Are you feeling overwhelmed by mounting debts and constant harassment from debt collectors? You’re not alone. Many people find themselves in a similar situation, struggling to navigate the complex world of debt resolution. However, there may be a powerful tool that can help you take control of your financial situation: the debt validation process.

In this article, we’ll dive deep into what the debt validation process entails, how it works, and whether it could be the key to clearing your debts and regaining your financial freedom.

Start Today and Explore the Features Firsthand!

Understanding the Debt Validation Process and Debt Collection Validation

The debt validation process is a legal right granted to consumers under the Fair Debt Collection Practices Act (FDCPA). It allows you to request proof of a debt’s validity from a debt collector. When you initiate the debt validation process, the debt collector must provide written verification of the debt, including details such as the original creditor, the amount owed, and their legal right to collect the debt.

This verification is known as debt collection validation. The primary purpose of the debt validation process and debt collection validation is to protect consumers from unfair or deceptive collection practices.

By requesting validation, you can ensure that debt collectors have accurate information and are pursuing legitimate debts. This process empowers you to challenge the validity of a debt and potentially.

Step-by-Step Guide to the Debt Validation Process

To effectively utilize the debt validation process, follow these steps to protect your rights and challenge the validity of a debt. By systematically requesting debt collection validation through a debt verification letter and a validation request letter, you can uncover potential errors, stop collection actions, and work towards resolving your debt.

Remember, the key to success in the debt validation process is to be proactive, meticulous, and persistent in your communication with debt collectors.

Send A Written Request

Within 30 days of a debt collector’s initial contact, send a written request known as a debt verification letter. Clearly state that you are disputing the debt and requesting validation. A debt verification letter is a crucial component of the debt validation process and debt collection validation.

Make sure to include your personal information, the alleged debt details, and a clear statement expressing your demand for validation.

Use Certified Mail

Send your debt verification letter via certified mail with a return receipt. This provides proof of delivery and ensures the debt collector receives your request. A debt verification letter is essential for initiating the debt validation process and obtaining debt collection validation.

Sending the letter via certified mail creates a paper trail and adds an extra layer of protection for your rights.

Wait For A Response

Once the debt collector receives your validation request letter, they must cease all collection activities until they provide you with the requested documentation. Your validation request letter is a key step in the debt validation process and debt collection validation.

The debt collector has 30 days to respond to your request and provide the necessary proof of the debt’s validity. During this time, they are prohibited from contacting you or attempting to collect the debt.

Review The Validation

If the debt collector provides debt collection validation, carefully review the documentation to ensure it is accurate and complete. If they fail to validate the debt or cannot provide sufficient proof, they must stop attempting to collect the debt and remove any negative information related to the debt from your credit reports.

Debt collection validation is a crucial aspect of the debt validation process. Take your time to thoroughly examine the provided documentation, looking for inconsistencies, errors, or missing information that could support your dispute.

Take Appropriate Action

Based on the outcome of the debt validation process and the debt collection validation, decide on your next steps. If the debt is invalid, you can send a debt dispute letter to challenge it and work towards having it removed from your credit reports. A debt dispute letter is an important tool in the debt validation process.

If the debt is valid, consider negotiating a settlement or payment plan with the creditor. You may also want to consult with a credit repair specialist or attorney to explore your options and ensure your rights are protected throughout the process.

Start Today and Explore the Features Firsthand!

Benefits of the Debt Validation Process

Engaging in the debt validation process offers several potential benefits that can help you take control of your financial situation and protect your rights as a consumer. By requesting debt collection validation through a debt verification letter and a validation request letter, you can uncover potential errors, stop collection actions, and work towards resolving your debt.

The debt validation process empowers you to challenge the validity of a debt, gather essential information, and make informed decisions about your financial future.

- Challenging Invalid Debts: The debt validation process allows you to identify and dispute invalid or miscalculated debts. By requesting debt collection validation through a debt verification letter, you can uncover errors and protect yourself from unfair collection practices.

- Stopping Collection Actions: Initiating the debt validation process by sending a validation request letter temporarily halts collection activities. This provides relief from constant calls and letters, giving you breathing room to assess your situation and develop a plan.

- Improving Your Credit: If a debt is found to be invalid through the debt validation process and debt collection validation, and subsequently removed from your credit reports, it can have a positive impact on your credit score. Clearing erroneous negative items can help you rebuild your credit over time. A debt dispute letter can be used to challenge invalid debts and improve your credit.

- Gathering Information: The debt validation process requires debt collectors to provide detailed information about the debt through debt collection validation. This empowers you to make informed decisions about how to proceed, whether it’s sending a debt dispute letter to challenge the debt’s validity or negotiating a resolution.

Navigating the Debt Validation Process

While the debt validation process can be a powerful tool, it’s essential to approach it strategically. Here are some tips to help you navigate the process effectively:

Act Promptly with a Validation Request Letter

Time is of the essence when it comes to debt validation. Make sure to send your validation request letter within 30 days of the collector’s initial contact to preserve your rights. A timely validation request letter is crucial for the debt validation process and obtaining debt collection validation.

Be Clear and Specific in Your Debt Verification Letter

When crafting your debt verification letter, be clear and specific about your request. Explicitly state that you are disputing the debt and requesting validation. Provide any relevant information or documentation that supports your dispute. A well-written debt verification letter is essential for the debt validation process and debt collection validation.

Keep Meticulous Records for Debt Dispute Letters

Maintain a well-organized record of all correspondence and documentation related to the debt and the debt validation process. This includes copies of your debt verification letter, validation request letter, the collector’s response, and any supporting evidence. Proper record-keeping is crucial for the debt validation process and any potential debt dispute letter.

Seek Professional Assistance for the Debt Validation Process

If you’re unsure about how to proceed or need credit repair expert guidance, consider consulting with a credit repair specialist or attorney who specializes in debt collection matters. They can provide invaluable expertise and support throughout the debt validation process, including drafting a debt verification letter, validation request letter, or debt dispute letter.

Start Today and Explore the Features Firsthand!

The Role of Debt Validation in Credit Repair and Financial Recovery

For entrepreneurs in the credit repair industry or individuals looking to improve their financial situation, understanding the debt validation process is crucial. Educating yourself and your clients about this valuable tool, including the importance of a debt verification letter, validation request letter, debt collection validation, and debt dispute letter, can empower people to take control of their debts and work towards a brighter financial future.

Incorporating debt validation into your credit repair strategy can help identify and dispute invalid debts, improve your clients’ credit scores, and provide them with the knowledge and confidence to navigate the often-intimidating world of debt collection. By leveraging the power of these letters and validation processes, you can help your clients achieve their financial goals.

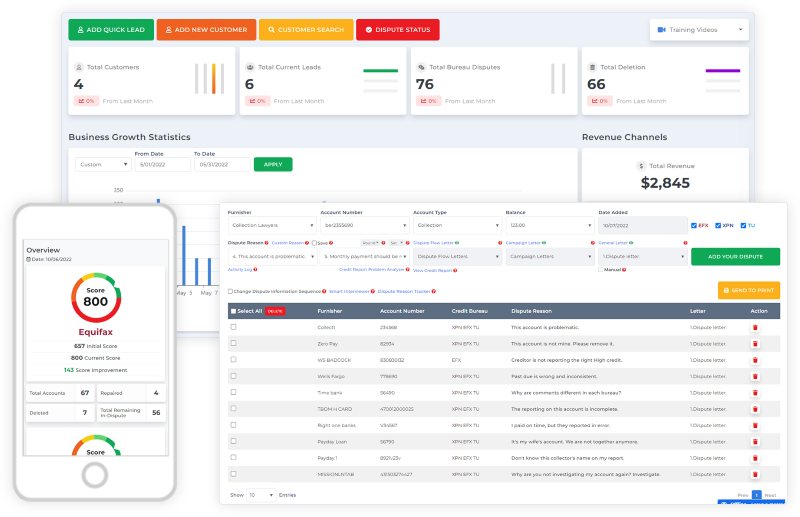

Streamline Your Debt Validation Process with Client Dispute Manager Software

As an entrepreneur in the credit repair industry, managing the debt validation process for your clients can be a time-consuming and complex task. That’s where Client Dispute Manager Software comes in. This innovative tool is designed to streamline the debt validation process, making it easier for you to generate debt verification letters, validation request letters, and debt dispute letters on behalf of your clients.

With Client Dispute Manager Software, you can:

- Automate the creation of personalized debt verification letters, validation request letters, and debt dispute letters based on your clients’ specific needs and circumstances.

- Keep track of important deadlines and follow-up dates related to the debt validation process and debt collection validation.

- Securely store and organize all documentation related to your clients’ cases, including debt verification letters, validation request letters, debt collection validation responses, and debt dispute letters.

- Access a comprehensive library of templates and resources to help you navigate the debt validation process and provide the best possible service to your clients.

By leveraging the power of Client Dispute Manager Software, you can save time, reduce errors, and improve your overall efficiency in managing the debt validation process for your clients. This powerful tool empowers you to focus on what matters most helping your clients achieve their financial goals and build a brighter future.

Start Today and Explore the Features Firsthand!

Conclusion

The debt validation process is a powerful weapon in the fight against unfair debt collection practices. By requesting validation through a debt verification letter or validation request letter, you can challenge invalid debts, stop collection actions, and potentially improve your credit.

However, it’s important to approach the process with a clear understanding of your rights and a commitment to following through, including obtaining debt collection validation and sending a debt dispute letter when necessary. Whether you’re an individual struggling with debt or an entrepreneur in the credit repair industry, mastering the debt validation process can be a game-changer.

By empowering yourself and others with knowledge about debt verification letters, validation request letters, debt collection validation, and debt dispute letters, you can take significant strides towards financial freedom and help build a more equitable and transparent credit system.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Credit Repair Software and Dispute Letter to Credit Bureau (2020)

- How to Remove Medical Collection Account from your Credit Report?