In today’s financial landscape, understanding what is credit utilization ratio stands as a crucial factor in achieving excellent credit health. As the second most important factor in your credit score calculation, your credit utilization ratio influences up to 30% of your overall credit score, yet many consumers struggle to maintain a good credit utilization ratio simply because they don’t understand how this vital metric works.

Whether you’re rebuilding credit or aiming for an excellent score, knowing what is a good credit utilization ratio and maintaining the best credit utilization ratio can transform your financial future.

In this comprehensive guide, we’ll explore how to achieve and maintain a credit utilization ratio good enough to maximize your credit score potential, providing you with both the knowledge and strategies needed for success.

Table of Contents

Start Today and Explore the Features Firsthand!

Understanding Credit Utilization Ratio Basics

Many consumers struggle to understand “what is credit utilization ratio” and its significance in their financial lives. Your credit utilization ratio represents one of the most critical factors in determining your credit score, accounting for approximately 30% of your FICO score calculation. Understanding and managing your credit utilization ratio effectively can make the difference between good and excellent credit.

Calculating Your Credit Utilization Ratio

The math behind what is credit utilization ratio is relatively straightforward and essential to understand. Your credit utilization ratio is calculated by dividing your current credit card balances by your total available credit limits and multiplying by 100 to get a percentage.

For example, if you have $2,000 in balances across all your credit cards and $10,000 in total available credit, your credit utilization ratio would be 20%. Understanding this calculation helps you monitor and maintain a good credit utilization ratio.

Why Your Credit Utilization Ratio Good Matters

Maintaining a credit utilization ratio good enough to positively impact your credit score requires understanding its significance. Credit scoring models view high utilization as a risk factor, which is why keeping a good credit utilization ratio is crucial for maintaining a healthy credit score.

Your utilization ratio often indicates to lenders whether you’re living within your means and managing credit responsibly, making it essential to maintain what experts consider a good credit utilization ratio.

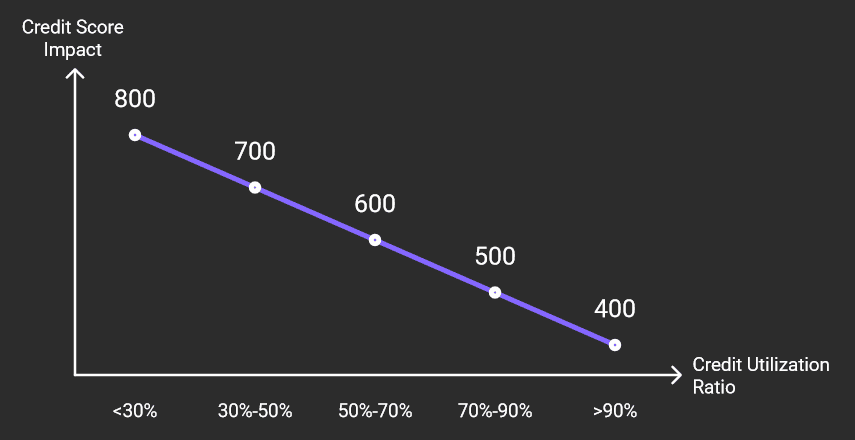

Finding the Best Credit Utilization Ratio

Achieving the best credit utilization ratio requires understanding the target ranges that credit scoring models prefer. The best credit utilization ratio typically falls below 10%, though maintaining any ratio below 30% is considered acceptable. Experts agree that striving for the best credit utilization ratio possible can significantly impact your credit score.

What Is a Good Credit Utilization Ratio Range?

When people ask “what is a good credit utilization ratio,” the answer depends on their credit goals. Generally, what is a good credit utilization ratio ranges between 1% and 30%, with lower percentages being better. Financial experts consistently emphasize that understanding what is a good credit utilization ratio is crucial for credit score optimization. Most agree that maintaining a ratio below 30% is essential for healthy credit.

Maintaining Your Credit Utilization Ratio Good Status

Keeping your credit utilization ratio good requires consistent monitoring and management. Maintaining a good credit utilization ratio involves more than just making minimum payments – it requires strategic planning and regular review of your credit usage. Your credit utilization ratio good standing can be maintained through various strategies, including multiple monthly payments and careful timing of major purchases.

Start Today and Explore the Features Firsthand!

Strategic Management for the Best Credit Utilization Ratio

Achieving the best credit utilization ratio requires implementing effective strategies and maintaining consistent habits. Your approach to managing the best credit utilization ratio should include regular monitoring, strategic payment timing, and careful consideration of new credit opportunities. Understanding how to maintain the best credit utilization ratio can help you maximize your credit score potential.

Understanding What Is Credit Utilization Ratio Impact

Knowing “what is credit utilization ratio” impact on your credit score helps prioritize its management. The relationship between what is credit utilization ratio and your credit score isn’t linear – small changes in utilization can have significant impacts. Understanding what is credit utilization ratio affects your credit score helps motivate maintaining lower utilization rates.

Achieving a Good Credit Utilization Ratio

Maintaining a good credit utilization ratio requires implementing specific strategies and habits. Your journey to maintaining a good credit utilization ratio might include requesting credit limit increases, making multiple monthly payments, or using multiple cards strategically. Regular monitoring ensures your credit utilization ratio remains in the optimal range.

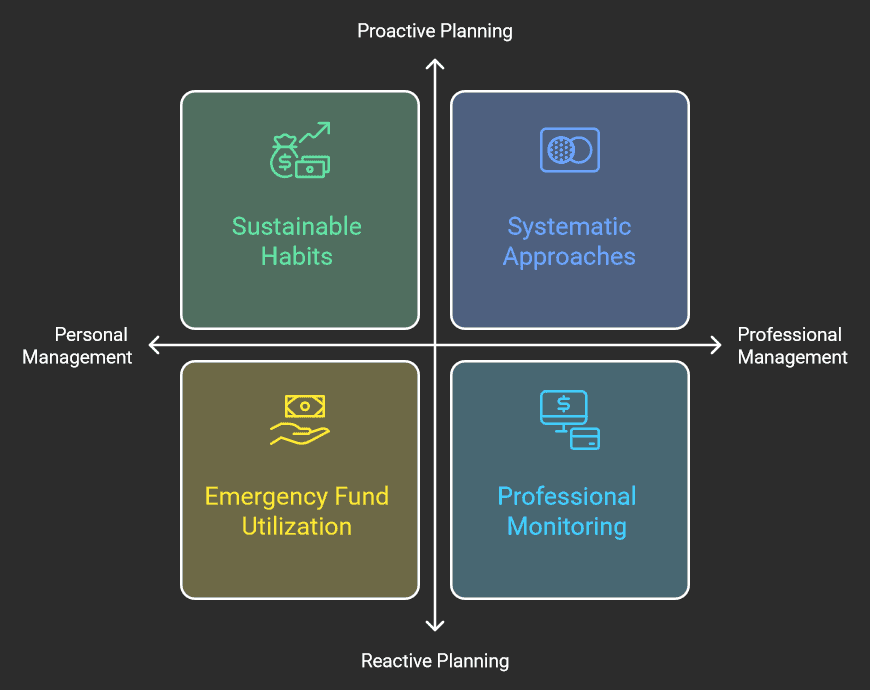

Long-term Strategies for Credit Utilization Ratio Success

Your long-term success with credit utilization ratio management depends on developing sustainable habits and systems. Understanding how to maintain an optimal credit utilization ratio over time requires planning for both expected and unexpected expenses. Regular review and adjustment of your credit utilization ratio strategy ensures continued success.

Emergency Planning for Credit Utilization Ratio Good Standing

Maintaining a credit utilization ratio good enough during emergencies requires advance planning. Having strategies in place helps keep your credit utilization ratio good even during unexpected financial challenges. Building an emergency fund can help maintain your credit utilization ratio during difficult times.

Professional Management of Your Credit Utilization Ratio

Professional credit management often focuses on maintaining an optimal credit utilization ratio through systematic approaches. Understanding how to manage your credit utilization ratio like a professional can lead to better credit outcomes. Regular monitoring and adjustment of your credit utilization ratio strategy ensures continued success.

Start Today and Explore the Features Firsthand!

Advanced Techniques for Credit Utilization Ratio Management

Managing your credit utilization ratio effectively requires understanding advanced optimization strategies. Maintaining the optimal credit utilization ratio involves more than just keeping balances low. Advanced management of your best credit utilization ratio can significantly impact your overall credit profile.

Timing Payments for Best Credit Utilization Ratio

Achieving the best credit utilization ratio requires strategic payment timing throughout the month. Most credit card companies report your credit utilization ratio to credit bureaus on your statement closing date, not your payment due date.

Making multiple payments throughout the month can help maintain the best credit utilization ratio possible. Understanding these reporting cycles helps you maintain a credit utilization ratio good for your credit score. The timing of your payments can significantly impact how your credit utilization ratio appears to credit bureaus.

Balancing Multiple Cards for a Good Credit Utilization Ratio

Maintaining a good credit utilization ratio across multiple cards requires careful balance management. Understanding what is a good credit utilization ratio for individual cards versus your overall profile is crucial.

Credit scoring models consider both individual and total credit utilization ratio when calculating your score. Managing multiple cards effectively helps maintain a credit utilization ratio good for optimal credit scoring. Strategic use of multiple cards can help you maintain the best credit utilization ratio possible.

Start Today and Explore the Features Firsthand!

Seasonal Planning for Credit Utilization Ratio Success

Your credit utilization ratio may fluctuate throughout the year due to seasonal spending patterns. Understanding how to maintain a good credit utilization ratio during high-spending seasons is crucial. Managing your credit utilization ratio effectively during holidays and special occasions requires advance planning.

Holiday Strategy for What Is a Good Credit Utilization Ratio

Understanding what is a good credit utilization ratio during holiday seasons helps maintain credit health. The challenge of maintaining a credit utilization ratio good enough during increased spending requires strategic planning.

Having a solid plan helps you maintain what is a good credit utilization ratio even during gift-giving seasons. Holiday spending can significantly impact your credit utilization ratio if not managed properly. Creating a holiday budget helps maintain your best credit utilization ratio during festive periods.

Special Events and Your Credit Utilization Ratio Good Standing

Maintaining a credit utilization ratio good enough during special events requires careful planning. Major life events can significantly impact your credit utilization ratio if not managed properly. Understanding how to maintain what is a good credit utilization ratio during significant expenses is crucial.

Planning ahead helps ensure your credit utilization ratio remains healthy during special occasions. Special event expenses shouldn’t compromise your best credit utilization ratio goals.

Recovery Strategies for High Credit Utilization Ratio

When your credit utilization ratio exceeds recommended levels, implementing recovery strategies becomes crucial. Understanding how to lower your credit utilization ratio quickly can help minimize credit score impact. Developing an effective plan to achieve a good credit utilization ratio requires strategic thinking.

Quick Fixes for What Is Credit Utilization Ratio Problems

Understanding what is credit utilization ratio recovery involves implementing immediate solutions. Quick strategies can help improve your credit utilization ratio when it’s too high. Making extra payments can help achieve a credit utilization ratio good for credit scoring. Strategic balance transfers might help maintain a better credit utilization ratio. Requesting credit limit increases can improve your best credit utilization ratio quickly.

Add Your Heading Text Long-term Solutions for Good Credit Utilization Ratio

Maintaining a good credit utilization ratio long-term requires sustainable strategies and habits. Creating a plan to consistently maintain what is a good credit utilization ratio ensures lasting success. Regular monitoring helps maintain a credit utilization ratio good for your credit goals.

Developing better spending habits supports a healthier credit utilization ratio. Building an emergency fund helps maintain your best credit utilization ratio during unexpected expenses.

Start Today and Explore the Features Firsthand!

Technology Tools for Credit Utilization Ratio Monitoring

Modern technology offers various tools for tracking your credit utilization ratio effectively. Understanding how to use these tools helps maintain a good credit utilization ratio. Regular monitoring through apps and websites ensures your credit utilization ratio stays optimal.

Apps for Tracking Your Best Credit Utilization Ratio

Several apps can help you maintain the best credit utilization ratio possible. These tools provide real-time monitoring of your credit utilization ratio across all accounts. Understanding what is credit utilization ratio tracking features helps maximize tool benefits. Mobile alerts can help maintain a credit utilization ratio good for your score. Regular app monitoring ensures your good credit utilization ratio stays consistent.

Online Tools for What Is Credit Utilization Ratio Management

Online platforms offer comprehensive tools for understanding what is credit utilization ratio management. These resources help maintain a credit utilization ratio good enough for excellent credit.

Web-based calculators help determine what is a good credit utilization ratio for your situation. Credit monitoring services track your credit utilization ratio automatically. Online budgeting tools support maintaining your best credit utilization ratio.

Conclusion: Mastering Your Credit Utilization Ratio

Success in managing your credit utilization ratio comes from understanding, planning, and consistent execution. Maintaining awareness of what is a good credit utilization ratio and implementing effective strategies helps achieve your credit goals. Regular attention to maintaining the best credit utilization ratio possible will support your long-term financial success.

Remember that managing your credit utilization ratio is an ongoing process requiring regular attention. Understanding what is credit utilization ratio impact on your credit score motivates consistent monitoring. Working towards maintaining a credit utilization ratio good for your credit goals requires dedication.

Finding and maintaining your ideal good credit utilization ratio supports overall financial health. Striving for the best credit utilization ratio possible maximizes your credit scoring potential.

Mark Clayborne

Mark Clayborne specializes in credit repair, running and growing a credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- From Average to Excellent: A Comprehensive Guide to Improving Your Credit Score

- How to Get 850 Credit Score: A Step-by-Step Guide