Here’s something most people don’t realize until it’s too late: paying off a collection account doesn’t automatically remove it from your credit report. That’s right you can settle your debt in full, do the “responsible” thing, and still watch that negative mark drag down your credit score for up to seven years.

It feels unfair because it is.But there’s a strategy that can change this outcome entirely. A pay for delete letter is a negotiation tool that allows you to offer payment in exchange for complete removal of the collection account not just a “paid” status, but actual deletion from your credit report.

It’s not guaranteed to work every time, and not every collection agency will agree, but when it does work, it can mean the difference between years of credit damage and a fresh start.If you’re staring at a collection account that’s blocking your mortgage approval, preventing you from getting that apartment, or just keeping you up at night wondering if you’ll ever get approved for decent credit again you’re in the right place.

The confusion you’re feeling about whether to pay, how to pay, and what happens after you pay? That’s completely normal. Most people don’t understand how credit reporting works, and collection agencies certainly aren’t going to educate you on your negotiating power.

Let me walk you through exactly how pay for delete works, when to use it, and most importantly, how to write a letter that actually gets results.

Start Today and Explore the Features Firsthand!

What Is a Pay for Delete Letter? (Definition and Legal Standing)

Before we dive into strategy and templates, let’s make sure we’re on the same page about what a pay for delete letter actually is and clear up some dangerous misconceptions that could cost you money and leverage.

How a Pay for Removal Letter Works?

A pay for removal letter is a written proposal you send to a collection agency or creditor offering to pay your outstanding debt in exchange for complete removal of the account from your credit report. Think of it as a business negotiation: you have something they want (payment), and they have something you want (deletion).

Here’s the critical distinction most people miss: there’s a massive difference between a paid collection and a deleted collection. When you simply pay a collection without negotiating, the account remains on your credit report for seven years from the date of first delinquency.

The status changes from “unpaid collection” to “paid collection,” but that negative mark is still there, still visible to lenders, and still dragging down your score.

A deleted collection, on the other hand, disappears entirely. It’s as if the collection account never existed on your report. No “paid” notation. No seven-year waiting period. Just gone.

Is this legal?

Absolutely. Pay for delete exists in a gray area that confuses a lot of people, so let me be clear: it’s not illegal under the Fair Credit Reporting Act (FCRA). Credit bureaus prefer that creditors report accurately, but here’s what matters collection agencies aren’t legally required to report your debt at all. Reporting to credit bureaus is voluntary.

Since they can choose not to report, they can also choose to delete what they’ve already reported. That’s your negotiating window.

Why this matters for your credit score: A single collection account can drop your credit score by 50-150 points depending on your credit profile. Removing it not just paying it can result in immediate score improvement, better loan approvals, lower interest rates, and peace of mind. You’re not trying to dodge responsibility; you’re negotiating the terms of your payment to protect your financial future. That’s smart, not shady.

When to Use a Pay for Delete Letter? (Best Candidates vs. Poor Fits)

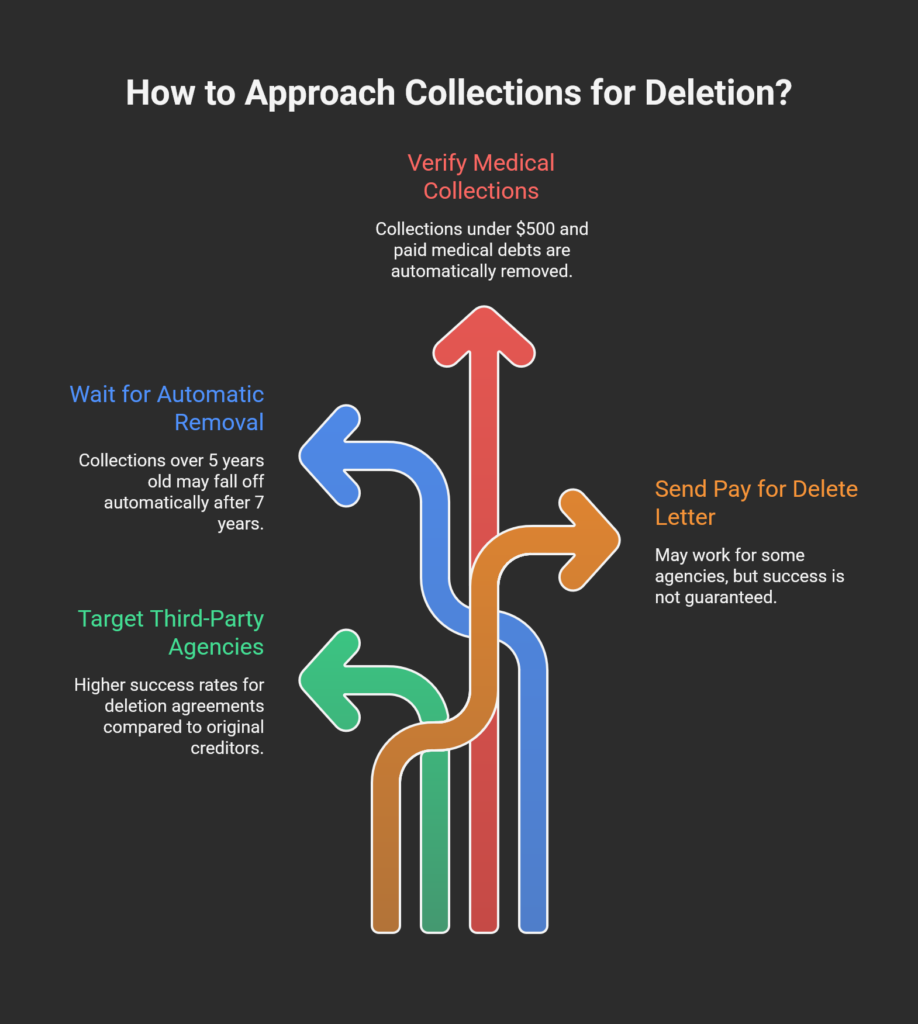

Not every collection account is a good candidate for a pay for delete letter. Understanding when this strategy makes sense and when it doesn’t will save you time, money, and the frustration of negotiating with a brick wall.

Let’s break down where your energy is best spent.

Collections That Respond Best to Pay for Delete Letters

Third-party collection agencies are your sweet spot. These are companies that purchased your debt from the original creditor for pennies on the dollar often 5-15 cents per dollar owed. Because they bought your account so cheaply, any payment you make represents profit.

They’re motivated to work with you, and they’re far more likely to agree to deletion than the original creditor ever would.

Recent collections under 2-3 years old give you the most negotiating power. Why? Because they’re actively hurting your credit score right now, and the collection agency is still in active collection mode. They know you’re motivated (you probably have an immediate need like a loan or apartment application), and they want to collect while you’re engaged. Older collections lose urgency on both sides.

Mid-range debts between $500 and $5,000 hit the negotiation sweet spot. They’re large enough that agencies want to collect, but small enough that you can potentially offer full payment or a substantial settlement. Collection agencies are far more likely to agree to a letter of deletion for credit report when they’re getting meaningful payment, not $100 on a $10,000 debt.

Lump sum payment ability is your leverage multiplier. If you can pay immediately today, this week you have serious negotiating power. Cash in hand beats payment plans every time. Collectors know that accepting your offer now is certain money, while waiting for you to save up or make monthly payments is risky. Use this to your advantage.

Start Today and Explore the Features Firsthand!

When a Pay for Delete Letter Won't Work?

