A collection dispute is a letter that demands the collection agency to show proof that your customer owes a certain amount of money mentioned in his or her credit report. Your credit repair business plan should include some default collectors letters that you can use at any time.

Every day, many Americans get phone calls from debt collectors over debts they don’t owe and sometimes don’t even recognize. If an account has wrongly been reported as in collections, then you can dispute that information by writing a collector’s letter.

If you are just getting started with your credit repair service, you may find it difficult to create your own collector’s letter.

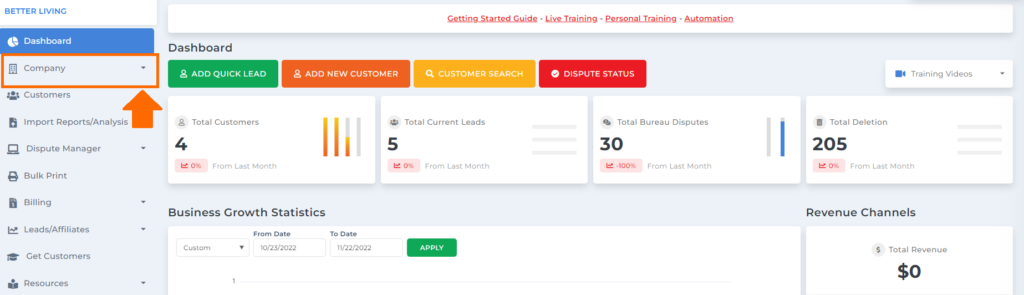

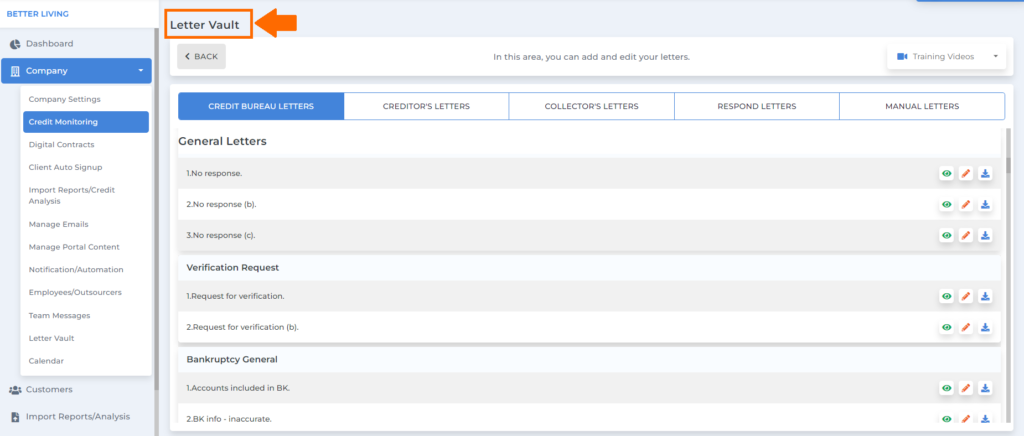

To check the collector letters inside the credit repair business plan. Go to the company tab.

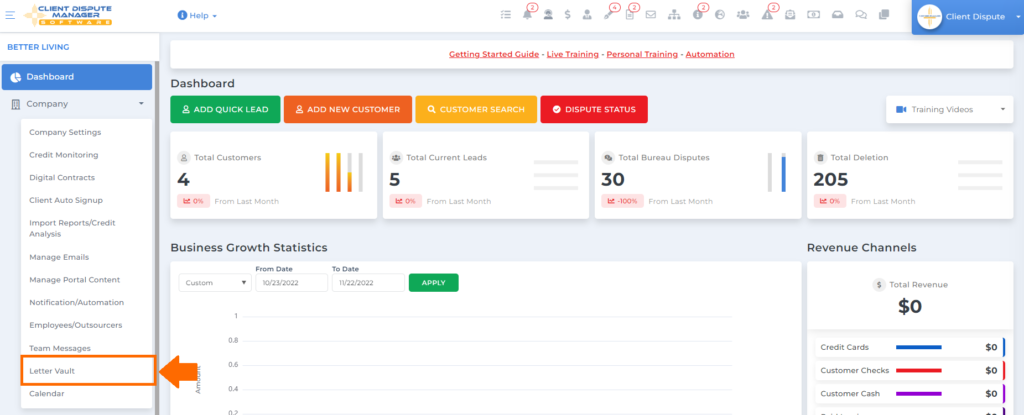

Then under the company menu options click letter vault.

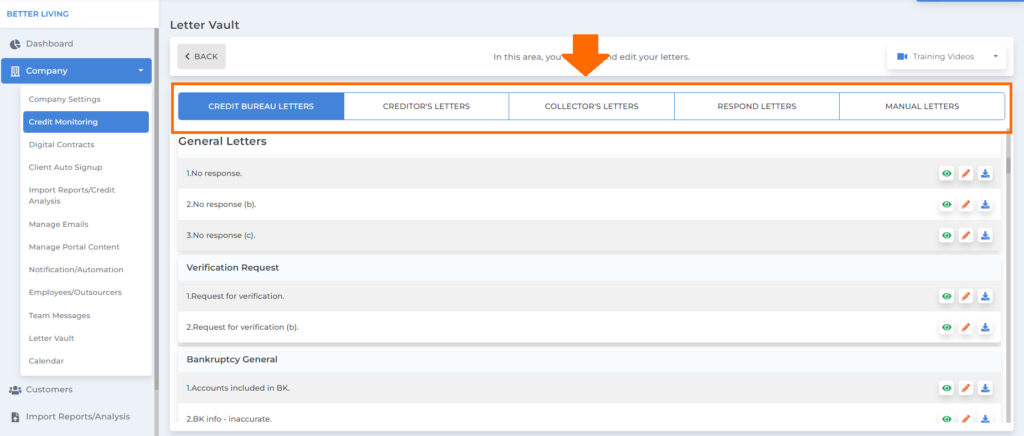

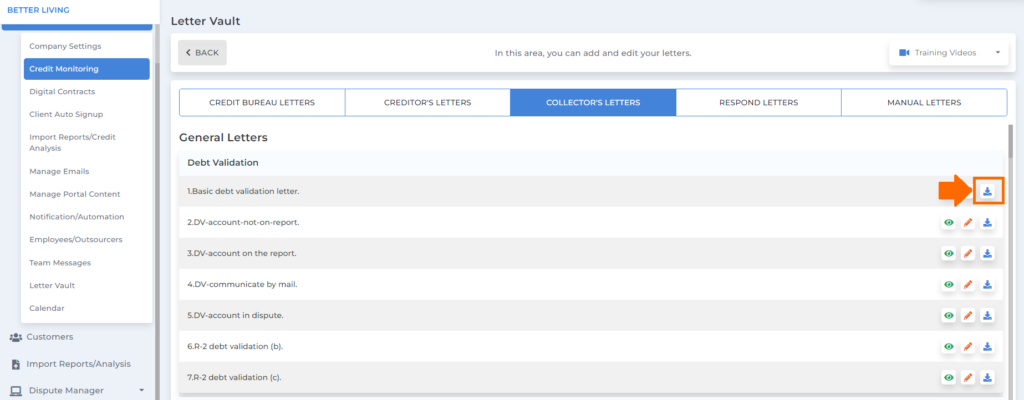

Then you will be routed to the letter vault screen where you can see all the letters available to use. In this area, you can also add and edit your letters.

Inside the letter vault, we have letters for credit bureaus, creditors, collectors, respond, and manual letters.

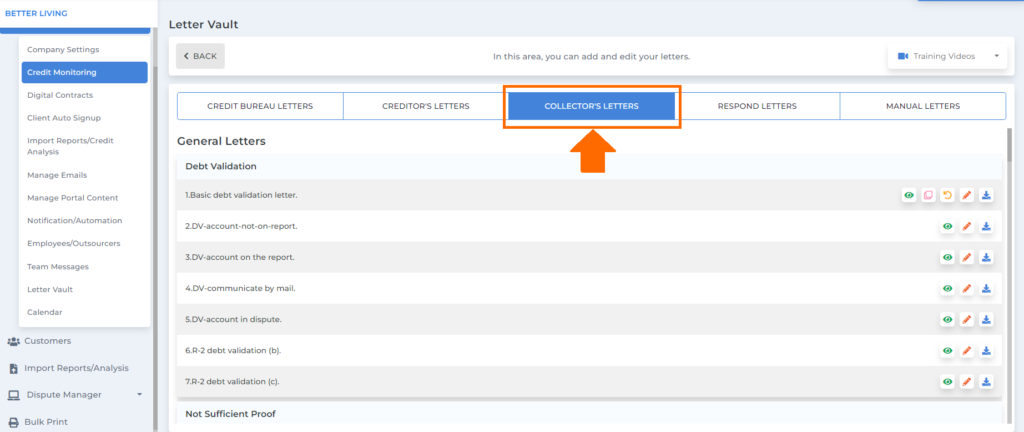

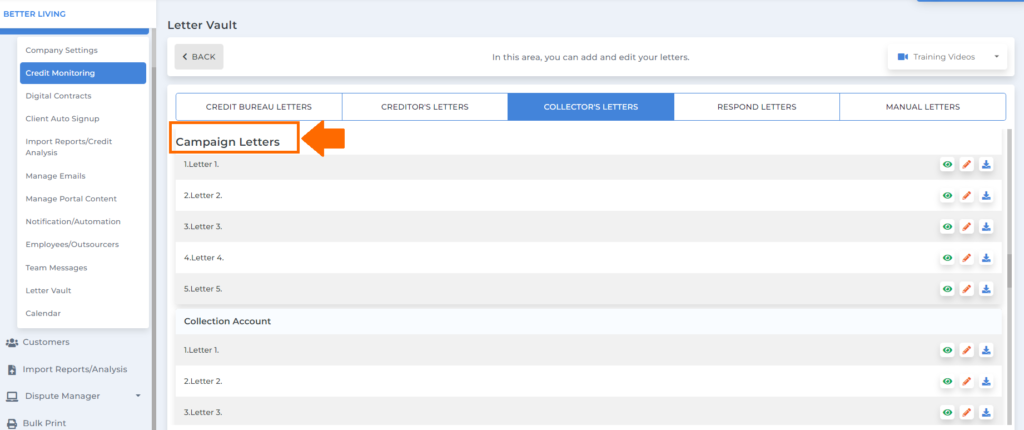

Over here are the collector’s letters available for you to use.

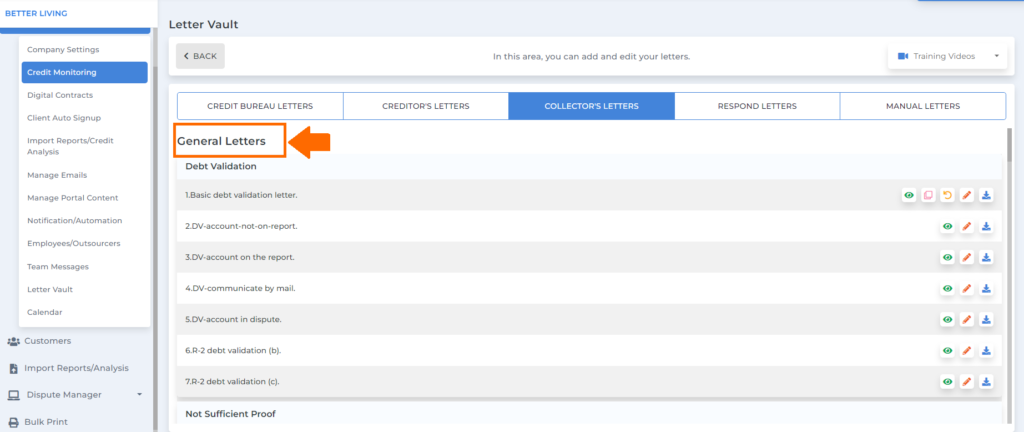

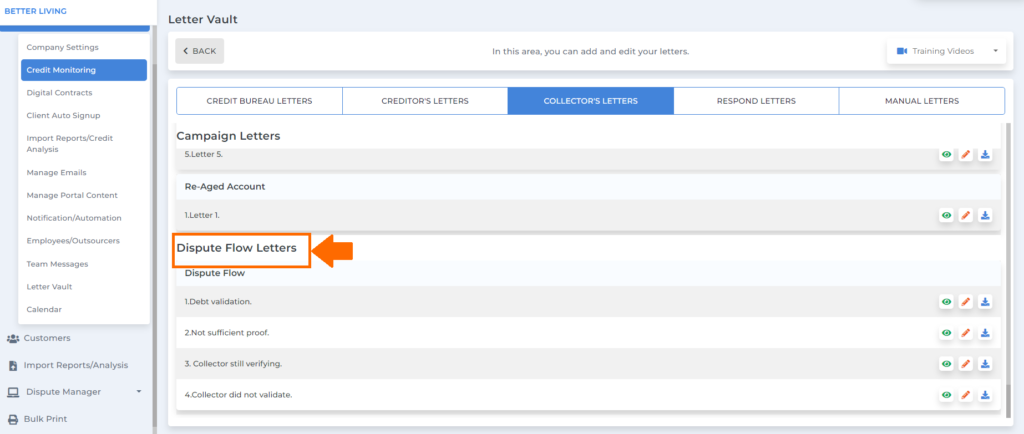

Under collector’s letters, we have general, campaign, and dispute flow letters.

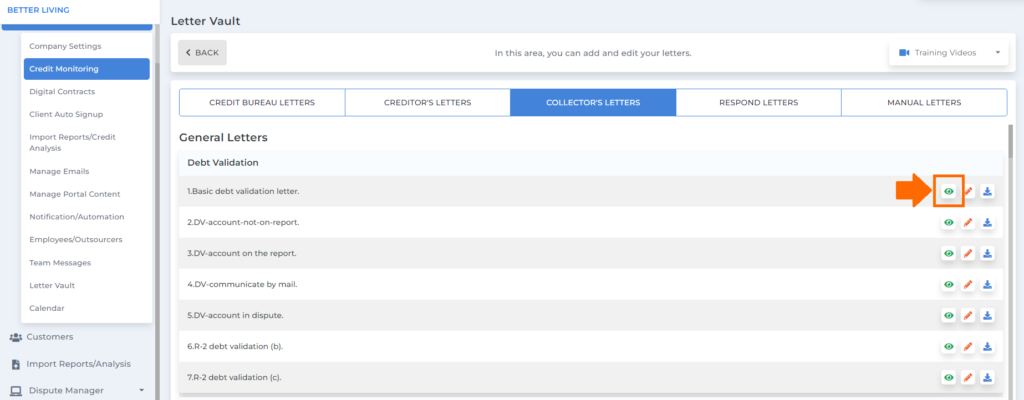

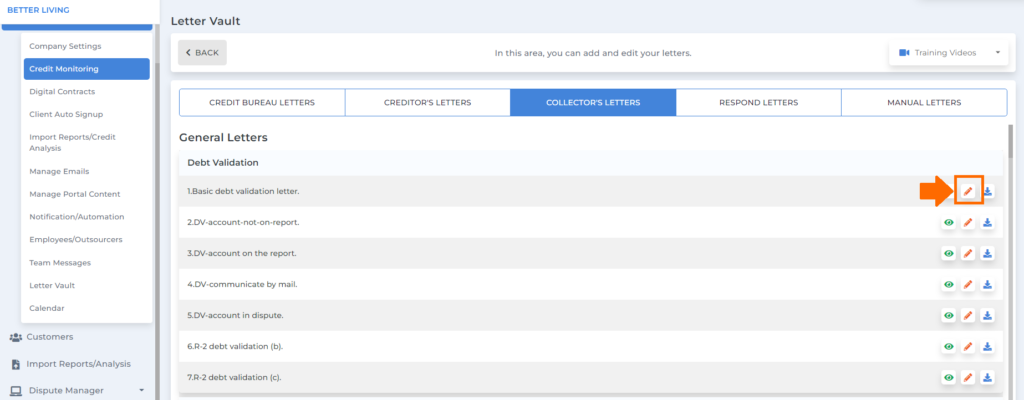

General Letters

– These letters are used to dispute or disagree with the errors in your credit report, like: personal information fix, validation, and bankruptcy, to name a few.

Campaign Letters

-These letters are more aggressive compared to other letters because they target derogatory accounts. And these letters do not follow a certain flow.

Dispute Flow Letters

-These letters are in general, and they follow a certain flow. It’s a series of dispute letters in a certain order.

Then you can click this icon if you want to preview the letter before you use it.

You can also edit the default letters by clicking this icon.

You can also download the letter by clicking this icon.

Ignoring the debt collector and not writing a collector’s letter might put your customers in a difficult position. The best way to dispute a collection is by sending a debt dispute letter to the collection agency and asking for the debt to be validated.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.