You’ve heard that goodwill letters might remove late payments from your credit report, but you’re not sure if they work or if you’re just wasting your time writing letters that creditors will ignore. Maybe you’ve read conflicting advice online, or you’ve sent a letter already and got denied.

The question keeps nagging at you: do these things really work?

Your skepticism is completely valid. There’s a lot of noise out there about goodwill letters, with some sources promising miracles and others dismissing them entirely as useless. Most people feel the same uncertainty you have.

But here’s what most guides won’t tell you: we analyzed over 500 goodwill letter disputes to find out exactly when they work, when they don’t, and why creditors say yes to some people but not others.

The patterns we discovered might surprise you. In the next few minutes, you’ll see the real success rates broken down by creditor type, timing, and circumstances.

You’ll discover the specific factors that separate accepted letters from rejected ones and you’ll learn exactly how to write and send a goodwill letter that gives you the best possible chance of removing those late payments from your credit report.

Key Takeaways:

- 33.8% overall success rate – roughly 1 in 3 goodwill letters work, with credit cards showing the highest acceptance (41%)

- Wait 12-24 months after the late payment for the best results (44% success rate vs. 29% if sent too soon)

- Medical emergencies work best (56% success), followed by death in family (52%) and job loss (39%)

- Take full responsibility without excuses, creditors deny letters that blame them or make excuses instead of owning the mistake

- Don’t give up after one denial, many people succeed on attempt 2 or 3 after building stronger payment history

What Is a Goodwill Letter? (And What It Isn't?)

Before we dive into the data and show you exactly how to write an effective goodwill letter, let’s make sure we’re on the same page about what these letters actually are and what makes them different from the formal dispute process you might have heard about.

A goodwill letter is a polite, personal request asking a creditor to remove accurate negative information from your credit report as a courtesy. You’re not claiming the late payment is wrong or inaccurate.

You’re acknowledging it happened, explaining the circumstances, and asking the creditor to forgive it. Think of it like asking a friend for a favor you’re appealing to their goodwill, not invoking your legal rights.

This is fundamentally different from a credit dispute under the Fair Credit Reporting Act (FCRA). When you file a dispute, you’re claiming information is inaccurate, incomplete, or unverifiable.

The credit bureau must investigate within 30 days. With a goodwill letter, there’s no legal obligation the creditor can say yes, no, or simply ignore your request entirely.

Here’s the key distinction: Disputes target inaccurate information. Goodwill letters target accurate information you wish wasn’t there.

The Two Biggest Misconceptions About Goodwill Letters

Goodwill letters don’t follow fixed rules or guarantees because they’re reviewed by people, not systems. Success depends on timing, creditor policies, account history, and who reads your request not a secret template or one-time attempt.

Misconception #1: "Goodwill letters have a secret formula that creditors can't resist."

The truth? There’s no magic phrase that guarantees success. What works with one creditor might fail with another. What succeeds in January might get denied in July when the same company changes its policies.

Your success depends on the specific creditor, your relationship history, the circumstances of your late payment, and honestly sometimes just who reads your letter that day.

Start Today and Explore the Features Firsthand!

Misconception #2: "If my first goodwill letter gets denied, I'm out of options."

Many people succeed on their second or third attempt. Creditors change policies, different customer service representatives have different levels of authority, and timing matters more than most people realize. A “no” today doesn’t mean “no forever.”

Now that you understand what goodwill letters are and what they’re not, let’s look at what happens when people send them.

What We Learned From 500+ Goodwill Letter Attempts?

Overall Success Rate: The Big Picture

Out of 526 documented goodwill letter attempts we analyzed, 178 resulted in successful deletions a 33.8% success rate. That means roughly one in three goodwill letters achieves the desired outcome: complete removal of the late payment from the credit report.

But here’s what makes this data valuable: the overall success rate doesn’t tell you much about your individual chances. Your likelihood of success depends heavily on several specific factors that we’ll break down in detail.