Original creditors (banks, credit card companies) rarely agree to pay for delete because they have stricter reporting policies that make deletion unlikely. Your better bet:

- Focus your energy on third-party collection agencies instead

- They have much higher success rates for deletion agreements

Very old collections over 5 years old often aren’t worth the effort to negotiate:

- All collections automatically fall off after seven years from the date of first delinquency

- If your collection is already six years old, waiting 12 more months might be smarter than paying

- In some states, making a payment can restart the statute of limitations for lawsuits on old debts

Medical collections changed dramatically in 2023 with new reporting rules:

- Collections under $500 aren’t reported to credit bureaus anymore

- Paid medical collections are automatically removed without negotiation

- Before sending a pay for delete letter for medical debt, verify if it qualifies for automatic removal first

Will this work every time? No, some agencies have blanket policies against deletion. But here’s the truth: you’ll never get deletion if you don’t ask for it. Many people successfully negotiate these agreements every day. Your approach and letter quality matter, which is exactly why we’re walking through this together

Pay for Delete Letter Template: How to Write One That Gets Results

Now let’s get to what you actually came here for: a pay for delete letter template that works. The difference between a letter that gets ignored and one that gets results often comes down to professionalism, clarity, and strategic language.

Here’s exactly what your letter needs:

6 Essential Elements of Your Paid Debt Removal Letter Template

- Professional Header with Complete Contact Information: Include your full name, mailing address, phone number, and email at the top. Below that, add the date and the collection agency’s complete contact information. This isn’t a casual email it’s a business proposal that deserves formal formatting.

- Specific Account Details that Eliminate Confusion: Reference the exact account number, original creditor name, and current balance they’re claiming. Be precise so there’s zero ambiguity about which debt you’re addressing. Vague letters get vague responses.

- Clear Payment Offer with Conditional Language: State exactly what you’re willing to pay whether that’s the full balance or a settlement amount. Here’s the critical part: make it crystal clear that your payment is conditional upon deletion. Use phrases like “contingent upon” or “in exchange for” to establish this is a trade, not a donation.

- Deletion Requirement from All Three Credit Bureaus: Don’t just say “remove from my credit report.” Explicitly state you want deletion from Equifax, Experian, and TransUnion. Some agencies will delete from one or two bureaus and leave it reporting on the third if you’re not specific.

- Written Agreement Request Before Payment: This is non-negotiable. Request that they send you written confirmation on company letterhead before you send any money. Never pay first and hope they follow through your payment is your only leverage.

- Professional but Firm Closing: Close politely but confidently. You’re not begging for a favor; you’re proposing a business deal that benefits both parties. Set a reasonable deadline for their response (10-15 business days) to create urgency.

Start Today and Explore the Features Firsthand!

Free Pay for Delete Letter Template (Ready to Customize)

Here’s a complete paid debt removal letter template you can customize and send today:

[Your Full Name]

[Your Street Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

[Today’s Date]

[Collection Agency Name]

[Agency Street Address]

[City, State ZIP Code]

RE: Account #[Account Number] – [Original Creditor Name]

Dear Sir or Madam,

I am writing regarding the account referenced above, which is currently reporting on my credit file. I understand the outstanding balance is $[Current Balance Amount].

I am prepared to pay [choose one: “the full balance of $X” OR “a settlement amount of $X”] to resolve this matter. However, this payment is contingent upon your written agreement to delete this account entirely from my credit reports with Equifax, Experian, and TransUnion.

I am not requesting that the account be updated to “paid” or “settled” status. I am requesting complete removal of this tradeline from all three credit bureaus.

If you agree to these terms, please send me written confirmation on company letterhead before I submit payment. Upon receipt of your written deletion agreement, I will promptly send payment via [cashier’s check/money order/specified method].

Please respond within 15 business days with your decision.

Sincerely,

[Your Handwritten Signature]

[Your Typed Name]

What NOT to include in your letter? (5 quick don'ts):

- Don’t admit the debt is yours if you’re uncertain about its validity, use neutral language like “the account referenced” instead of “my debt”

- Don’t apologize excessively or sound desperate, this weakens your negotiating position

- Don’t mention why you need this removed (credit score goals, loan applications), keep it strictly transactional

- Don’t threaten legal action or use aggressive language, this will backfire and make them less cooperative

- Don’t send payment with the letter, always wait for written confirmation first

Start Today and Explore the Features Firsthand!

