Starting credit repair without a plan often leads to frustration and wasted time. Many people rush to send dispute letters before understanding what’s actually on their reports or which items can be challenged. That’s where a credit repair checklist makes all the difference. It’s your roadmap to prepare, stay organized, and avoid costly mistakes.

In 2025, new credit reporting standards and automated systems mean accuracy matters more than ever. Whether you’re learning how to fix your credit or managing clients through your business, following structured credit repair steps ensures your disputes are legitimate and effective.

This guide will show you exactly what to do before you start from collecting reports and spotting errors to gathering proof and staying compliant with federal laws. By the end, you’ll have a complete credit report review checklist you can use with confidence.

Key Takeaways:

- A credit repair checklist helps you organize reports, proof, and disputes before taking action, saving time and reducing errors.

- Always review all three credit reports—Experian, Equifax, and TransUnion—to catch mistakes that may appear on only one bureau.

- Focus your credit repair steps on legitimate errors; never dispute accurate or verified accounts under FCRA rules.

- Build strong habits before disputing, like lowering credit utilization, paying on time, and tracking every update with a progress report.

- Client Dispute Manager Software automates credit repair tasks, organizes documents, and ensures full CROA and FCRA compliance.

Start Today and Explore the Features Firsthand!

Why Following a Credit Repair Checklist Matters Before You Start Disputes?

Following a credit repair checklist before starting disputes isn’t just helpful, it’s essential. Many credit repair efforts fail because people skip the groundwork. When you take time to prepare, you catch small details that can make or break your results.

Each item on your checklist ensures that your dispute letters are accurate, supported by proof, and compliant with credit laws.

Organization is the foundation of every successful credit repair step. When your reports, documents, and timelines are neatly arranged, you avoid confusion and keep your progress clear. A solid checklist also helps you track what you’ve already verified and what still needs attention.

Whether you’re repairing your own credit or running a credit repair business, a structured plan saves time, prevents duplicate work, and increases the success rate of your disputes.

Step #1: Get All Three Credit Reports Before Starting Credit Repair

The first and most important step on your credit repair checklist is getting all three of your credit reports. Each credit bureau—Experian, Equifax, and TransUnion may list different information, so you need all three to spot inconsistencies.

You can request free copies once a year from AnnualCreditReport.com, the only official source approved by the federal government. Many people check just one report and miss major errors reported by another bureau, which leads to incomplete disputes later.

Once you have your reports, review them carefully for accuracy and completeness. Check your personal information first, including your name, address, and Social Security number. Then move to accounts and payment history, verifying that every account belongs to you and that the payment dates, balances, and limits are correct.

Look for duplicate entries, closed accounts still marked as open, and old debts past the reporting period. Mark every questionable item these will form the basis of your next credit repair steps. Taking this time upfront ensures your disputes are built on verified facts, not assumptions.

Step #2: Review Your Credit Report Line by Line for Errors

The next step in your credit repair checklist is to review each credit report line by line. This careful review helps you find mistakes that could hurt your score or slow down your progress.

Here’s how to approach it:

- Check Personal Information: Make sure your name, date of birth, addresses, and Social Security number are correct. Outdated or misspelled details can link your report to someone else’s data.

- Review Account History: Confirm that every listed account belongs to you. Check balances, payment dates, and status. Watch for duplicate accounts, wrong balances, or false late payments.

- Inspect Credit Inquiries: Look for hard inquiries from lenders you don’t recognize. Unauthorized inquiries may signal identity theft or credit report errors.

- Flag Inconsistencies: Highlight anything inaccurate, incomplete, or suspicious. These notes will guide your next credit repair steps and help you prepare accurate disputes.

Taking time to analyze every section ensures you know how to fix your credit the right way before you begin formal disputes.

Start Today and Explore the Features Firsthand!

Step #3: Identify Common Credit Report Errors That Hurt Your Score

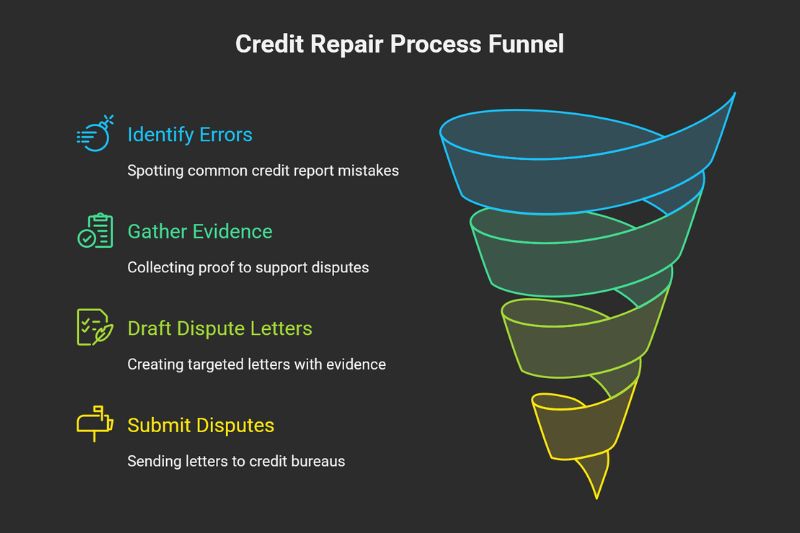

Errors are the backbone of most credit repair cases. Identifying them early helps you build stronger, more targeted dispute letters. In this step of your credit repair checklist, you’ll focus on spotting the most common mistakes that damage your credit score.

Here are the typical reporting errors to look for:

- Wrong Payment Dates: Late payments shown when you actually paid on time.

- Duplicate Accounts: The same loan or credit card listed twice, doubling the negative effect.

- Incorrect Balances or Limits: A wrong balance can raise your credit utilization ratio and lower your score.

- Accounts that Don’t Belong to You: Possible identity mix-ups or fraud.

- Closed Accounts Marked as Open: This makes your credit look riskier than it is.

- Outdated Negative Items: Collections or charge-offs still listed after the seven-year reporting period.

Spotting these early gives your credit repair steps real direction. It ensures your dispute letters are backed by facts, which increases your chances of success when fixing your credit.

Step #4: Gather Proof and Documents for Credit Disputes

Gathering proof is one of the most powerful steps in your credit repair checklist. Dispute letters work best when supported by solid evidence. Every claim you make must be backed by documentation that proves the information reported is incorrect or outdated. Without it, the credit bureaus will likely reject your dispute.

Here’s the type of evidence that strengthens your credit repair steps:

- Payment receipts or statements that show you paid on time.

- Bank statements verifying transactions or account closures.

- Correspondence from lenders or collectors confirming updates or resolutions.

- Settlement letters or payoff confirmations that prove a debt was cleared.

- Screenshots or reports showing mismatched data across bureaus.

Once you collect these documents, keep them organized and easy to access. Staying structured saves time and ensures you can respond quickly if the bureau asks for verification.

Tools like Client Dispute Manager Software make this process simple by allowing you to upload, tag, and track all your evidence in one place. Using automation to manage your documents helps you stay compliant, efficient, and ready for every step of preparing for credit repair.

Start Today and Explore the Features Firsthand!

Step #5: Know What You Can and Can’t Dispute in Credit Repair

Knowing what you can and can’t dispute is one of the most important parts of your credit repair checklist. The Fair Credit Reporting Act (FCRA) gives you the right to challenge inaccurate, incomplete, or outdated information on your credit report but it doesn’t allow you to dispute accurate, verified data.

Before sending any letters, make sure your claim meets FCRA standards. You can dispute:

- Accounts that don’t belong to you

- Incorrect payment dates or balances

- Duplicate or outdated negative items

- Closed accounts still marked as open

- Incorrect personal information

However, avoid disputing items that are accurate and verified. Trying to remove legitimate debts or late payments can delay your results or cause the credit bureaus to flag your account for frivolous disputes. Sticking to the truth keeps your credit repair steps effective and compliant with the law.

Understanding the Legal Boundaries of Credit Repair

Legal compliance is what separates responsible credit repair from risky shortcuts. The FCRA and the Credit Repair Organizations Act (CROA) are designed to protect consumers and ensure fairness in the dispute process.

Following these laws prevents unnecessary rejections and keeps your case credible with the credit bureaus.

Always base your disputes on clear evidence, not assumptions. Use documentation to prove errors, and never alter or falsify information. If you’re unsure, tools like Client Dispute Manager Software can guide you through compliant dispute creation and tracking.

Staying within legal boundaries keeps your process smooth, professional, and results-driven as you learn how to fix your credit the right way.

Step #6: Create a Credit Repair System to Track Your Progress

Tracking your progress is one of the most overlooked parts of credit repair. Many people send out disputes but forget to follow up or record results. Creating a system to organize your documents and responses keeps your process efficient and transparent. This step in your credit repair checklist helps you see what’s working and what still needs attention.

Here’s how to stay organized and consistent:

- Create Digital or Physical Folders: Separate them by credit bureau Experian, Equifax, and TransUnion. Keep copies of all dispute letters, responses, and supporting proof.

- Use a Tracking Sheet: Record the date you sent each dispute, the reason for it, and the outcome. This makes it easier to spot patterns and avoid duplicate disputes.

- Update Regularly: Add notes when you receive new correspondence or when accounts change status.

- Monitor Your Results: Use a credit repair progress report to track how your score and reports improve over time. This transparency builds confidence and accountability.

Tools like Client Dispute Manager Software simplify this entire process. It automatically tracks your disputes, organizes documents, and generates reports showing your progress. Whether you’re working on your personal credit or managing clients, staying organized ensures that every credit repair step you take is clear, measurable, and compliant.

Start Today and Explore the Features Firsthand!

How Client Dispute Manager Software Helps You Complete Every Step on Your Credit Repair?

Client Dispute Manager Software is built to help you manage every stage of your credit repair checklist efficiently. Instead of juggling spreadsheets and folders, you can handle reports, letters, and client updates all in one secure platform.

Here’s how it supports your credit repair steps from start to finish:

- Imports and Tracks Credit Reports Automatically: Pulls data from all three bureaus Experian, Equifax, and TransUnion—so you can spot errors instantly.

- Manages Dispute Letters and Responses Securely: Customize, send, and store letters directly within the software to stay organized and compliant.

- Generates Progress Reports to Measure Results: View updates on disputes, credit changes, and timelines to keep clients informed and motivated.

- Keeps Every Action CROA- and FCRA Compliant: Built-in safeguards ensure your credit repair process follows federal regulations.

Whether you’re learning how to fix your credit or managing clients as a business owner, this software helps you stay organized, compliant, and productive. It simplifies every part of preparing for credit repair, giving you the tools to focus on results instead of paperwork.

Start Today and Explore the Features Firsthand!

Step #7: Build Healthy Financial Habits Before Filing Disputes

Credit repair goes beyond fixing report errors it’s about changing the habits that caused those issues in the first place. Before sending any dispute letters, take time to build stronger financial routines.

This part of your credit repair checklist focuses on developing behaviors that support lasting credit improvement, not just short-term fixes.

Here’s how to start building healthy financial habits:

- Lower Your Credit Utilization: Try to use less than 30% of your available credit. Paying down balances before the billing date can improve your score faster.

- Avoid New Debt: Each new credit inquiry can temporarily lower your score. Wait until your credit report is clean and stable before applying for new accounts.

- Pay on Time, Every Time: On-time payments make up a large part of your credit score. Setting reminders or using auto-pay helps you stay consistent.

- Track Your Spending: Use budgeting apps or simple spreadsheets to monitor expenses. This helps you manage your cash flow and prevent unnecessary borrowing.

- Keep Old Accounts Open: Length of credit history matters. Closing older accounts can shorten your credit age and reduce your available credit.

By adopting these habits, you’re not just preparing for disputes you’re laying the foundation for long-term financial stability. When you combine smart money management with structured credit repair steps, you set yourself up for lasting success, not just temporary score improvements.

Frequently Asked Questions (FAQs)

How Often Should You Review Your Credit Reports?

You should review your credit reports from Experian, Equifax, and TransUnion at least once every 12 months, or more often if you’re actively repairing your credit. Regular reviews help you spot new errors, track dispute results, and make sure corrected items stay updated.

If you’re following a structured credit repair checklist, check your reports every 60 to 90 days to monitor progress and detect changes early.

What Is the Best Way to Organize Credit Repair Documents?

The best way to stay organized is to create a credit repair system that tracks every letter, response, and report update. Keep both physical and digital copies of your documents, labeled by credit bureau and dispute type. Include payment receipts, settlement letters, and any correspondence with lenders.

Using Client Dispute Manager Software can simplify this process—it stores all files securely, tracks dispute progress, and keeps your workflow compliant with CROA and FCRA.

Can You Dispute Accurate Information on Your Credit Report?

No. You can only dispute inaccurate, incomplete, or outdated information under the Fair Credit Reporting Act (FCRA). Attempting to remove verified data may cause the credit bureaus to flag your disputes as frivolous, which delays or stops your case.

A proper credit repair checklist helps you focus only on valid items, improving your credibility and saving time.

How Long Does Credit Repair Take?

Credit repair is a process, not an instant fix. Once you file a dispute, the credit bureaus usually have 30 to 45 days to investigate. The total time depends on how many accounts you’re disputing and how quickly creditors respond.

Most people see noticeable results within three to six months of consistent effort. Using organized credit repair steps and tracking your results ensures steady progress and faster resolutions.

Is It Legal to Repair Your Own Credit in 2025?

Yes, it’s completely legal to repair your own credit. The Credit Repair Organizations Act (CROA) protects your right to dispute incorrect information and improve your credit on your own.

However, if you choose to use professional help, make sure the company follows all CROA guidelines no upfront payments and full disclosure of services. Tools like Client Dispute Manager Software make it easy to manage disputes yourself while staying fully compliant and organized.

Conclusion

Improving your credit starts with preparation, not paperwork. Following a credit repair checklist gives you structure, accuracy, and confidence before you send a single dispute. By reviewing all three credit reports, identifying errors, gathering proof, and staying compliant with credit laws, you set yourself up for success from day one.

Whether you’re learning how to fix your credit or managing clients as part of a credit repair business, organization is your strongest tool. Every document you save, every response you track, and every habit you build contributes to lasting financial progress.

If you want to simplify the process, tools like Client Dispute Manager Software make each step easier automating your disputes, tracking progress, and keeping your workflow compliant with CROA and FCRA. Start your credit repair journey the smart way in 2025: prepare first, act with clarity, and stay consistent until you reach your goal.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!