Have you ever checked your credit report and felt your stomach drop after spotting a late payment? You’re not alone. Whether it was an honest mistake or a temporary financial slip, a single late payment can sit on your report for up to seven years, quietly pulling down your credit score and making it harder to qualify for better rates or approvals.

But here’s some good news: there’s a way to ask your lender for a second chance in writing. It’s called a goodwill letter.

A goodwill letter is a simple, polite request you send to your creditor. You’re not disputing the accuracy of the late payment.

Instead, you’re asking them to consider removing it as a one-time exception based on your past good behavior or a situation that caused the slip. Many people don’t realize this approach exists, and when used the right way, it can be an honest and respectful tool to clean up your credit profile.

In this article, you’ll learn:

- What a goodwill letter is (and what it isn’t)?

- When it makes sense to send one?

- What to say and how to say it?

- How to use templates and AI tools to help write and manage your letters?

- How credit repair professionals and individuals use this method effectively without overpromising or breaking compliance rules?

Whether you’re trying to fix your personal credit or running a credit repair business, knowing how to write a goodwill letter could save you time, stress, and maybe even points on your score.

Ready to see how it works? Let’s start by understanding what this letter actually is and why creditors sometimes say yes.

What Is a Goodwill Letter and How Can It Help with Late Payments?

A goodwill letter is a written request you send to a creditor, asking them to remove a late payment from your credit report as a gesture of goodwill. You acknowledge the late payment was valid, but you’re hoping the creditor might consider taking it off your record based on your history or specific circumstances.

This approach doesn’t work for everyone or every account, but it has helped many people restore their credit after a temporary slip. Lenders are not required to honor your request, but some may choose to grant it, especially if you’ve been consistent with on-time payments before and after the missed one.

The key difference between a goodwill letter and a dispute is intent. You’re not arguing that the information is incorrect. You’re simply asking for a one-time exception.

For example, someone might write a goodwill letter to a creditor after missing a payment during a medical emergency or job loss. If the account is now current and the person has shown responsibility since then, the creditor might agree to remove the late payment as a courtesy.

Keep in mind that results vary. What works for one person may not work for another. Still, when done correctly and respectfully, a goodwill letter can be worth the effort, especially if you’re trying to boost your credit score or clean up your report before applying for a loan.

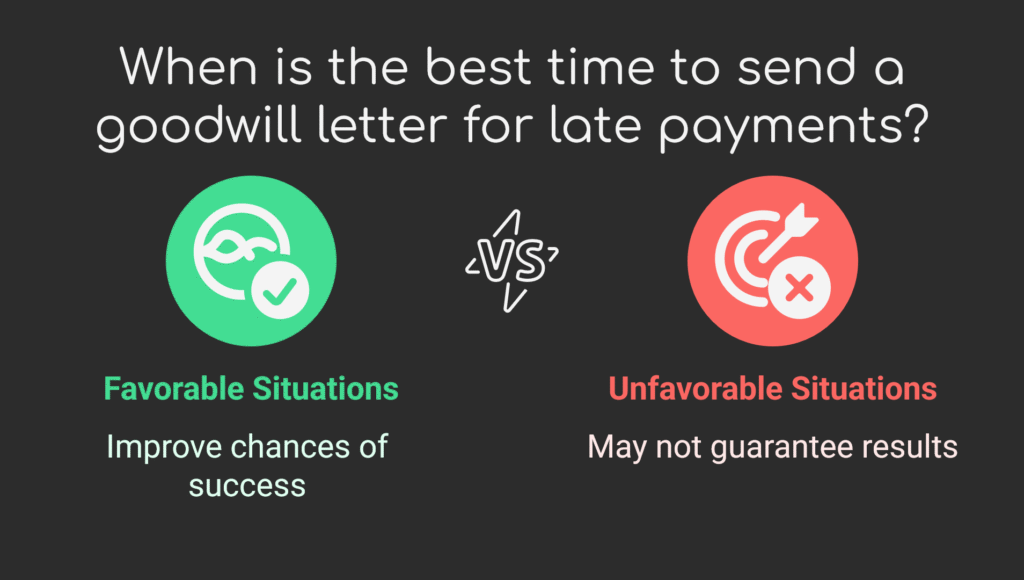

When to Use a Goodwill Letter to Remove Late Payments?

Timing matters. Sending a goodwill letter to remove late payments makes more sense in some situations than others.

Creditors are more likely to listen if your account is current and if your history shows that the late payment was unusual for you. It helps if you’ve already taken steps to prevent it from happening again.

Late payments caused by one-time life events, like a family emergency, a brief illness, or a job interruption, may have a stronger case. The more stable your record looks overall, the better your chances of a positive response.