Manage Pay for Delete Letters With Client Dispute Manager Software

If you’re dealing with multiple collection accounts, keeping track of letters sent, responses received, and follow-up deadlines can quickly spiral into chaos. Add in managing credit reports from three bureaus, storing documentation, and remembering critical dates and you’re drowning in paperwork.

This is exactly why Client Dispute Manager Software exists.

Here’s how our credit repair software simplifies your pay-for-delete process:

- Professional Letter Templates: Access customizable pay for delete letter templates you can personalize and generate in minutes. No more staring at blank pages.

- Centralized Document Storage: Keep all letters, written agreements, payment confirmations, and credit reports organized in one secure place. No more digging through emails.

- Credit Report Tracking: Upload and monitor your reports over time. Easily see which collections were deleted, which changed status, and what needs attention.

- Automated Deadline Reminders: Set follow-up alerts for response deadlines, payment dates, and report checking. Never miss critical dates that could derail your negotiation.

Whether you’re managing your own credit or considering helping family and friends (maybe even building a credit restoration business), Client Dispute Manager Software provides professional-grade tools to handle everything efficiently. Many people who start with their own credit discover they’re good at this and turn that knowledge into income helping others.

Start Today and Explore the Features Firsthand!

Pay for Delete Letter FAQs: Your Questions Answered

Is a Pay for Delete Letter Legal?

Yes, pay for delete letters are completely legal under the Fair Credit Reporting Act (FCRA). Collection agencies aren’t legally required to report your debt to credit bureaus reporting is voluntary. Since they can choose not to report at all, they can also choose to delete what they’ve already reported. The credit bureaus discourage this practice, but there’s no law preventing it.

Will My Pay for Removal Letter Always Work?

No guarantees exist. Some agencies have policies against deletion and aren’t obligated to agree. However, many do negotiate because getting paid now often beats holding a tradeline. You’ll never get deletion if you don’t ask and many people successfully negotiate pay for removal letters daily.

Should I Settle or Pay in Full in My Pay for Delete Letter?

Full payment gives you maximum leverage. When a collector receives 100% of the balance, they’re more likely to agree to deletion because they’re getting the full benefit. However, if you can’t afford the full amount, offering 50-60% of the balance plus deletion can still work. Start with what you can afford and be prepared to negotiate upward.

What if They Won't Send a Written Letter of Deletion for Credit Report?

Don’t pay. Period. If a collector agrees verbally but refuses to provide written confirmation, they’re not planning to follow through. Your payment is your only leverage once it’s gone, you have no recourse. Politely insist: “I’ll need written confirmation on company letterhead before I send payment.” If they still refuse, walk away or explore other options.

Can I Use a Pay for Delete Letter for Charged-Off Accounts?

Yes. A charge-off simply means the original creditor wrote off the debt for accounting purposes. If a third-party collection agency now owns the debt, they’re often excellent candidates for pay for delete negotiation. These agencies purchased the charged-off debt cheaply and are motivated to collect.

Is Client Dispute Manager Software Compliant With Credit Repair Laws?

Yes. Client Dispute Manager Software is built with FCRA, CROA, and other credit repair regulations in mind. The software helps you maintain compliance through proper documentation, required disclosures, and best practices built into the workflow.

Take Control With Your Pay for Delete Letter Today

Here’s what I want you to remember: that collection account sitting on your credit report doesn’t have to define your financial future for the next seven years. You have more power in this situation than you might think and now you have the knowledge to use it.

You understand what a pay for delete letter is and why it works. You know when to use this strategy and when to walk away. You have a professional template ready to customize. You’ve learned the step-by-step negotiation process. And you’re aware of the critical mistakes that derail people who try this without guidance.

Will every negotiation succeed? No. Some agencies have policies against deletion. But here’s the truth: you’ll never get deletion if you don’t ask for it. Every successful negotiation starts with someone who decided to take action instead of accepting the status quo.

Your next step is simple: customize the template, send it certified mail, and follow the process we’ve outlined. Every credit repair expert started exactly where you are right now looking at a collection account and wondering what to do about it.

Take control of your credit destiny. You’ve got this.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: