Are you struggling with a low credit score that’s holding you back from achieving your financial goals? You may have heard about credit sweeps as a potential solution, but are they really worth the risk? In this article, we’ll dive into what credit sweeps are, how they work, and the key factors you must consider before deciding if a credit sweep is right for you.

Start Today and Explore the Features Firsthand!

What is a Credit Sweep?

A credit sweep, also known as a credit cleanup or credit repair, is a process that aims to remove negative items from your credit report. These negative items could include late payments, collections, charge-offs, and other derogatory marks that are dragging down your credit score.

The idea behind a credit sweep is that by disputing these negative items with the credit bureaus, you may be able to get them removed from your report, resulting in a quick boost to your credit score. Sounds appealing, right? But before you jump in, there are some important risks and considerations to keep in mind.

How Does a Credit Sweep Work?

The process of a credit sweep typically involves working with a credit repair company or doing it yourself. Here’s a general overview of how it works:

- Review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify negative items.

- Gather any documentation that supports your case for disputing the negative items, such as proof of payment or evidence of identity theft.

- Draft and send dispute letters to the credit bureaus challenging the accuracy of the negative items.

- The credit bureaus have 30 days to investigate your dispute and verify the information with the original creditor. If they can’t verify it, they must remove the item from your report.

- Continue monitoring your credit reports and disputing any remaining or new negative items until you achieve your desired credit profile.

Understanding the Legal Landscape of Credit Sweeps

Credit sweeps are legal, but there are some important caveats. The Credit Repair Organizations Act (CROA) governs credit repair companies and sets strict rules around how they can operate. For example, credit repair companies cannot charge you upfront fees, guarantee results, or misrepresent their services.

Additionally, disputing accurate negative items on your credit report is considered fraud. You should only dispute items that you believe are genuinely inaccurate or unverifiable.

It’s also important to note that you have the right to dispute negative items on your credit report yourself, without hiring a credit repair company. The process can be time-consuming, but it can also save you money and give you more control over the process.

Start Today and Explore the Features Firsthand!

What are the Risks of Using Credit Sweeps?

While credit sweeps may seem like a quick fix for your credit woes, there are some significant risks to consider:

- Scams: The credit repair industry is rife with scams that prey on desperate consumers. Some common red flags to watch out for include guarantees of results, upfront fees, and pressure to sign up immediately.

- Temporary Results: Even if a credit sweep successfully removes negative items from your report, there’s no guarantee they won’t reappear later. Creditors can re-report removed items if they verify their accuracy.

- Legal Trouble: If you dispute accurate negative items or use false information in your disputes, you could face legal consequences for fraud.

- Wasted Time and Money: If a credit sweep doesn’t work or the removed items reappear on your report, you may have wasted valuable time and money that could have been better spent on other credit improvement strategies.

The Impact of Credit Sweeps on Your Credit Score

A credit sweep that successfully removes negative items from your credit report can result in a quick boost to your credit score. However, it’s important to keep in mind that this boost may only be temporary if the removed items are accurate and later reappear on your report.

Additionally, a credit sweep doesn’t address the underlying issues that led to the negative items in the first place, such as overspending or late payments. Without addressing these root causes and adopting healthier financial habits, you may find yourself right back where you started even after a successful credit sweep.

How to Identify Credit Sweep Scams?

With so many credit repair scams out there, it’s crucial to know how to spot them. Here are some common warning signs:

Guarantees of Results

No legitimate credit repair company can guarantee specific results, as every individual’s credit situation is unique. If a company promises to remove all negative items from your credit report or boost your score by a certain number of points, be very wary. These claims are often too good to be true and are a clear indication of a scam.

Upfront Fees

The Credit Repair Organizations Act (CROA) prohibits credit repair companies from charging fees before providing services. If a company demands payment upfront or tries to pressure you into signing up for a long-term contract with high fees, it’s likely a scam.

Legitimate credit repair companies will typically charge a modest monthly fee and will not require payment until after they’ve completed work on your behalf.

High-Pressure Sales Tactics

Scammers often use high-pressure sales tactics to get you to sign up before you have time to research their company or consider other options. They may try to create a sense of urgency, claiming that their offer is only available for a limited time or that you need to act now to avoid further damage to your credit.

Don’t let yourself be rushed into a decision.Take the time to thoroughly research any company before agreeing to work with them.

Promises of a New Credit Identity

Some scammers may claim they can help you establish a new credit identity using a Credit Privacy Number (CPN) or Employee Identification Number (EIN). They may market these numbers as a “legal” way to create a fresh start on your credit. However, using a CPN or EIN to apply for credit is considered fraud and is illegal. No legitimate credit repair company will suggest this tactic.

Lack of Transparency

A legitimate credit repair company will be transparent about their process, fees, and what you can realistically expect in terms of results. They should provide a detailed contract outlining their services and have a clear, published privacy policy.

