Are you tired of seeing inaccurate information on your credit report holding you back from achieving your financial goals? Do you feel like you’re fighting an uphill battle when it comes to disputing these errors with creditors? If so, you’re not alone. Many people struggle with the frustrating and time-consuming process of factual dispute letter writing, but the truth is that you have more power than you might think.

By crafting a winning factual dispute letter, you can take control of your credit and set yourself up for a brighter financial future. In this comprehensive guide, we’ll walk you through five pro tips for creating a factual dispute letter that creditors can’t ignore. We’ll cover everything from gathering supporting documentation to understanding your rights under the factual dispute law.

Whether you’re an entrepreneur looking to improve your business credit or an individual seeking to overcome credit challenges, these strategies will help you navigate the factual dispute meaning and process with confidence and success.

The Importance of Factual Disputing

Before we dive into the tips, let’s take a moment to understand why factual disputing is so crucial. Your credit report is essentially your financial resume, and it plays a significant role in determining your access to credit, loans, and even job opportunities. When inaccurate or incomplete information appears on your factual dispute credit report, it can drag down your credit score and make it harder to achieve your goals.

Imagine this scenario: You’ve been working hard to pay down your debt and improve your credit, but when you apply for a mortgage, you’re denied due to a collection account that you’ve already paid off. The creditor failed to update the information on your credit report, and now you’re stuck dealing with the consequences. This is where factual disputing comes in.

By actively identifying and challenging errors on your credit report, you can ensure that your credit score accurately reflects your financial responsibility. This can open up new opportunities for lending, housing, and even employment. In fact, a study by the Federal Trade Commission found that one in five consumers had an error on at least one of their credit reports. That’s a staggering number, and it underscores the importance of being proactive about your credit health through factual disputing.

Tip #1: Gather Supporting Documentation

The first step in crafting a winning factual credit dispute letter is to gather all the necessary supporting documentation. This is critical because it provides evidence to back up your claims and makes it harder for creditors to dismiss your factual dispute letter.

Obtaining Your Credit Reports

Start by obtaining a copy of your current credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You’re entitled to one free report from each bureau every 12 months, which you can access through AnnualCreditReport.com. Once you have your reports, carefully review them for any inaccurate or incomplete information that you can address in your factual dispute letter.

Collecting Supporting Documents

Next, gather any documentation that supports your factual dispute meaning. This may include:

- Proof of identity, such as a copy of your driver’s license or passport

- Billing statements or receipts showing that a debt has been paid

- Correspondence with creditors or collection agencies

- Court documents, such as a bankruptcy discharge or judgment in your favor

Having this documentation organized and readily available will make the factual disputing process much smoother and increase your chances of success.

Tip #2: Be Specific and Concise in Your Dispute Letter

When it comes to writing your factual dispute letter, clarity is key. You want to make it as easy as possible for the creditor or credit bureau to understand the issue and take appropriate action. To do this, be specific and concise in your language when explaining the factual dispute meaning.

Identifying Disputed Items

Start your factual dispute letter by clearly identifying each item you are disputing and explaining why you believe it is inaccurate. Use short, direct sentences and stick to the facts. Avoid using emotional language or including unnecessary details that could distract from your main points in your factual credit dispute letter.

Structuring Your Dispute

Here’s an example of how you might structure a dispute in your factual dispute letter:

“Item in dispute: Collection account from XYZ Collection Agency, Account #1234567

Reason for dispute: This debt was paid in full on January 15, 2023, as evidenced by the enclosed payment receipt and confirmation letter from the collection agency.”

By being specific and concise in your factual dispute letter, you make it easier for the recipient to understand and investigate your dispute, increasing the likelihood of a favorable outcome.

Tip #3: Know Your Rights Under the Factual Dispute Law

When it comes to factual disputing, knowledge is power. The more you understand about your rights under the factual dispute law, also known as the Fair Credit Reporting Act (FCRA), the better equipped you’ll be to advocate for yourself and protect your credit.

Your Rights Under the FCRA

Under the FCRA factual dispute law, you have the right to:

- Dispute inaccurate or incomplete information on your credit report

- Have the credit bureau investigate your dispute within 30 days

- Receive a copy of the investigation results and a corrected credit report if changes are made

- Have the creditor provide evidence to support the accuracy of disputed information

- Have inaccurate or unverifiable information removed from your factual dispute credit report

Leveraging Your Knowledge

By referencing these rights in your factual dispute letter and demonstrating your knowledge of the factual dispute law, you show creditors and credit bureaus that you’re serious about protecting your credit and willing to take legal action if necessary.

Tip #4: Choose the Right Factual Dispute Method

When it comes to factual disputing, there are two main methods: direct dispute with the creditor and indirect dispute through the credit bureaus. Choosing the right method can make a significant difference in the outcome of your factual dispute letter.

Direct Dispute with the Creditor

In most cases, it’s best to start with a direct dispute to the creditor. This gives the creditor an opportunity to investigate the issue and correct any errors before the information is reported to the credit bureaus. If the creditor fails to respond or does not resolve the issue, you can then escalate the dispute to the credit bureaus.

Indirect Dispute Through the Credit Bureaus

When sending your factual dispute letter, always use certified mail with a return receipt requested. This provides proof that your factual credit dispute letter was received and creates a paper trail for future reference. Keep copies of all correspondence and documentation related to your factual disputing efforts, as this will be valuable if you need to escalate the issue or take legal action.

Tip #5: Follow Up and Escalate if Necessary

Crafting a winning factual dispute letter is just the first step in the process. To ensure a successful outcome, it’s crucial to follow up with the creditor or credit bureau and escalate the dispute if necessary.

Following Up on Your Dispute

After sending your factual dispute letter, wait 30 days for a response. If you don’t receive a response within this timeframe or if the response is unsatisfactory, it’s time to take further action. This may involve:

- Sending a follow-up factual dispute letter reiterating your dispute and requesting a resolution

- Filing a complaint with the Consumer Financial Protection Bureau (CFPB)

- Contacting a consumer protection attorney to discuss your legal options

Persistence is Key

Remember, persistence is key when it comes to protecting your credit through factual disputing. Don’t be afraid to stand up for your rights and keep pushing until you achieve a satisfactory resolution.

Streamline Your Dispute Process with Client Dispute Manager Software

While following these pro tips can significantly improve your chances of success when disputing credit report errors, managing the process can still be time-consuming and challenging, especially if you’re dealing with multiple disputes. This is where Client Dispute Manager Software comes in.

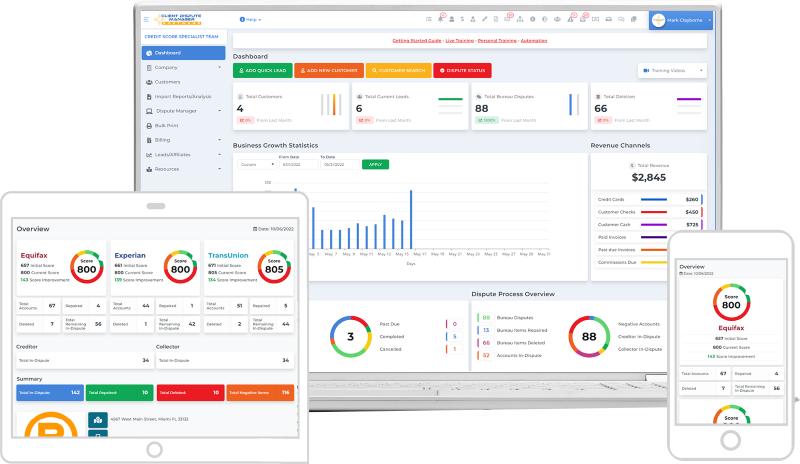

Client Dispute Manager Software is designed to streamline the factual disputing process, making it easier for you to track your disputes, communicate with creditors and credit bureaus, and ensure that your disputes are resolved in a timely manner. With features like automated factual dispute letter generation, deadline tracking, and comprehensive reporting, Client Dispute Manager Software can help you save time and stay organized throughout the factual disputing process.

Whether you’re an individual looking to improve your personal credit or a business owner seeking to help your clients navigate the complex world of credit disputes, investing in Client Dispute Manager Software can be a game-changer. By leveraging the power of technology to simplify and optimize the factual disputing process, you can achieve better results in less time and with less stress.

Frequently Asked Questions (FAQs)

What Is The Factual Dispute Meaning?

A factual dispute refers to the process of challenging inaccurate, incomplete, or unverifiable information on your credit report with creditors and credit bureaus.

How Long Does A Creditor Have To Respond To A Factual Credit Dispute Letter?

Under the Fair Credit Reporting Act (FCRA) factual dispute law, creditors and credit bureaus have 30 days to investigate and respond to a factual dispute letter.

Can I Dispute Accurate Negative Information On My Factual Dispute Credit Report?

No, you can only legally dispute information that is inaccurate, incomplete, or unverifiable. Accurate negative information, such as late payments or collections, will generally remain on your credit report for seven years.

What Happens If A Creditor Fails To Respond To My Factual Dispute Letter?

If a creditor does not respond to your factual dispute letter within the required 30-day timeframe, you can escalate the dispute to the credit bureaus and file a complaint with the Consumer Financial Protection Bureau (CFPB).

Is There A Limit To How Often I Can Factual Dispute Credit Report Errors?

No, there is no limit to how often you can dispute inaccurate information on your credit report. In fact, it’s recommended to review your credit report regularly and dispute any errors as soon as you discover them.

Conclusion

Remember, your credit report is a vital part of your financial life, and it’s essential to ensure that the information it contains is accurate and up to date. By understanding your rights under the factual dispute law and following these pro tips for crafting a winning factual dispute letter, you can take control of your credit and pave the way for a more secure financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review:

- Metro 2 Letters Unveiled: A Comparative Analysis with Consumer Law and Factual Dispute Letters

- Guide to Factual Dispute Letter: 5 Steps to Get Results