Are you an entrepreneur looking to make a difference in people’s lives while building a profitable business? Starting a credit repair business from home in 2024 could be the perfect opportunity for you. In this article, we’ll explore the steps you need to take to launch your own credit repair venture and help individuals improve their financial well-being.

Start Today and Explore the Features Firsthand!

Understanding the Credit Repair Industry

Before diving into the specifics of starting a credit repair business, it’s essential to understand the industry itself. Credit repair involves assisting individuals in identifying and disputing inaccurate or unfair negative items on their credit reports. By helping clients remove these negative items, credit repair businesses can help improve their clients’ credit scores, enabling them to access better financial opportunities.

The credit repair industry has seen significant growth in recent years, with more and more individuals seeking assistance to improve their credit standing. According to a report by IBISWorld, the credit repair services industry in the United States has grown by an average of 2.1% per year between 2016 and 2021, reaching a market size of $4.1 billion.

The Demand for Credit Repair Services

In today’s economy, many individuals struggle with credit issues that hold them back from achieving their financial goals. Whether it’s due to past mistakes, identity theft, or unfair reporting practices, poor credit can have a significant impact on a person’s life. A low credit score can make it difficult to secure loans, rent an apartment, or even land a job.

This is where credit repair businesses come in, offering a valuable service to help individuals get back on track. By assisting clients in identifying and disputing inaccurate or unfair negative items on their credit reports, credit repair businesses can help improve their clients’ credit scores and open up new financial opportunities.

The demand for credit repair services is expected to continue growing in the coming years. As more people become aware of the importance of good credit and the impact it can have on their lives, the need for professional credit repair assistance will only increase.

Steps to Starting Your Credit Repair Business

Starting a credit repair business involves a blend of legal compliance, industry knowledge, and strategic planning. Here’s a streamlined approach to launching your venture into the world of credit repair from the ground up.

Start Today and Explore the Features Firsthand!

#1: Gain Knowledge and Certifications

To start a successful credit repair business, you need to have a deep understanding of credit laws, credit reporting practices, and dispute processes. Educating yourself on the Fair Credit Reporting Act (FCRA), the Fair Debt Collection Practices Act (FDCPA), and other relevant laws is crucial to ensuring compliance and providing effective services to your clients.

Consider obtaining certifications from reputable organizations such as the National Association of Credit Services Organizations (NASCO) or the Credit Consultants Association (CCA). These certifications will not only enhance your credibility but also provide you with valuable resources and support.

Attending industry conferences, workshops, and webinars can also help you stay up-to-date on the latest trends, best practices, and regulatory changes in the credit repair industry.

#2: Develop Your Business Plan

Like any business venture, a credit repair business requires a solid plan. Your business plan should outline your target market, marketing strategies, and financial projections. Take the time to research your competition and identify what sets your business apart.

When defining your target market, consider factors such as age, income level, and specific credit challenges they may face. This will help you tailor your services and marketing efforts to effectively reach and attract your ideal clients.

In terms of marketing strategies, think about how you will reach your target audience and communicate the benefits of your services. This may include a combination of online marketing efforts, such as social media campaigns and search engine optimization, as well as offline tactics like networking events and referral partnerships.

Finally, your financial projections should include a realistic assessment of your startup costs, ongoing expenses, and potential revenue streams. Be sure to factor in the cost of credit repair software, marketing investments, and any necessary licenses or certifications.

#3: Establish Your Business Structure

Deciding on the legal structure of your credit repair business is an important step in the startup process. The most common options include:

- Sole Proprietorship: The simplest structure, allowing you to operate your business as an individual. However, it also means you are personally liable for any debts or legal issues related to your business.

- Partnership: Involves two or more individuals sharing ownership of the business, with each partner contributing resources and sharing in the profits and losses.

- Limited Liability Company (LLC): Offers personal liability protection, separating your business assets from your personal assets. This structure provides flexibility in terms of ownership and management while still offering legal protection.

- Corporation: More complex and typically suited for larger businesses with multiple shareholders. Corporations offer the highest level of personal liability protection but also involve more extensive record-keeping and reporting requirements.

Consider consulting with a legal professional or accountant to determine the best business structure for your specific situation and goals.

Start Today and Explore the Features Firsthand!

#4: Obtain Necessary Licenses and Insurance

Before launching your credit repair business, it’s crucial to research and obtain any necessary licenses and permits required by your state or local government. Some states have specific regulations governing credit repair services, so it’s essential to ensure compliance to avoid legal issues down the road.

In addition to licenses, consider obtaining professional liability insurance to protect your business from potential legal claims. This type of insurance can provide coverage in case a client alleges that your services caused them financial harm.

#5: Invest in the Right Technology

To run a successful credit repair business from home, you’ll need reliable technology. Invest in a secure computer system, high-speed internet, and credit repair software to streamline your operations and ensure data security.

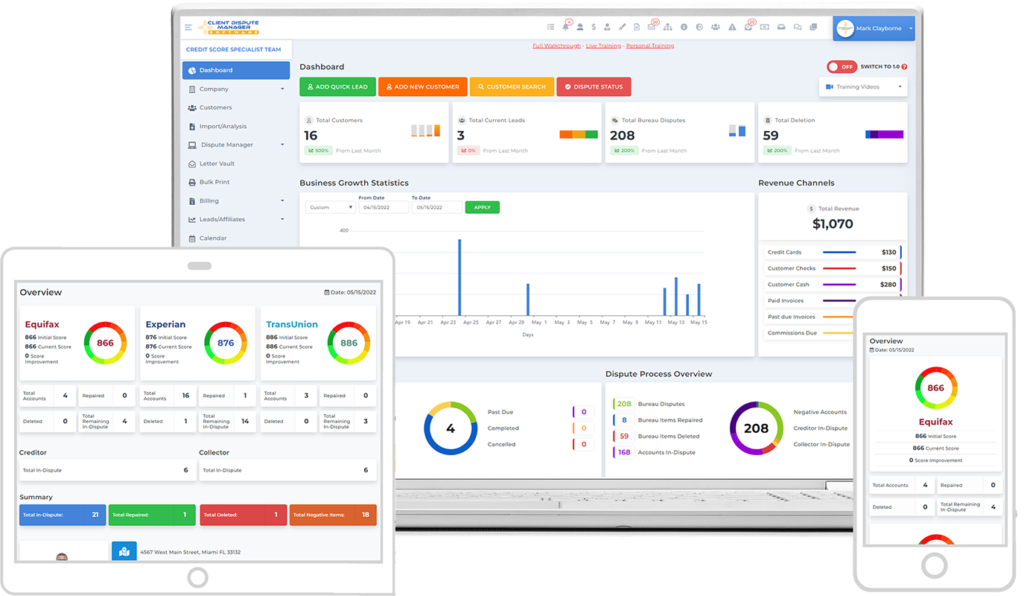

Client Dispute Manager Software is a comprehensive credit repair software solution that offers features like automated dispute tracking, customizable dispute letters, and integrated billing and payments. It also provides a client portal where your clients can access their credit reports, view the status of their disputes, and communicate with your team securely.

When selecting credit repair software, consider factors such as ease of use, customization options, and integration with other business tools like customer relationship management (CRM) systems and accounting software. Choosing the right technology stack will help you streamline your processes, improve client communication, and ultimately grow your credit repair business.

#6: Build Your Network

Networking is essential for growing your credit repair business and establishing yourself as a trusted expert in the industry. Attend local business events, join online forums and social media groups related to credit repair, and connect with other professionals in complementary fields.

Building relationships with mortgage brokers, real estate agents, financial advisors, and other professionals who serve clients with credit challenges can lead to valuable referrals and partnership opportunities. These professionals often encounter individuals in need of credit repair services and can recommend your business to their clients.

Joining industry associations, such as NASCO or CCA, can also provide valuable networking opportunities and keep you informed about industry trends and best practices.

#7: Market Your Services

To attract clients and grow your credit repair business, you need to effectively market your services. Start by developing a professional website that showcases your expertise, highlights the benefits of working with your business, and provides clear information about your services.

Utilize social media platforms, such as Facebook, Twitter, and LinkedIn, to engage with potential clients and share valuable credit-related content. This can help establish your business as a knowledgeable and trustworthy resource in the credit repair industry.

Consider offering free credit consultations or educational workshops to demonstrate your value and build trust with your target audience. These events can be held online or in-person, depending on your preferences and local health guidelines.

Other marketing strategies to consider include search engine optimization (SEO) to improve your website’s visibility in search results, pay-per-click (PPC) advertising to drive targeted traffic to your site, and email marketing to nurture leads and keep clients engaged.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

How much does it cost to start a credit repair business from home?

The startup costs for a home-based credit repair business can vary depending on factors such as licensing fees, software expenses, and marketing investments. On average, you can expect to invest between $1,000 and $5,000 to get your business up and running.

Do I need a specific degree or certification to start a credit repair business?

While there are no mandatory degree requirements, obtaining certifications from organizations like NASCO or CCA can enhance your credibility and provide valuable industry knowledge.

How long does it take to see results for clients in credit repair?

The timeline for credit improvement varies depending on the individual’s specific credit situation. On average, clients may start seeing positive results within 3-6 months of working with a credit repair business.

Is starting a credit repair business worth it?

Starting a credit repair business can be a rewarding and profitable venture for entrepreneurs passionate about helping others improve their financial lives. With the right knowledge, tools, and marketing strategies, a credit repair business has the potential for significant growth and success.

Conclusion

In conclusion, starting a credit repair business from home in 2024 offers a unique opportunity to make a positive impact on individuals’ financial well-being while building a thriving business. By following the steps outlined in this article and staying committed to providing exceptional service, you can establish yourself as a trusted expert in the credit repair industry.

Remember to prioritize education, compliance, and client satisfaction as you launch and grow your credit repair business. Stay up-to-date on industry regulations, invest in the right tools and technology, and continually refine your marketing strategies to reach and serve more clients effectively.

With dedication, persistence, and a genuine desire to help others, your home-based credit repair business can thrive in 2024 and beyond, making a meaningful difference in the lives of those you serve.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- How Credit Repair Software Works: A Comprehensive Guide

- The Top Mistakes in the Credit Repair Business and How to Avoid Them