This content is a transcript of the video above.

In this video, I’m going to show you how to respond to debt collectors when they send you a respond letter from the initial letter that you sent. My name is Mark Clayborne, and I’m the founder of the Client Dispute Manager, which is a credit repair online business software. I’m also the founder and writer, the best-selling author of the book, Hidden Credit Repair Secrets, which is in the back right there, as you can see.

But today I want to show you exactly how to respond to debt collectors when you send the initial letter out to them and they respond back to you. So today we’re going to talk about debt collection responses. Again, debt collection response. So this is going to be a pretty lengthy video, so you definitely want to get your favorite beverage as I go deep into how to respond to a debt collector.

Now before we do that, what I want to do, I want to show you the first initial letter that you sent out to the debt collector. So before we talk about debt collection response, debt validation response, I want to show you the first letter you want to send out to the debt collector before allowing them to respond to you and before you respond back to them. All right?

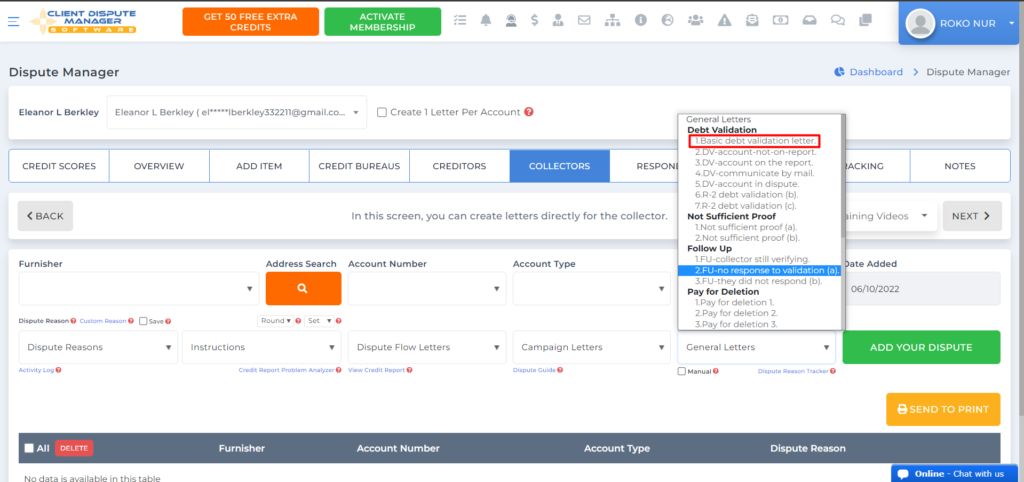

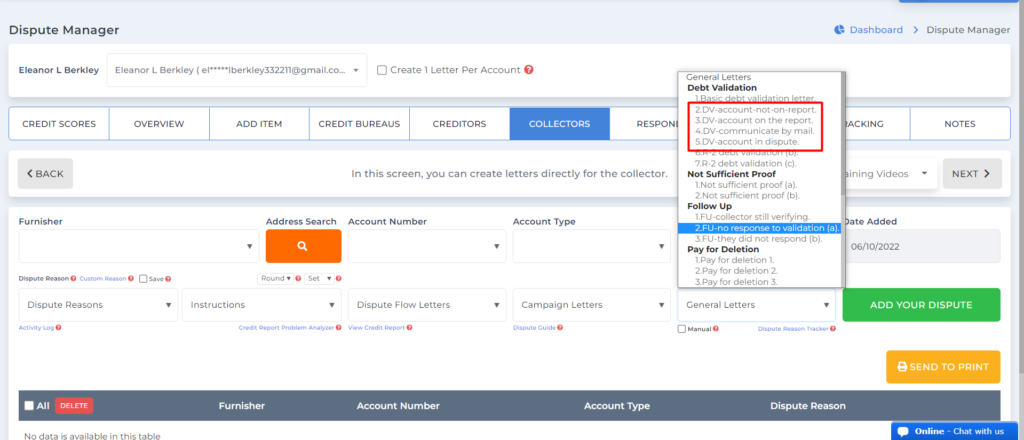

So let me show you exactly what I’m talking about here, so let’s go there. What we’re going to do, I’m logged into the Client Dispute Manager right now, and let’s go down here. Let’s go to customers and let’s go ahead and click on dispute and we’re going to go to collectors and let’s go ahead and use general letters and we’re going to go with the basic debt validation letter.

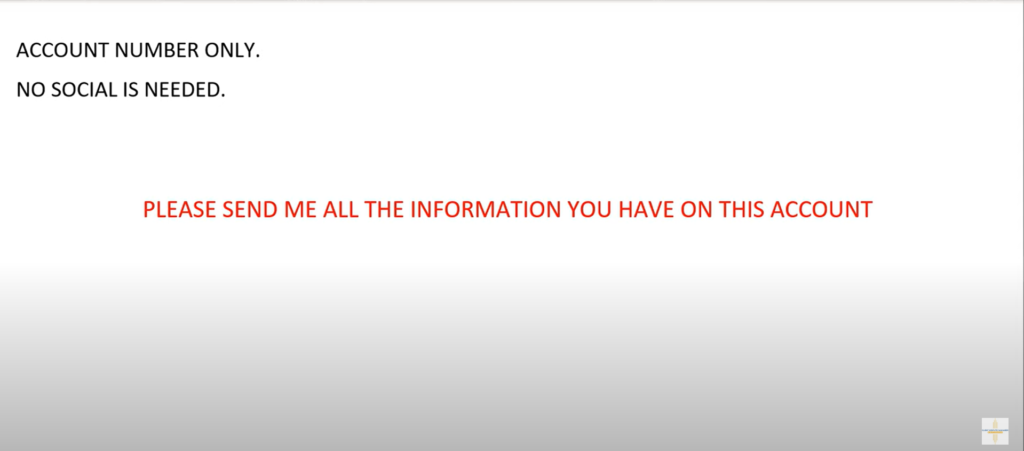

All right, so this is some of the information that we have in the basic debt validation letter. Now, you may say this is a blank screen and you may say there is not a lot of information inside of this particular letter. But let me show you something here really quick.

First of all, when you’re sending out a basic debt validation letter, you’re not asking the collection agency to validate anything, and see, that’s the key. You’re not asking them to validate anything. I see a lot of people misunderstand that, and the only reason why they misunderstand that because they’re not educated enough in this industry and that’s okay. I’ve been in the game for a long time so I understand kind of what I’m doing here.

You’re not asking them to validate or verify anything. What you’re doing is you’re saying, “Please send me all the information you have on this account.” That is the only thing you’re doing. You’re just asking the debt collection agency to send you all of the information that they have pertaining to the account.

Now, every debt validation letter does not have to be filled with a lot of requests. So whenever I’m doing credit repair and I’m sending out a debt validation letter for the first time, and this is the flow that you need to go through, all right? You don’t have to jump all the way down to the deep debt validation letter, which is here, DB account on the report.

That is a more deeper debt validation letter that you’re asking the collector to provide certain information. In the prior video, I went into deep details with that. But when you’re first starting now and you want to get some general information, you want to send the basic debt validation letter to the collection agency.

So what we’re going to do is I’m going to show you, I’m going to give you an ideal of what to include in that basic debt validation letter, and you’re going to be shocked about what I’m about to show you. Okay? Here we go.

Secret One: Account Number & SSN

Now, one of the reasons why you’re doing that is because you’re looking for certain things, but before we go further, let’s talk about a couple other things. Now over here on the left where it says account number only, whenever you’re sending out a debt validation letter, you want to make sure you include the account number only.

You don’t want to put your social security number on the letter. Now, you can, but I don’t recommend it, and it’s not needed from the collection agency anyway because your first name, your last name, your address, and the account number, that is enough data. That’s enough information for the collection agency to find your account in their database, okay? So the first thing is don’t include your social security number.

Secret Two: Send A Basic Letter & Ask Information

You know what kills me is that people that are amateurs in the credit space, they always say that a letter has to be so detailed. They always say that, “Oh, this letter looks really weak.” The thing is that the collection agencies, first of all, they don’t care about you, number one. Number one, they don’t care. They don’t care about you. Trust me when I tell you that. I have enough experience. I’ve worked on enough clients to understand that.

So what I’m trying to tell you is that you’re going to go with people who have experience in the game. They understand what they’re doing. They’ve done this before. They have big credit repair companies. They’ve worked with multiple customers. What I’m telling you, sending a basic letter to the collection agency, asking them only for all of the information that they have on this particular account, that’s all you’re doing.

“Please send me all of the information that you have on this account.” You’re not asking for anything else. You’re not asking for them to validate the debt. You’re not asking them to verify the debt. You’re not asking for any of that. You’re not sending a payment. You’re not doing anything. You’re just asking for the basic information on the account.

Now, I’m going to show you the reason why you’re asking for this information. All right, so let me go ahead and explain to you the reason why you’re asking for this information. The reason why you’re asking for this information is because you want to analyze all of the information that they send over to you and you want to look for holes. You want to look for problems with the information that they give you, right?

So if you ask to send all of the information over, you want to compare so you can come up with rebuttals. You want to compare the info that they have so you can write back to them and rebuttal the information that they sent to you. You understand?

So that’s why we always say you always should ask for information pertaining to the account before you run out there and start paying the debt collector, because sometimes some of these collectors are scams, so you may not know if they even real or not, right? So you don’t want to run out there and start giving them money if you don’t know if they are a real debt collection agency or not, or even if you owe them money.

Secret Three: Analyze Their Data

So what we want to do is we want to analyze the data that the debt collector has on you or your particular customer. You want to see all the information that they have so you can analyze and compare with your information and then you develop an argument based on that. You understand what I mean?

So that way, when you respond back to the debt collector, you’re going to use a debt validation response. When you respond back to the debt collection agency, you will have a better argument on why you feel that you don’t owe this money or why you feel that your customer doesn’t owe this money or what are some of the things that the debt collector must do before they can try to collect this money.

So this is why you want to get that general information and you want to analyze their data, so that’s the whole purpose of analyzing the data. Now, say for example, they send you back what you need, right? Say for example, they send you all of this paperwork, because I know that they’re not going to send you exactly what you need.

So the next step is you presented your argument to them. You explained to them, you argued your points and your cases and you sent it back to them, right? You responded back to the collection agency. They’re still validating the debt on your credit report or on your customer’s credit report. They’re still verifying it with the credit bureaus.

Secret Four: Not Sufficient Proof

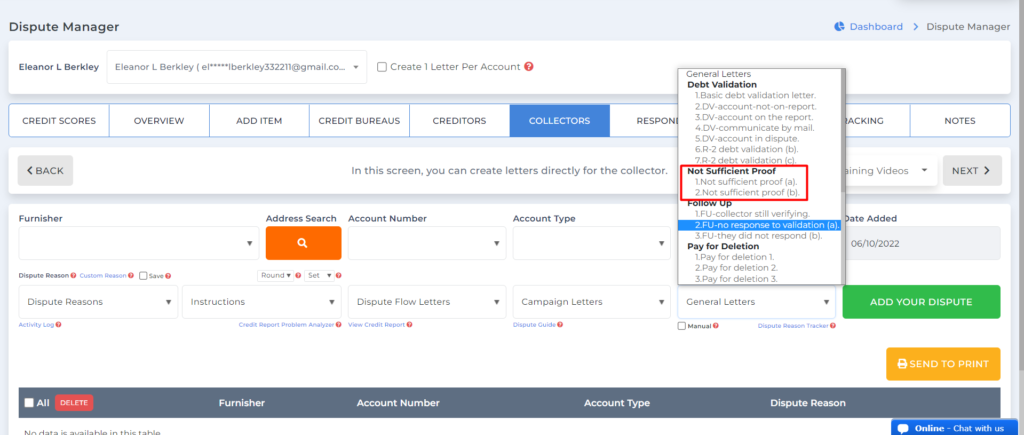

So your next step, your next step is to send this next letter because we know the type of information that the debt collector is going to send. They’re going to send you bull crap. They’re going to send you a summary of just basic information that doesn’t really give you anything. So the next response that you’re going to use, you’re going to use this letter inside of the Client Dispute Manager. So let me show you this letter that I’m talking about.

All right, so let me show you. I’m in the Client Dispute Manager right now. We’re on the collector screen. I’m going to go over to the general and let’s go to not sufficient proof. So this is the letter right here, not sufficient proof, not sufficient proof. So this letter is the letter that you use to respond back to the collection agency when they don’t send you the information that you want that’s going to validate why, that’s going to validate why they’re reporting to the credit bureaus, okay? You guys got it?

So that is the letter that you want to send back to the collection agency because they’re not providing you with the information that you requested, but yet they’re still verifying the account with the credit bureaus. Not sufficient proof is the name of the letter, not sufficient proof right here. Not sufficient proof A and not sufficient proof B.

Again, this is in the Client Dispute Manager, a professional credit repair business software that consumers use and business owners use not consumers, I’m sorry, business owners use to help their customers improve their credit score.

All right, so say in the example, you send this letter, right? Say you send this letter and then you wait, and yet the collection agency is still verifying the account with the credit bureaus, right? So I have two strategies for you. I have two strategies that has worked in the past and I think personally, it’s more powerful, okay? So I’m going to show you this right now.

This is information that I don’t normally give out. This is information that customers usually charge me. I usually charge them in coaching sessions, but these two strategies I’m going to show you right now will get the collection agency to act or to respond or to deliver the information that you’re requesting, okay? So here are the two strategies right now. Let me show it to you right here.

Secret Five: Submit A Complaint to The CFPB

The first one is submitting a complaint to the Consumer Financial Protection Bureau. Now right here, as you can see, it says debt collection. So before you submit this complaint to the Consumer Financial Protection Bureau, you want to make sure you went through step one and two.

Again, before you submit this complaint to the Consumer Financial Protection Bureau, you want to make sure you’ve went through step one, which is asking for the basic information, and step two, responding to them with, “This is not enough proof for you to continue to report this on my credit report,” or to report it on on your customer’s credit report if you have a credit score improvement business.

What you want to do is you want to file a complaint with the Consumer Financial Protection Bureau, but you want to make sure you have all of the information that you need to file this complaint, all right? You want to make sure you have all the information that you need to file this complaint on the collection agency, like the collection agency’s address, the name of the collection agency, the account number, what you did first, the first letter you sent, what you asked for, the collection agency’s response back to you, your response back to the collection agency.

So you want to make sure when you come to the Consumer Financial Protection Bureau that you have your case solid, all right? You want to make sure that your case is solid when you come to the Consumer Financial Protection Bureau, okay? They’re going to say, “We’re going to investigate.” It normally takes about 15 days, but what you’re really doing is you’re trying to build some sort of case against the collection agency in case you have to get a lawyer involved in this matter, all right?

All right. So again, like I said, dealing with debt collectors and responding to them, you have to respond to them the correct way and if you don’t have the education and if you don’t know what you’re doing, then they’re going to run circles around you because you just don’t understand. But now that you’ve watched this video on how to respond to debt collectors and the regulatory bodies and the agencies that you can use to respond to debt collectors, this is your time.

Secret Six: Better Business Bureau

Now, the next one, the next powerhouse that I normally use is using the Better Business Bureau. Now, for some reason the Better Business Bureau has produced better results than the Consumer Financial Protection Bureau. Now, I don’t know why, but for some reason the Better Business Bureau has produced better results for me in the past than the Consumer Financial Protection. I don’t know. I have no reason for that, but the Better Business Bureau for some reason does.

So again, you want to file your complaint right here with the Better Business Bureau and you want to make sure you have everything lined up, all of the information, all of the communication back and forth from the collection agency and yourself. And again, you’re kind of building this case in case you need to take your entire case to an attorney. At least you would have some ammunition that you’ve been trying to resolve this already with the collection agency before you came to the attorney’s office, okay? You guys with me so far, right?

Now, I want to show you something really quick before we go, okay? I want to show you something before we go here real quick. If you have not subscribed to my channel, let me show you how to subscribe to my channel. So every single a new video like this one comes out, you guys can get notified by email. You can get notified by alerts so you can get more information on how to handle your own credit. If you’re a credit restoration company, you can get more information on how to help your customers.

And lastly, if you ever thought about earning an additional stream of income from doing what you already know, you’re already studying credit repair, you’re already fixing your own credit, you already raised your credit score, or you’re thinking about raising your own credit score, you are already studying because you’re watching this video, right?

So just think about it. All the studies that you do, everything you’re doing to improve your credit score, why not use that knowledge? Why not use that knowledge to earn extra stream of income helping other people improve their credit score as well? Think about it.

You can become a credit score improvement specialist helping others improve their credit score and yet earn an additional stream of income, because right now ladies and gentlemen, we can’t just live off the one single income that we have because things are hard. You want to do things with your life. You want extra things. You want to buy things for your family. And every single time when you get that paycheck, it’s very tight. So why not do what you know, do what you love and earn an extra stream of income?

So listen, I put this course together on how to become a credit score improvement specialist. You’re going to see something on the right hand side pop up very soon. You can watch my next video on how to become a credit score improvement specialist, or you can click the links below this video right here. I have a free training on how to do that.

Also, try out the Client Dispute Manager software. Got a 30 day trial there. And also, we have a Credit Repair Master Class if you’re interested in that too. So we have a lot of stuff for you to help you grow, to help you make an extra stream of income and to also change your life. This is Mark Claiborne again, the founder of the Client Dispute Manager, and I’m also a motivational marketing expert. Until next time, don’t forget to subscribe. Take care.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.