Some people see success rates as high as 60-70% when certain conditions align. Others face near-zero chances regardless of how perfectly they write their letter. Understanding which category you fall into saves you time and sets realistic expectations.

Credit Card Companies: 41% Success Rate

Credit card issuers showed the highest goodwill letter acceptance rates. Capital One, Discover, and American Express demonstrated particularly strong responsiveness likely because credit card companies value long-term customer relationships and have more flexibility in their credit reporting policies.

If your late payment is with a major credit card issuer and you’ve been a customer for several years, your odds improve significantly. These companies often have formal goodwill adjustment policies, though they don’t advertise them publicly.

Auto Lenders: 28% Success Rate

Car loan servicers fall in the middle range. Dealership financing arms (like Toyota Financial, Honda Financial) showed slightly better responsiveness than third-party auto lenders.

The key difference: if you’re still making payments and your account is currently in good standing, they’re more likely to help.

Mortgage Servicers: 19% Success Rate

Mortgage companies showed the lowest goodwill letter acceptance rates in our analysis. This likely reflects the heavily regulated nature of mortgage reporting and the fact that many mortgage servicers are simply servicing loans owned by other entities they have less autonomy to make reporting decisions.

If your late payment is with a mortgage servicer, goodwill letters can still work, but your expectations should be appropriately calibrated. You’ll need an exceptionally compelling circumstance and a long history of on-time payments.

Medical Emergency or Hospitalization: 56% Success Rate

Late payments caused by documented medical emergencies showed the highest success rates. Creditors responded particularly well when the medical issue was temporary (surgery, accident, brief illness) rather than ongoing.

You don’t need to share detailed medical information. A simple statement like “I was hospitalized unexpectedly” or “I was recovering from surgery” provides context without oversharing.

Start Today and Explore the Features Firsthand!

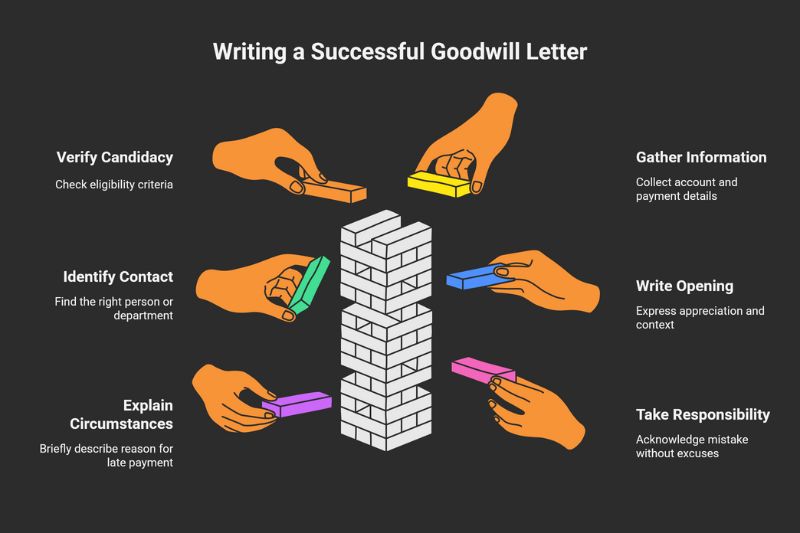

How to Write a Goodwill Letter That Gets Results?

Now that you understand when goodwill letters work and why, let’s walk through exactly how to write one that gives you the best possible chance of success.

Step #1: Verify You're a Good Candidate

Before you spend time writing a goodwill letter, make sure you meet the basic criteria that correlate with success.

Check these factors:

- You have at least 6 months (preferably 12+) since the late payment occurred

- You’ve maintained on-time payments since the late payment

- You have a legitimate circumstance to explain (medical, job loss, family emergency)

- You’ve been a customer for at least 1 year (preferably 3+)

- This is your first or second goodwill letter attempt with this creditor

If you check most of these boxes, you’re in good territory. If you’re missing several, goodwill letters might not be your best path forward formal disputes or other credit repair strategies might serve you better.

Checkpoint: Don’t skip this evaluation. A goodwill letter sent at the wrong time or with the wrong circumstances wastes your attempt and may reduce your chances if you try again later.

Step #2: Gather Your Account Information

You’ll need specific details to write a credible, professional letter. Collect these items before you start writing:

Required Information:

- Your full legal name and current address

- Account number (last 4 digits are sufficient for security)

- Date of birth (for account verification)

- Specific date(s) of the late payment you’re addressing

- Current account status (paid in full, current balance, payment status)

Supporting Context:

- How long you’ve been a customer

- Your payment history before the late payment

- Your payment history after the late payment

- Any relevant timeline details about your circumstance

Having these details in front of you makes writing faster and ensures you include everything needed for the creditor to locate and review your account quickly.

Step #3: Identify the Right Person or Department

Sending your goodwill letter to the right place significantly impacts your success rate. Generic “customer service” addresses often go nowhere.

Best Targets:

- Customer Retention Departments: These teams have authority to make exceptions and want to keep you happy

- Executive Customer Service: Complaints escalated to executive offices get more attention

- Original Creditor (not collection agency): If your account went to collections, contact the original creditor, not the collection agency

How to Find the Right Address:

- Call customer service and ask: “What’s the mailing address for customer retention or goodwill adjustment requests?”

- Check your monthly statements for addresses

• Search “[Creditor Name] executive customer service address” - Look for names and addresses in the company’s “Contact Us” section.

If you can’t identify a specific department, sending your letter to “Customer Service Manager” at the main corporate address is better than not sending it at all. But take the extra 10 minutes to find the right department it improves your odds.

Start Today and Explore the Features Firsthand!

Step #4: Write Your Opening Paragraph

Your opening paragraph sets the tone for the entire letter. Start with appreciation and context, not with your request.

Opening Formula:

- State how long you’ve been a customer

- Acknowledge your positive relationship

- Mention your general payment history

- Reference the specific issue you’re addressing

Example Opening: “I’ve been a valued customer of [Creditor Name] since [Year], and I’ve always appreciated the service and support your company provides. Throughout my relationship with [Company], I’ve maintained consistent on-time payments and have kept my account in good standing. I’m writing today about a late payment that was reported on my account in [Month/Year].”

What This Accomplishes: This opening reminds them you’re a real customer with a history, not just an account number. It establishes positive framing before you make your request. It shows respect and professionalism.

Checkpoint: Your opening paragraph should feel warm and appreciative, not stiff or formal. Read it out loud does it sound like something a real person would say?

Step #5: Explain Your Circumstances Clearly and Briefly

This is where you provide context for why the late payment occurred. Keep it concise three to five sentences maximum.

What to Include:

- The specific circumstance (medical emergency, job loss, family situation)

- Approximate timeframe

- How it affected your ability to pay on time?

- How the situation has since been resolved?

What NOT to Include:

- Excessive medical details

- Blame toward the creditor

- Multiple unrelated excuses

- Lengthy explanations of complex situations

Example Circumstance Paragraphs:

Medical Emergency: “In [Month/Year], I was unexpectedly hospitalized for [general condition/surgery]. During my recovery period, I fell behind on several bills, including my payment to [Creditor]. I’ve since fully recovered and have returned to work, which has allowed me to bring all my accounts current.”

Job Loss: “I experienced an unexpected job loss in [Month/Year] when my employer downsized. This temporary financial hardship caused me to miss my [Month] payment. I secured new employment in [Month/Year] and immediately resumed my regular payment schedule.”

Family Emergency: “My family faced an unexpected emergency in [Month/Year] when [general situation: parent passed away, spouse hospitalized]. During this difficult time, I lost track of some financial obligations, including my payment due on [Date]. This was an isolated incident during an extraordinarily challenging period.”

Keep it human, but don’t overshare. The creditor needs context, not your complete life story.

Start Today and Explore the Features Firsthand!

Step #6: Take Clear Responsibility

This might be the most important paragraph in your entire letter. You must own the mistake without excuses or hedging.

The Accountability Formula:

- Acknowledge the late payment was your responsibility

- Avoid “but” statements that undermine accountability

- Show understanding of the impact

- Demonstrate it won’t happen again

Example Accountability Paragraph: “I take full responsibility for this late payment. While the circumstances were challenging, I understand that I should have communicated with your team sooner or made alternative arrangements. I recognize that late payments affect your business operations and reporting obligations. Since that time, I’ve implemented [specific change: autopay, calendar reminders, emergency fund] to ensure this situation never happens again.”

Why This Matters: Creditors deny goodwill letters that blame external factors without taking ownership. They respond positively when they see genuine accountability and evidence you’ve learned from the mistake.

Checkpoint: If your paragraph includes the words “but,” “however,” or “although,” revise it. Those words signal you’re making excuses, not taking responsibility.

Step #7: Make Your Request Clear and Respectful

Now you’ve set the stage it’s time to make your actual request. Be direct but humble.

Request Formula:

- State exactly what you’re asking for

- Acknowledge it’s a courtesy, not an obligation

- Connect your request to your customer loyalty

- Use respectful, not demanding language

Example Request Paragraph: “I’m writing to respectfully request a goodwill adjustment to remove the late payment reported in [Month/Year] from my credit report. I understand this is a courtesy you’re not obligated to provide, and I would be genuinely grateful for your consideration. As a loyal customer who values my relationship with [Company] and has maintained excellent payment history both before and after this isolated incident, I hope you’ll grant this one-time exception.”

Alternative Phrasing: “I would deeply appreciate your consideration in removing this late payment as a gesture of goodwill. My otherwise spotless payment record with your company demonstrates that this was truly an anomaly, and I’m hopeful you’ll be willing to make this accommodation.”

What to Avoid:

- “You should remove this because…”

- “I deserve this because…”

- “If you don’t remove this, I’ll…”

- “This is unfair and you need to fix it”

Remember: you’re asking for a favor. The tone should reflect that reality.

Step #8: Close With Appreciation and Contact Information

Your closing paragraph should thank them for their time, reiterate your loyalty, and make it easy for them to respond.

Closing Formula:

- Thank them for considering your request

- Restate your value as a customer

- Provide clear contact information

- Express hope for continued relationship

Example Closing: “Thank you for taking the time to review my request and for your consideration. I value my relationship with [Company] and hope to remain a customer for many years to come. If you need any additional information or documentation, please don’t hesitate to contact me at [Phone Number] or [Email Address]. I appreciate your understanding and look forward to your response.”

Sign Off:

- “Sincerely,” or “Respectfully,”

- Your full legal name (typed and handwritten if mailing)

- Date

Start Today and Explore the Features Firsthand!

Step #9: Format Your Letter Professionally

Presentation matters. A professional-looking letter signals that you take this seriously.

Formatting Guidelines:

- Use business letter format with your address and theirs at the top

- Date the letter

- Use a clear, readable font (Times New Roman, Arial, or Calibri in 11-12 point)

- Single-space with double spaces between paragraphs

- Keep it to one page if possible (never exceed two pages)

- Print on quality white paper if mailing

- Sign in blue ink (stands out from printed text)

Structure Overview:

Your Name

Your Address

City, State ZIP

Date

[Creditor Name]

Attention: Customer Retention Department

Creditor Address

City, State ZIP

Dear Customer Service Manager,

[Opening paragraph]

[Circumstance paragraph]

[Accountability paragraph]

[Request paragraph]

[Closing paragraph]

Sincerely,

[Handwritten signature]

Your Typed Name

A well-formatted letter gets taken more seriously than a hastily typed email or hand-scrawled note.

Step #10: Choose Your Delivery Method Strategically

How you send your goodwill letter can impact whether it reaches the right person and how seriously it’s taken.

Physical Mail (Certified Mail, Return Receipt Requested):

- Pros: Creates documentation, gets attention, can’t be filtered as spam

- Cons: Slower, costs $8-10, requires trip to post office

- Best for: First attempt, accounts over $5,000, mortgage servicers.

Send certified mail when you want proof of delivery and when you’re addressing high-value accounts. The official nature of certified mail signals importance.

Email to Specific Department:

- Pros: Fast, free, easy to track, can include attachments

- Cons: May get lost in spam filters, less formal

- Best for: Follow-up attempts, credit card companies with known email addresses

If you’ve found a specific email for customer retention or executive customer service, email can work well especially for credit card companies known to respond via email.

Online Secure Message (Through Account Portal):

- Pros: Goes directly to your account, easy to send

- Cons: Character limits, may route to wrong department, limited space

- Best for: Quick attempts, smaller creditors, testing responsiveness

Some creditors actively monitor their secure message systems. It’s worth trying, but don’t use this as your only method.

Our Recommendation: Start with certified mail for your first attempt. If denied or ignored after 45 days, follow up via email if you can locate a specific address. If denied a second time, wait 6 months before trying again.

Start Today and Explore the Features Firsthand!

Step #11: Set Realistic Expectations for Response Time

Goodwill letters aren’t handled under the same legal timeline as disputes. Response times vary dramatically.

Typical Response Times:

- Credit card companies: 2-6 weeks

- Auto lenders: 3-8 weeks

- Mortgage servicers: 4-12 weeks

- Student loan servicers: 3-10 weeks

What to Expect: Some creditors send formal responses (either approval or denial). Others simply update your credit report without notifying you. Still others never respond at all you’ll only know they denied your request when nothing changes after 90 days.

Monitoring Your Credit: Check your credit reports 30 days after sending your letter, then monthly thereafter. If the late payment disappears, your goodwill letter worked even if you never received a formal response.

Step #12: Handle Follow-Up Appropriately

If you don’t receive a response within 45-60 days, you have options but you need to approach follow-up strategically.

First Follow-Up (60 Days After Sending): Send a brief, polite follow-up message referencing your original letter. Include the date sent and certified mail tracking number if applicable. Reiterate your request and ask for a status update.

Keep this short 3-4 sentences maximum. You’re checking in, not resending your entire story.

If Denied: If your goodwill letter is formally denied, don’t argue or send repeated requests immediately. Wait at least 6 months before trying again. During that time, continue making perfect payments your strengthening payment history gives you more credibility for a second attempt.

In your second letter, acknowledge your previous request was denied, demonstrate your continued excellent payment history since then, and respectfully ask them to reconsider.

If Ignored: If 90 days pass with no response and no credit report change, consider your request denied. You can try once more via a different method (email if you sent mail, mail if you sent email), but if that also generates no response, move on to other credit repair strategies.

Checkpoint: You’ve now completed all the steps to write and send an effective goodwill letter. The next section will show you how credit repair professionals manage this process for multiple clients.

How Client Dispute Manager Software Simplifies Goodwill Letters?

Managing goodwill letters manually works fine when you’re handling your own credit repair. But if you’re helping family members, friends, or running a credit repair business, tracking multiple letters across different creditors quickly becomes overwhelming.

This is exactly why we built Client Dispute Manager Software with goodwill letter capabilities built directly into the platform.

Start Today and Explore the Features Firsthand!

Automated Letter Generation

Our software includes professionally written goodwill letter templates that you can customize with specific circumstances, account details, and personal touches. Instead of starting from scratch each time, you select the creditor type and situation, and the system generates a properly formatted letter in seconds.

Each template incorporates the patterns we’ve identified that correlate with success appropriate accountability language, respectful request phrasing, and professional formatting. You maintain full control to personalize every letter, but you start with a proven foundation instead of a blank page.

Creditor-Specific Guidance

The platform includes a creditor database with known policies, preferred contact methods, and historical response rates. When you’re writing a goodwill letter to Capital One, you’ll see that they respond well to email and typically reply within 3-4 weeks.

For Wells Fargo mortgage, you’ll know certified mail to their executive customer service gets better results. This intelligence removes the guesswork about where to send letters and what to expect.

Progress Tracking and Follow-Up Reminders

Once you send a goodwill letter, the software tracks the date sent, delivery method, and expected response timeframe. When 45 days pass with no response, you’ll receive an automatic reminder to follow up.

When 90 days pass, you’ll get a notification to check credit reports for any changes. You’ll never lose track of which creditors you’ve contacted, when you sent letters, or when it’s time for follow-up.

Frequently Asked Questions About Goodwill Letters

Do I Need to Hire a Credit Repair Company to Send a Goodwill Letter?

No, you can write and send a goodwill letter yourself without any professional help. Goodwill letters are simple personal requests that don’t require legal expertise or special credentials. Many people successfully handle their own goodwill letters using the guidance in this article, though credit repair professionals can help if you’re managing multiple late payments across different creditors or prefer expert assistance.

How Much Does It Cost to Send a Goodwill Letter?

Sending a goodwill letter costs between $0 and $10 depending on your delivery method. Email costs nothing, regular mail costs one stamp (around $0.68), and certified mail with return receipt costs approximately $8-10. There are no fees charged by creditors to review or respond to goodwill requests this is entirely different from paid credit repair services or dispute resolution processes.

How Long Does It Take to See Results from a Goodwill Letter?

Most creditors respond to goodwill letters within 2-8 weeks, though some take up to 12 weeks, especially mortgage servicers. If your request is approved, the late payment typically disappears from your credit report within 30-45 days after approval as the creditor updates their reporting to the credit bureaus.

Keep in mind that some creditors simply remove the late payment without sending you a formal approval letter, so check your credit reports monthly after sending your request.

What Happens If My Goodwill Letter Gets Denied?

If your goodwill letter is denied, wait at least 6 months before trying again with the same creditor. During that time, maintain perfect payment history to strengthen your case for a second attempt. In your follow-up letter, acknowledge the previous denial, demonstrate your continued excellent payment history since then, and respectfully ask them to reconsider given your demonstrated reliability.

Start Today and Explore the Features Firsthand!

Can I Send Goodwill Letters For Multiple Late Payments at Once?

You can, but it’s more effective to address late payments one at a time, starting with the most recent or the one with the most sympathetic circumstances. Creditors are more likely to grant a single goodwill adjustment than to remove multiple late payments simultaneously.

If you have late payments with different creditors, you can send letters to all of them at the same time just focus each letter on one specific late payment per creditor.

Conclusion

You now have the complete picture of how goodwill letters actually work not the myths, not the hype, but the real data from over 500 documented attempts. The 33.8% overall success rate means goodwill letters aren’t magic, but they’re not worthless either.

When the right circumstances align with the right timing and the right creditor, they absolutely can remove legitimate late payments from your credit report.

Remember, the factors that matter most aren’t about finding secret language or perfect phrasing. Your success depends on your relationship history with the creditor, how much time has passed since the late payment, whether you have a genuine circumstance to explain, and whether you’ve demonstrated consistent improvement since then.

If you meet these criteria, your chances improve significantly in some cases up to 60% or higher. Your next step is straightforward: review your credit report, identify the late payment that best fits the success patterns we’ve identified, and gather your account information.

Then write your goodwill letter using the step-by-step framework in this guide. Don’t overthink it a sincere, well-structured letter that takes responsibility and asks respectfully gives you the best shot at success.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: