Are you tired of the endless paperwork and manual tasks involved in running a credit repair business? Do you dream of scaling your business but feel held back by the time-consuming nature of your day-to-day operations? It’s time to embrace the power of credit repair automation and watch your credit repair business soar to new heights.

Streamline Credit Repair: Time-Saving Tips for Your Business

The key to success in the credit repair industry lies in efficiency. By streamlining credit repair processes, you can take on more clients and grow your business exponentially. Credit repair automation is the secret weapon that can help you achieve this goal.

Start by identifying the most repetitive and time-consuming tasks in your business. These might include:

- Collecting client information and documents

- Drafting dispute letters to credit bureaus and creditors

- Tracking client progress and sending updates

- Generating reports and invoices

Once you’ve identified these tasks, look for automation software for credit repair that can handle them for you. With the right tools in place, you can significantly reduce the time and effort required to manage each client’s case.

The Benefits of Streamlining Your Credit Repair Process

By streamlining credit repair processes, you can experience numerous benefits, such as:

- Increased Efficiency: Credit repair automation allows you to complete tasks faster and more accurately, reducing the time spent on each client’s case.

- Scalability: With streamlined credit repair processes, you can take on more clients without being overwhelmed by the workload, enabling your business to grow.

- Improved Client Experience: Automated credit repair systems ensure that no client falls through the cracks, and everyone receives timely updates and progress reports.

- Reduced Errors: Credit repair automation minimizes the risk of human error, ensuring that all tasks are completed accurately and consistently.

Embrace these benefits and watch your credit repair business thrive as you implement automation software for credit repair.

How Can Credit Repair Software Transform Your Business?

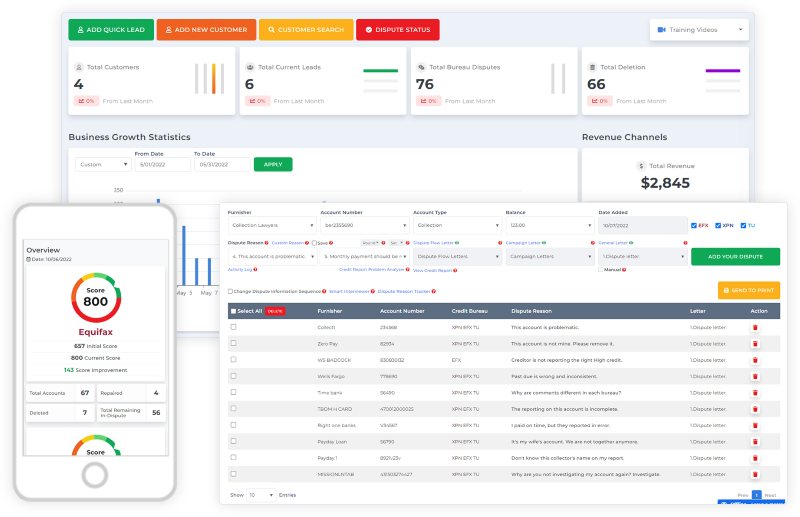

Implementing credit repair software can lead to a significant transformation in how your business operates. By centralizing client information, automating routine tasks, and streamlining compliance, the software allows you to handle a larger client base while maintaining quality service.

Streamlined Client Management with Credit Repair Software

Effective client management is crucial in the credit repair industry. With credit repair software, you can keep all client details, credit reports, and dispute statuses organized in one place. This consolidation allows you to track every step of a client’s credit repair journey, providing transparency and accountability.

Organized client management also enhances your ability to provide timely updates and build trust with clients. When clients feel informed and engaged, they are more likely to stay committed to the process, increasing your retention rates and improving your reputation.

Automation Through AI Credit Repair Software

One of the most advanced tools available today is AI credit repair software. By using artificial intelligence, this software can analyze credit reports, recommend dispute strategies, and predict dispute outcomes. The automation capabilities of AI credit repair software free up your time and allow you to manage more clients with greater efficiency.

AI-based tools also enhance decision-making. With AI credit repair software, you can leverage data-driven insights to improve dispute outcomes and speed up the credit repair process. This is a competitive advantage for businesses that aim to deliver results more quickly and accurately.

Client Management Automation: Transforming Your Credit Repair Business

Managing client relationships is a crucial aspect of any credit repair business. However, it can also be one of the most time-consuming. By implementing client management automation, you can streamline communication, keep track of important dates, and ensure that no client falls through the cracks.

Some key features to look for in a client management automation system include:

- Automated email and text message reminders

- Centralized client database with easy access to information

- Integration with your credit repair automation software for seamless workflows

- Customizable templates for dispute letters and other communications

With these tools at your fingertips, you can provide a better experience for your clients while freeing up your time to focus on growth and strategy.

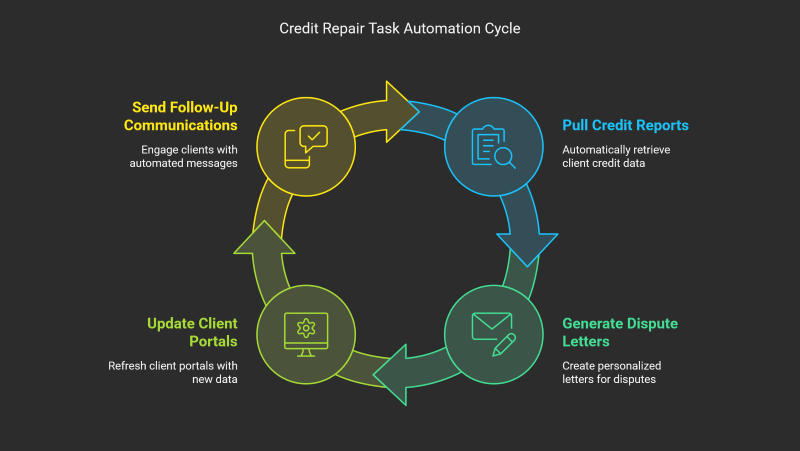

Harness the Power of Task Automation for Credit Repair

In addition to client management automation, there are countless other tasks involved in running a credit repair business that can be automated. From generating reports to updating client portals, task automation for credit repair can help you save time and reduce the risk of errors.

Consider implementing task automation for credit repair tools that can:

- Automatically pull credit reports and scores

- Generate customized dispute letters based on client information

- Update client portals with real-time progress and results

- Send automated follow-up emails and texts to keep clients engaged

By automating these tasks, you can not only save time but also provide a more professional and efficient service to your clients.

The Power of Task Automation in Credit Repair

Task automation for credit repair is a powerful tool that can revolutionize the way you run your credit repair business. By implementing task automation for credit repair, you can experience:

- Increased Accuracy: Automated systems ensure that tasks are completed consistently and accurately, reducing the risk of errors.

- Time Savings: Automating credit repair tasks frees up your time to focus on more important aspects of your business, such as client relationships and growth strategies.

- Improved Client Experience: Automated updates and real-time progress tracking keep your clients informed and engaged, enhancing their overall experience with your business.

- Scalability: As your business grows, task automation for credit repair allows you to handle an increasing number of clients without becoming overwhelmed by manual tasks.

Harness the power of task automation for credit repair and watch your credit repair business thrive.

What to Look for in the Best Credit Repair Software for Your Business

Choosing the best credit repair software can make all the difference in how effectively you serve your clients. When selecting software, focus on aspects like usability, customization options, scalability, and integration capabilities. By choosing the right software, you can ensure smooth operations and an enhanced experience for your clients.

Essential Criteria for Choosing the Best Credit Repair Software

To identify the best credit repair software for your business, consider these key factors:

- Ease of Use: An intuitive interface is essential for smooth onboarding and daily use.

- Customization Options: Choose software that lets you customize templates, workflows, and reports to match your specific needs.

- Compliance Features: Make sure the software supports adherence to regulations, minimizing potential legal issues.

- Scalability: As your client base grows, the software should be able to handle increased demand without compromising performance.

- Integration Capabilities: Look for software that integrates seamlessly with other tools, such as CRM and email marketing platforms, to enhance productivity.

By focusing on these elements, you can ensure that you’re choosing the best credit repair software for your unique business needs, helping you serve clients better and grow your business.

Top Benefits of Using Credit Repair Software for Business Growth

The right credit repair software for business growth provides several key benefits. Not only does it improve productivity and client satisfaction, but it also gives you the tools to make smarter, data-driven decisions that can lead to better client outcomes and higher retention rates.

Time Savings and Productivity with Credit Repair Software

Credit repair software automates many tedious tasks, such as generating dispute letters, tracking responses, and ensuring compliance. This automation enables you to save time, which you can reinvest into other areas of your business, like customer service and client acquisition.

By reducing the need for manual input, credit repair software lowers the chance of human error and ensures that tasks are completed on time. This results in an efficient workflow and satisfied clients who benefit from timely service and consistent updates.

Improved Client Experience with Credit Repair Software

Many credit repair software solutions include a client portal, where clients can check the status of their credit repair process, view documents, and communicate with your team. This level of transparency builds trust and helps clients feel engaged and informed throughout their journey.

With a dedicated client portal, clients have access to the information they need, fostering a positive experience that encourages client loyalty. When clients feel connected to the process, they are more likely to stay on board, improving your client retention rates.

Data-Driven Decision Making with AI Credit Repair Software

With AI credit repair software, you have access to data-driven insights that allow for better decision-making. AI algorithms can assess previous dispute outcomes, identify trends, and recommend the most effective strategies for future cases. This advanced functionality can significantly enhance the success rate of your credit repair efforts.

By leveraging AI credit repair software, you can operate more strategically, which sets your business apart in a competitive market. This insight-driven approach improves dispute results and client satisfaction, giving you an edge over competitors.

Streamline Your Dispute Process with Client Dispute Manager Software

One of the most critical aspects of running a successful credit repair business is effectively managing client disputes. This process can be time-consuming and complex, involving extensive documentation and communication with credit bureaus and creditors. However, with the help of client dispute manager software, you can streamline this process and take your credit repair business to new heights.

Client Dispute Manager Software is designed to simplify and automate the dispute process, allowing you to efficiently manage multiple disputes simultaneously. Some key features to look for in a client dispute manager software include:

- Automatic generation of dispute letters based on client information and credit report data

- Tracking and management of dispute status and timelines

- Integration with credit bureau and creditor systems for seamless communication

- Customizable dispute templates and strategies

Comprehensive reporting and analytics to monitor dispute progress and success rates

By implementing a Client Dispute Manager Software, you can significantly reduce the time and effort required to manage client disputes while improving the overall effectiveness of your dispute process. This, in turn, can lead to better client outcomes, increased client satisfaction, and ultimately, business growth.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

What Is Credit Repair Automation?

Credit repair automation refers to the use of software and tools to streamline and automate various tasks involved in running a credit repair business, such as client management, dispute letter generation, and progress tracking.

How Can Automation Help My Credit Repair Business Grow?

Credit repair automation can help you save time and reduce errors, allowing you to take on more clients and provide a better service. By streamlining credit repair processes, you can focus on growth and strategy rather than getting bogged down in manual tasks.

What Tasks Can Be Automated In A Credit Repair Business?

Many tasks can be automated, including client onboarding, dispute letter generation, credit report analysis, client progress tracking, and reporting. The specific tasks you automate will depend on your business needs and the automation software for credit repair you choose.

How Do I Choose The Right Automation Software For My Credit Improvement Business?

When choosing automation software for credit repair, look for tools that integrate with your existing systems, offer the features you need, and provide good customer support. Consider factors such as ease of use, scalability, and pricing to find the best fit for your business.

How Long Does It Take To Implement Automation In A Credit Business?

The time required to implement automation varies depending on the size and complexity of your business, as well as the specific automation software for credit repair you choose. However, most businesses can start seeing the benefits of credit automation within a few weeks to a few months.

Conclusion

Credit repair automation is the key to unlocking the full potential of your credit business. By streamlining credit repair processes, embracing client management automation, implementing task automation for credit repair tools, and utilizing Client Dispute Manager Software, you can triple your business growth while reducing the tedium of day-to-day operations.

The benefits of credit business automation are clear: increased efficiency, scalability, improved client experience, and reduced errors. By automating repetitive tasks and streamlining your workflows, you can focus on what truly matters building relationships with your clients and growing your business.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review:

- What Are the Main Features of Credit Repair Software?

- Revolutionizing Financial Recovery: The Rise of Automation in Credit Repair