In the dynamic field of credit repair, understanding the nuances of dispute letters is crucial. This article focuses on Metro 2 letters, comparing them with consumer law letters and factual dispute letters to unravel their distinct roles and effectiveness.

We’ll also explore the integration of these letters with Client Dispute Manager Software, offering insights for Credit Repair Specialists seeking to navigate credit report disputes efficiently.

What is a Metro 2 Letter?

Metro 2 Letters is a special tool for talking to credit bureaus. Think of them as a specific language that credit experts use to communicate with the companies keeping track of your credit history. They follow a certain format that makes it easier for these bureaus to understand and respond to what we’re saying.

Why Metro 2 Letters Matter in Credit Repair

The importance of Metro 2 Letters comes into play when there’s a mistake in your credit report. If you find an error, like a charge you don’t recognize, a Metro 2 Letter acts like a direct message to the bureau. It clearly points out the mistake and explains why it’s incorrect, using a format that the credit bureaus take seriously.

The Power of Metro 2 Letters in Disputes

Think of a Metro 2 Letter as a key that helps unlock discussions about errors on your credit report. It’s the perfect tool for opening a conversation with the bureaus and getting those mistakes fixed. The clarity and directness of these letters make them effective and hard for credit bureaus to ignore.

Making the Most of Metro 2 Letters

In the world of credit report disputes, Metro 2 Letters are incredibly useful. They’re designed to grab the attention of credit bureaus and prompt them to act on the errors in your report. This is crucial for anyone looking to maintain good credit and resolve issues efficiently.

Why Do Credit Repair Companies Use Metro 2 Letters?

Now, you might be wondering why credit repair companies love using Metro 2 Letters. The answer is pretty simple: these letters are super effective. They’re like a secret weapon for fixing credit report mistakes. Metro 2 Letters are designed to match exactly what the credit bureaus are looking for, making it easier for them to understand and fix the errors on your report.

The Advantages of Metro 2 Letters Over Other Dispute Methods

One big plus of Metro 2 Letters is that they speak the same language as the credit bureaus. This means they’re more likely to get a quicker and more accurate response than other types of letters, like Consumer Law Letters or Factual Dispute Letters. When credit repair companies use Metro 2 Letters, they know they’re sending something that the bureaus can process easily and act on fast.

How Metro 2 Letters Improve the Dispute Process?

Another cool thing about Metro 2 Letters is that they help make the whole dispute process smoother and more straightforward. Because these letters are so clear and to the point, they reduce the back-and-forth that often happens with credit disputes. This not only saves time but also increases the chances of getting those credit report mistakes fixed without a hassle.

Why Credit Experts Prefer Metro 2 Letters for Effective Disputes?

As a credit repair expert, I can tell you that Metro 2 Letters are often the first choice for tackling credit issues. They’re powerful because they cut through the noise and get straight to the point. This means we can help people fix their credit reports faster and more efficiently, which is what everyone wants.

Effectiveness of Metro 2 Letters in Credit Disputes

When it comes to fixing mistakes on your credit report, Metro 2 Letters are like the superheroes of the credit world. They’re really good at what they do. These letters are designed specifically to deal with credit bureaus, so they hit the mark more often than not. They’re not just any letters; they follow a special format that makes the bureaus sit up and take notice.

The Success Rate of Metro 2 Letters

What’s really cool about Metro 2 Letters is how often they work. Compared to other kinds of letters, like Consumer Law Letters or Factual Dispute Letters, Metro 2s have a great track record. They get right to the point and lay out the problem clearly, which means the bureaus can fix it faster. This can be a big deal if you’re trying to improve your credit score quickly.

Click here to get everything you need for FREE.

Why Metro 2 Letters Stand Out in Resolving Credit Issues?

Metro 2 Letters are special because they’re based on the Metro 2 format, which is the standard way credit information is reported. This means that when a credit bureau sees a Metro 2 Letter, it knows exactly what you’re talking about. It’s like speaking the right language from the start, which can make a big difference in how quickly and accurately your dispute is handled.

Metro 2 Letters vs. Other Dispute Methods

While Consumer Law Letters and Factual Dispute Letters have their own strengths, Metro 2 Letters often come out on top for being straightforward and effective. They cut through the confusion and make it easier for credit bureaus to see and fix the problem. For anyone trying to clear up their credit report, that’s a big win.

When to Use Metro 2 Letters in the Dispute Process?

Knowing when to use Metro 2 Letters is a big part of winning the credit repair game. These letters are perfect for when you spot a mistake on your credit report that seems pretty clear-cut. Let’s say you find something on your report that you’re sure shouldn’t be there, like a debt you never had. That’s a good time to whip out a Metro 2 Letter.

Ideal Situations for Metro 2 Letters

Metro 2 Letters shine the most when dealing with common errors. This includes stuff like charges you don’t recognize, accounts that aren’t yours, or errors in your personal information. Since these letters are super direct and clear, they help the credit bureaus see the mistake quickly and get to fixing it.

Why Choose Metro 2 Letters for Certain Disputes?

These letters are especially great if you need a fast response. Because they’re designed in a way that the credit bureaus are used to, they often get quicker and more effective results. If you’re in a hurry to clean up your credit report, maybe for a loan or a new job, Metro 2 Letters can be your best friend.

Metro 2 Letters in Complex Disputes

Now, for more complicated issues, like those needing a lot of back-and-forth, you might consider other types of letters. But for most problems on your credit report, Metro 2 Letters are the way to go. They’re like the first and best tool in your credit repair toolbox.

Understanding Consumer Law-Based Dispute Letters

Consumer Law-Based Dispute Letters are another tool you can use when fixing your credit report. These letters are a bit different from Metro 2 Letters. They focus on using specific consumer protection laws to help sort out mistakes on your credit report. It’s like having a rulebook, and you’re pointing out where the credit bureaus need to follow the rules.

How Consumer Law-Based Letters Work?

When you send a Consumer Law-Based Dispute Letter, you’re basically telling the credit bureau, “Hey, look at these laws that say you need to make sure my credit report is correct.” These letters are helpful when you need to remind the bureaus about the legal reasons they have to fix your report. It’s a way to show you know your rights, and you’re serious about protecting them.

When to Use Consumer Law-Based Letters?

These letters are great for more complicated problems. Say there’s an error that keeps coming back, or something really tricky on your report. That’s when you might want to use a Consumer Law-Based Letter. They bring in the big guns – the law – to help make your case stronger.

The Strength of Consumer Law-Based Letters

The strength of these letters lies in their legal muscle. They can be really effective, especially when a credit bureau isn’t paying attention to your regular dispute letters. It’s like saying, “I know the rules, and you need to follow them.” This can get you some serious attention from the credit bureaus.

Factual Credit Bureau Dispute Letters: An Overview

Factual Dispute Letters are a key tool in the world of credit repair, but they work a bit differently than Metro 2 or Consumer Law Letters. These letters are all about the details, the facts. Imagine you’re a detective pointing out clues in a case.

That’s what you do with a Factual Dispute Letter. You focus on specific errors on your credit report, like a wrong date, a payment you made that they missed, or an account that isn’t yours.

How Factual Dispute Letters Work?

These letters are pretty straightforward. They directly address the errors on your credit report, providing clear evidence to back up your claims. Let’s say your credit report shows that you missed a payment, but you actually paid on time.

In a Factual Dispute Letter, you would clearly state the mistake, then provide proof, like a bank statement, to show you did pay. This letter doesn’t beat around the bush; it gets straight to the point with solid facts.

Click here to get everything you need for FREE.

The Strength of Factual Evidence

The strength of a Factual Dispute Letter lies in its ability to present clear, undeniable proof. It leaves little room for doubt because you’re presenting hard evidence. This approach is particularly effective when you have documents or records that clearly show an error on your credit report. It’s like having a photo or a receipt that proves your point – it’s hard to argue with that.

Why Factual Dispute Letters are Different?

What sets Factual Dispute Letters apart from Metro 2 Letters or Consumer Law Letters is this reliance on concrete evidence. While Metro 2 Letters communicate in the credit bureaus’ language and Consumer Law Letters leverage legal rights, Factual Dispute Letters are all about showing the truth with proof. They work best when there’s a clear-cut mistake that can be easily proven with documents.

Comparing Metro 2 Letters, Consumer Law-Based Letters, and Factual Dispute Letters

When fixing your credit report, choosing the right kind of letter is like picking the right tool for a job. Metro 2 Letters, Consumer Law-Based Letters, and Factual Dispute Letters each have their own special uses. Metro 2 Letters are the go-to choice for speaking the credit bureaus’ language. They follow a format that bureaus understand best, making them great for clear-cut errors on your report.

Consumer Law-Based Letters are like bringing the rulebook into the game. They use legal terms and point out where the credit bureaus need to stick to the law. These letters are powerful, especially for tricky problems that need a bit more muscle to get fixed.

Factual Dispute Letters are all about the hard evidence. They work best when you have proof, like a bank statement or a receipt, that clearly shows an error. These letters are perfect for pointing out specific, factual mistakes.

Finding the Similarities

While these letters are different, they also have something in common: they’re all about getting your credit report right. All three types aim to clear up mistakes and make sure your credit report is fair and accurate. No matter which one you use, the goal is the same – to fix errors and improve your credit score.

Choosing the Right Letter

So, which one should you use? It depends on the situation. Metro 2 Letters are often the first choice for many credit repair experts because they’re straightforward and effective. Consumer Law-Based Letters are great when you need to highlight legal issues, and Factual Dispute Letters are ideal when you’ve got clear proof of a mistake.

In the end, understanding the differences and strengths of each type of letter can help you make the best choice for your credit repair journey. Knowing when to use each one can be a big help in getting your credit report cleaned up the right way.

Picking the Right Letter for Your Credit Dispute

When it comes to fixing errors on your credit report, picking the right type of letter is key. If you’re dealing with a simple mistake, like a wrong name or date, a Metro 2 Letter is often your best bet. They’re straightforward and get right to the point, which is great for clear-cut issues.

For more complex problems, especially those where you need to remind the bureaus about the laws they should follow, Consumer Law-Based Letters are your go-to. They show you know your rights and aren’t afraid to point out when those rights are being ignored.

Click here to get everything you need for FREE.

If you have solid proof of an error, like a statement showing a payment you made on time, Factual Dispute Letters are the way to go. They let you present clear evidence, making it hard for the bureaus to ignore the mistake.

Using a Combination for the Best Results

Sometimes, you might find that using a combination of these letters works best. For example, you could start with a Metro 2 Letter to address a simple error. If that doesn’t get the result you want, you could follow up with a Consumer Law-Based Letter to add some legal weight to your dispute.

In really tough cases, using all three types of letters at different stages can be effective. Start with the facts, back them up with the law, and make sure everything is presented in a way the credit bureaus understand. This approach covers all bases and increases your chances of getting the error fixed.

Remember, the goal is to make your credit report as accurate as possible. Knowing which letter to use, or which combination of letters, can make a big difference in cleaning up your credit report and improving your score.

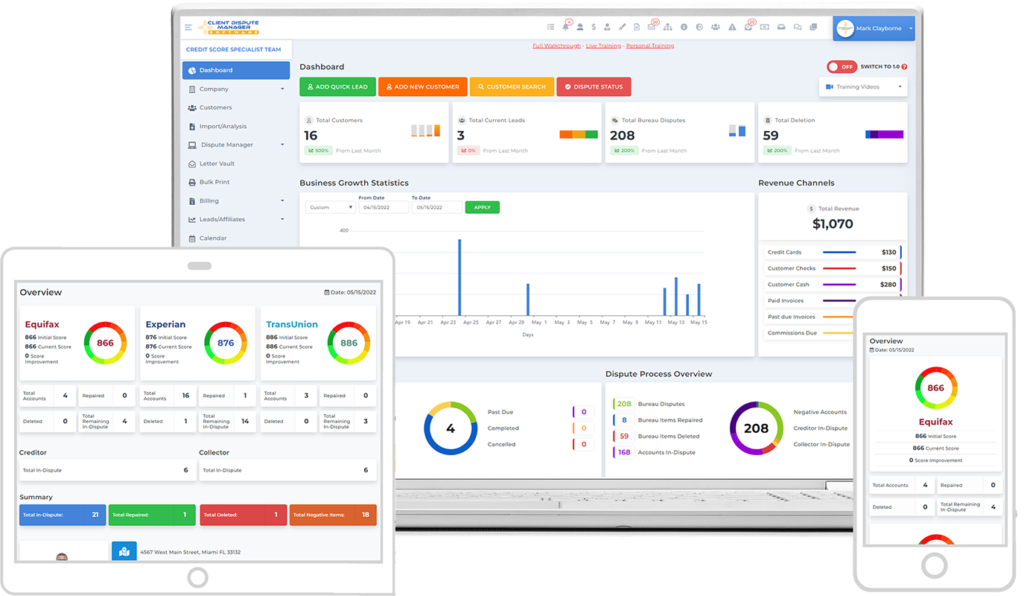

Incorporating Client Dispute Manager Software in Your Credit Repair Strategy

Have you heard of Client Dispute Manager Software? It’s like a super tool for anyone working on credit repair. This software is designed to make your life easier when dealing with credit disputes. It’s a program that helps you manage everything from keeping track of your credit report errors to sending out the right kind of dispute letters. It’s like having a personal assistant for your credit repair journey.

How the Software Works with Different Dispute Letters?

One of the coolest things about this software is how it works with different types of dispute letters. Whether you need to send a Metro 2 Letter, a Consumer Law-Based Letter, or a Factual Dispute Letter, this software has got you covered.

It helps you create these letters in the right format and keeps track of which ones you’ve sent. This means less hassle for you and no worrying about mixing things up.

Learn About Credit Repair Automation: A Guide to Streamlining Disputes with AI Software

Making Credit Repair More Efficient

Client Dispute Manager Software really shines when it comes to making the whole credit repair process more efficient. Imagine having all your credit dispute information in one place, easy to see and manage.

This software helps you stay organized, keeps track of your disputes, and even reminds you when to follow up. It’s like having a roadmap that guides you through the whole credit repair process.

Conclusion

In summary, choosing the right letter – whether it’s a Metro 2 Letter, a Consumer Law-Based Letter, or a Factual Dispute Letter – is crucial for effective credit repair. Each has its unique role in addressing credit report errors. And with tools like Client Dispute Manager Software, managing these disputes becomes more streamlined and efficient. Armed with this knowledge, you’re ready to tackle credit repair challenges more confidently.

Click here to get everything you need for FREE.