Growing a credit repair business isn’t just about results it’s about trust and visibility. Many companies deliver strong outcomes for clients yet struggle to attract consistent, qualified leads. Paid ads are restrictive, cold outreach damages credibility, and traditional referrals eventually stall.

This is why a well-structured credit repair affiliate program has become one of the most effective growth models in the industry.

A compliant credit repair affiliate network allows businesses to partner with trusted educators and referral sources who already have audience trust. When done correctly, credit repair affiliate marketing produces higher-quality clients, better conversion rates, and long-term scalability without violating CROA or FTC guidelines.

This guide explains how to build a compliant affiliate network step by step, work with credit repair referral partners, and get credit repair clients through affiliates in a way that protects your brand while supporting sustainable growth.

Key Takeaways:

- Affiliate programs help credit repair businesses generate consistent, partner-driven leads.

- Structured systems with tracking and payouts are required, not informal referrals.

- Partner trust increases conversions in a highly regulated industry.

- Clear commission models and compliance guidelines must be defined from the start.

- Client Dispute Manager Software supports affiliate growth by managing clients, tracking workflows, and scaling operations efficiently.

Why Most Credit Repair Businesses Struggle to Get Consistent Clients?

Many credit repair businesses don’t struggle because they lack expertise. They struggle because client acquisition in this industry is uniquely constrained. Regulations limit what can be advertised, platforms restrict financial services messaging, and consumers are understandably cautious.

As a result, even skilled credit repair professionals often experience unpredictable lead flow strong months followed by long dry spells. Understanding why consistency breaks down is the first step toward fixing it.

The Limits of Paid Ads and Cold Outreach in the Credit Repair Industry

Paid advertising looks attractive on paper, but in practice, it’s one of the least reliable channels for credit repair businesses. Major ad platforms closely monitor financial services, often disapproving ads or suspending accounts with little warning. Even when ads do run, rising costs and low trust from cold audiences reduce profitability.

Cold outreach has similar challenges. Unsolicited emails, messages, or calls asking someone to trust you with their credit history often trigger skepticism rather than interest. In an industry where credibility matters more than speed, pushing offers to people who don’t know you usually leads to low response rates and high friction.

These channels may generate leads, but they rarely produce consistent, high-quality clients.

Why Trust Is the Biggest Barrier to Client Acquisition?

Credit repair is deeply personal. Clients aren’t just buying a service they’re sharing financial mistakes, fears, and long-term goals. Because of past scams and exaggerated claims in the industry, many consumers approach credit repair with hesitation.

This means trust must exist before the first conversation. Without it, prospects hesitate to book calls, delay decisions, or avoid engagement altogether. No amount of ad spend or aggressive outreach can replace credibility that comes from trusted recommendations or education-based introductions.

Businesses that fail to address this trust gap often blame their pricing, messaging, or market conditions when the real issue is how prospects are being introduced to their service.

The Hidden Cost of Growth Without Referrals or Partners

Relying solely on ads or direct outreach creates another problem: fragility. If one platform changes its policies or costs increase, lead flow can disappear overnight. This forces businesses into a constant cycle of testing, spending, and restarting.

Without referral partners or trusted distribution channels, growth becomes linear and effort-dependent. Each new client requires the same level of work as the last. Over time, this limits scalability and increases burnout.

Businesses that want consistent growth need systems that compound where trust, visibility, and client acquisition improve over time rather than reset each month. That’s where partner driven strategies begin to matter.

What Is a Credit Repair Affiliate Program and How Is It Different From Referrals?

A credit repair affiliate program is a structured partnership system where individuals or businesses promote a credit repair service and earn compensation when qualified clients sign up through their referral link or tracking method.

Unlike casual word-of-mouth referrals, affiliate programs are designed to be trackable, repeatable, and scalable making them a core growth channel rather than a side benefit.

While many credit repair businesses rely on informal referrals to get started, those systems often lack consistency and transparency. Understanding the difference between referrals and a true affiliate model is critical if the goal is predictable, long-term growth.

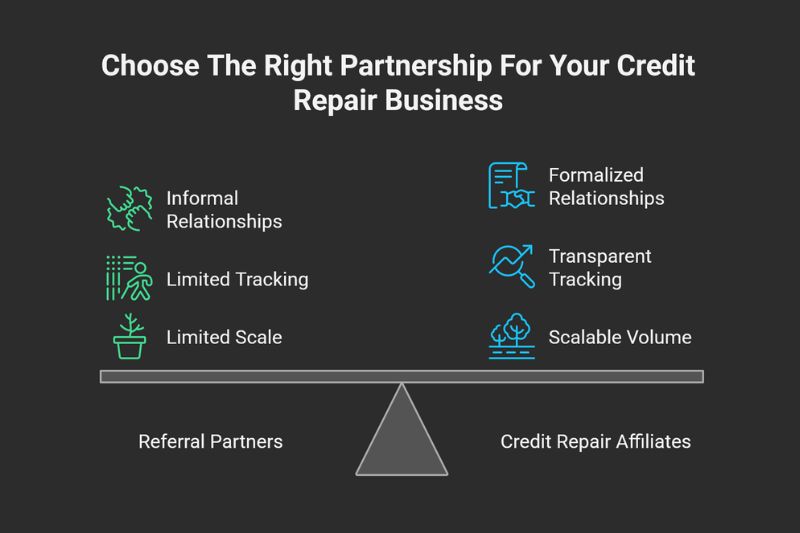

What’s the Difference Between a Credit Repair Affiliate Program and Referral Partners?

Referral partners typically operate on an informal basis. A financial coach, real estate professional, or past client may occasionally send a lead your way, often without tracking, clear expectations, or structured compensation. These relationships can be valuable, but they’re usually limited in scale and difficult to manage as volume increases.

A credit repair affiliate program, on the other hand, formalizes these relationships. Affiliates receive clear guidelines, approved messaging, and transparent tracking so they know exactly how referrals are attributed. This structure benefits both sides businesses gain visibility into performance, while credit repair referral partners understand how their efforts translate into results.

In short, referrals are occasional. Affiliate programs are intentional.

When Does a Referral Model Stop Scaling for Credit Repair Businesses?

Referral models usually stop scaling when volume increases. Without proper tracking, businesses struggle to attribute leads accurately. Disputes over credit, inconsistent follow-ups, and unclear compensation can quickly strain relationships. What once felt simple becomes messy and inefficient.

At this stage, businesses often realize that relying solely on referrals limits growth. Without systems, every new partner adds complexity instead of momentum. A structured affiliate program solves this by introducing consistency, accountability, and compliance safeguards making it possible to grow without sacrificing control.

For credit repair businesses looking to move beyond unpredictable referrals, transitioning to a formal affiliate program is often the natural next step.

How Do You Build a Credit Repair Affiliate Program That Scales?

A credit repair affiliate program only scales when it’s built on systems, not assumptions. Many businesses rush into partnerships hoping affiliates will “just send leads,” but without structure, growth quickly becomes inconsistent or risky.

Scalability comes from clarity clear offers, clear rules, and clear expectations for everyone involved.

The goal isn’t to recruit as many affiliates as possible. It’s to build a program that grows predictably while protecting compliance, brand reputation, and partner relationships.

How Do You Set Up the Foundation of a Credit Repair Affiliate Program?

Every scalable affiliate program starts with a strong foundation. This is where expectations are set and long-term issues are prevented.

First, define the offer structure. Affiliates should understand exactly what service they are promoting, who it’s for, and who it’s not for. Vague offers lead to mismatched leads and compliance problems.

Next, choose a commission model that supports sustainability. Some programs use flat commissions per client, while others offer recurring payouts tied to client retention. The right model depends on your margins, service delivery, and ability to track results accurately.

Payout timing also matters. Delayed or unclear payments quickly erode trust with affiliates. Clear schedules whether weekly, biweekly, or monthly create confidence and reduce disputes.

Finally, build in compliance safeguards from day one. This includes approved messaging, clear boundaries around claims, and written guidelines that affiliates must follow. Scalability depends on reducing risk as volume increases, not reacting to problems after they appear.

How Do You Recruit the Right Credit Repair Referral Partners?

Not all partners are a good fit for a credit repair affiliate program. High-quality affiliates usually share three traits: credibility with their audience, alignment with ethical marketing practices, and a basic understanding of financial responsibility.

Good partners often include educators, coaches, real estate professionals, and content creators who already discuss credit-related topics. These credit repair referral partners add value through context and trust, not aggressive promotion.

Equally important is knowing who to avoid. Affiliates who promise quick fixes, use exaggerated claims, or focus solely on commissions often create more problems than growth. These partners increase compliance risk and damage brand credibility.

Ethical outreach positioning matters here. Instead of pitching commissions, position the program as a way to help audiences make informed decisions. Affiliates who join for the right reasons are far more likely to produce consistent, high-quality leads.

How Do You Enable Affiliates to Succeed Without Compliance Risk?

Affiliates can only succeed when they know what’s allowed and what isn’t. Training is not optional in a regulated industry like credit repair.

Start with approved messaging that explains how to talk about credit repair accurately. This helps affiliates set realistic expectations and prevents overpromising. Clear examples of compliant language go a long way in reducing risk.

Provide pre-approved content assets such as educational articles, guides, or explanations affiliates can reference or share. This keeps messaging consistent while still allowing partners to add their own voice.

Finally, establish tracking and attribution basics. Affiliates should know how leads are tracked, how credit is assigned, and where to view performance. Transparency here prevents misunderstandings and builds long-term trust.

How Do You Turn Individual Affiliates Into a Scalable Network?

A scalable affiliate network doesn’t rely on one-off relationships. It uses structure to encourage long-term participation and quality growth.

Partner tiers and incentives reward affiliates who consistently deliver compliant, high-quality leads. These don’t have to be financial alone priority support, early access to resources, or recognition can also drive engagement.

Retention and quality control are just as important as recruitment. Regular communication, performance reviews, and clear standards help maintain consistency as the network grows.

Lastly, scalable programs actively work on preventing fraud and brand damage. Monitoring traffic quality, reviewing messaging, and enforcing guidelines protect both the business and its partners. Growth without control isn’t scale it’s exposure.

When these systems work together, a credit repair affiliate program becomes a stable, long-term growth channel rather than a short-lived experiment.

Why Do Affiliate-Referred Credit Repair Clients Convert Better?

Affiliate-referred credit repair clients tend to convert better because they are introduced through a trusted source rather than cold marketing. By the time they reach your business, they already have context about the service, realistic expectations, and a basic understanding of how credit repair works.

This reduces skepticism and eliminates many of the objections commonly seen with paid ads or cold outreach. Instead of questioning legitimacy, these prospects focus on whether your business is the right fit for their situation. As a result, conversations are more productive, sales cycles are shorter, and conversion rates are typically higher compared to unqualified traffic.

How Do Affiliates Pre-Educate Leads Before First Contact?

Affiliates pre-educate leads by explaining the credit repair process before a prospect ever speaks with your team. Through content, conversations, or recommendations, affiliates help prospects understand what credit repair can and cannot do, how long the process typically takes, and what level of involvement is required.

This early education addresses common misconceptions and builds confidence, allowing prospects to self-qualify before reaching out. When leads finally make contact, they arrive prepared with informed questions rather than doubts, making the initial interaction focused on clarity and next steps instead of persuasion.

How Can Client Dispute Manager Software Help Scale a Credit Repair Affiliate Network?

As a credit repair affiliate network grows, complexity increases quickly. More partners mean more leads, more attribution questions, and greater compliance responsibility. Managing this growth manually often leads to tracking errors, reporting disputes, and inconsistent workflows that strain both internal teams and affiliate relationships. This is where structured systems become essential.

Client Dispute Manager Software supports credit repair affiliate programs by centralizing client, dispute, and referral data in one system. Instead of relying on spreadsheets or disconnected tools, businesses can clearly track where each client originated, which affiliate referred them, and how cases progress over time. This transparency reduces attribution conflicts and builds trust with partners who want confidence that their efforts are recorded accurately.

Beyond tracking, structured workflows help maintain consistency as volume increases. Affiliates operate independently, but the credit repair process itself remains standardized and compliant. Clear separation between marketing activity and dispute work protects the business while ensuring every client receives the same level of service regardless of referral source.

As a result, affiliate programs can grow without introducing operational blind spots, making scale sustainable rather than risky.

Start Today and Explore the Features Firsthand!

Is a Credit Repair Affiliate Program Right for Your Business?

A credit repair affiliate program isn’t a shortcut it’s a multiplier. When implemented at the right stage, it can create steady, trust-based client acquisition. When introduced too early, it can amplify weaknesses instead of results. The key is understanding whether your business is structurally ready to support partners, protect compliance, and deliver consistent outcomes at scale.

When Does an Affiliate Network Make Strategic Sense?

An affiliate network makes strategic sense when your credit repair business already has a clear offer, defined processes, and a track record of delivering consistent service. At this stage, affiliates don’t need to “sell” for you they simply introduce qualified prospects who are already looking for help.

Businesses that benefit most from affiliate programs typically have stable onboarding, predictable fulfillment, and clear messaging around what credit repair can and cannot achieve. In these conditions, affiliates act as trusted distribution channels that extend reach without increasing operational strain.

Affiliate programs also work best when a business understands its ideal client profile. When affiliates know who the service is designed for, lead quality improves and conversion rates remain strong. This alignment allows growth to compound rather than reset with each new partner.

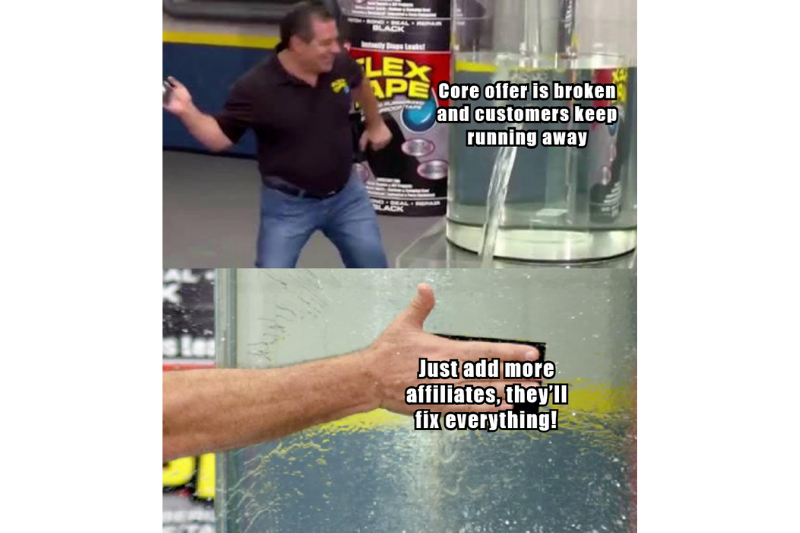

When Should You Fix Your Core Offer Before Adding Affiliates?

If your business struggles with inconsistent results, unclear pricing, or frequent client misunderstandings, adding affiliates too soon can create more problems than growth. Affiliates amplify what already exists. If messaging is unclear or fulfillment is unstable, those issues spread faster through partner networks.

It’s often better to pause and refine the core offer before expanding outward. This includes tightening onboarding, clarifying expectations, and ensuring internal systems can handle increased volume without sacrificing compliance or service quality. Once these foundations are solid, an affiliate program becomes far easier to manage and far more effective as a long-term growth channel.

Frequently Asked Questions About Credit Repair Affiliate Programs

Is a Credit Repair Affiliate Program Legal in the U.S.?

Yes, a credit repair affiliate program is legal in the U.S. when it is structured and managed correctly. Credit repair businesses and their affiliates must comply with the Credit Repair Organizations Act (CROA) and Federal Trade Commission (FTC) guidelines. This means affiliates cannot make misleading claims, guarantee results, or misrepresent how credit repair works.

As long as marketing is truthful, disclosures are clear, and clients are not deceived, affiliate programs are a compliant and widely used growth model in the credit repair industry.

What Makes a Credit Repair Affiliate Partner Compliant?

A compliant credit repair affiliate partner follows approved messaging, avoids exaggerated claims, and clearly discloses their affiliate relationship. They understand what credit repair can and cannot do, set realistic expectations, and never promise specific credit score increases or timeframes.

Compliance also means respecting advertising rules, using truthful language, and directing prospects to official resources rather than offering legal or financial advice beyond their role.

Do Affiliate Leads Convert Better Than Paid Ads?

In most cases, yes. Affiliate leads often convert better than paid ad traffic because they come from trusted sources rather than cold marketing. Prospects referred through affiliates typically arrive with context, education, and realistic expectations, which reduces skepticism. While paid ads can generate volume, affiliate-driven leads tend to be higher quality and require less persuasion during onboarding.

How Long Does It Take to See Results From Affiliate Marketing?

Affiliate marketing is not instant, but it is sustainable. Some businesses begin seeing referrals within a few weeks of onboarding partners, while others take several months to build momentum. Results depend on the quality of affiliates, clarity of the program, and how well partners are supported. Unlike paid ads, affiliate marketing compounds over time as trust and content continue working long after initial setup.

Can Client Dispute Manager Software Be Used With a Credit Repair Affiliate Program?

Yes. Client Dispute Manager Software works well alongside a credit repair affiliate program by helping businesses track where clients come from and how cases progress after onboarding. While affiliate tracking tools may handle referrals and attribution, Client Dispute Manager Software supports the operational side ensuring that once a client is referred, their case is handled consistently and professionally.

This separation helps maintain clarity between marketing activity and credit repair work, which is important for compliance.

Conclusion

Building a successful credit repair affiliate network isn’t about quick wins or aggressive promotion. It’s about creating systems that allow trust, education, and compliance to work together over time. When affiliate programs are structured thoughtfully, they become more than a marketing channel they become a sustainable extension of how a credit repair business reaches and serves clients.

The most effective credit repair affiliate programs focus on clarity first. Clear messaging, realistic expectations, and ethical partnerships protect both the business and the client. Instead of relying on cold traffic or unpredictable advertising platforms, affiliate networks grow through trusted introductions and education-driven referrals that compound rather than reset.

Equally important is having the right infrastructure in place. As affiliate activity increases, consistent workflows, accurate tracking, and organized client management ensure growth doesn’t come at the expense of control or compliance. Systems exist to support scale not to replace judgment, but to reinforce it.

For credit repair businesses thinking long term, affiliate programs offer a path to steady growth that aligns with how people actually make decisions about their financial future. When built with intention, transparency, and the right tools, a credit repair affiliate network can support both business expansion and client trust without shortcuts or unnecessary risk.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: