Picture this: You’re about to apply for your dream home, but you’re worried about those pesky inquiries on your credit report. You’ve heard that they can drag down your credit score and hinder your chances of getting approved for a mortgage.

As a credit repair specialist, I’ve seen this scenario play out countless times. But here’s the good news – you have the power to remove hard inquiries and boost your credit score in just 24 hours.

In this ultimate guide, I’ll walk you through a detailed, step-by-step plan to remove inquiries in 24 hours. Whether you’re an entrepreneur looking to secure funding for your business or an individual striving for financial freedom, this guide will empower you to take control of your credit health.

Start Today and Explore the Features Firsthand!

The Science Behind Hard Inquiries

Before diving into the steps, it’s essential to grasp what hard inquiries are and their effect on your credit score. These occur when lenders assess your creditworthiness for credit cards, loans, or mortgages.

A single hard inquiry may slightly lower your score, but multiple ones in a short span can be detrimental. They signal potential financial distress to lenders, likely leading to higher interest rates or rejected applications.

However, not all inquiries are harmful. Soft inquiries, like pre-approved offers or your own credit report checks, don’t affect your score. It’s the hard inquiries that demand attention.

Step 1: Review Your Credit Report for Unauthorized Inquiries

The first step in removing hard inquiries fast is to get a clear picture of your credit landscape. You’re entitled to one free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion every 12 months. Visit AnnualCreditReport.com to claim yours.

Once you have your reports in hand, put on your detective hat and scrutinize them for any unauthorized or unfamiliar inquiries. These could be inquiries you didn’t initiate or ones that you don’t recognize. Highlight these entries, as they’ll be the focus of your dispute efforts.

Common Examples of Unauthorized Inquiries

- Identity Theft: If someone has stolen your personal information and applied for credit in your name, you may see inquiries you didn’t authorize.

- Creditor Errors: Sometimes, creditors make mistakes and pull your credit report without a valid reason or confuse you with someone else.

- Prescreen offers: If you didn’t opt-out of prescreen credit offers, you may see inquiries from lenders you’ve never contacted.

Start Today and Explore the Features Firsthand!

Step 2: Dispute Unauthorized Inquiries with the Credit Bureaus

Now that you’ve identified the unauthorized inquiries, it’s time to take action and remove inquiries in 24 hours. Your weapon of choice? The dispute process.

You can dispute unauthorized inquiries directly with the credit bureaus online, by phone, or via mail. While all three methods can be effective, I recommend using certified mail with return receipt requested. This provides a paper trail and proof of delivery, which can be valuable if you need to escalate your case.

Here’s a step-by-step breakdown of the dispute process:

- Gather Evidence: Collect any documentation that supports your claim, such as proof that you didn’t authorize the inquiry or that the creditor made an error. This could include emails, letters, or screenshots.

- Draft a Dispute Letter: Clearly identify the inquiries you’re disputing and explain why they’re unauthorized. Use a professional and factual tone, and include copies of your supporting evidence. Get Guide to Factual Dispute Letter: 5 Steps to Get Results

- Submit Your Dispute: Send your dispute letter and evidence to the credit bureau via certified mail with return receipt requested. This ensures that you have proof of delivery and a timeline for their response.

- Wait For a Response: The credit bureau has 30 days to investigate your dispute and provide a response. However, many bureaus prioritize disputes and can remove inquiries in 24 hours, especially for straightforward cases.

If the credit bureau finds that the inquiry is indeed unauthorized, they’ll remove it from your credit report and notify the other bureaus to do the same. You’ll receive a copy of your updated credit report reflecting the removal.

Step 3: Follow Up with the Creditors

While disputing with the credit bureaus is often sufficient to remove hard inquiries, you can also contact the creditors directly for added assurance. This is particularly effective if you have a relationship with the creditor or if the inquiry was made in error.

When reaching out to creditors, use a polite but firm approach. Explain your situation and request that they remove the unauthorized inquiry as a gesture of goodwill. Some creditors may be more receptive if you’re a loyal customer or if the inquiry was made by mistake.

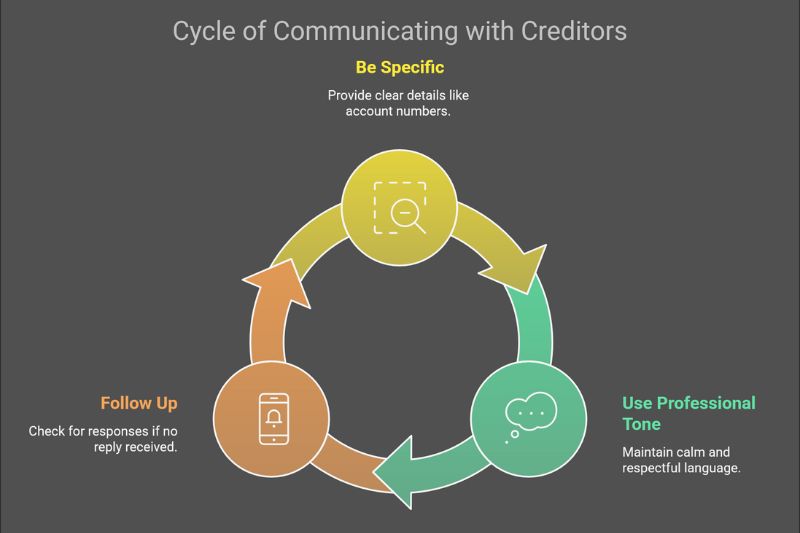

Here are a few tips for communicating with creditors:

- Be Specific: Clearly identify the inquiry you’re referencing and provide any relevant account numbers or dates.

- Use a Professional Tone: While it’s okay to express frustration, avoid using aggressive or accusatory language. Remember, you’re more likely to get a positive response if you remain calm and respectful.

- Follow Up: If you don’t receive a response within a week, follow up with a phone call or email. Persistence can pay off, but don’t cross the line into harassment.

Start Today and Explore the Features Firsthand!

Step 4: Consider Legal Action for Stubborn Inquiries

In rare cases, you may encounter a creditor or credit bureau that refuses to remove an unauthorized inquiry, even after multiple disputes and requests. If you find yourself in this situation, you may need to consider legal action.

The Fair Credit Reporting Act (FCRA) is a federal law that protects consumers’ rights when it comes to credit reporting. Under the FCRA, you have the right to dispute inaccurate or incomplete information on your credit report, including unauthorized inquiries.

Start Today and Explore the Features Firsthand!

Step 5: Monitor Your Credit Moving Forward

Additionally, be proactive about your credit habits moving forward:

While it’s okay to shop around for the best rates and terms, avoid applying for multiple accounts in a short period. Each application generates a hard inquiry, which can add up and impact your credit score.

Payment history is the most significant factor in your credit score, so make sure to pay all your bills on time, every time. Set up automatic payments or reminders to stay on track.

Your credit utilization ratio (the amount of credit you’re using compared to your credit limits) is another key factor in your credit score. Aim to keep your utilization below 30%, and even lower if possible.

Regularly review your credit reports. Even after you’ve removed unauthorized inquiries, it’s essential to review your credit reports regularly for errors or signs of identity theft. Mark your calendar to request your free reports every 12 months.

By adopting these healthy credit habits, you can build and maintain a strong credit profile that opens doors to better opportunities and financial success.

How to Remove Hard Inquiries from Your Credit Report: A Step-by-Step Guide

Hard inquiries, also known as “hard pulls,” occur when a lender checks your credit report during the application process for credit cards, loans, or mortgages. These inquiries can impact your credit score, especially if multiple inquiries occur over a short period of time.

Understanding how to remove hard inquiries from your credit report is crucial if you’re aiming to maintain or improve your credit score, particularly if there are unauthorized inquiries.

Here is a detailed, step-by-step guide on how to remove hard inquiries, including options to remove hard inquiries in 24 hours if necessary.

Obtain Your Credit Report and Identify Hard Inquiries

The first step to removing hard inquiries is to obtain a copy of your credit report. You are entitled to one free report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Review your report carefully and focus on the section listing hard inquiries.

Look for any inquiries that seem unfamiliar or unauthorized. These are the entries you’ll need to focus on for removal.

Dispute Unauthorized Hard Inquiries with the Credit Bureaus

If you find any unauthorized or incorrect hard inquiries, you have the right to dispute them with the credit bureau that issued your report. This process can often be done online, which is the fastest and most efficient way to resolve these issues.

- Filing an Online Dispute: To remove hard inquiries from your credit report, log in to the credit bureau’s website and locate the dispute section. You’ll be asked to provide details about the unauthorized inquiries, and you may need to upload supporting documents, such as proof that you did not authorize the credit inquiry.

- Timeline: Once submitted, the credit bureau typically takes 30 days to investigate. However, in some cases, you may be able to remove hard inquiries in 24 hours if the dispute is clear and well-documented.

Contact the Creditor Directly

In addition to disputing inquiries through the credit bureau, you can also contact the creditor or financial institution that performed the hard inquiry. If the inquiry was made in error or without your consent, request that the creditor removes the inquiry from your credit report.

In some cases, contacting the creditor directly can result in a quicker resolution, especially if the creditor acknowledges the mistake. If processed quickly, this method can help you remove hard inquiries in 24 hours.

Provide Supporting Documentation

To ensure a smooth dispute process, make sure to provide any documentation that supports your claim. This might include written proof that the inquiry was unauthorized or that you did not apply for any new credit during the time of the inquiry.

Submitting the right documents can help expedite the process and make it easier for both the creditor and the credit bureau to investigate and resolve the dispute in your favor.

Monitor Your Credit Report for Updates

After submitting a dispute or contacting a creditor, follow up regularly to check the status of the inquiry removal. You can monitor your credit report to ensure that the hard inquiries are removed as requested.

Keep an eye on your credit report to confirm that the hard inquiries are no longer listed. Additionally, monitoring your credit can help you spot any new unauthorized inquiries in the future and take action before they affect your score.

Prevent Future Hard Inquiries

Once you’ve successfully removed hard inquiries from your credit report, it’s important to take steps to prevent unauthorized inquiries from happening again. Consider freezing your credit if you’re not actively seeking new credit, as this can prevent unauthorized parties from accessing your credit report.

Take Control of Your Credit by Removing Hard Inquiries

Whether you’re disputing unauthorized inquiries or proactively removing old inquiries, knowing how to remove hard inquiries is a key part of maintaining a strong credit score. By reviewing your credit report regularly, disputing unauthorized entries, and contacting creditors when necessary, you can keep your credit in good standing.

For those looking for a quick resolution, using the online dispute process or contacting the creditor directly can sometimes result in removing hard inquiries in 24 hours. Always stay vigilant by monitoring your credit report and taking action to protect your financial health.

Frequently Asked Questions About Removing Hard Inquiries

Can I dispute inquiries online?

Yes, all three major credit bureaus (Equifax, Experian, and TransUnion) allow you to dispute inquiries online through their respective websites. However, it’s still a good idea to follow up with a written dispute letter for your records.

How long do inquiries stay on my credit report?

Hard inquiries typically remain on your credit report for up to two years. However, they only impact your credit score for the first 12 months.

Can I remove legitimate inquiries that I authorized?

Removing legitimate inquiries is more challenging and not always possible. Creditors are not obligated to remove inquiries that you authorized, even if you later regret the decision. However, some creditors may be willing to remove the inquiry as a goodwill gesture if you have a strong relationship with them.

Start Today and Explore the Features Firsthand!

How many points will removing an inquiry boost my credit score?

The impact of removing an inquiry varies depending on your individual credit profile. Generally, a single inquiry removal may only boost your score by a few points. However, removing multiple inquiries can have a more significant impact, especially if you have a shorter credit history.

What if I've been a victim of identity theft?

If you suspect that unauthorized inquiries on your credit report are the result of identity theft, take immediate action to protect yourself:

- Place a fraud alert on your credit reports

- Contact the creditors associated with the unauthorized inquiries

- File a police report and an identity theft report with the FTC

- Consider placing a credit freeze to prevent further fraudulent activity

Remember, recovering from identity theft can be a lengthy process, but staying vigilant and taking swift action can minimize the damage to your credit and financial well-being.

How Do I Remove Hard Inquiries from My Credit Report?

To remove hard inquiries from your credit report, first, review your credit report from one of the major bureaus (Equifax, Experian, or TransUnion) for any unauthorized inquiries. If you find inquiries you did not authorize, you can dispute them with the credit bureau either online or by mail. Additionally, contacting the creditor directly can expedite the process.

Can I Remove Hard Inquiries in 24 Hours?

Yes, in some cases, you can remove hard inquiries in 24 hours. The quickest way to do this is by filing an online dispute with the credit bureau or contacting the creditor who made the inquiry. Be sure to provide supporting documentation to help expedite the removal process.

Will Removing Hard Inquiries Improve My Credit Score?

Removing hard inquiries that were unauthorized can potentially improve your credit score, especially if you had multiple unauthorized inquiries. However, hard inquiries usually have a small impact on your credit score and only affect it for about 12 months, even though they remain on your report for two years.

Conclusion

In this ultimate guide, we’ve explored the ins and outs of removing hard inquiries from your credit report in just 24 hours. By disputing unauthorized inquiries, communicating with creditors, and monitoring your credit moving forward, you can take control of your financial destiny.

Remember, your credit health is a journey, not a destination. By staying proactive and adopting healthy credit habits, you can build and maintain a strong credit profile that opens doors to better opportunities and financial success.

So what are you waiting for? Put these secret ways to remove hard inquiries into action and start repairing your credit today. Your dream credit score is within reach you just have to claim it.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.