Facing tough competition in the ever-expanding credit repair industry? Simply having expertise is no longer the golden ticket. To truly make a mark, you need credit repair marketing that grabs attention and holds it. This guide is here to help.

Dive in to fine-tune your promotional tactics, learn innovative strategies, and position yourself distinctively in a saturated market. Remember, in this industry, knowledge isn’t just power—it’s your blueprint to unmatched success.

Understanding Your Target Audience

Hey there! So, you want to help folks fix their credit, right? But first, let’s talk about who these folks are. Understanding your audience is a lot like making a new friend. You need to know what they like, what troubles them, and how you can help.

Who's Looking for Credit Repair?

People with Money Hiccups:

We all stumble sometimes. Some folks have made money mistakes in the past and now want to clean up their credit. They might’ve missed a few payments or got hit with big unexpected bills.

Dream Chasers:

Think of folks who are dreaming big! They might want to buy a house, get a new car, or start a business. But their credit score is holding them back. They need your help to make their dreams come true.

The Worriers:

Some people constantly check their credit score. A tiny drop, and they panic! They want someone to guide them, keep their score in the green, and help them understand the credit world better.

What Do They Need?

People don’t just want a better credit score. They want the good things that come with it, like trust from lenders or peace of mind. Most importantly, they want to feel secure and hopeful about their financial future.

How Can You Reach Them?

Now, here’s the fun part! Once you know who they are and what they want, you can speak their language. If you’re talking to the dream chasers, show them how good credit can open doors. For the worriers, offer them guidance and reassurance.

Remember, the key to great credit repair marketing is like making a new friend. Listen to their stories, understand their dreams and worries, and then show them how you can help.

Building a Strong Brand Identity

Let’s dive into something super important: your brand. Think of your brand like the clothes you wear. Just as you dress to impress, your brand should show everyone why they should pick you over everyone else.

Why Does Brand Matter in Credit Repair?

Trust Building:

People want to trust the person fixing their credit. After all, they’re handing over some of their most personal details and hoping for a brighter financial future. A strong brand isn’t just about a catchy logo or a neat slogan.

It’s a promise, a commitment. It’s your way of telling them, “Hey, I understand what you’re going through. I’m genuine, reliable, and equipped to help you. I’m the real deal. You’re not just another client to me. I’ve got your back, every step of the way.”

Standing Out:

In today’s bustling market, so many folks are offering credit repair services. Everywhere you turn, there’s another ad or offer. Amidst this crowd, your brand is your superhero cape. It’s like your unique fingerprint, leaving an impression on everyone you meet. While others might blur into the background, your brand shines bright, capturing attention and hearts.

It’s your story, your values, and your promise all wrapped up in one. This special touch is what makes you different from the rest and ensures that when people think of credit repair, they think of you. Because with a memorable brand, you’re not just another name; you’re the name they remember and trust.

Key Ingredients for a Winning Brand:

Clear Message:

In simple words, what’s your promise to the people? Is it lightning-speed fixes with “fast credit repair”? Or perhaps it’s a warm, understanding approach with “friendly credit advice”? Think of this as your brand’s handshake, your introduction. Just as you’d greet someone with a smile and a friendly hello when meeting them for the first time, your service promise is your brand’s way of reaching out and making that first connection.

It tells folks what to expect and why they should trust you. In a world buzzing with offers and claims, this straightforward message is like a beacon, guiding folks straight to your door.

Looking Good:

Colors, logos, and design aren’t just random choices. They’re the visual heartbeat of your brand, setting the stage before you even say a word. Think of them as the ‘outfit’ your brand chooses to wear every single day. Just like we feel different when we wear a cozy sweater versus a sharp suit, different design elements evoke different feelings in people.

Perhaps blues and greens give off a calming, trustworthy vibe, while a dynamic logo might hint at your modern, cutting-edge methods. The design is your brand’s first impression, its welcoming smile. So, when picking out that ‘outfit’, choose the one that not only looks good but also makes folks feel comfortable, valued, and ready to trust you with their credit journey.

Consistency:

Every touchpoint, be it your website, social media channels, or even the flyers you hand out on a busy street, tells a piece of your brand’s story. Consistency is the golden thread that ties all these pieces together. Just as you’d feel a sense of familiarity seeing someone in their signature outfit daily, your brand’s consistent appearance makes you instantly recognizable in the vast sea of businesses.

It’s about more than just visuals; it’s about delivering a uniform experience, emotion, and promise. When every part of your brand sings the same tune, from the fonts on your website to the colors on your Instagram posts, people not only recognize you instantly but also feel a deeper, more trusting connection to what you represent.

Digital Marketing Strategies for Credit Repair

Time to dive into the digital world. Now, I get it. Hearing words like “digital marketing” or “SEO” might make your head spin and feel like you’ve stepped into a sci-fi movie. But, trust me on this, it’s not as complicated as it seems. Imagine it like learning to ride a bike. Might be a bit wobbly at first, but with a little practice, you’ll be cruising smoothly.

The digital realm is a goldmine for credit repair marketing. And with the right tools and a bit of know-how, you can tap into its power, reaching more folks and making your credit repair services the talk of the online town.

Why Go Digital?

Everyone's Online:

From teens to grandparents, everyone’s online these days, busy scrolling and searching. Imagine the internet as the bustling town square of old. In this digital hub, your credit repair services need a standout spot, ensuring you’re seen and sought after by all.

Cost-Effective:

Credit repair marketing often comes with cost-effective perks compared to old-school methods. With handy online tools, you can keep an eye on your strategies, seeing what’s hitting the mark and what’s missing. This allows for real-time adjustments, ensuring your message resonates and gets results every time.

Tips to Shine Online:

User-Friendly Website:

Picture your website as the front window of your digital shop. Just as you’d arrange a store to be inviting, your website should pull visitors in. With intuitive design and straightforward navigation, it should guide them effortlessly, spotlighting your credit repair services and the benefits they offer.

Social Media Presence:

Position yourself in the digital crowd’s midst! On platforms like Facebook and Instagram, you have a stage to showcase success stories and share invaluable tips. These spaces aren’t just for selfies; they’re golden opportunities to engage, build trust, and draw in those seeking your credit repair expertise.

Email Marketing:

The simple charm of a well-crafted email shouldn’t be overlooked. By sending out regular updates, sprinkling in some handy tips, and occasionally treating your audience to special offers, you’re not just filling up inboxes. You’re carving a cozy spot in their memories, ensuring your credit repair services remain top of mind and easy to reach for when needed.

Online Ads:

Picture these online ads as bright digital billboards on the internet’s highways. Platforms, including the giants like Google and Facebook, offer tools that precisely position your message. So, when someone’s out there searching for credit repair solutions, it’s your name they see, shining brightly, guiding them to the answers they seek.

Reviews & Testimonials:

In the world of business, word-of-mouth reigns supreme. When past clients share their positive experiences, it’s like a friend vouching for you. By encouraging these satisfied customers to pen down reviews, you’re amplifying their voices. And in doing so, you’re beckoning a wave of new individuals seeking the same stellar credit help you offer.

Offline Marketing Techniques

Let’s take a step back from the digital whirlwind and get a bit old school. Just because we live in a tech-heavy world doesn’t mean the classic ways of spreading the word have lost their charm. There’s gold in them thar hills of traditional marketing! Let’s mine it.

Business Cards:

Ah, those classic business cards! Think of them as pocket-sized billboards, always ready to share your message. Every time you hand one out, you’re leaving a little reminder of your expertise. Best part? They’re always on, no charging required, and no batteries to replace!

Flyers and Brochures:

Designing these flyers and brochures requires a thoughtful touch. Be it at a buzzing community event or during your neighborhood walks, dropping them off in mailboxes, these pieces should be loud and proud. They should almost wave at folks, exclaiming, “In a credit crunch? Look no further, I’ve got the expertise you’re searching for!”

Local Newspapers:

Picture someone unwinding with their morning brew, newspaper in hand. A strategically placed ad, or an insightful article offering valuable credit tips, can be the talk of the morning. And let’s be honest, amidst our tech-heavy days, there’s a certain nostalgia and trust in flipping through those crisp paper pages occasionally.

Networking Events:

Step out, blend in, and let your enthusiasm for credit repair shine through. Face-to-face interactions have a magic of their own; they humanize the service. When people see the knowledgeable face behind the brand, a bond forms. That bond? It’s trust. And once trust is established, it’s just a matter of time before they reach out, dialing your number for expert guidance.

Sponsor Local Events:

Embracing events like school fairs, spirited charity runs, or vibrant town festivals as a sponsor is a surefire way to elevate your presence. This isn’t just about logos or banners; it’s a heartfelt message to the community. It resonates, “I’m more than a business. I’m a part of this community, deeply invested, and eager to assist with all your credit challenges.”

Leveraging Customer Testimonials and Reviews

Let’s chat about something amazing: the power of word-of-mouth! Remember the last time you tried that new eatery in town because a friend raved about it? Or bought that gadget because of its fantastic reviews? That’s the magic we’re diving into here.

Real Stories, Real Impact:

Pause and picture this: You’re chatting with a friend, and they exclaim, “Wow, this expert turned my credit woes upside-down!” It’s a feeling akin to being a student again, earning that shiny gold star sticker on your work. When genuine folks voice their genuine success tales, it not only boosts your reputation but also warms your heart. It’s truly a testament to your hard work and their trust combined!

Easy Peasy:

Ask your happy clients to leave a review. Whether it’s on Google, Yelp, or even your own website, a few good words can go a long way. And guess what? Most folks are happy to help if you’ve done right by them.

Shout It Out:

When you get a glowing review, it’s like a badge of honor. Don’t keep it hidden! Showcase it prominently on your website’s front page. Think of your flyers as confetti – sprinkle those rave words generously. And in your advertisements? Let them shine like the brightest star. Sending a clear message to everyone: people have put their trust in you, and you’ve delivered on the credit repair promise!

Stay Grateful:

Never underestimate the power of gratitude. Every time someone leaves feedback, always – and I can’t stress this enough – ALWAYS extend a heartfelt “thank you.” It’s a tiny gesture, but it can work wonders. That moment of appreciation can transform a casual reviewer into a vocal supporter who’ll sing praises of your credit repair services for years to come.

Introducing Client Dispute Manager Software

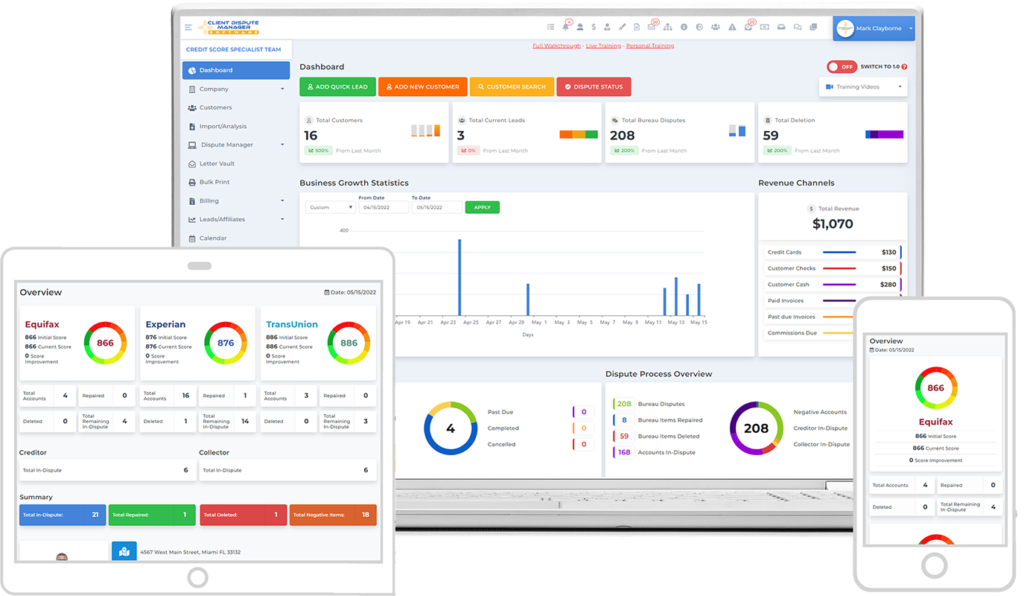

In the realm of credit repair, efficient case management and meticulous record-keeping are paramount. To that end, the introduction of robust software tools can significantly enhance your service offerings and streamline operations. Among the notable options available today, the Client Dispute Manager Software stands out.

Comprehensive Features for Credit Repair Professionals

The Client Dispute Manager Software offers an array of functionalities tailored to the unique needs of credit repair specialists. From detailed client profiling to systematic tracking of dispute statuses and reporting, this software encapsulates all requisite features under a single platform.

Intuitive User Interface:

One of the primary concerns when integrating new technology is the learning curve. However, the Client Dispute Manager has been designed with simplicity in mind. Its intuitive interface ensures that even those not particularly tech-savvy can navigate through with ease.

Commitment to Data Security

Handling sensitive financial data necessitates stringent security measures. The software prioritizes the safeguarding of client information, ensuring encrypted storage and secure data transmission protocols are in place.

Enhancing Operational Efficiency:

With the Client Dispute Manager Software, credit repair businesses can notably increase their operational efficiency. Automation of routine tasks, organized data management, and insightful reporting tools mean professionals can focus more on client engagement and strategy formulation.

Conclusion

Embracing the right technology, like Client Dispute Manager Software, is crucial in today’s credit repair landscape. This tool streamlines operations and enhances client service. As we pivot to a more digital age, such innovations are the keys to thriving in the credit repair industry.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.