There is no doubt that the idea of starting your own business for credit repair is thrilling. However, there’s a lot of hard work behind making it a success. You have to consider availing of credible and effective credit repair software for businesses such as the Client Dispute Manager for thriving in this business.

Table of Content:

Understanding Credit Repair:

Prior to giving life to your idea of establishing a business, let’s begin by trying to understand what is credit repair? Individuals across the country aim at gaining an impressive credit score and report because these directly affect the financial options available to them. Whether they are looking for a loan that comes with a minimum interest rate, a fancy car, or an insurance premium, all their financial options are dependent on their credit scores.

If any individual’s credit report is poor, they’ll need all the help they can to improve and rebuild it. That is where your business can step in to help, and with the right credit repair software for businesses such as the Client Dispute Manager, you’ll be handling more consumers than you can count!

In credit repair, you will offer, as a third and impartial party, the service of bettering the credit reports of your consumers by removing unverifiable or inaccurate information from their credit reports. This can be tiring and challenging at times, which is why you will need the help of a quality software platform like the Client Dispute Manager that caters accurately to such requirements with accuracy. In fact, you can use this platform for your own credit report improvement!

Why does your business need credit repair software?

Statistics show that in the year 2019, the industry on credit repair has grown exponentially, leading to expansion of their market and a boom in businesses dealing with credit repair. You will need an added advantage if you intend to launch your own business in this highly-competitive industry, and that can be achieved through cost-effective and productive software platforms.

Not only will you benefit from lower upfront expenses through such software platforms, but the infrastructure support these platforms offer will additionally enhance your business right from the start. However, you need to get a detailed idea before you opt for software to help your consumers with credit repair solutions. The following guide for beginners will help you get a better understanding of a platform like the Client Dispute Manager for your business credit repair software.

Types of software for credit repair:

This software works to find out any error in a person’s credit report. They specifically function to file a credit dispute or to search for a mistake on a person’s report. Additionally, these types of software pull out data from any individual’s credit report that is provided by TransUnion, Equifax, and Experian. They also provide users with the ability to catch an error, track their activities, and also dispatch dispute-based letters to mortgage lenders, creditors, and credit card organizations.

Here are details about different types of credit repair software for businesses:

In general, the software for credit repair includes credit simulators, cleaning kits, and credit trackers. These are either cloud-based or can be hard drive (local) installation-based.

Credit Simulator:

It will allow users to view the way in which potential investments, purchases, and loans influence their credit score before making the actual investment or purchase. Such software will work to inspect the Vantage Score and also FICO Score for making predictions for the user’s financial future based on their present and past spending habits. This software for credit repair will make calculations to find out how cost-efficient the HOA (homeowner association) payments and monthly loans will be.

Cleaning Kits:

A cleaning kit is software that can help with repairing any past credit-related mistake via requests for credit reports, consideration of scores, submission of dispute letters, and identification of frauds. This type of software for credit repair functions as a one-stop solution for a need-based credit repair. Kits assist with making requests for reports, a better understanding of credit score, disputing credit errors, and identification of frauds. It can, however, take time to learn using this credit repair software type, and the results might not be as expected.

Credit Trackers:

This type of software is connected with the credit bureaus. Such trackers manage a user’s credit reports and dig out an activity, which might lower the user’s credit score. For example, a credit tracker might forward the user notification if there is any potential troublesome payout, provide an alert for negative items, identify any theft, or even send a message related to any credit pull. This type of credit repair software allows users to access viewing through mobile phones or home computers. It is perfect for any user who borrows money and needs to maintain credit on a regular basis.

Software for Businesses for credit repair:

Services offered by businesses for an individual’s credit repair exceed all the above-mentioned DIY (or Do-it-yourself) software. This is because they offer to manage a consumer’s credit report, get in touch with credit card organizations, credit bureaus and lenders on behalf of the consumer. If you opt for credit repair software for small businesses for your business like the Client Dispute Manager, you can offer consumers better solutions for their credit-related issues.

With the help of this software, your business for service in credit repair will perform all the tough tasks of score tracking, contacting creditors, identifying errors for your consumers, saving them money, time, and stress. You can even save a consumer from major issues like bankruptcy. Moreover, you can use the software to provide guidance on smart financial goals to the consumer to achieve immediate or long-term financial success.

How to Select Software for Credit Repair Business?

With several free credit repair software available today, it can be tough to find the one that works best for your business. But with Client Dispute Manager software as a choice, your growth in business is almost assured. Their reputation is built on the trustworthiness of clients that they have earned through impressive performance.

While mistakes are common when working with numbers on a consumer’s credit report, with efficient software you can fix misinformation and errors without much effort. This, in turn, will boost the consumer’s credit score so that they can obtain any loan with ease.

Using software for credit-related issues of your consumers will open up better windows of opportunities for your business. A credit repair software like Client Dispute Manager will offer you the leverage you need to grow in this business by giving access to important tools along with strategies for credit repair so that your consumers can get accurate credit data. You will save loads of time when working with a software platform for catering to your consumers’ demands regarding credit repair.

While selecting the right software for business requirements it is necessary for you to find the one that comes with a system that is easy to use. Platforms that are cost-efficient are great for business, but the ones that offer automation of the process are the best credit repair software for small businesses.

Software that functions exclusively for credit repair should be efficient in exercising its primary role. It needs to be able to eliminate errors as well as replace those with accurate information. To ensure that you give your clients the best experience in credit repair, you need to opt for the finest software that has the best reviews in performing improved credit scores, with the ability to dispute and eliminate negative items.

Any genuinely exclusive software offers complete automation, eradicating the majority of the concerns such as contacting banks and lenders. Such credit repair software has the capability of exploring the overall dispute process.

How does software for credit repair work?

Client Dispute Manager, (CDM) as a well-reputed software functions uncomplicatedly, and their working can be divided into three parts, which include:

Credit Report Importing:

The process of credit repair starts with credit report importing. The CDM software for credit repair should be able to smoothly take you through the entire process while providing answers to questions such as the best way to access the credit report of the consumer. It will also tell you how you can monitor the changes, provided the credit repair software comes with such features.

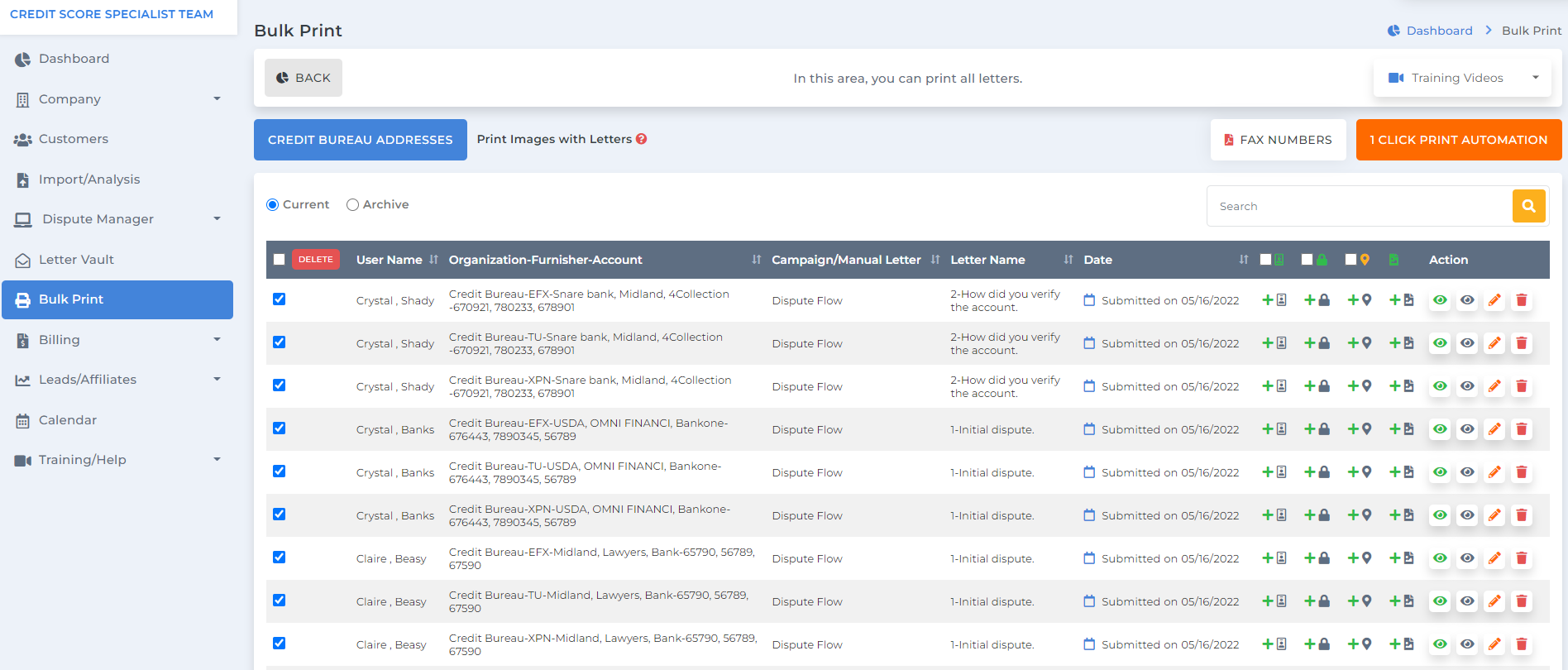

Generating Letters Automatically:

Once the foundation for the consumer’s dispute letter has been set, it will start generating the letter. You have the option of selecting the items that you need to dispute. There are several disputes including credit inquiries, late payments, erroneous collections, etc. The software will be able to generate the letter instantly to be sent to the credit bureau.

Progress Tracking:

When the letter is sent, you can do nothing but wait. But in the meantime, you have the advantage through CDM as credit repair software of tracking the progress of the letter and making assumptions on the duration it may take for things to fall into place. In most cases, you just have to patiently wait for the letters to get responses from the credit bureaus prior to anything being eliminated.

The Client Dispute Manager credit repair software for business has helped a lot of individuals correct their wrongful poor scores. This software platform gives the benefit of improving credit scores once all errors in their credit reports are corrected.

What to Expect from a Business Credit Repair Software:

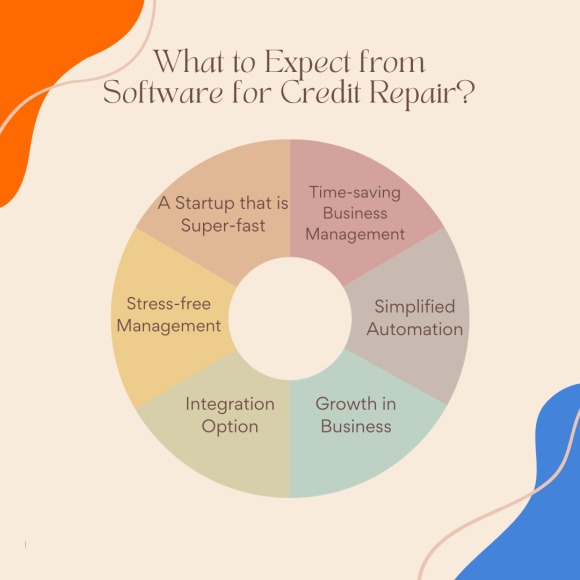

Here’s a detailed look at what you, as a new or experienced business owner, can expect from top-notch credit repair software like Client Dispute Manager:

A startup that is Super-fast:

The first step in using such a software platform is getting started with the repair process, which is made easy and fast for any entrepreneur, be it an amateur or an experienced professional. Features that you can expect in the startup include ensuring a fast input of client details without any effort, no additional payment for securing dispute training, processing the initial consumer’s needs within the first 15 minutes, and obtaining free training for credit business.

Stress-free, Time-saving Business Management

You will not need to spend hours at length with credit repair software for assistance. You have the benefit of managing the disputes of several accounts in no time, looking for any deletion in seconds, printing out hundreds of dispute letters at a time in bulk, and preventing cancellations by auto nurturing your consumers.

Easy and Simplified Automation

Business credit repair software like the Client Dispute Manager will take over a lot of your tasks. You can do automated printing option in a click and even send out letters without going to the post office.

You will enjoy the option of using smart interview, an exclusive feature of the software, wherein the software will do an automated interview of your customers instead of you .

Such software will also allow the integration of multiple apps with Zapier automating hundreds of tasks. And finally, the updates of credit scores will be automated on the credit repair software and relayed to your clients through their own portal without you breaking a sweat.

Growth in Business

With growth and automation in your credit repair business, you can spend your free time traveling around the world. This credit repair software will allow the signing up of new consumers automatically. The affiliate portal will enhance your business growth as your affiliates can easily send you leads directly through the platform.

You may also find more ways to market your business through the software. It has its own business learning section where you have videos and materials to use for marketing your business.

Integration Option

Hassle-free integration with important apps through the Client Dispute Manager software platforms will make your life much easier. You have the option of integrating with apps like authorize.net, LetterStream, Zapier, and Twilio.

Credit Repair Software Benefits:

With an efficient and pocket-friendly software platform like the Client Dispute Manager, you can achieve profitable results without requiring adding more staff to your business venture.

Work Remotely 24*7

Any credible, quality credit repair software gives you the chance to improve your existing business or start a new venture in credit repair. You don’t have to step out of your home or work under anyone to make a living. Saving you the time of walking past the morning crowd, this software platform allows you to work from anywhere 24 hours a day, 7 days a week.

Outsourcing Work

You also enjoy the benefit of outsourcing any of your projects to other individuals with necessary qualifications anywhere across the globe. The only requirement that these individuals need to have while using CDM credit repair software will be a high-speed internet connection along with access codes provided by you for accessing sales leads as well as your consumers’ credit reports. However, with the amount of sensitive information related to credit repairs, you might not be open to outsourcing specific tasks, depending on your requirements.

Customer Service Outsourcing

It can be time-consuming and tiring to provide answers to queries of your consumers, which keeps you from acquiring new leads or managing your existing consumer accounts. While you stick to the primary, crucial job of credit repair requiring personal information access, you can outsource the customer service part of your business with the Client Dispute Manager credit repair software. Again, for this job you can hire executives from across the globe to answer calls and provide satisfactory answers to any questions from existing or potential clients, day and night.

There are several open source credit repair software available today, but you will benefit immensely by selecting the CDM software for your business requirements.

Exclusive Features of Client Dispute Manager Software:

If you haven’t already made up your mind, here are some of the exquisite features of this software that will want you to start working on it immediately:

Easy to Use

The entire platform of this credit repair software can be navigated with ease, and you will get along with the processes without any hiccups. This will save you time, and you can work for a greater number of clients without much effort on your part.

Finest Automations

You will not have to worry a tad bit about the automations as the software will do that job for you. You can rest assured that the job will be done, while you sit back and relax.

Backed by Support

The support provided by the CDM software will ensure that all your queries receive satisfactory responses. All your worries will be taken care of by their extensive support system that works 24*7 for full customer support.

Free Training

This software also offers free training in credit repair solutions, which will be an added advantage for those of you who are newly embarking on this venture.

Free 30-day Trial

Additionally, the CDM credit repair software also gives you the option of a 30-day free trial so that you can try out using this software to find out how efficient it is in building your business. This way, you don’t have to spend any money for the first 30 days of use, while profiting from the software’s efficiency to grow your business.

What a Client Dispute Manager Software Does For Your Business:

It can be tough to start a business from scratch, and while it is rewarding, there are several challenges along the way. Finding the right footing or brand building can be tiring when you start a venture on credit repair. However, specific features and qualities are common to any good company which you can achieve with the help of Client Dispute Manager Software:

All-inclusive System

Your business will manage and provide services on credit through a clear and comprehensive system. With CDM credit repair software, you can provide an improved approach towards credit repair services, while explaining the entire process to potential clients, making sure that your services are accessible for anyone you invite on board.

Your choice of software platform should assist you with organizing data and simplifying the service model for clarity in helping out your clients.

Credibility in Service

It is required of any business on credit repair to maintain good relations with anyone they interact with. You will need to earn the trust and respect of your clients. Having our credit repair software on your side will help you impress them with the credibility and quality of your service, ensuring that they provide you with proper information that will help you dispute inaccurate information in their reports.

Open to Transparency

Transparency is crucial for any business. Your business approach should always be open and crystal clear to potential consumers. Being upfront and clear about your services will help you earn and build a lasting reputation. Make no promises that you cannot fulfill, and keep your customers in the progress loop.

Provide them effective solutions through the software’s very own Client Tracking Portal so that you can avert any complications or miscommunications with your consumers. The more factual your approach is, the better relationship you can build with clients over time. This will also help build trust in your business.

Finally

The above-mentioned guide will surely help you narrow down the one software platform that fulfills your requirements. In due time you will be profiting from your new or existing venture in credit repair, knowing that you have invested in the right software to boost the business in the right direction.

Out of the numerous credit repair software download options for you, your business will profit most from the Client Dispute Manager software. Free doesn’t always mean the best, so be wise in your choice and make sure that you immediately opt for the CDM software to meet your business goals without burning a hole in your pocket, especially as it offers 30-day free trial for your business!