Best Times to Send a Goodwill Letter for Late Payments

Here are a few situations where it may be helpful to send a goodwill letter for late payments:

- You missed a single payment but have an otherwise strong payment history

- You’ve corrected the issue and the account is now current

- The late payment happened due to a temporary hardship or situation beyond your control

- You’re applying for a mortgage or other loan and need to clean up your report

Remember, timing won’t guarantee results, but it can influence how your request is received.

Does a Goodwill Letter to Remove Late Payments Actually Work?

This is one of the most common questions people ask. The answer depends on your situation and the creditor’s policy. Some lenders will never adjust accurate negative information. Others might be more flexible if you’ve had a long, positive relationship with them.

A goodwill letter to remove late payments works best when:

- The payment was late by a short period (like 30 days)

- Your account has since returned to good standing

- You include a sincere explanation with your request

While success isn’t guaranteed, many people have reported positive outcomes. Lenders are more likely to consider a request when it shows accountability and a pattern of responsibility.

It helps to be honest and avoid sounding demanding. A respectful tone, clear reason, and a brief letter often make the biggest difference.

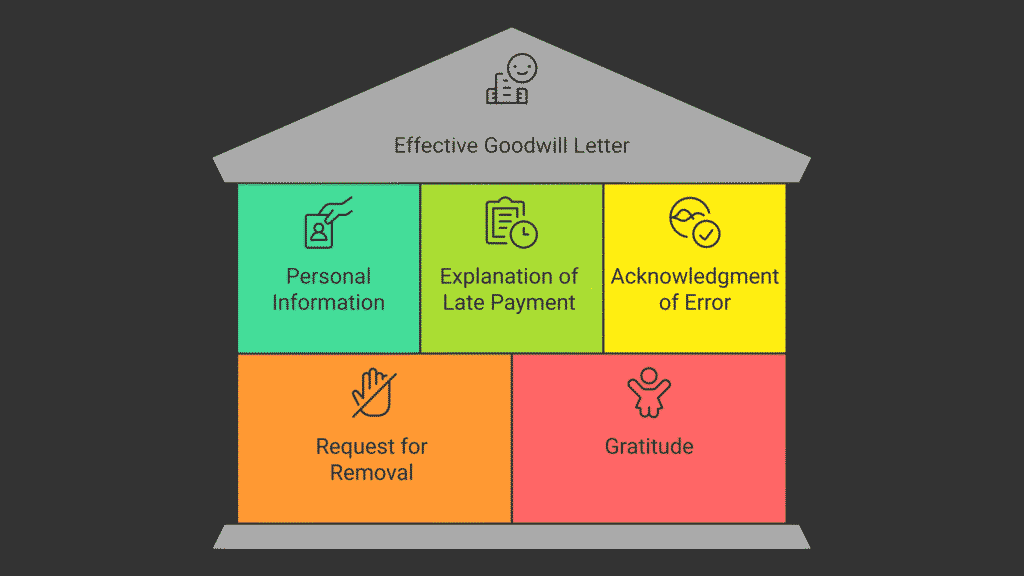

What to Include in a Goodwill Letter for Late Payments?

A goodwill letter for late payments should be short, respectful, and focused. You’re asking for a courtesy, so it’s best to be polite and professional without sounding demanding. Keep the tone cooperative.

Including the right details and using a clear format makes your goodwill letter to creditor easier to read and more likely to be taken seriously. Many people find success by adapting a goodwill letter template to reflect their specific situation and tone.

Key Elements of an Effective Goodwill Letter to Remove Late Payments

When writing your goodwill letter, include these elements:

- Your full name and account number

- A clear explanation of the late payment and what caused it

- A statement acknowledging the error without disputing it

- A brief request for the creditor to consider removing the late payment

- A thank-you for their time and consideration

Make sure to check spelling, grammar, and tone before sending it. A well-written letter can leave a better impression.

Structuring Your Goodwill Letter to Creditor Professionally

The letter doesn’t need to be long. Aim for 3 to 5 short paragraphs. Keep your explanation simple, your request clear, and your tone courteous.

You can write the letter by hand, type it and print, or send it electronically depending on what your creditor allows. If mailing, send a physical copy with your signature. Whether you’re sending a goodwill letter for late payments or a goodwill deletion letter, make sure it’s formatted neatly and addresses the creditor directly.

A well-prepared goodwill letter to creditor helps show that you’re taking responsibility and are serious about maintaining your credit.

Goodwill Letter Templates You Can Use

Templates can help you get started if you’re unsure how to write your letter. A goodwill letter template gives you a basic structure that you can customize with your own words and details. This can make the writing process faster and reduce the chance of forgetting something important.

Here’s a simple goodwill letter template you can use for a credit card account:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State, ZIP Code]

Subject: Request for Goodwill Adjustment on Late Payment

Dear [Creditor’s Name],

I am writing to respectfully request a goodwill adjustment to remove a late payment reported on my account [Account Number] in [Month, Year]. I take full responsibility for the missed payment, which occurred due to [brief explanation of situation].

Since then, I have kept the account current and have worked to maintain a strong payment history. I truly value our relationship and ask if you would consider removing the late mark as a one-time courtesy.

Thank you for your time and understanding.

Sincerely,

[Your Name]

This example can be edited to fit your tone, situation, and account type. Just remember to keep it honest, respectful, and clear.

Goodwill Letter Template for Mortgage or Auto Loan Late Payments

If your late payment occurred on a mortgage or auto loan, you can adjust the wording to better match that type of account. Here’s a modified version:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Date]

[Loan Servicer’s Name]

[Servicer’s Address]

[City, State, ZIP Code]

Subject: Request for Goodwill Removal of Late Payment

Dear [Loan Servicer’s Name],

I am writing to respectfully request the removal of a late payment recorded on my mortgage/auto loan account [Account Number] for the payment due in [Month, Year]. This delay was due to [brief reason: unexpected illness, temporary job loss, etc.], and since then, I have worked diligently to bring the account current and continue making on-time payments.

I value our relationship and the opportunity to finance through your institution. I hope you will consider removing the late payment from my credit file as a gesture of goodwill.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Make sure to update the letter based on the actual details of your situation. Even a goodwill deletion letter works best when it reflects your voice and experience honestly.

Customizing a Goodwill Letter for Late Payments to Your Creditor

No two situations are exactly alike, and your goodwill letter to creditor should reflect your specific experience. While templates are helpful, taking the time to personalize your message makes a stronger impact.

A thoughtful and sincere goodwill letter for late payments can demonstrate accountability and a genuine desire to maintain a positive financial relationship.

Start by adjusting the language in the template to match your tone. Use your own words when describing what caused the late payment and explain what you’ve done to ensure it doesn’t happen again.

Avoid exaggerations or over-explaining. Creditors are more likely to respond favorably to a short, respectful note that sounds like it came from you, not a script.

Also, be sure to double-check that all details are accurate, including account numbers and dates. A small mistake can create confusion or slow down the review process. Clear communication and a respectful tone are just as important as the request itself.

How to Send a Goodwill Letter to Creditor?

Once your goodwill letter to creditor is ready, the next step is to get it into the right hands. How you send it can make a difference in how quickly it’s reviewed and how seriously it’s considered. Some companies offer online forms, while others prefer a traditional mailed letter.

It’s a good idea to review the creditor’s website or customer service guidelines before deciding.

Choosing the Right Method to Send a Goodwill Letter for Late Payments

There are three common methods to send your goodwill letter for late payments:

- Mailing a Physical Letter: This is often the most formal and trusted method. Use certified mail with a tracking number so you know it was delivered.

- Email: If the creditor lists a customer service email or provides direct support through email, this can be a quicker option. Make sure your message is professional and includes all the same information as a mailed letter.

- Online Account Portal: Some lenders let you send secure messages through their customer portal. This can be efficient if they don’t list a clear mailing address or email contact.

Each method has pros and cons. A mailed goodwill letter to creditor may stand out more, while an email or portal message can speed things up. Use the method that best matches how the creditor usually communicates.

Following Up on Your Goodwill Letter to Remove Late Payments

After sending your goodwill letter to remove late payments, allow some time for a response. If you haven’t heard back within three to four weeks, it’s okay to follow up.

- Start by calling the creditor’s customer service line to confirm they received your request.

- Be polite and explain that you’re checking on the status of your letter.

- If they say no, you can respectfully ask if there’s a better time or method to re-submit it.

Keep a copy of your original letter and note the dates you sent and followed up. Staying organized and respectful during follow-ups shows professionalism and may increase your chances of success.

What to Expect After Sending a Goodwill Letter?

Once your letter has been sent and received, what happens next can vary depending on the creditor. Some may review it quickly and respond within days. Others may take weeks or even longer, depending on their internal process and volume of requests.

Patience is key. While you wait, monitor your credit reports for updates and check your mail or email regularly in case the creditor reaches out with a decision.

How Long Does It Take for a Creditor to Respond to a Goodwill Letter?

On average, a response to a goodwill letter to creditor can take between two to four weeks. Some lenders may respond faster, while others might not reply at all.

If you mailed your goodwill letter for late payments, allow extra time for it to arrive and be processed. Electronic messages or online submissions might get quicker attention, but even then, there’s no standard timeframe for a decision.

During this period, avoid sending multiple follow-ups too quickly. Give the process time and keep track of your communication.

What to Do If Your Goodwill Letter to Creditor Is Rejected?

Not all goodwill letters to remove late payments are accepted. If the creditor declines your request, don’t take it personally. It doesn’t mean your effort was wasted. Some companies have strict policies against removing accurate information, even as a courtesy.

If this happens:

- Recheck your credit report to ensure the information is still accurate.

- Focus on continuing to make on-time payments going forward.

- Consider re-sending the letter after more time has passed, especially if your payment history has remained strong.

While a rejection can be disappointing, building a consistent and positive record over time still strengthens your creditworthiness.

How AI Credit Repair Software Can Help with Goodwill Letters?

Using AI credit repair tools can simplify the goodwill process, especially if you’re managing multiple accounts or helping others. These tools are designed to streamline the process of writing, sending, and monitoring goodwill letters to creditors efficiently.

Automating the Goodwill Letter Template Process Using AI Tools

AI-powered software can help you generate a goodwill letter template quickly by asking you a few simple questions. Once you input details like account type, payment history, and your explanation for the late payment, the system creates a personalized draft.

These templates can often be edited before sending, giving you the flexibility to adjust the tone or wording to match your situation. This saves time and ensures consistency, especially if you’re sending multiple goodwill letters for late payments.

Tracking Goodwill Letters to Creditors with AI Credit Repair Software

In addition to writing letters, AI credit repair software often includes tracking features. You can record when a goodwill letter to creditor was sent, which method was used, and whether a follow-up is needed.

Having a clear record helps avoid duplication and makes follow-ups more effective. It also allows credit repair businesses to manage client cases professionally, making sure each request stays organized and timely.

Whether you’re an individual working on your own credit or a credit repair business owner, using AI tools makes the goodwill process smoother and easier to manage.

Client Dispute Manager Software: Helping You Manage Goodwill Letter Requests with Ease

Client Dispute Manager Software is designed specifically for people working in the credit repair industry, whether for personal use or to serve clients. It offers a practical way to manage tasks like sending goodwill letters with less manual work and more consistency.

This software can be especially useful when you’re dealing with multiple accounts or a growing business.

Key Features That Help You Create, Track, and Send Goodwill Letters to Creditors

Client Dispute Manager Software provides tools that streamline every step of the goodwill letter process:

- Built-in Goodwill Letter Templates: Choose from a library of professional goodwill letter templates and personalize them for your needs.

- AI-assisted Customization: Quickly generate content by entering a few details and letting the software do the heavy lifting.

- Tracking Tools: Monitor the status of every goodwill letter to creditor and schedule reminders to follow up.

- Document Storage: Keep your letters and communication history organized in one secure place.

- Team Management: Assign letter tasks across users while keeping files structured and easy to access.

With these tools, Client Dispute Manager Software not only simplifies the process but also helps ensure no goodwill letter falls through the cracks. Whether you’re sending one letter or managing hundreds, the platform keeps your workflow consistent and efficient.

Can a Goodwill Letter Improve Your Credit Score?

Sending a goodwill letter to remove late payments might have a positive impact on your credit score, depending on how the creditor responds and the overall state of your credit profile.

While it’s not a guaranteed fix, it’s a legitimate step people take to try and clean up past mistakes and move toward better credit health.

How a Goodwill Letter to Remove Late Payments Might Affect Your Credit?

If the creditor agrees to remove the late payment from your file, your credit report will no longer show that negative mark. That can lead to a higher credit score, especially if the late payment was recent or your credit history is still developing.

Removing just one late payment can boost your score by several points, depending on your full credit picture.

However, not all creditors agree to these requests. The effectiveness of a goodwill letter to creditor depends on their internal policy, the length of your payment history, and how you’ve managed your account before and after the late payment.

Supporting Your Credit Goals with a Well-Written Goodwill Letter

Even if your score doesn’t improve immediately, a well-written goodwill letter for late payments can still support your credit goals. It shows effort, responsibility, and a willingness to maintain a clean record going forward.

In addition, writing and tracking goodwill letters can be part of a broader strategy to manage and improve your credit.

When paired with consistent on-time payments and careful account management, these letters become one more tool in your plan to build strong credit over time.

Conclusion

Writing a goodwill letter to creditor won’t always lead to a removed late payment, but it’s still worth trying. It gives you the chance to explain your situation directly, without disputing valid information or using aggressive tactics.

If you’ve kept your account in good standing and have a clear reason for the late payment, creditors may be willing to give you a break. Just remember to be polite, clear, and honest in your letter.

Whether you’re repairing your own credit or helping others through a credit repair business, knowing how and when to send a goodwill letter for late payments is a skill that can make a difference.

With the help of templates, automation tools, or software like Client Dispute Manager, the process becomes more manageable and efficient.

Take the step. Draft your letter, send it with confidence, and keep working toward your credit goals—one smart move at a time.