Have you ever checked your credit report and spotted something that did not look right? Many people feel confused when they see numbers or accounts that do not match their real history. Credit report errors happen more often than most people think. These mistakes can hurt your score, slow down loan approvals, and create stress you do not need.

The good news is that you can fix many of these problems on your own. You do not need special training to understand what should or should not be on your report. You just need clear steps and a simple process. This guide walks you through the most common issues, why they happen, and what you can do to correct them.

If you run a business or plan to start one, keeping a clean report helps you build trust with lenders and partners. If you are dealing with credit challenges, cleaning up these errors can help you move forward with confidence. Every correction brings you closer to a stronger financial foundation.

As you read, ask yourself questions. Does your report show accounts you do not recognize? Are there late payments you know you made on time? Does your personal information look wrong? Each question helps you spot the errors that matter.

You have more control than you think. This article gives you the tools to understand your credit report, find mistakes, and fix them step by step.

Key Takeaways:

- Review your Experian, Equifax, and TransUnion reports often so you can spot common credit report errors like incorrect late payments, wrong balances, duplicate accounts, outdated debts, and personal information mistakes.

- Gather documents such as statements, receipts, and letters before you dispute errors so you can prove what is wrong and help the credit reporting agencies update your file.

- File disputes directly with the bureaus and the data furnisher, then follow the investigation timeline to make sure your corrections appear.

- Use tools like Client Dispute Manager Software to organize your disputes, track responses, store documents, and keep the process simple and structured.

- Prevent future errors by protecting your personal information, watching for identity theft, keeping good payment habits, and reviewing your credit reports with a simple checklist.

Start Today and Explore the Features Firsthand!

Why Accurate Credit Reports Matter for Fixing Credit Report Errors?

Accurate credit reports give you a clear picture of your financial history. When the information is right, lenders can see your real payment habits, balances, and accounts. When the information is wrong, you face problems you did not cause.

Many people deal with credit report errors without knowing it. These errors can lower your credit score, raise your interest rates, or make it harder for you to borrow money. They can also confuse lenders who use your report to judge your creditworthiness.

You may ask yourself a simple question. Why does one small mistake matter? The answer is that even small errors in a credit report can create big setbacks. A single incorrect late payment can drop your score. A wrong balance can make you look like you use too much credit. Duplicate accounts can make your report appear riskier than it is.

When you understand how credit report errors affect your daily life, you can take control. You can review your reports, catch mistakes early, and fix issues before they create long term harm.

Checking your credit file regularly helps you protect your financial health. It also helps you learn how the credit system works. This knowledge supports you whether you want to improve your personal finances or start a credit repair business.

What Your Credit Report Shows and Why Errors in Credit Report Information Hurt You?

Your credit report shows your personal details, your open and closed accounts, your payment history, and your credit limits and balances. Lenders use this information to judge how responsible you are with credit. When the information is correct, you get a fair review. When there are errors in a credit report, your financial picture becomes unclear.

Some errors seem small, but they can affect you in real ways. An incorrect late payment may lower your score and make lenders think you pay bills late. A wrong balance on an account can make it look like you use too much credit.

Duplicate or unrecognized accounts on a credit report can create a false sense of risk. These issues may lead to higher interest rates or denied applications.

You can protect yourself by reviewing your reports and learning what belongs there. When you understand what your report should show, you can find inaccurate information on a credit report faster. This helps you fix problems early and avoid harm to your credit score and future borrowing power.

How Credit Report Errors Affect Your Score and Loan Approvals?

Credit report errors can make your score drop even when you pay your bills on time. An incorrect late payment can lower a score by many points. A wrong balance on an account can raise your credit utilization, which also lowers your score. These mistakes tell lenders a story that does not match your real habits.

When lenders see reporting errors on a credit report, they may treat you as a higher risk. This can lead to higher interest rates or denied credit. Even small mistakes can change your loan offers. A duplicate account or outdated debt on a credit report can suggest that you carry more debt than you do.

Fixing credit report errors helps you present an accurate picture of your financial behavior. When your report is correct, lenders can judge you fairly. This improves your chances of getting approved for credit cards, car loans, home loans, or business funding.

Start Today and Explore the Features Firsthand!

Your Rights Under the Fair Credit Reporting Act for Correcting Credit Report Errors

The Fair Credit Reporting Act gives you the right to dispute inaccurate information on a credit report. This law requires credit reporting agencies to investigate your dispute and correct any verified mistakes. You also have the right to see what is in your file and to request updates when information changes.

When you file a credit bureau dispute, the bureau must contact the furnisher of the information. The furnisher must review your claim and respond with proof. If they cannot confirm the details, the bureau must remove or correct the entry. This protects you from errors that can hurt your credit without reason.

You also have the right to add a statement to your report if a dispute does not resolve the way you expect. This gives you a way to explain the situation to lenders. Knowing your rights helps you take action with confidence and fix credit report errors that affect your financial life.

Common Credit Report Errors to Look For and How to Spot Them

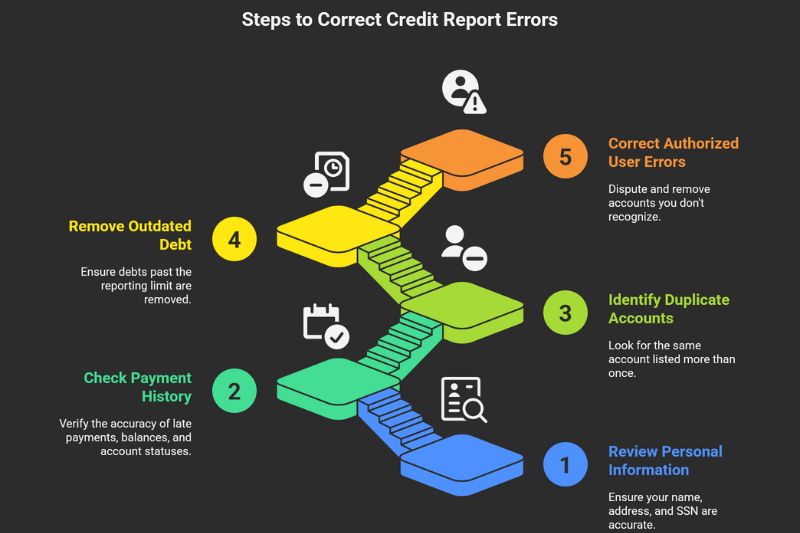

You can find many common credit report errors when you know what to check. These problems often appear in the personal information section, payment history, balances, and account listings. A simple credit file review helps you catch mistakes before they affect your score.

Learning how to spot these issues makes the dispute process easier. You can compare your report to your own records, look for inaccurate information on a credit report, and note anything that seems out of place. When something does not match your real history, it may be an error you can correct.

Below are the issues you should watch for when reviewing your reports.

Incorrect Personal Information on Your Credit Report

Personal details should match your legal records. Look for wrong names, old addresses, or incorrect Social Security number variations. These errors often come from mixed files or outdated records.

When your personal information is wrong, lenders may view another person’s activity as yours. This can make your profile appear risky. Check every line to confirm the details belong to you and match your identity.

Incorrect Late Payments, Wrong Balances, or Wrong Account Status

A single incorrect late payment can lower your score. Wrong balances can raise your credit utilization. Wrong account status, such as a paid account marked open, can mislead lenders.

Compare each account with your statements. If something does not match, you may be seeing reporting errors on a credit report. These are fixable once you gather proof and start a dispute.

Duplicate Accounts on Credit Report or Unrecognized Accounts

Duplicate accounts show the same account more than once. This can give lenders the impression you have more debt than you do. Unrecognized accounts may come from simple reporting errors or identity mix-ups.

Review all accounts line by line. If you see two listings with the same number, or an account you never opened, mark it for correction. These errors are common and often easy to fix.

Outdated Debt on Credit Report or Items Past Reporting Limits

Some debts should no longer appear on your report. Most negative items fall off after seven years. If old accounts still show, they may be outdated debt on a credit report.

Check the dates on each entry. If the reporting period has expired, you can ask the bureau to remove the item. Outdated information can make your report look worse than it is. These old items may also hurt your chances of getting fair loan offers.

Removing them helps lenders see your current financial habits instead of your past mistakes.

Start Today and Explore the Features Firsthand!

Authorized User Errors You Can Correct Yourself

Authorized user errors happen when you are linked to someone else’s account by mistake. This can happen through reporting issues or name similarities.

If an account appears that you do not use or recognize, confirm whether you were added by accident. You can dispute these entries and have them removed when you provide proof. These mistakes can affect your credit utilization and payment history. Fixing them helps you keep your file accurate and easier to review in the future.

Authorized user errors happen when you are linked to someone else’s account by mistake. This can happen through reporting issues or name similarities.

If an account appears that you do not use or recognize, confirm whether you were added by accident. You can dispute these entries and have them removed when you provide proof.

How to Dispute Credit Report Errors With Experian, Equifax, and TransUnion?

You can correct credit report errors by filing disputes with each of the three major credit reporting agencies. Experian, Equifax, and TransUnion must review your claim and update any information they cannot verify.

This process helps remove inaccurate information on a credit report, including incorrect late payments, wrong balances, duplicate accounts, and outdated debt.

A strong dispute begins with clear records. When you show proof, the bureau can compare your documents with what the furnisher reported. This gives you a better chance of getting the correction you need.

Gathering Supporting Documentation for a Credit Bureau Dispute

Supporting documentation is important when you dispute errors. These records help you show what is wrong on your report. You can use bank statements, payment confirmations, letters from creditors, or screenshots of accurate account details.

Keep your documents organized before you begin the dispute. Create a small folder for each error. This makes it easier to explain the issue to the credit reporting agencies. When your information is clear, the bureau can understand your claim faster.

How to Contact the Data Furnisher Before Filing a Dispute?

The data furnisher is the company that reported the information to the bureau. This may be a credit card company, lender, or collection agency. Contacting them first can help you fix credit report errors quickly.

Explain the issue and provide a copy of your supporting documents. Ask them to update their records if they find a mistake. When the furnisher corrects the information, the update should appear on all your reports.

How to Report Credit Report Errors to Experian, Equifax, and TransUnion?

Each bureau allows you to file disputes online, by mail, or by phone. Online disputes are faster, but mail lets you include detailed documentation.

When you report credit report errors, list each problem clearly. State why the information is wrong and attach your proof. This helps the bureau start the credit report investigation with accurate details.

- Experian dispute portal, mailing address, or phone number

- Equifax dispute portal, mailing address, or phone number

- TransUnion dispute portal, mailing address, or phone number

Use only the method you trust and keep copies of everything you send.

What to Expect During a Credit Report Investigation?

After you file your dispute, the bureau reviews your claim. They contact the data furnisher and request verification. The investigation usually takes up to 30 days.

If the furnisher cannot confirm the information, the bureau must correct or remove the entry. If the furnisher confirms the information, it may stay on your report. You will receive the results in writing from each bureau.

Review the updated report after the investigation. Make sure the corrections appear and check for any remaining errors. This helps you keep your file clean and ready for future credit opportunities.

How Client Dispute Manager Software Helps You Correct and Track Credit Report Errors?

Client Dispute Manager Software gives you a simple system to organize and track the credit report errors you want to fix. You can store your documents in one place, review your reports, and follow guided steps that help you understand how to correct credit report errors. This helps you stay focused while you work through each dispute.

The software also lets you track your progress. You can see which disputes you filed, which bureau you contacted, and which items still need attention. This keeps you from missing deadlines during a credit report investigation. Clear tracking helps you stay in control of your own repair process.

Many beginners feel overwhelmed when they try to manage disputes on their own. The software breaks the process into small steps. You can upload your supporting documentation, create letters, and update your notes as you move forward. This makes the process easier for entrepreneurs, individuals with credit issues, or anyone learning how to fix credit report errors.

Start Today and Explore the Features Firsthand!

How to Prevent Future Credit Report Errors?

Preventing future mistakes on your credit report starts with simple habits. When you check your reports often, protect your personal details, and watch for unusual activity, you lower the chance of inaccurate information on a credit report. These steps help keep your file clean and easier to manage over time.

Regular Credit Report Reviews Using a Simple Credit Report Checklist

A regular review helps you catch common credit report errors early. Use a short checklist each time you look at your reports. Confirm your name and address, check your account balances, review payment history, and make sure no duplicate accounts appear. A consistent routine makes it easier to spot changes before they affect your score.

Add one more step to your checklist. Compare your credit limits with your statements. A wrong limit can change your utilization rate and lower your score. Also check closed accounts to confirm they show the right status. When you follow a structured list, you reduce the chance of missing important details.

Protecting Your Personal Information to Avoid Inaccurate Information on Credit Reports

Your personal information must stay accurate to prevent mix ups. Keep your Social Security number, account numbers, and home address secure. Update your address with lenders when you move. When your information stays correct, you avoid errors that come from file merges or wrong data entries.

Store sensitive documents in a safe place and shred papers you no longer need. Be careful when sharing information online and check for unusual account activity. When you protect your details, you lower the chance that someone else’s information gets linked to your file.

Monitoring for Identity Theft vs Reporting Errors

Identity theft can create new accounts you did not open, but reporting errors can also make accounts appear that are not yours. Check your reports for unrecognized accounts and look for sudden score drops or changes in balances. Quick monitoring helps you respond faster if you see something suspicious.

Use alerts from your bank or credit cards when possible. These alerts can notify you when a new account appears or when a large charge posts. Reviewing your accounts once a week helps you tell the difference between a reporting mistake and a real case of identity theft. When you act early, you protect your score and prevent further damage.

Smart Financial Habits That Reduce Incorrect Late Payments and Wrong Balances

Good financial habits support accurate reporting. Pay your bills on time, keep your balances low, and review your statements each month. When your records stay clean, it is easier to prove when an incorrect late payment or wrong balance appears on your report. These habits help you protect your score and reduce future errors.

Set up automatic payments or reminders if you struggle to keep track of due dates. Review each account statement for small changes that may look innocent but can turn into reporting problems. When you stay organized, you make it easier to fix mistakes and harder for errors to appear on your report.

Good financial habits support accurate reporting. Pay your bills on time, keep your balances low, and review your statements each month. When your records stay clean, it is easier to prove when an incorrect late payment or wrong balance appears on your report. These habits help you protect your score and reduce future errors.

Start Today and Explore the Features Firsthand!

When You Need Extra Help Fixing or Disputing Credit Report Errors?

Some credit report errors are simple to fix, but others require more support. You may need extra help when you deal with repeated mistakes, mixed credit files, or issues that return even after a bureau investigation. These situations can be stressful, especially when they affect your score or cause lenders to deny your applications.

If the same errors keep showing up, the data furnisher may not be updating their records correctly. You may also face problems when information from another person appears in your file. These situations can confuse the bureaus and make self correction difficult. Extra help can guide you through the steps when the process becomes complicated.

Government resources can help you understand your rights. Agencies like the CFPB and FTC provide information on filing complaints when a bureau or furnisher handles your dispute incorrectly. You can also explore legal help when errors affect your ability to work, rent, or obtain credit. Extra support gives you more options when simple fixes do not work.

What Are The Common Errors On A Credit Report?

Common credit report errors include wrong personal information, incorrect late payments, wrong balances, duplicate accounts, outdated debts, and authorized user mistakes. These errors can appear when lenders send incorrect data or when credit reporting agencies mix files.

You should review your full report from Experian, Equifax, and TransUnion to confirm that every account matches your records. Catching these issues early helps you correct credit report errors before they lower your score or affect loan approvals.

Can You Fix Errors On Your Credit Report?

Yes, you can fix many credit report errors on your own. Start by reviewing each section of your report and noting anything that does not match your statements. Gather documents that prove the correct information, then file disputes with the credit reporting agencies.

When you dispute credit report errors, the bureaus must investigate and update items they cannot verify. This gives you a fair chance to correct inaccurate information on your credit report without paying for outside services.

What Cannot Be Removed From Your Credit Report?

You cannot remove accurate negative information from your report. Correct late payments, collections, charge offs, repossessions, or bankruptcies remain for up to seven years. The only items you can remove are inaccurate entries such as wrong balances, incorrect late payments, or accounts that do not belong to you.

Understanding this difference helps you focus on what you can correct and avoid wasting time on items that are legally required to stay.

Can You Remove Inaccurate Information From Your Report?

Yes, any inaccurate information on a credit report must be removed or updated. This includes wrong personal details, duplicate accounts, incorrect balances, outdated debts, and unrecognized accounts.

You can file a dispute with the three major credit reporting agencies. They must investigate your claim and fix entries the data furnisher cannot prove. Removing inaccurate information helps improve your score and ensures lenders see a true picture of your financial history.

Start Today and Explore the Features Firsthand!

Can I Use Client Dispute Manager Software To Manage All Three Bureaus?

Yes, you can manage disputes for Experian, Equifax, and TransUnion in one place. You can store letters, add notes, and save responses from each bureau. This helps you avoid losing documents or forgetting deadlines.

When you work with all three bureaus, keeping everything in order is important. The software makes it simple by giving you a single system where every update, dispute, and result stays organized and easy to find.

How Long Does A Credit Bureau Have To Investigate A Dispute?

A credit bureau has up to 30 days to investigate your dispute. During this time, the bureau contacts the data furnisher and reviews the documents you submitted. If the furnisher cannot verify the information, the bureau must correct or delete the entry.

When the investigation finishes, you will receive a written update along with a new copy of your report. Understanding this timeline helps you manage expectations and track your progress while fixing credit report errors.

Conclusion

You can take control of your credit by checking your reports and looking for common credit report errors. Small mistakes can create big problems, but you can fix many issues on your own. When you understand how errors appear and how to correct them, you protect your score and improve your chances of getting fair loan offers.

Begin with a simple review. Look for inaccurate information on a credit report, gather your documents, and file disputes when you see something that does not belong. Use tools like Client Dispute Manager Software to stay organized and track your progress.

Your credit plays a major role in your financial future. When your report is accurate, lenders can see your true history. Take a few minutes today to pull your reports and start your review. Every small step helps you build a stronger financial foundation.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: