In an age where technology shapes every facet of our lives, automated credit repair software emerges as a beacon for those navigating the tumultuous waters of financial recovery. The complexities of restoring one’s credit have often deterred many from taking proactive steps. Yet, with the rise of credit repair software solutions, individuals and professionals alike now possess a powerful tool that promises efficiency, precision, and hope in the quest for improved credit scores.

In this article, we delve into the transformative impact of automated credit repair software, offering insights into its operation, the factors influencing result timelines, and a closer look at standout platforms such as the Client Dispute Manager. Whether you’re a novice to credit repair or a seasoned professional, understanding the nuances of this revolutionary software can reshape your financial journey.

Understanding An Automated Credit Repair Software

In the vast landscape of financial tools, automated credit repair software has emerged as an indispensable asset for those striving to enhance their financial standing. This specialized software is designed to streamline the process of detecting, disputing, and rectifying inaccuracies present on credit reports, ensuring that users are accurately represented in their credit histories.

The essence of automated credit repair software lies in its dual functionality. Firstly, it leverages advanced algorithms to scrutinize credit reports, pinpointing errors that might be diminishing a user’s credit score. These can range from minor clerical mistakes to significant misreporting. Secondly, it facilitates a seamless dispute process, enabling users to challenge and correct these inaccuracies efficiently.

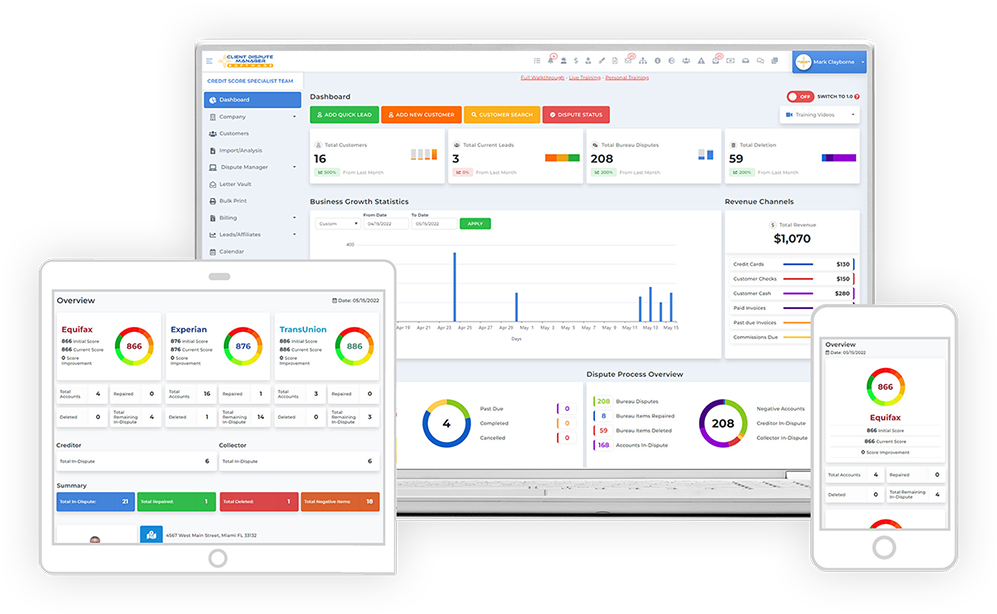

A name that resonates strongly in the credit repair software domain is Client Dispute Manager. Pioneering a holistic approach, it not only identifies potential discrepancies but also provides automated mechanisms, such as dispute letter generation and progress tracking. This ensures users navigate the credit repair journey with ease and effectiveness.

The need for such software becomes clear when considering that countless individuals face repercussions from undetected errors on their credit reports. These can lead to higher interest rates, loan denials, or even employment challenges.

Factors Influencing the Time to See Results

Navigating the intricacies of credit repair, many individuals and businesses turn to sophisticated solutions like an automated credit repair software to expedite the process. However, understanding the duration required to witness tangible results involves recognizing various factors at play. Here’s a deep dive into the elements that influence the timeline when using tools like Client Dispute Manager software.

Nature of Credit Report Discrepancies

The foundation of any credit repair journey is identifying and understanding the errors present on a credit report. Some discrepancies are straightforward, like misspelled names or outdated addresses, which can be rectified swiftly. However, more intricate issues, such as fraudulent accounts or incorrect payment histories, demand a more extended engagement, even with advanced credit repair software at one’s disposal.

Response Time of Credit Bureaus

Upon initiating a dispute, credit bureaus are typically legally bound to investigate and respond within 30 days. Nevertheless, this isn’t always a hard and fast rule. Some disputes might get resolved sooner, while others, due to their complexity or backlog at the bureau, might stretch beyond this timeframe.

User Engagement

An automated credit repair software, like Client Dispute Manager, offers automated features and streamlined processes. However, user involvement remains paramount. How promptly users act on software recommendations, follow up on disputes, or engage with credit bureaus can significantly impact the timeline.

Volume of Disputes

A user challenging multiple discrepancies simultaneously might experience varied response times for each. Credit repair software optimizes and manages these disputes, but the sheer volume can affect the overall timeframe for results.

Software Capabilities

Not all credit repair solutions are created equal. Premium software like Client Dispute Manager harnesses advanced algorithms, AI integrations, and a user-centric interface to hasten the credit repair process. However, software efficiency and features can play a pivotal role in determining how fast users witness improvements.

In essence, while credit repair software significantly optimizes the credit rectification process, multiple factors interplay to determine the exact duration for tangible results. Recognizing these can set realistic expectations and guide users in their credit repair journey more effectively.

How An Automated Credit Repair Software Works?

An Automated credit repair software has revolutionized the way individuals and businesses manage and improve their financial profiles. For those unfamiliar with the term, let’s delve into how credit repair software, like Client Dispute Manager Software, functions and its role in expediting the credit restoration process.

Automated Dispute Management

One of the primary ways credit errors arise is due to discrepancies in reporting from creditors and credit bureaus. The essence of credit repair is identifying these errors and disputing them. Credit repair software simplifies this by providing tools to generate and track dispute letters, ensuring that disputes are submitted on time and are well-documented.

Credit Report Monitoring

Monitoring your credit report is crucial to catch any irregularities or potentially fraudulent activities. Credit repair software offers integrated monitoring tools, allowing users to access and review their reports from the three major credit bureaus regularly.

Templates and Document Management

Crafting a persuasive dispute letter is an art. With credit repair software, users are provided with a multitude of templates tailored for various dispute scenarios. Moreover, the software assists in organizing these documents, making it easier to reference past disputes or furnish proof when necessary.

Analytics and Performance Tracking

Beyond merely addressing errors, it’s essential to understand your credit score’s trajectory. Credit repair software offers analytical tools that show score improvements over time, lending insights into what strategies are most effective for each individual.

Integration with Creditors and Bureaus

Advanced credit repair software solutions are often designed to integrate directly with creditors and credit bureaus. This streamlines the communication process, making it faster and more efficient to resolve disputes.

Credit repair software operates as a comprehensive tool that manages, monitors, educates, and expedites the credit repair journey. With an intuitive software solution like Client Dispute Manager Software, users can be assured of a structured approach to restoring their credit, leading to quicker and more substantial results. Investing in the right credit repair software can significantly shorten the time it takes to see noticeable improvements in one’s credit score.

The Typical Timeline for Credit Repair Software Results

In the ever-evolving world of finance, many individuals and businesses are turning to credit repair software, like Client Dispute Manager, to address and improve their credit profiles. However, one common query emerges: How long does it take to see tangible results? Understanding the typical timeline can set realistic expectations and facilitate a smoother journey.

Initial Report Analysis (Days 1-7)

Once integrated with credit repair software, your credit report undergoes an in-depth analysis. Sophisticated algorithms scan for potential discrepancies or errors. This initial phase, given the automated prowess of modern software, usually takes anywhere from a few minutes to a couple of days, depending on the complexity of the report.

Dispute Initiation (Days 7-14)

After identification, the software aids users in creating and sending dispute letters tailored to each specific error. With platforms like Client Dispute Manager, this process is not only streamlined but also optimized to ensure that disputes adhere to legal and industry standards.

Bureau Response Window (Days 15-45):

Credit bureaus, by law, typically have 30 days to investigate and respond to disputes. However, this window can occasionally extend due to factors like the complexity of the dispute or bureau backlogs. It’s worth noting that while the credit repair software can optimize the initiation and tracking of disputes, the response time is predominantly in the hands of the credit bureaus.

Result Analysis and Further Action (Days 45-60)

Once responses are received, users can analyze the outcomes within their credit repair software dashboard. Positive results could manifest as score improvements, while unresolved issues might necessitate further disputes or alternative strategies.

Ongoing Monitoring (Beyond Day 60)

Even after initial disputes are addressed, it’s essential to continue using the credit repair software for ongoing monitoring. This ensures any new discrepancies are promptly detected and acted upon, reinforcing credit health in the long run.

To sum up, while the timeline for results using credit repair software can vary based on individual circumstances, many users begin to observe changes within 45 to 60 days. However, true credit repair is an ongoing process, and leveraging tools like Client Dispute Manager ensures that users are always at the forefront of their credit management journey.

Conclusion

Navigating the intricacies of credit restoration is simplified by innovative tools like credit repair software. Client Dispute Manager stands out in this realm, offering an efficient approach to enhancing credit profiles. While timelines may vary, the importance of robust, user-friendly software like Client Dispute Manager remains paramount. As the landscape of financial health evolves, prioritizing reliable credit management tools becomes essential.

With Client Dispute Manager, individuals and businesses are not only equipped to repair but also to sustain and flourish in their financial journeys. In essence, with the right software, brighter financial futures are within reach.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.