If you’ve ever wondered, “How can I challenge inaccurate collection accounts on a credit report?” you’re not alone. Tackling incorrect credit report entries can be confusing, but with the right approach and tools, you can turn a seemingly impossible task into a manageable process.

In this article, we’ll walk you through a step-by-step guide to using debt validation and verification letters effectively, including how to craft effective debt validation letters and collection account removal letters.

Start Today and Explore the Features Firsthand!

Introduction to Removing Collection Accounts

Incorrect collection accounts on a credit report can hurt your financial health. These inaccuracies lower your credit score and make life harder. From securing loans to renting an apartment, a bad credit report creates unnecessary hurdles.

Fortunately, you can take steps to correct these errors and improve your financial standing. Debt validation letters and verification letters are essential tools that help you remove collection accounts or fix incorrect entries.

Using the right collection account dispute letter can significantly improve your results.

Why Fixing Errors Matters?

Mistakes on your credit report can cost you money and opportunities. Banks and landlords use credit reports to judge your financial reliability. Inaccuracies can create the impression that you are careless with money.

Correcting these mistakes ensures you have a fair chance at financial success. It’s not just about improving numbers it’s about unlocking better opportunities.

With the right inaccurate collection account removal letter or debt validation letter, you can protect your financial reputation.

Tools to Help with Collection Account Removal

Debt validation letters and verification letters empower you to dispute inaccurate information. These documents require collectors to provide evidence for their claims. Knowing how and when to use these tools makes all the difference.

Each collection account dispute letter addresses specific issues, so it’s vital to understand their distinct purposes. Whether you need a letter for collection account disputes or a formal validation letter, precision is key.

Start Today and Explore the Features Firsthand!

Understanding Collection Account Removal Letters

Although these tools seem similar, debt validation letters and verification letters serve unique roles. Knowing the difference will help you use them effectively to remove collection accounts.

What is a Debt Validation Letter?

A debt validation letter is the first tool you should use when disputing a collection account. It ensures that the collector has the right to claim the debt. This letter demands evidence showing the debt belongs to you and that the collector is authorized to collect it.

For example, you can request original loan agreements or account statements. If the collector cannot provide proof, they must stop pursuing the debt and remove it from your credit report using an inaccurate collection account removal letter.

What is a Debt Verification Letter?

A debt verification letter focuses on confirming the accuracy of the debt amount. Sometimes, collectors report incorrect balances or add extra fees. This letter challenges those discrepancies.

For instance, if a collector claims you owe $700 but your credit report states $300, you can request a breakdown of the amount. Verification ensures that all reported information aligns with reality.

A well-written collection account dispute letter or debt validation letter can highlight errors effectively.

Key Differences Between Validation and Verification

Debt validation letters check ownership of the debt.

Debt verification letters confirm the accuracy of the debt details.

Understanding when to use each letter is crucial for effective credit repair. By applying the correct tool to the situation, you increase your chances of success. Proper use of collection account removal letters will simplify the process.

Start Today and Explore the Features Firsthand!

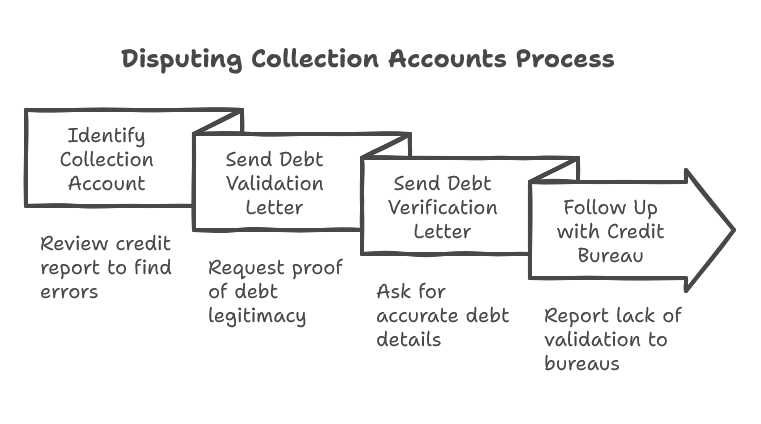

Step-by-Step Guide to Using Collection Account Dispute Letters

Successfully challenging a collection account requires careful planning and execution. Follow these steps to address inaccuracies on your credit report.

Step #1: Identify the Collection Account

The first step is to locate errors on your credit report. Start by obtaining a copy of your report from trusted sources like AnnualCreditReport.com. Carefully review it for flagged accounts or negative items.

Look at the collection agency’s name, the amount owed, and any discrepancies in the report. Once you identify the issue, take note of the details for your next steps. This will help you draft a precise letter for collection account disputes.

Step #2: Send a Debt Validation Letter

After identifying the problem, send a debt validation letter to the collector. This letter ensures the collector proves the debt is legitimate and belongs to you.

When writing a debt validation letter, keep the tone professional and direct. State your request for evidence clearly. Include basic account details, but avoid providing too much personal information.

Mail the letter via certified mail to track delivery. Once sent, the collector must respond with proof. If they cannot, the debt should be removed from your credit report using a collection account removal letter.

Start Today and Explore the Features Firsthand!

Step #3: Send a Debt Verification Letter

If the debt amount looks incorrect, send a verification letter. This step helps ensure the collector provides accurate details about the balance. For example, you can ask for an itemized list of charges or fees. This letter also serves as a record of your dispute.

When drafting a verification letter, mention specific errors you’ve noticed. Be precise about what information you want verified. As with validation letters, send this via certified mail.

If the collector fails to provide accurate information, you can escalate the issue to the credit bureaus with a collection account dispute letter.

Step #4: Follow Up with the Credit Bureau

If the collector fails to validate or verify the debt, your next step is contacting the credit bureaus. A deletion request letter informs the bureau of the collector’s failure to provide proof.

Explain the situation clearly in the letter. Attach copies of your debt validation letter, verification letter, and any responses from the collector. Highlight the lack of sufficient evidence for the debt. Send the letter to all three major credit bureaus (Experian, Equifax, and TransUnion).

If the bureau finds the debt invalid, it should be removed from your credit report. An inaccurate collection account removal letter can simplify this process.

Step #5: Use the Right Tools for Collection Account Removal

Managing disputes manually can be overwhelming. Using credit repair software simplifies the process. Tools like the Client Dispute Manager help you track progress, organize documents, and send pre-drafted letters.

By streamlining your workflow, you can focus on achieving better results for yourself or your clients. These tools often include templates for debt validation letters, collection account removal letters, and other key documents.

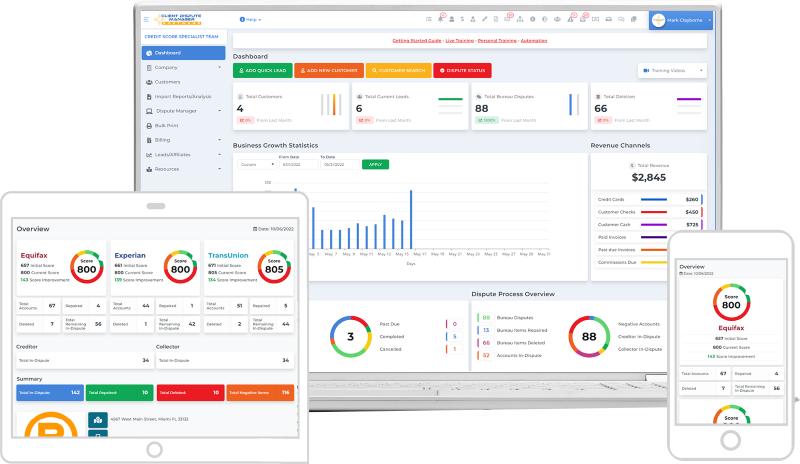

The Role of the Client Dispute Manager Software in Collection Account Removal

Start Today and Explore the Features Firsthand!

The Client Dispute Manager software is a valuable asset for anyone involved in credit repair. It provides tools to simplify the dispute process and improve efficiency.

Features of Client Dispute Manager Software

The software offers a variety of features designed for dispute management. It includes pre-drafted letters for common scenarios, such as validation and verification requests. The workflow is intuitive, guiding you through each step of the process.

Additionally, the software tracks all communication with collectors and credit bureaus, ensuring no detail is overlooked. Whether you need a letter for collection account disputes or follow-ups, the software has you covered.

Benefits for Client Dispute Manager Software Users

Using the Client Dispute Manager saves time and reduces stress. The templates eliminate guesswork, while the tracking tools keep everything organized. These features are particularly helpful for entrepreneurs managing multiple clients.

By maintaining a systematic approach, you can handle disputes with confidence and accuracy. Crafting precise collection account dispute letters and debt validation letters becomes easier with the right tools.

Start Today and Explore the Features Firsthand!

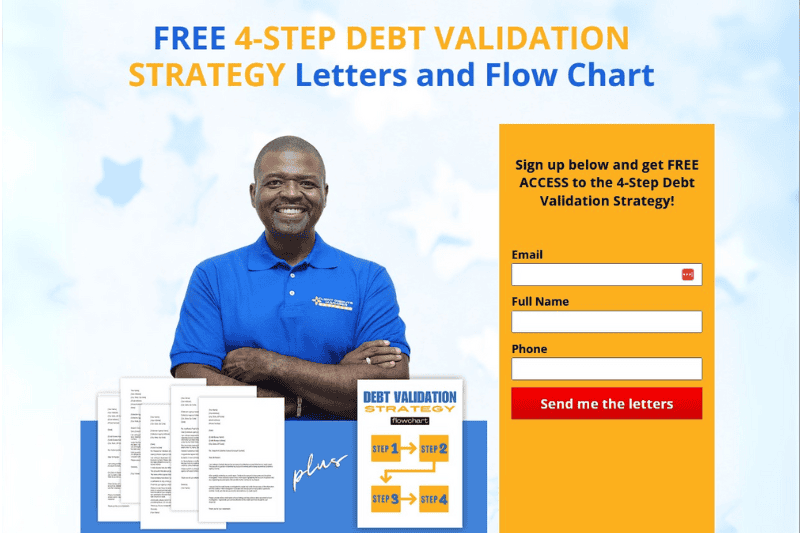

Access the Free Four-Step Debt Validation System for Collection Account Removal

To make the credit repair process even easier, take advantage of the Four-Step Debt Validation System. This free resource provides a structured approach to handling disputes.

What’s Included in the System?

The system includes step-by-step guides for each stage of the dispute process. Flowcharts help you visualize your progress, making complex steps easier to follow. You’ll also receive customizable collection account removal letters and debt validation letters that you can adapt to specific situations.

Accessing the system is simple and free, download your copy and start using it today. This resource is designed to empower you with the knowledge and tools needed for effective credit repair.

Conclusion

Challenging inaccurate collection accounts doesn’t have to be overwhelming. By understanding and using debt validation letters and verification letters, you can correct errors and improve your credit score.

Errors on your credit report can harm your financial future. Acting now protects your opportunities and strengthens your financial health. Don’t wait for the mistakes to impact your life further.

Download the free Four-Step Debt Validation System today. Explore the Client Dispute Manager software for additional support. With these tools, you can take control of your credit and help others do the same. Start making positive changes now your financial future depends on it.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: