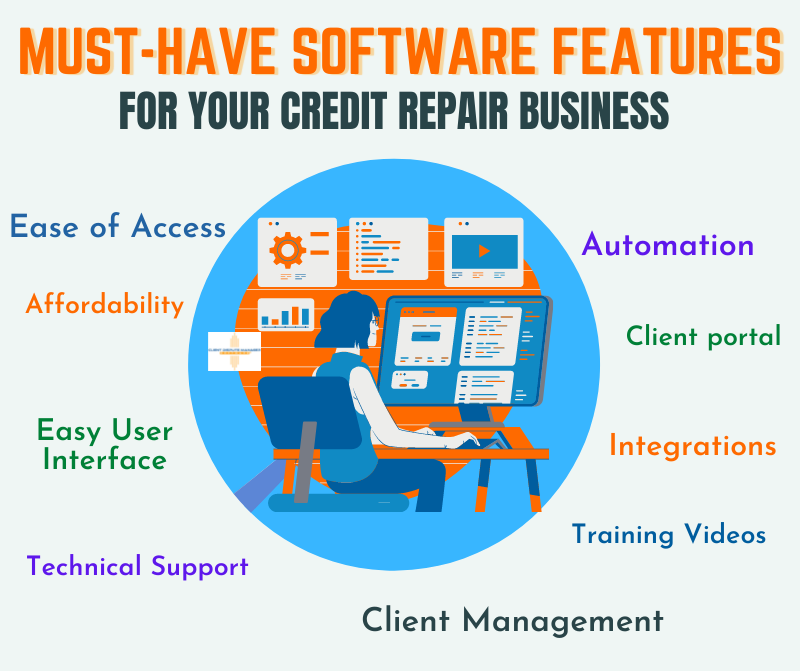

Let’s talk about the different must-have features of an efficient credit repair software for business. First, we say “must-have” because the life cycle of a feature of any specialized platform largely depends on clients’ feedback. By that, we mean their satisfaction on how their needs are being met or not. The more useful the features are, the more they draw users.

Second, we say “efficient” because we understand that just like any business software, your system must be capable and adaptable according to the needs of the industry in general. So, your credit repair software must be updated and streamlined. Just like an assistant that works for you 24/7, never gets tired, and ready to accommodate and process your needs in a zap.

Keep reading as we will give you the ultimate guide on how to choose the best credit repair software for business.

Must-Have Features for Your Credit Repair Software and Their Benefits

A credit repair software for business must have the following features that way it will give you value for your money:

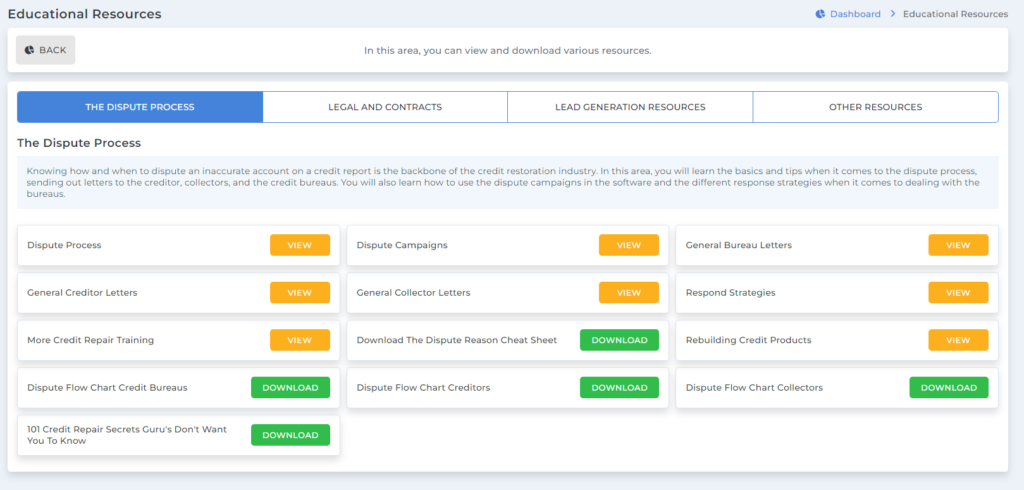

1. Training for Ease and Confidence When Starting Out

Needless to say, any skill or service offered, along with the business side, needs expertise and experience. This takes time and effort to acquire, as this also holds for the business of repairing credit. Your credit repair software for business must have resources to guide you on managing a start-up. A good credit repair software will give you valuable options right from the get-go, as it should at least contain the following:

Credit Business Training Videos that You Can Access Anytime, Anywhere.

Apart from your own experience of repairing credit (if you haven’t already), you get to learn the ins and outs of the credit repair service industry in a shorter period by accessing business training videos right from your credit repair software. This is so that you can confidently conduct your business by knowing the basics through qualified training already connected with the platform.

Credit Dispute Training

Your software must also have the resources to immediately get to the “meat” of the problem. With training, you learn how to read, analyze, and interpret credit reports that lead to the submission of proper disputes that bring in results. In essence, you are getting the necessary training for the credit repair process itself, which is the core of your business.

Remember, a good dispute resolution is all there is for you and your clients. With training, you may confidently represent and guide them through the whole process.

Software Training

Your system must have ready-access training videos on operating and managing it. Allow your software to teach you step-by-step how to work the platform and use its features. Be wary of software that doesn’t teach you how to use it and makes you work for it instead. If that is your case, maybe it’s time to look for another provider.

2. Speed and Automation

In today’s hyper online state of businesses, speedy and efficient automation is all the rage. The faster, the better:

Credit Repair Software for Business will Auto-Sign Up Your Client

Suppose it’s the middle of the night, and it’s outside of daytime business hours. And a prospective client who is convinced by your website wants to sign up. No problem. You can let your system assist them in signing up automatically, which can easily be completed in 15 minutes.

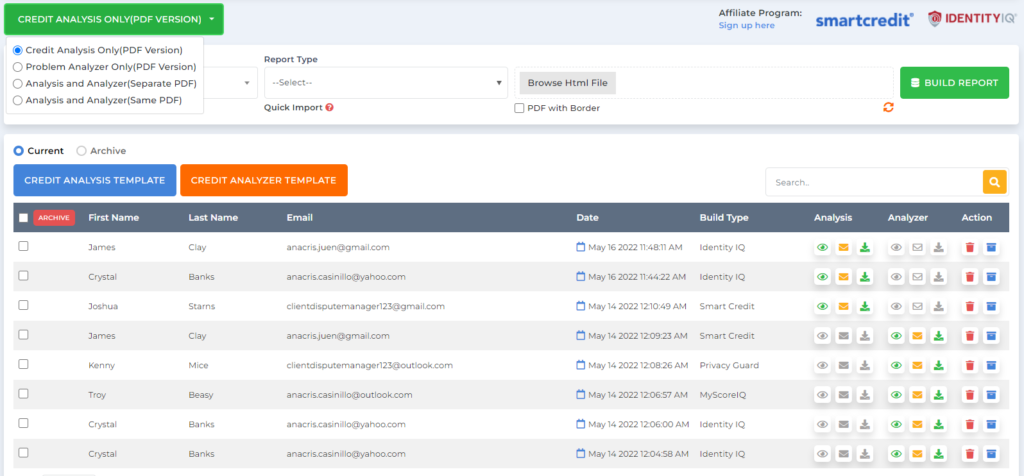

Automatically Input and Process Your Client’s Initial information

Your system may quickly import Identity IQ, Smart Credit, and Privacy Guard Credit reports without having to log on to the credit monitoring sites.

Credit Repair Software for Business Can Auto-Analyze Credit Status

As an owner of a credit repair company, you will be dealing with more than a hundred clients per month; this depends on how long you have been in operation. Processing and writing disputes for every case is a semi-repetitive task that fortunately has been already ported over to automated systems like The Client Dispute Manager Software.

No more spending hours of your time preparing dispute letters for your clients. Your software should be able to write a custom letter in just a few clicks. Now, that’s what you call “time difference.” This kind of speedy resolution exponentially accelerates productivity. It also frees up most of your time for marketing and communication.

Doing all of the writing and sending could take forever. Just like all financial markets, we say time is money. So, if you could save time by using specialized software, finding a good one nowadays could be your best option.

How Fast Can Your System Process Initial Information?

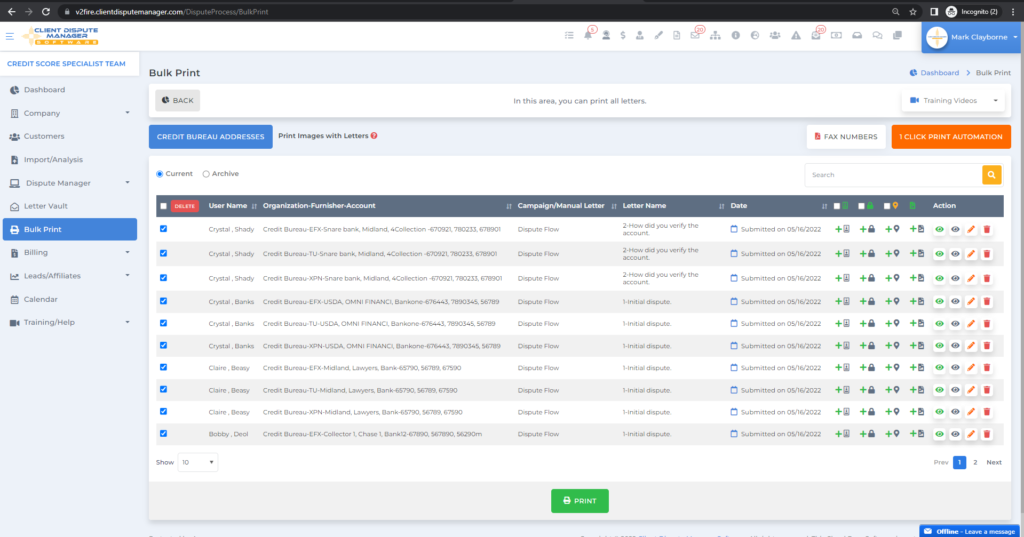

In addition to that, your system may even dispute several accounts at the same time using letter templates that can be customized within the system. On top of that a software should be able to print all your dispute letters for you and your clients at any one time.

Your system may read into the details of the extracted information and build a credit audit report in less than a minute. After which, it may detect inconsistencies and, create a report about it as well.

What Other Core Features Should a Credit Repair Software for Business Have?

- Communicate and send text messages directly from the system

- Integrations with other platforms and tools through Zapier

- Automatic Sending of Disputes

- Bulk Mail Sending Feature without going to the post office

- In-system email campaigns to nurture clients to prevent cancellations

- Bulk printing

- Employee Management and Outsourcing

- 24/7 Availability of Client Portal

What Are the Direct Benefits of Automation Tools in the Core Features of a Credit Repair Software?

- It can run credit reports quickly.

- It uses integrations for client management and follow-ups

- Provides you calendar alerts and notifications

- Helps you easily track dispute letters and results.

- Keeps you and your clients abreast through a progress tracker.

- Useful tools integrated into it for your business management.

- You can do efficient client follow-up due to organized data files.

3. Credit Repair Software with Efficient Client Management System

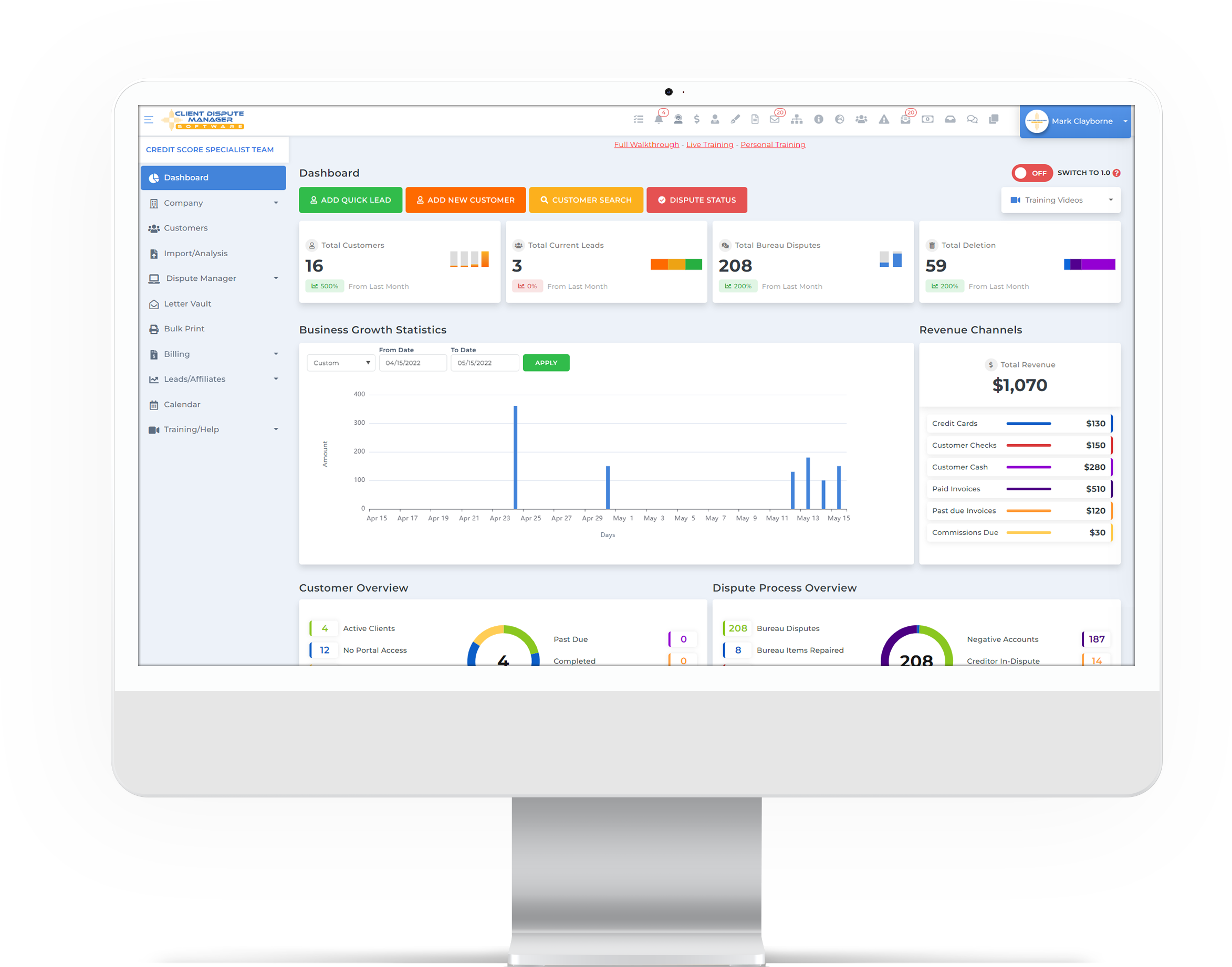

After pulling in your leads and converting them into active clients, your next move must be to assist them properly and help them succeed. This way, you give and get more of the same value for your business. Your system must have a user-friendly dashboard that not only presents the data in a clear and organized manner but must also function as an interface to make necessary changes and fine-tune areas that need some improvements:

Your client management system should include:

- Quick search and fast loading of client files and relevant data.

- Monitoring of client status such as “Active,” “Completed,” “Pending,” and so forth.

- Viewing and automatic notification for financial management.

- Leave important notes to specific clients

- Automatic Credit Score Improvement Notification

4. Lead Generation Training

Similar to all other online businesses, credit repair not only accepts clients but is also actively looking for them too. Online Marketing is a burgeoning industry increasingly becoming a standard for all businesses. Your software may at least provide you with training on generating leads and ultimately converting them into active clients for you to assist and nurture.

How-to’s on how to use platforms like Facebook, YouTube, on-website design, working with affiliates, and even how landing pages are created may be included as part of a training. Take care to ensure the growth of your business by actively generating leads while minding your current base.

5. Affordability

Nowadays, it is no longer wise to scrimp and scrape on your investment regarding software systems that can’t potentially boost your business. Sometimes, too cheap software could have you spending more time troubleshooting than profiting from your business, and that’s not good.

Neither should you be buying one with a price too high on a service that is not proportional to what you paid for.

We suggest that you may want to do your due diligence when deciding what brand of credit repair software you will use. Always choose one with a good trust rating, is relatively popular, and has the value for your money when it comes to features.

6. Credit Repair Software With User-Friendly Interface

As technology advances, the term user-friendly is now slowly disappearing as SaaS platforms become more and more intuitive, in so much that ease of use is already considered a standard for most platforms today. There is no more excuse for outdated, hazy, and clunky software that could bog you down while trying to grow your business.

It is pretty simple. You may do some research on true testimonials and authenticated customer feedback. It should give you some clues on how easy or hard it is to use your prospective software.

7. Affiliate Management

Affiliate management, by estimates, already constitutes 1/4 of the lifeblood of business’ growth. Having a software with a tool already integrated into it, and helps manage your affiliates’ processes, will ultimately lead to the expansion and the organic growth of your client base. Your software should also have an affiliate portal to keep your associates abreast with developments and other affiliate marketing strategies that you or they can create for your service.

The portal will also foster a community atmosphere that will further bond your business to the potential growth that only an affiliate partnership can offer.

8. Support Right When You Need It

Being able to talk to someone live is not only a much better experience for you client but is also a great avenue to nurture and grow your business with less stress. You get the help you need when you need it. It will also put you at ease knowing that someone will be there if you face challenges when using the system or teach you how to maximize its use.

The Client Dispute Manager Software includes dedicated real-time support for your credit repair business. You can contact us through phone, email, and one-on-one training (if you need it) to better understand the system. That being said, it’s also unlikely you will get this support feature even from any one of our best competitors.

Final Thoughts on Credit Repair Software for Business

At this point, you may have already realized that having the right credit repair software is necessary for your business. This way, you can start out competitive and stay competitive. The Client Dispute Manager Software team is dedicated to providing you with tools that spell the difference between merely turning up a profit versus rendering quality and efficient credit repair service.

Our business is to help you grow and establish a scalable enterprise with a loyal base. Take advantage of our credit repair software free trial. No credit card is needed. Use it for free for 30 days to experience and enjoy its benefits. Or you can call us today and let one of our dedicated experts show you more of what our system can do for you. And if you prefer, we can build one for you instead.

All the best!