If a company is vague about their methods, refuses to put promises in writing, or doesn’t have a physical address or website, consider these red flags.

Start Today and Explore the Features Firsthand!

What are Legal Alternatives to Credit Sweeps?

While credit sweeps may seem like a quick solution to improving your credit, they come with significant risks and limitations. Fortunately, there are several legal alternatives that can help you build and maintain a healthy credit profile without resorting to potentially fraudulent tactics. Here are some effective strategies to consider:

DIY Credit Repair

One of the most straightforward and cost-effective alternatives to credit sweeps is doing your own credit repair. Under the Fair Credit Reporting Act (FCRA), you have the right to dispute inaccurate or incomplete information on your credit reports.

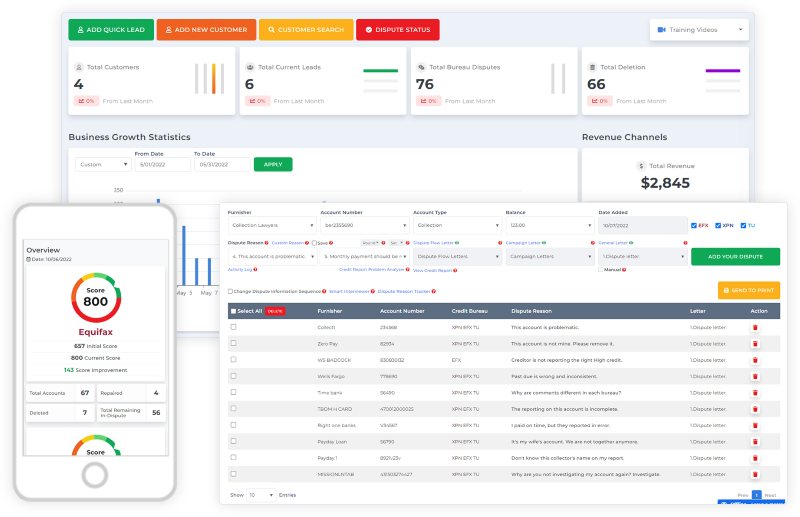

Utilizing tools like Client Dispute Manager Software can significantly streamline this process. This software is designed to help individuals and credit repair professionals manage credit report disputes more efficiently, offering features like automatic dispute letter generation, tracking of dispute progress, and insights into credit repair strategies.

With such resources, you can navigate the complexities of credit repair with greater ease and effectiveness.

Credit Counseling

If you’re struggling with debt or need help developing a plan to improve your credit, consider working with a reputable credit counseling agency. These nonprofit organizations provide a range of services, including:

- Budgeting and money management advice

- Debt management plans (DMPs) to consolidate and pay off unsecured debts

- Personalized credit improvement strategies

- Financial education resources

When choosing a credit counseling agency, look for one that is accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These organizations ensure that their member agencies adhere to strict standards of ethics and professionalism.

Secured Credit Cards

If you have a limited or damaged credit history, a secured credit card can be an excellent tool for building or rebuilding your credit. With a secured card, you provide a cash deposit that serves as collateral and typically equals your credit limit.

As you use the card responsibly and make on-time payments, the issuer reports your activity to the credit bureaus, helping you establish a positive payment history.

Credit-Builder Loans

Another option for building credit is a credit-builder loan, which is designed specifically to help individuals with limited or damaged credit histories. With a credit-builder loan, the lender deposits the loan amount into a savings account that you can access once you’ve repaid the loan in full.

As you make on-time payments, the lender reports your activity to the credit bureaus, helping you build a positive payment history.

Credit-builder loans are often available through credit unions, community banks, and online lenders. Be sure to compare offers and read the fine print carefully before signing up, as terms and fees can vary widely.

What Should I Do If A Credit Sweep Offer Scammed Me?

If you believe you’ve been scammed by a credit repair company, there are steps you can take to protect yourself and seek recourse:

- File a Complaint: File complaints with the Federal Trade Commission (FTC), your state Attorney General’s office, and the Consumer Financial Protection Bureau (CFPB).

- Contact Your Bank: If you paid the scammer with a credit card or debit card, contact your bank to dispute the charges and request a chargeback.

- Monitor Your Credit: Keep a close eye on your credit reports for any suspicious activity or inaccurate information. You can request a free copy of your credit report from each bureau once a year at Annual Credit Report.

- Seek Legal Assistance: If you’ve suffered significant financial losses due to a credit repair scam, consider seeking legal assistance to explore your options for recovery.

Remember, the best defense against credit repair scams is education and prevention. Before signing up for any credit repair service, thoroughly research the company, read reviews, and understand your rights under the CROA.

Navigating the Credit Repair Regulatory Landscape: A Comprehensive Overview

Credit repair laws have undergone significant transformations since the industry’s inception. Initially operating with minimal oversight, the sector saw the introduction of crucial legislation to protect consumers and regulate practices. Two foundational laws for credit repair emerged: The Fair Credit Reporting Act (FCRA) of 1970 and the Credit Repair Organizations Act (CROA) of 1996.

These credit repair laws revolutionized the industry by establishing clear guidelines for credit reporting agencies, credit repair organizations, and consumers alike.

The Fair Credit Reporting Act: Cornerstone of Credit Repair Laws

The Fair Credit Reporting Act (FCRA) marked a significant milestone in consumer rights protection within the credit repair industry. It grants individuals the power to access their credit reports annually at no cost, contest inaccuracies, and understand how their credit information is used.

For credit repair entities, FCRA compliance is crucial and involves obtaining explicit consent before pulling credit reports and educating clients about their rights under the Fair Credit Reporting Act.

FCRA compliance extends beyond just following rules; it’s about embracing the spirit of the law to ensure fair and accurate credit reporting. Credit repair organizations must implement robust systems to assist clients in exercising their FCRA rights, including disputing inaccuracies and understanding the impact of negative items on their credit reports.

The Credit Repair Organizations Act: Elevating Industry Standards

The Credit Repair Organizations Act (CROA) addresses specific challenges within the credit repair sector. This pivotal law for credit repair mandates that credit repair organizations provide detailed written agreements, avoid charging upfront fees, allow a cooling-off period for contract cancellation, and maintain truthful advertising practices. CROA compliance is essential for any business operating in the credit repair industry.

By setting these standards, the Credit Repair Organizations Act has significantly elevated the professionalism of the industry. It forces organizations to be more transparent in their dealings, more ethical in their practices, and more focused on delivering real value to their clients. Adherence to CROA is not just about legal compliance; it’s a fundamental aspect of building a reputable credit repair business.

Credit Repair Compliance: A Business Imperative

Credit repair compliance encompasses adherence to both the Fair Credit Reporting Act and the Credit Repair Organizations Act, as well as other relevant laws for credit repair. It’s not merely a legal obligation but a business imperative that builds trust, enhances reputation, and differentiates ethical operators in a competitive market.

Key credit repair compliance strategies include:

- Prioritizing consumer education on credit repair laws

- Maintaining meticulous documentation of all credit repair activities

- Implementing robust dispute management systems in line with FCRA requirements

- Ensuring transparent communication throughout the repair process as mandated by CROA

By embracing these strategies, credit repair organizations can not only meet legal requirements but also position themselves as trusted advisors in their clients’ financial journeys.

Navigating the Dynamic Landscape of Credit Repair Laws

The regulatory environment for credit repair is constantly evolving, with frequent updates and new interpretations of existing laws. Staying compliant with credit repair laws requires continuous monitoring of legislative changes and regular policy reviews. Organizations must invest in ongoing staff training on FCRA compliance, CROA requirements, and other relevant laws for credit repair.

This proactive approach to credit repair compliance helps organizations stay ahead of regulatory changes and adapt their practices accordingly. It demonstrates a commitment to ethical operations that can set a company apart in the credit repair industry.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

How much does a credit sweep typically cost?

Credit repair companies often charge monthly fees ranging from $50 to $150, with some charging initial setup fees as well. However, keep in mind that the CROA prohibits credit repair companies from charging upfront fees before providing services.

How can I tell if a negative item on my credit report is inaccurate?

Review your credit reports carefully and look for any items that you don’t recognize, have incorrect information (such as wrong payment dates or amounts), or should have aged off your report (most negative items should be removed after 7-10 years).

Can I dispute negative items on my credit report online?

Yes, all three major credit bureaus (Equifax, Experian, and TransUnion) allow you to dispute items online through their respective websites. However, it’s important to keep thorough records of your disputes and follow up regularly, which may be easier to do with mailed dispute letters.

What's the difference between a credit repair company and a credit counseling agency?

Credit repair companies focus solely on disputing negative items on your credit report, while credit counseling agencies provide a broader range of services, including budgeting advice, debt management plans, and financial education. Credit counseling agencies are typically non-profit organizations, while credit repair companies are for-profit businesses.

How long does negative information stay on my credit report?

Most negative items, such as late payments, collections, and charge-offs, stay on your credit report for seven years from the date of the original delinquency. However, some items, such as bankruptcies, can stay on your report for up to 10 years.

Conclusion

In conclusion, while credit sweeps may seem like a tempting solution for bad credit, they come with significant risks and limitations. Before deciding to pursue a credit sweep, it’s crucial to weigh the potential benefits against the risks of scams, temporary results, legal trouble, and wasted resources.

Remember, the most effective and sustainable way to improve your credit is through consistent positive financial habits, such as paying bills on time, keeping credit utilization low, and disputing inaccurate information on your credit reports. While this process may take longer than a credit sweep, it sets you up for long-term success and financial stability.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: